(Icon) Air Asia (2) - Understand Its Past To Better Feel Its Future

Icon8888

Publish date: Tue, 15 Mar 2016, 12:04 PM

(Buffett was averse to airline stocks due to their low profit margin and heavy capex requirement. Will he change his mind now that oil is so cheap ?)

Executive Summary

(a) In the past few years, Air Asia has grown its fleet and revenue substantially, yet its profitability remained more or less the same. To find out why, I undertook a detailed study of the group's historical P&L.

(b) Pursuant to my analysis, high fuel cost (and the inability to pass through to passengers) is the main culprit.

(c) Current low oil price will unshackle the group, allowing it to keep price low and at the same time rake in healthy profit margin.

(d) As a conclusion, Air Asia is entering a golden era, with strong profit and potentially high dividend going forward. Maintained "Screaming Buy".

1. Introduction

Last week, after I published Part 1, many readers gave their comments. One in particular caught my attention - "Warren Buffett doesn't like airline stocks".

Without the need to cross check, I immediately know that the comment is very likely true.

This is because everybody knows that Warren Buffett likes strong free cashflow. You don't need to be an aviation expert to know that airline business is characterised by low margin and high capex. Some people describe it as "growing themselves into bankruptcy". This is the exact opposite of what Warren Buffett desires.

Is this stereotype applicable to Air Asia ? How has it performed in the past ? What actually dragged down its performance ? Are these inhibitors stil there ? Will they continue to affect the group going forward ?

2. Unpleasant Big Picture Indeed

The only way to answer those questions is to study the group's past performance.

First of all, we need to establish whether Air Asia meets Buffett's stereotype for airline companies.

Indeed, the group displayed certain characteristics of Buffett stereotype for airline companies :-

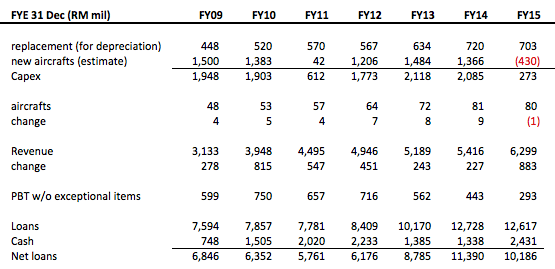

(a) Between FY2009 and FY2015 (a period of 7 years), Air Asia spent a total of RM10.7 billion on capital expenditure.

(b) The group increased its fleet size by 67% from 48 aircrafts to 80 aircrafts.

(c) In line with the fleet expansion, revenue also increased by 73% from RM3.13 billion to RM5.42 billion (I used FY2014 figure as 2015 was inflated by huge aircraft operating lease, as pointed out in my first article).

(d) Unfortunately, PBT (exlcudes exceptional items) remained stagnant throughtout the years.

(e) Net borrowings increased from RM6.85 billion to RM10.2 billion.

What had transpired ? What are the things that held back the group ?

To answer the above question, we need to take a closer look at the group's historical P&L.

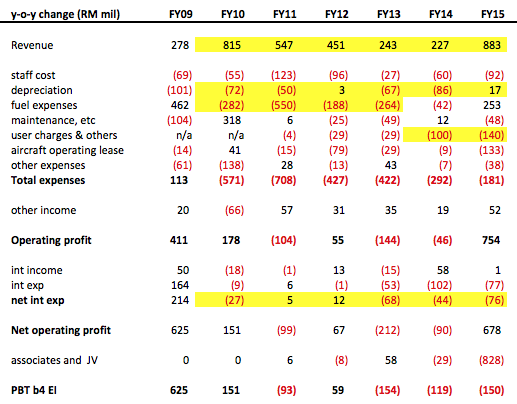

The table above contains a lot of information. Unfortunately, it is a format that is not conducive for spotting patterns and trends.

It turns out that by looking at year-on-year changes, the various major factors affecting Air Asia's profitability will immediately show up.

Just in case the readers do not understand how to read the above table, let me use revenue to demonstrate. For example, the FY2010 figure of RM815 mil = FY2010 revenue - FY2009 revenue = RM3,948 mil - RM3,133 mil.

Key observations :-

(a) Between FY2009 and 2015, average revenue growth was RM492 mil per annum.

(b) Despite heavy capex, depreciation charges had not grown by much. On average, the increase was around RM70 mil per annum. Not a small number, but relatively insignificant compared to average revenue growth of RM492 mil per annum. It is not the major culprit we are looking for.

(c) The same is true for interest expenses. The group's borrowings increased by 66% from RM7.6 billion in FY2009 to RM12.6 billion in FY2015. However, net interest expenses on average increased by RM33 mil per annum only. Again, it was relatively insignificant compared to annual revenue growth of RM492 mil per annum.

(Note : Further analysis showed that the relatively small increase in interest expenses was largely due to the group's ability to lower its cost of financing from 4.9% to 4.2% over the years)

(d) The item that has the biggest negative impact on group profitability turned out to be fuel expenses. As shown in table above, during the period from FY2010 until FY2013, average increase in fuel expenses was RM321 mil per annum. This item alone knocked off 65% of the increase in revenue from capacity expansion, leaving behind only 35% to cater for increase in other expenses. After deducting all the additional expenses, there is nothing much left for shareholders.

4. The Economics Of Fuel Surcharge

In my opinion, the high fuel cost experienced by Air Asia was actually a result of competitive pressure.

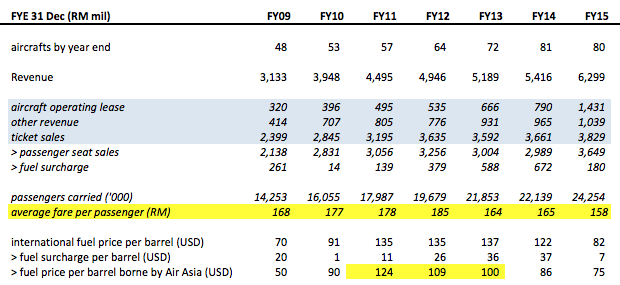

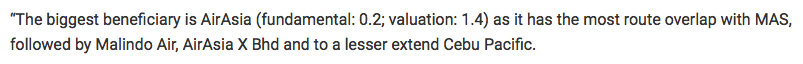

The group is entitled to pass on higher fuel cost to passengers. However, due to intense competition from MAS and other low cost operators, the group absorbed the bulk of the cost increase to defend market share. During the period under review, average fare per passenger was on downward trend despite persistently high oil price.

The effects of high fuel price was particularly pronounced during the period from 2011 to 2013. Even after passing on some of the cost to passengers by way of fuel surchage, average cost per barrel was still as high as USD111 per barrel.

That was the main reason why Air Asia was not able to grow its profit despite healthy top line growth.

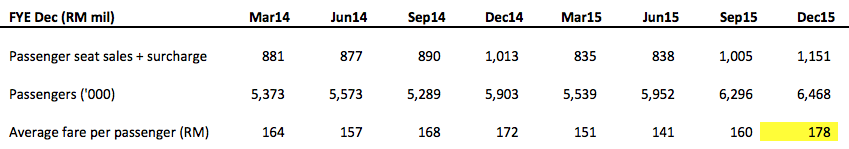

However, there are signs that things are improving. In the latest quarter ended 31 December 2015, average fare has increased to RM178 per passenger.

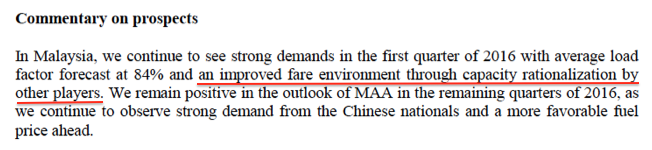

The improvement was likely due to MAS' rationalisation exercise which involved shutting down certain flight routes. The company made the following commentary in the December 2015 quarterly report :-

5. Cashflow

There are allegations that airline companies need to call on shareholders to inject capital every now and then. Is that the case for Air Asia ? Let's look at the group's historical cash flow to help us answer the question.

Key observations :-

(a) Good time or bad time, the group generated robust EBITDA of approximately RM1.5 billion per annum. I give that a big LIKE.

(b) The group spent heavily on capex (RM10.7 billion over a period of 7 years) to grow market share.

I reject the notion that the group is growing itself into bankruptcy.

As per my analysis above, profit stagnation was mostly due to high fuel cost and competitive pressure tying their hands. Now that we are entering an era of low oil price, many of the routes that previously struggled to break even should turn profitable.

On hind sight, the group has done the right thing by pushing ahead with capacity expansion in the face of high fuel cost. Without that, it won't be able to enjoy the current windfall gain brought by low oil price.

Opportunity is indeed for the prepared mind.

(c) During the period from FY2011 to 2015, the group injected RM743 mil capital into its associate companies and jointly controlled entities (Thai Air asia, Indonesia Air Asia, Philippine Air Asia, etc) by way of equity injection as well as shareholders' advances.

Apart from Thai Air Asia, the other associate companies had not performed well. However, with the current low oil price, the odds of them turning around had improved substantially. In coming quarters, we will find out whether that will indeed be the case.

(d) In FY2009, the group undertook a placement exercise involving issuance of 380 mil new shares at RM1.33 per share to raise RM500 mil. Apart from that, there is no other equity fund raising exercise. Seemed like "rights issue every now and then" is nothing more than wild talks.

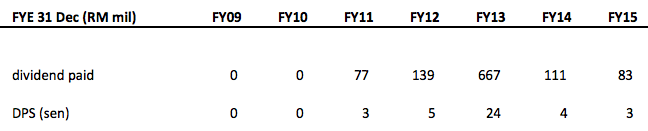

(e) Not only that, Air Asia has been consistently paying out dividend since FY2011.

With prevailing low oil price and expected spike in earnings, shareholders will be looking forward to generous payout going forward. Why not ? Tony loves cash too.

Cheers.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Great work icon8888!

However, it is Profit growth that matters rather than Revenue growth.

2016-03-15 12:35

Warren Buffett suggests (for capital intensive industry) to adjust net profit figure by add back depreciation and subtract capital expenditure, the numbers will look really ugly if you do that, i think.

2016-03-15 12:43

airlines was facing intense competition & high fuel costs. the game changer was introduction of low cost fares structure ( pioneer by virgin air ) and copied by AA. to address the high fuel charges ( eg sky rocking crude prices ). Majority of airlines now pass on the fuel excess surcharge to passengers. AA did one better - passengers also charge for meal, drinks and even faster check in.

AA model was further improvise by Tony FErnandez and make the model super efficient compared to MAS. Using AA models ( Tony Fernandez ) spread the wings to all regional centres using the lease and JV structures. The head hong cho knows traffic connectivity is important and volume is the name of the game.

Icon did a good job on the AA operating analysis fare structure. It may not be 100% perfect but it need time and good anaytical skill. Whatever is it ( without sounding crony ) those reading this blog must have some vested interest in AA or AAX.

The only drag on AA was their overseas JV in Vietnam, Indonesia. THailand is going geat and in fact the second biggest contributor, With the new routes to Chiang Mai and Hathyai coming April. AA Thailand will be even better. Last year the USD rallied against most Asian currciences resulting in forex losses.

Hopefully, this year we have seen the peak in the USD strenght. The reverse will benefit all the regional curriences (i.e. if they strenghten against the USD ) Forex gains will be substantial. this is my personal take on AA. Happy trading

2016-03-15 16:16

When the Crude price dips...RM weakens.

But the effective fuel cost in RM is still cheaper...

so don't worry about the short terms effects of Forex - only think of the long term implication of Fuel price.

2016-03-15 19:58

No other air line can compete with Tony, he start from nothing ! He refinance his house...and start his dream .cost =0.

2016-03-15 20:05

now still not too late to sailang.

i seldom see Icon call for "screaming buy", i continue to average up everyday.

2016-03-15 20:10

great work , sifu icon888, i join the plane already. fly together. cheers...

2016-03-15 21:22

I'm not giving up my pride! I'll never going to give up my pride. This is me. AA

2016-03-16 00:34

Icon is too late at his call. When it traded last yr ending, u shld have picked it.

You let your ego takeover your logic instead.

But overall some assumption can be danger. What if fuel cost goes up again. What if mas turnaround and be in competition again, they had to cut price again. And Indonesia is the biggest mkt now, must tackle

2016-03-16 02:45

Unless they can succeed in Indonesia, else no way I see it can grow strongly. 2bil ppl, imagine 10% only travel using aa. Tht is super mkt, must tackle

2016-03-16 02:46

why everyone like to see the last quarter and tells story, if that is so good ? why everyone dont buy on 0.8 that time? everytime i see air asia story i feel so funny, it is like wave, everyone tells how good it is how good it is, in the end drop like shit, like last time aax 0.75, people say how good it is, in the end drop until 0.2 , what now? want to goreng again and drop further? tony does not change the nature of business, does not change the operation , if a company does not make the changes , everything is still same, the improved quarter report does not give the people who does not willing to make a changes. the air asia is like passive mode, what i see is only all crazy people buy only

2016-03-16 09:42

Ryan, not crazy people, but small people.

When Tony was on the roadshow selling AAX IPO, he told us Airasia was worth RM6. "AAX should follow growth trajectory of Airasia." And then we all see huge losses after AAX listed.

3 weeks ago i was quite excited when the QR released. But after i read what icon did, look through the numbers, i changed my mind. Warren Buffett is right! It is a zero sum game, the economics of airlines fit what Warren predicts (let's say it is monopolistic competition).

You take away the unusual amount recovered, PAT is -200m.

IAA is in bigger mess when oil price is low, whatif their competitors cut prices even more, IAA is a prey (and all other loss making associates).

Goreng goreng ok lah, don't sailang.

2016-03-16 10:08

Not very good sign today, failed to stand above 1.80. See how later.

2016-03-16 10:45

after ICON8888 post, I sailang AA share, thank you ICON8888, now I can buy new car, new house and spend AA money

2016-03-16 11:19

007, how much you bought? So fast can buy so many things aledi? Just up few cents & you start celebrate aledi?

If you have so much money as what you said, you won't feel so extremely excited like this.

2016-03-16 18:50

may bought with 1.62 Million and sold at 1.81 Million..

150K house & 50K car?

hmm...agreed..not so attractive for a millionaire

2016-03-16 19:01

Buy or sell is a choice.

But there is no way a blogger can run an airline. Even PW partner would be lost if asked to do it.

2016-03-17 02:10

moneySIFU, I'm a timid person, AA is a big risk counter to me. I had sleepless night last few months due to my own decision. ICON8888 come to my rescue. I will go back to bank and palm oil again

2016-03-17 10:05

Icon

You have rightly point and clearly state airasia topline consistent growth, and with lowering now oil cost will direct impact on airasia bottom line significantly. I have bought many today at 1.74, expect it will regain momentum to break 1.80 decisively, paving toward 2.00 soon

In additional, if you have time, kindly also figure out the fair value for awc.......many contract secure and concession agreement + net cash position+ eps growth. Thanks

2016-03-21 17:51

Icon,

How likely AA will pay dividend next month? Will it more than 3 sen judging for improving prospect

2016-03-21 19:54

No problem, AA is growth stock, even with dividend yield at low side 2%, fair valuation PE should above 10x.

2016-03-21 20:29

股海無涯

MAA is cash cow, the problem always lie on Oversea affliate(TAA, AAI, PAA, IAA), Thailand stable and become another cashcow, if AAI, PAA, IAA, and new Japan AA stop Bleeding, the Cashflow(and Profit) will 10x more strong then now under low fuel price.

2016-03-15 12:34