(Icon) MNRB - The Most Undervalued Stock In Bursa

Icon8888

Publish date: Wed, 15 Jul 2015, 05:26 PM

Executive Summary

(1) MNRB is principally involved in reinsurance business. It is a subsidiary of PNB.

(2) Never loss money before. Trading at PER of 6.3 times only.

(3) Gearing of 0.24 times only.

(4) Dividend yield of 4.3%. Dividend expected to be announced in September.

(5) Regulated by Bank Negara Malaysia. No hanky panky.

(6) Plenty of room for growth

Mnrb Holdings Bhd (MNRB) Snapshot

|

Open

3.75

|

Previous Close

3.75

|

|

|

Day High

3.76

|

Day Low

3.75

|

|

|

52 Week High

07/16/14 - 4.86

|

52 Week Low

03/31/15 - 3.53

|

|

|

Market Cap

799.0M

|

Average Volume 10 Days

128.0K

|

|

|

EPS TTM

0.60

|

Shares Outstanding

213.1M

|

|

|

EX-Date

09/26/14

|

P/E TM

6.3x

|

|

|

Dividend

0.17

|

Dividend Yield

4.39%

|

1. Impeccable Profit Track Record

The Group has never lost money before, not even during 2008 Global Financial Crisis :-

Annual Result:

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) |

|---|---|---|---|

| TTM | 2,384,975 | 127,569 | 59.90 |

| 2015-03-31 | 2,384,975 | 127,569 | 59.90 |

| 2014-03-31 | 2,386,177 | 155,986 | 73.20 |

| 2013-03-31 | 2,303,169 | 112,665 | 52.90 |

| 2012-03-31 | 2,018,043 | 87,187 | 40.90 |

| 2011-03-31 | 1,463,262 | 122,942 | 57.70 |

| 2010-03-31 | 1,345,183 | 48,167 | 22.60 |

| 2009-03-31 | 1,173,819 | 26,288 | 12.30 |

| 2008-03-31 | 978,555 | 170,441 | 80.30 |

| 2007-03-31 | 834,127 | 129,479 | 61.40 |

| 2006-03-31 | 751,400 | 115,183 | 57.50 |

| 2005-03-31 | 719,194 | 90,024 | 45.70 |

| 2004-03-31 | 670,730 | 88,581 | 45.48 |

| 2003-03-31 | 843,214 | 61,106 | 31.50 |

| 2002-03-31 | 733,369 | 57,407 | 29.56 |

| 2001-03-31 | 659,974 | 31,018 | 16.01 |

| 2000-03-31 | 363,310 | 85,963 | 45.01 |

| 1999-03-31 | 421,669 | 68,109 | 35.66 |

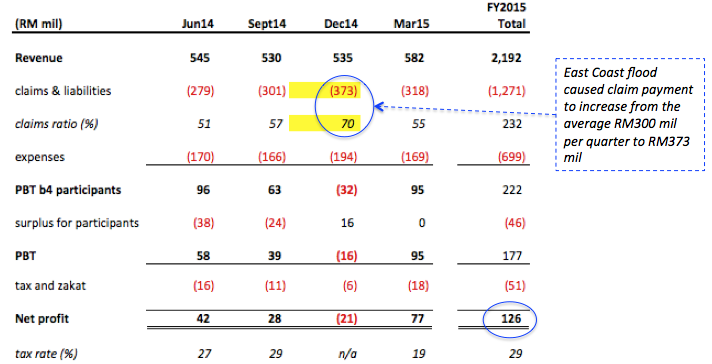

In December 2014 quarter, the group was adversely affected by East Coast flood, which caused its claim payment to increase by an estimated RM70 mil. Adjusted for that (based on conservative RM50 mil) and assume tax rate of 29%, FY2015 net profit should be RM163 mil instead of RM127.5 mil.

Based on existing market cap, PER will be 4.9 times only.

2. Business Model

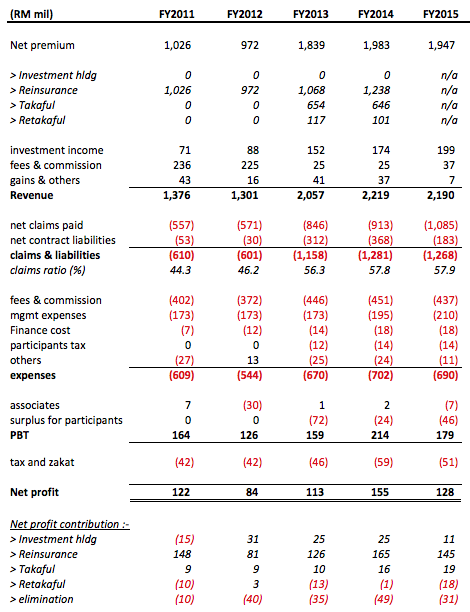

The group's P&L statement looked complicated but is actually quite easy to understand :-

(a) Revenue comprises mostly premium collected from insurance buyers and investment income (cash from insurance buyers are invested in financial instruments).

(b) When an insurance buyer makes a claim, it become an expense item for the insurer. Over the past 5 years, this item on average is equals to 53% of premium collected (Claim Ratio of 53%).

(c) Other expenses are commission paid to agents, salary, admin and marketing expenses, etc. The amount is usually quite stable. In MNRB's case, the amount is approximately 30% of revenue.

(d) There is an item called "surplus for Participants Funds". This is related to MNRB's Takaful operation, which is relatively small compared to its reinsurance business. The surplus for Participants Funds is not a drag on MNRB as it is paid out of Takaful revenue. We can ignore this item as MNRB's core earnings is from reinsurance.

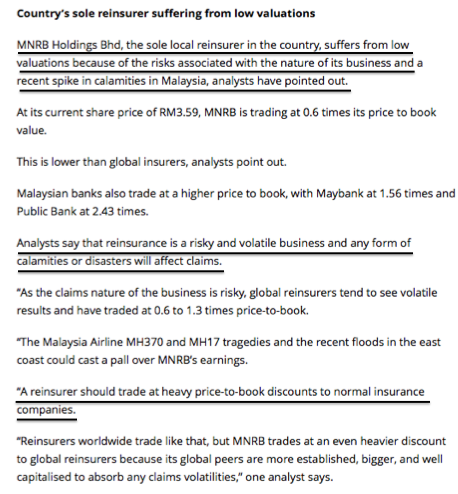

3. Risky Business ?

The article below by a reporter from The Star claimed that Reinsurance is a risky business.

According to the article, "Reinsurance is a risky and volatile business and any form of calamities or disasters will affect claims". It also stated that "A reinsurer should trade at heavy price to book discounts to normal insurance companies".

I am not an insurance expert. However, I don't think the reporter's view is logical or based on facts. MNRB has been consistently profitable at least since 1999. If you look at MNRB's historical earnings at Section 1 above, no matter how you look at it, it doesn't look like a "volatile business".

Of course, reinsurer will get hit when calamities happen (just like any insurance company). But according to preliminary research, systemic risk can be minimized by geographical diversification. Reinsurers also systematically 'reinsure" with other reinsurers, some of them overseas.

As such, in my opinion, the notion that reinsurers will be wiped out when a major calamity happen is an oversimplistic way of looking at things.

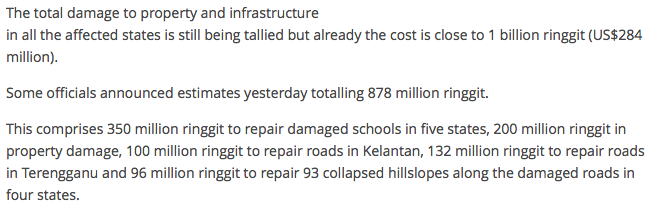

(according to the article above, damage caused by the East Coast flood at end of 2014 is estimated to be approximately RM1 billion. But MNRB only saw spike of RM70 mil in its claims during that quarter)

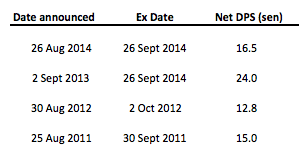

4. Dividend

Over the past 4 years, the group paid out average net DPS of 17 sen. Dividend is traditionally announced in the month of August / September.

5. A Low Beta Stock

MNRB has traditionally been trading at low PER and price-to-book ratio. I don't subscribe to the view that they deserve depressed valuation to justify the "riskiness" of their business. I don't think their business is any more risky than insurance companies (which have been trading at PER of more than 10 times).

In my opinion, MNRB has all the things that a good company should have :-

(1) viable business model that leads to sustainable profitability;

(2) healthy balance sheets;

(3) attractive dividend yield;

(4) good corporate governance, in no small part due to regulatory oversight by Bank Negara Malaysia; and

(5) abundant room for growth.

The depressed valuation is simply a case of mispricing.

However, this is a low Beta stock that can really test your patience. I intend to lock it up for long long time.

Nevermind if it doesn't go up by much over the next few years. As long as it generates good profit, pay me regular dividend and injects retained earnings into shareholders' funds year after year to inflate it like a balloon, it serves my investment objective.

Market will wake up one day to unlock its value.

I am very sure about that.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Teh tarek?

Better call Chinese Tea. Teh tarek only got coloring & palm oil. No milk at all.

2015-07-15 17:36

Icon8888: sure or not. I though china company lagi undervalue according to someone hahahahaha

2015-07-15 18:44

I dont invest in china company. I just point out recently some one post about xinghe is the most undervalue stock in bursa. Haha

2015-07-15 18:52

This share i observe for awhile but still dun know why cannot go up. Haha i dun know how to value this share. Maybe revenue and dividend is the best indicator?

2015-07-15 18:53

COLD STOCKS? STOCKS IN ICE BOX?

WAH! MY FAVOURITE!

SEE MULPHA!

SELLING AT FANTASTIC VALUE AT 90% DISCOUNT TO REVISED NTA!

JUST LIKE FOCAL AIMS AT 11 CENTS!

CHINESE ARE BUYING UP AUSTRALIAN PROPERTIES!

MULPHA IS THE LARGEST PROPERTY OWNER IN AUSTRALIA FROM MALAYSIA

AND UNKNOWN TO ALL OTHERS LEISURE FARM BUNGALOWS ARE SELLING LIKE HOT CAKES IN SINGAPORE!

2015-07-15 19:06

why did the revenue grow from 400k to 2.4k but profit grow only from 68k to 127k?

2015-07-15 20:04

we all must die die believe in XingHe peanut oil.......to go into langit!!! kikikkiiiiikiiiii

2015-07-15 20:05

If you said it undervalued, means u dun understand Malaysia insurance industry

2015-07-15 20:32

I mean cold stock that undervalue with good fundermental and grow. This kind of stock can curi-curi simpan without other people notice

2015-07-15 21:17

lol ... all bias view here... sigh ...

paperplane2, can you explain how much you understand about Malaysia insurance industry ? Might enlighten a bit to small potato like me ?

2015-07-16 01:57

Effective from April 01, 2015, the company has a new CEO who is touted to a proven leader with competency in business. This is positive for the stock. At the present price of RM3.77, the stock is at a steep discount to its book value of over RM6. My bet is on.

2015-07-16 04:18

They are getting ri biz not due to their competitive ness, but rather due to some policy. U know lah ,Malaysia Mah.and this kind of policy can't last long

2015-07-16 06:47

Klse screener software show that it lost money for few years....2014,2012....

2015-07-16 08:15

hahahahah ... all late comers .... KAKAKAKAKAK ... but better late than later ... kee kee kee ...

2015-07-16 11:54

paperplane2 They are getting ri biz not due to their competitive ness, but rather due to some policy. U know lah ,Malaysia Mah.and this kind of policy can't last long

can elaborate more ? I don't know about everything. Please fill me up.

2015-07-16 22:21

There is a rule, some part of general ins ri in Malaysia has to go to mnrb. And this is coming end soon . Think is 2017 this rule end

2015-07-16 23:09

40% revenue from overseas. This is an "international" player. Doesn't look like they are relying on government

-----

(The Star, April 2015)

Malaysian Reinsurance Bhd (Malaysian Re), a wholly-owned unit of MNRB Holdings, is targeting to expand its business in Europe, Singapore and Hong Kong in the next two years to drive its earnings and broaden its reinsurance market beyond Asean.

Malaysian Re, which is the largest contributor to the group, at the moment is also the biggest national reinsurer in Asean in terms of market presence as well as gross premiums.

Elaborating on the company’s expansion drive, Malaysian Re new president and chief executive officer Zainudin Ishak in an interview says the group is targeting to have an equal contribution in terms of gross premiums for both its local and overseas markets for the financial year ending March 31, 2017.

Currently, the ratio in terms of the contribution in premiums for the domestic market to that of overseas market is 60:40, he adds.

2015-07-17 07:36

It is a good undervalued counter. However, investors have to put up with volatile earnings. I had this stock long time ago, and was truly shocked it plunged into the red during the Thailand floods. Who would have thought that MNRB took up reinsurance policy there? Whenever there is a major disaster, like the Kelantan floods, there is always tremendous anxiety on the earnings of MNRB. I didn't like the volatility, and I am sure many others don't either. But I agree with you that it is deeply undervalued. When there is no major disasters, earnings is fantastic!

2015-07-17 08:56

Kian Leong Lim,

First of all, I can sense you have immense animosity towards my article. I don't think that is anything personal. But more because you dislike MNRB, I guess.

Secondly, I can tell that you are very familiar with MNRB's history and business operation. So I am dealing with an expert here, need to be careful with what I say : )

I have gone through your points. Some are valid, some are angry rhetorics.

It is not my intention to paint a rosy picture (your red apples analogy). It is also not my intention to trap investors. For your info, yesterday the stock went up, I didn't sell a single share. I don't pump and dump for a few thousand ringgits gain. I aim for bigger gain, and that can only be achieved via long term investment. If you read my blog articles long enough, you can feel me, whether I am saying the truth.

Have I been reckless to recommend a stock that can put many forum members' life saving in jeopardy ? I don't think so. When investing in a stock, there are two risky outcomes : (1) huge capital losses. (2) underperformance, the stock simply doesn't move. Or it declines by 10% to 20%.

I don't think the chance of (1) happening is very high. Most likely it will be (2), namely underperformance.

If you said that "many investors will be trapped", you are underestimating investors' intelligence in Bursa. Many people have punted stocks with super high gearing, high PER, closed to bankruptcy (which I think is stupid). I simply cannot accept the accusation that my article will victimise "innocent investors" and cause them to lose money big time.

As mentioned above, I think you have strong dislike for MNRB. But just relaxed, it is Hari Raya.

Peace

==========

Posted by Kian Leong Lim > Jul 17, 2015 08:26 AM | Report Abuse

When you recommend a stock, you must tell the good and bad also. You are setting a trap for investors to buy shares in this company. Look 40% revenue from overseas.Look the revenue went up every year; Look the net profit did not go up everyday, is this because of intelligent account? You see apple you don't see the worm, and you say the everything that is red is a good apple. All the apples are looking the same, but some contain a worm, did you tell the investors about the worm. How come revenue went up so much, the net profit didn't go up, but I think borrowing went up too and the debts never come down. Most undervalued only on the surface?

2015-07-17 09:30

Anyway, this is only part 1 of my stories on MNRB. My style is always that I browse through a group, feel the important information, then I will jump in already ("buy first think later"). I don't wait to compile a 500 pages report before I press the buy button.

The same applies to how I write my articles.

Later on, I will conduct a more comprehensive study of MNRB's operational details, probably will cover why their earnings had not gone up in line with revenue, etc (if I have the time to go back so many years !!!). I will try to highlight the shortcomings as well as strengthens.

There is no issue of me only highlighting the good points as you accuse "When you recommend a stock, you must tell the good and bad also. You are setting a trap for investors to buy shares in this company."

If anybody is STUPID enough to purely rely on my article and sai lang (means "bet all") in this counter, he deserves to lose all his money.

That is all I can say.

2015-07-17 09:56

Sorry, I cannot accept your accusation below.

I believe among so many contributors in i3 (and other internet sites), I am one of those that dedicate a lot of time to try to look towards the future to guide my investment decisions and write my articles (for example, Thong Guan’s capacity expansion, Johore Tin’s low raw material cost, Poh Huat's earning boost from weak RM, etc).

In MNRB’s case, my claim of undervaluation is based on their many years of profit track record (not an easy task, no matter what you say). Of course you can zoom in and start picking on various minute details about the group. I have read your comments above disapproving the way they invest in debt securities that do not beat inflation, etc. Those might be valid points, but are they serious enough to threaten the existence of MNRB ? I don’t think so. (anyway, your points might not be valid. There might be risk associated with higher yield instruments. I have yet to hear the other side of the argument).

The way I see it, MNRB might not be operating at optimum level (you already pointed out few things). But until now, I havn’t seen any systemic weakness that can change the way I think of the group. The only potential skeleton in the closet is what you (and others) mentioned before, “why their earnings have not grown in line with revenue over past 15 years", which I am very curious to find out with further study.

Until you point out further flaws, I remained committed to my view that MNRB is NOT a rotten apple as what you said.

Btw, it wasn’t me who flagged you.

=================

Kian Leong Lim Mr. Icon8888: all the stocks (not just MNRB)you recommended saying the truth from the bottom of my heart they were pretty good in the past but they may be some problems in the future. This may be because you are using old measurements to assume that their future business environment are going to be the same as they were in the past.

When you recommend a stock, you must tell the good and bad sides also. You are setting a trap for investors to buy shares in this company.

2015-07-17 10:41

did I ask anybody to buy Media Prima ? please refer to my concluding remarks for that article below :-

=======

"2014 has been a bad year for media companies. 2015 will continue to be tough.

Due to the subdued sentiment, I am not really in a mood to undertake a comprehensive analysis at this stage. The objective of this article is just to lay out some details of the group's past few quarters' performance for everybody to have a feel.

Having said so, I am tracking Media Prima closely for entry opportunities. The group is an established player with solid track record. It pays out 11 sen dividend in 2014. Based on existing price, the yield is 8.5%. Even though it is unlikely to repeat the same payout this year, a 50% reduction to 5.5 sen will still yield 4.2%.

Media companies are sensitive to economic performance. When consumer sentiment improves, they will snap back with a vengeance.

If you are a long term investor, maybe you should pay some attention to this group going forward."

2015-07-17 10:44

As mentioned above, I have been careful not to recommend people to buy Media prima, as I too notice EPF has been selling.

But even if I recommend people to buy Media prima, are you sure that I am wrong with my recommendation ? Of course very likely I will be wrong in the short term as the selling pressure might persist and operating environment not about to improve any time soon.

But over the long run, to buy Media prima at this level can turn out to be a super smart move. From a long term investor point of view, Media prima's existing weak result is due to soft market conditions. One day when economic condition improve, Media prima earnings will recover.

Are you really sure that I shouldn't even write an article to discuss Media prima at this point ? Are you sure ?

You hint that I try to pump and dump on i3 forum members by writing about media prima ? Are you kidding me ? Buy a whole lot of media prima shares that are under severe selling pressure everyday (with few million shares transacted), write an article and hope that everybody will chase up the shares and I can dispose off at T+3 ?

ARE YOU KIDDING ME ?????

========

Like media, epf sell and sell shares, you recommend that share? What is the problem with the share? Why epf sell and sell? right! It is not that you can not recommend that counter, you must be careful when you recommend one to your bloggers or what. Find out the reason why epf sell and why you think the problem can go away in the future. There must be a problem for the share price for people to sell and there must be a solution somewhere that the management or epf hasn't realized it. (1) Find out the problem (2) Find out the solution (3)Sell price good or not? Use pe ratio or what (4) Buy a lot yourself first before you also recommend it to investors. Please do not not buy a lot of shares yourself but recommend it to investors instead, I hate people like that! Hit and Run take commission. One guy that start with "K", all the shares he recommend are those that he has received inf. in advance from interest group. He bought the shares and start recommending them. He told people you must sell when the news come out. This is how he got rich working for himself, his fan, and his inf.. Don't learn from him, he is old, you are younger, work hard, do something that you can be proud of yourself everyday of your life.

2015-07-17 10:58

did I charge anybody fee for managing their funds ? do i have the resources to dig out so much info ? Do i have the responsibility to answer all these tricky questions ? will anybody be so stupid to sai lang on media prima after reading my article ? you got to be kidding me !

============

Like media, epf sell and sell shares, you recommend that share? What is the problem with the share? Why epf sell and sell? right! It is not that you can not recommend that counter, you must be careful when you recommend one to your bloggers or what. Find out the reason why epf sell and why you think the problem can go away in the future. There must be a problem for the share price for people to sell and there must be a solution somewhere that the management or epf hasn't realized it. (1) Find out the problem (2) Find out the solution (3)Sell price good or not?

2015-07-17 11:02

why don't you highlight what are the things that you mentioned below ? I simply don't have the info ? D you have ?

I am not defending MNRB. I am just defending why I am not able to highlight the "worms"

=====

Kian Leong Lim

Let the investors know and decide whether the bad sides of the company by themselves can be diminished by the company management or some miracles in the future or not?

It is the flaws that are important, not the red apple that is important, it is the worm that is important. Who in the world, hell, or heaven is telling you that an apple will surely drop on you big head. Your head is too big, you even have the balls to write like that to me! Your recommendation is telling everyone that an apple will surely fall on their head? Common! This is your personal likings, I like problems, no problems big shot ah, no need to work but when somebody tell you got money to take you rush and go and take? Are you that kind of person yourself? Tell everybody yourself, can you?

2015-07-17 11:08

Icon, you are like oldman. Ppl disagree u you keep defensive. Come on, be a man, accept others opinion

2015-07-17 11:11

I accept mah. Just chit chatting.

By the way, I found out what you mentioned above about the government helping them out. It is called voluntary cession.

It is not a new issue. Announced since 2001. The government is reducing it gradually for them to build up overseas revenue. I will discuss this in my future articles, together with detariffication, etc

2015-07-17 11:16

Paperplane, FYI, I have a lot of respect for you despite our frequent skirmishes. I took your view into consideration most of the time (quietly, he he). The only thing is that you are very cocky. So I don't dare to talk to you much, ha ha

I won't say the same thing about optimus (regarding views on issues). I think he is neither a trader nor investor. I think he is an operator, albeit a smallish one. So most of the time, fundamentals are irrelevant for him. (Just my guess)

2015-07-17 11:23

Is MNRB undervalue?

This is my view:

In year 2006 I first bought MNRB & MNI at the recommendation of Dr. Neoh Soon Kean (The Benjamin Graham of Malaysia) in his monthly digest.

MNI was so profitable it was later taken private. MNRB became one of my strong dividend stock - yielding 8% to 9% then. I noticed that ASB also loaded up on MNRB for its dividends. ASB needs high dividend for yearly pay out to Amanah Saham Bumi investors - 8% to 10% yearly yield!

Warren Buffet also has lots of Insurance Companies in Berkshire - example Geiko insurance. The overhead costs of Insurance Companies are negligible. Unlike airplanes which incur high capital expenditure and can depreciate substantially. So Warren avoided airline cos and bought Insurance cos.

Then the businesses of MNRB went through some tough times and Dr. Neoh changed his mind. In His 6 Monthly Stock Performance Guide he said that MNRB will have only average growth. True enough. MNRB's dividend shrank to only 5% to 6%.

I noticed 2 things as time went by.

1) In Malaysia Insurance Companies are subjected to fraudulent claims due to "monkey business". Furniture shops frequently set fire to its own premises to claim insurance. One guy specialize in car accident claims. To claim for higher damage he would even take a car with slight accident & ram it, wreck it and smash it further for the maximum damage to claim the Highest AMOUNT from Insurance companies. (The exception is Takaful as the muslims do have the instilled fear of Allah - thus preventing them from outright cheating.)

2) The Bible predicts that the future is beset by earthquakes, pestilences, upheaval and unforeseen perils {See Matthew chapter 24). . So there are floods in thailand, trengganu/kelantan & pahang. 2 MAS & One Airasia planes crashed or missing. Damaging Earthquakes in many places & more to come.

Of course Insurance Companies can always Raise Premiums because of so much claims. But there will come a time when people start turning away.

For me MNRB is just a fifty-fifty investment. It has average yield now. Unlike those days of almost double digit dividend.

Will I buy back MNRB? If it drops to Rm2.50. Why not?

For now Amanah Saham Bumi is selling & selling MNRB. Why? 5% dividend will not meet ASB's criteria of helping bumiputra investors.

And Calvin has taken notice.

Have a nice day.

Selamat Hari Raya

Calvin Tan Research

2015-07-17 11:52

I know you must have a lot of MNRB. I can tell from the way you kutuk them, ha ha.

This stock is slow, I don't buy a lot. The reason I buy is because I like the idea of "long term investing" - buy and wait and be rewarded at the end. It is a beautiful concept.

Anyway, in stock market, never say never. When value of a company built up to a certain level, something will happen to unlock it. I have seen it happens so many times already.

In my opinion, too early to say MNRB is a flop.

2015-07-17 11:54

Kian Leong,

After you are done with your girlfriends, can you please share with us your high quality counters? You set high standard but I never have a chance to read about your holdings or recommendations.

2015-07-17 12:03

ha ha really kah ? Kcchong also have a tough time ? Maybe uncle Lim girl friends like the way he argue leh ?

2015-07-17 12:18

hahahahah ... the sifoo of all the sifoos is .. of course leno the most panlai ... hahahHAHAHAHAHAH ... the sifoo of all the sifatt is of course that Singapore Ah Tan lor ... canTEEEEEKKKKKKKKKKK !! Silamat hari kaya aidil fitri ... yeeeHAAAAAA

2015-07-17 15:28

it's getting harder to find undervalued stocks to invest right now, especially by urself only, restricted by limitations like exposure, time, energy etc. that's why some of us come here, forum to get some sharing. this is a forum, but nobody owes anyone anything. someone hardworking and generous like icon8888 keep sharing. but how many ppl say thank you to him for earning some money from the sharing. if u have comment, commend nicely. this world need more encouraging ppl than discouraging ppl.

2015-07-17 16:46

perfectly said anony...

encouragement + healthy factual opinion (does not matter if is differing)

2015-07-17 16:49

Ya, I better don't say anything to disagree. Otherwise will get mr paperplane to blow his blood vessels again

2015-07-17 20:38

Let's see how much dividend declare next month.. Who knows if there is surprise

2015-07-18 00:12

paperplane2

most undervalued? IT WILL BE BJCORP OR INSAS

2015-07-15 17:30