(Icon) HIL Industries - High Growth, Cash Rich, Undervalued

Icon8888

Publish date: Fri, 27 Feb 2015, 04:30 PM

Hil Industries Berhad (HIL) Snapshot

|

Open

0.85

|

Previous Close

0.81

|

|

|

Day High

0.89

|

Day Low

0.85

|

|

|

52 Week High

02/9/15 - 0.90

|

52 Week Low

02/28/14 - 0.54

|

|

|

Market Cap

242.0M

|

Average Volume 10 Days

54.0K

|

|

|

EPS TTM

0.07

|

Shares Outstanding

276.6M

|

|

|

EX-Date

07/23/14

|

P/E TM

12.3x

|

|

|

Dividend

0.02

|

Dividend Yield

1.71%

|

HIL Industries Berhad manufactures and sells industrial and domestic molded plastic products in Malaysia and the People’s Republic of China. It operates through two principal segments: Manufacturing and Property Development.

The company offers various services, including design and development, mold and dies fabrication, injection molding, spray painting, etc.

It is also involved in the development of residential, commercial, and light industrial properties.

The company was founded in 1969 and is headquartered in Shah Alam, Malaysia.

HIL and A&M Realty has same major shareholder.

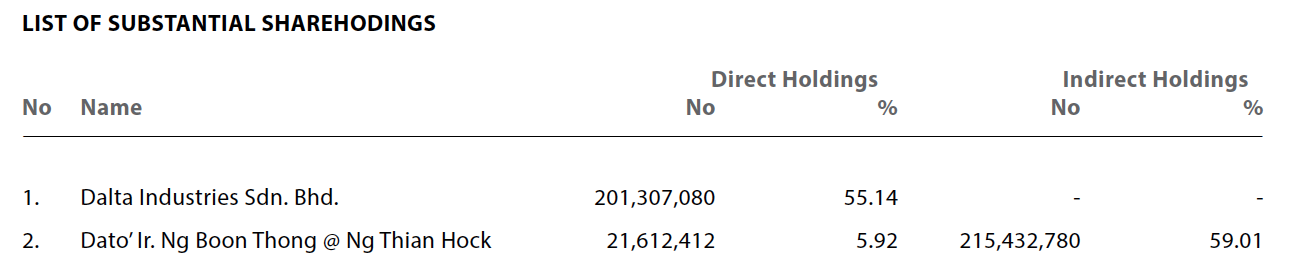

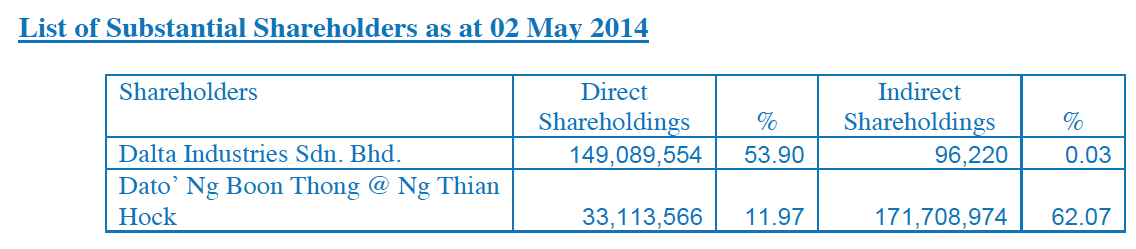

A&M's major shareholder :-

HIL's major shareholder :-

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | NAPS |

|---|---|---|---|---|---|---|

| 2014-12-31 | 2014-12-31 | 42,498 | 10,188 | 7,737 | 2.80 | 1.0500 |

| 2014-12-31 | 2014-09-30 | 37,310 | 7,263 | 5,246 | 1.90 | 1.0200 |

| 2014-12-31 | 2014-06-30 | 32,345 | 5,575 | 4,138 | 1.50 | 1.0100 |

| 2014-12-31 | 2014-03-31 | 24,252 | 3,592 | 2,592 | 0.94 | 1.0000 |

| 2013-12-31 | 2013-12-31 | 23,697 | 2,898 | 2,111 | 0.76 | - |

| 2013-12-31 | 2013-09-30 | 21,122 | 1,654 | 739 | 0.27 | 0.9800 |

| 2013-12-31 | 2013-06-30 | 20,256 | 1,520 | 939 | 0.34 | 0.9800 |

| 2013-12-31 | 2013-03-31 | 16,575 | -554 | -1,002 | -0.36 | 0.9700 |

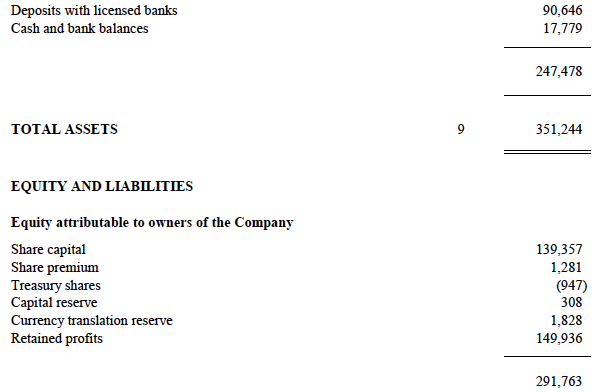

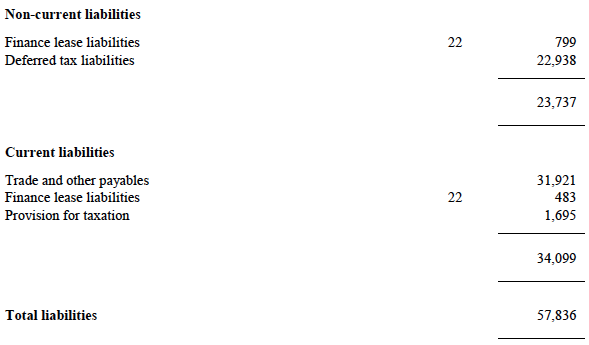

The group has strong balance sheets. It has net assets of RM292 mil, ZERO borrowings and cash of RM108.4 mil. Based on 277 mil shares, cash per share is RM0.39, repesenting 44% of existing price of RM0.88.

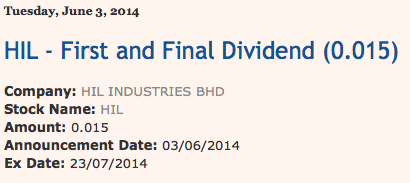

The company paid out 1.5 sen dividend in 2014. Based on 88 sen share price, dividend yield is 1.7%. Will the company pay out more now that profit has been growing nicely ?

Since early 2014, the group's earnings has been growing at leaps and bounce. Manufacturing and property development are the major contributors.

| (RM mil) | Mac 13 | Jun 13 | Sep 13 | Dec 13 | Mac 14 | Jun 14 | Sep 14 | Dec 14 | FY2013 | FY2014 |

| Revenue | 16.7 | 20.1 | 21.1 | 23.7 | 24.3 | 32.3 | 37.3 | 42.5 | 81.6 | 136.4 |

| > Manufacturing | 16.1 | 19.9 | 20.6 | 23.3 | 23.9 | 32.0 | 25.7 | 26.1 | 79.9 | 107.7 |

| > Prop development | 0.5 | 0.5 | 0.5 | 0.6 | 0.5 | 0.4 | 11.7 | 16.6 | 2.1 | 29.2 |

| PBT | (0.6) | 1.5 | 1.7 | 2.9 | 3.6 | 5.6 | 7.3 | 10.2 | 5.5 | 26.7 |

| > Manufacturing | (0.8) | 1.2 | 1.4 | 2.6 | 3.4 | 5.3 | 1.9 | 2.5 | 4.4 | 13.1 * |

| > Prop development | 0.3 | 0.3 | 0.2 | 0.4 | 0.2 | 0.3 | 5.4 ^ | 7.6 ^ | 1.2 | 13.5 * |

| Net profit | (1.1) | 0.9 | 0.7 | 2.1 | 2.6 | 4.1 | 5.2 | 7.7 | 2.6 | 19.6 |

| shares (mil) | 279 | 279 | 279 | 279 | 279 | 279 | 279 | 279 | 279 | 279 |

| EPS (sen) | (0.4) | 0.3 | 0.3 | 0.8 | 0.9 | 1.5 | 1.9 | 2.8 | 0.9 | 7.0 |

| PBT margin (%) | (3.6) | 7.5 | 7.8 | 12.2 | 14.8 | 17.3 | 19.5 | 24.0 | 6.7 | 19.5 |

| > Manufacturing | (5.0) | 6.0 | 6.8 | 11.2 | 14.2 | 16.6 | 7.4 | 9.6 | 5.5 | 12.2 |

| > Prop development | 60.0 | 60.0 | 40.0 | 72.7 | 40.0 | 75.0 | 46.2 # | 45.8 | 58.5 | 46.2 |

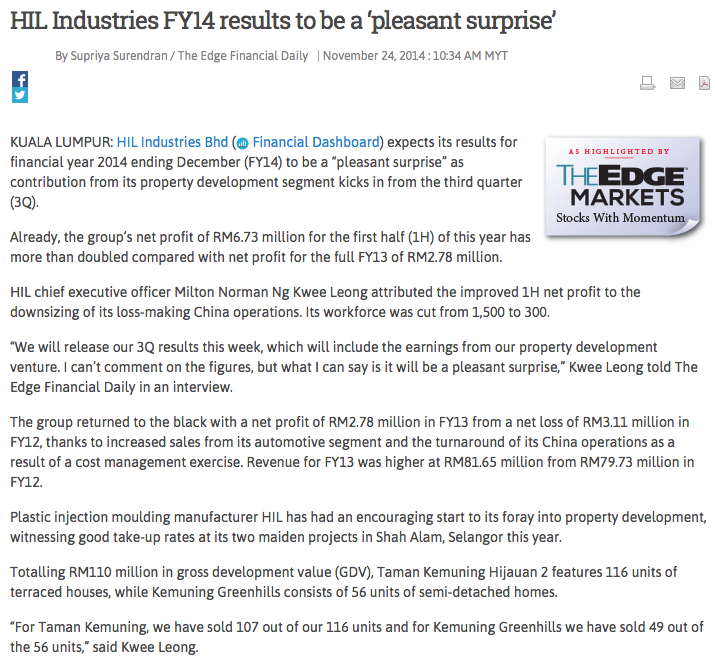

^ Since September 2014 quarter, property development has emerged as a major earnings contributor.

# Property development profit margin is high, probably due to low land cost.

* During FY2014, manufacturing and property development contributed equally to earnings. However, going forward, property development should play a more important role as the group books in further profit.

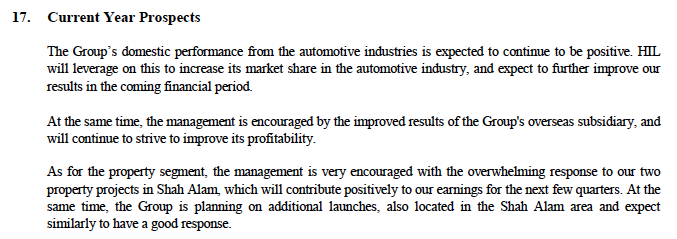

Despite property industry slowing down, the group remained saguine about the prospects of their development projects :-

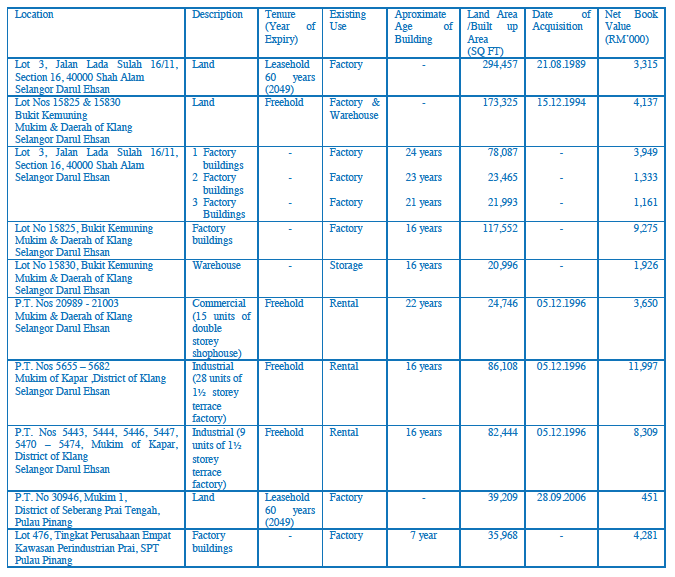

The group's properties :-

Concluding Remarks

(a) The group has strong balance sheets with net cash of RM108.4 mil. Generous dividend payout in the future ?

(b) High property development profit margin propbably due to low land cost.

Despite making significant contribution to net profit, total revenue booked in over past 2 quarters are only RM29 mil.

With such high PBT margin, impact on future earnings can still be material.

For illustration purpose : based on assumption that total GDV is RM100 mil, remaining unbooked sales would be RM100 mil less RM29 mil = RM71 mil. Based on PBT margin of 46.2%, remaining PBT to be booked in is RM32.8 mil ? Net profit = RM24.6 mil ?

If that is the case, earnings over next one to two years looked pretty secured ? For further information, please refer to article below publlshed by The Edge Financial Daily in November 2014 :-

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Hi, the GDV for the Kemuning project is RM 110 mil with more than 90% take up rate already. Should sustain them for the next year or two. They do have others in the pipeline...

http://www.malaysiastock.biz/Corporate-Infomation.aspx?type=A&value=H&securityCode=8443

2015-02-27 22:39

GDV for project Tmn Kemuning Hijauan 2 is RM110M (90% sold) projet Kemuning Greenhill not sure but is 52 units SemiD so est. (56 x RM1.6m per unit = RM90M). Just nice a total of RM200M. However, I have done a SOP valuation using simple projection. I got TP at RM0.83 only, but my valuation have not includes RNAV of its properties. Will share my valuation soon when free later. I wonder where they get the land for development? The previous annual report stated most of the lands are for factory/warehouse purpose. Which land they are using for the development?

2015-02-27 22:46

http://imgur.com/QjddCev

I have done a very simple projection to obtain TP at RM0.83, which exclude RNAV of the Group's properties. The projection is generally optimistic, feel free to twist the no. Would appreciate anyone provide some insight on the RNAV of properties, which i haven't look into it.

2015-02-28 01:11

Icon, agreed with you that HIL is undervalue at this juncture & well managed. But co that involved in properties always have their up & downs. They are not consistent. Look at L&G, Seal, GOB and many others, i can easily say that 9 out of 10 property co have recently reported lower turnover & profits.

2015-02-28 08:47

thx rikki

Your comment is fair. Lets see what happened to next few quarters' earnings

2015-02-28 09:13

dear icon8888, i m a newbie here n may i noe how u get the net cash amount of rm108.4milliom? i only c total cash n deposit of rm247 mil ? pls guide , thanks so much^^

2015-02-28 15:44

yeah agree, property counter is rather inconsistent. got trapped at EUPE for quite sometimes, despite the so-called "undervalued" counter. but with "zero" borrowing with healthy cash position, this counter is worth looking at.

2015-02-28 20:03

when i review the past financial in 2009, i noticed that property development segment ady start contributed but is only RM1m-2m per year until year 2013. The kemuning hijaaun 2 project will completed on Jan 2016?,if yes, why the progressive billing only start contributed on sept 2014.anyone can explain to me?

2015-05-03 18:36

Latest MYR 128 million cash...no debt...is there any chance for special dividend?

2015-06-22 15:09

hockhuat, NTA=0.15 cents ? do you know how to interpret balance sheet ? Real joker...

2015-07-31 15:31

willnck

Thanks for the info,Icon.

2015-02-27 17:05