(Icon) Air Asia (3) - How Much Will It Benefit From Ringgit Appreciation ?

Icon8888

Publish date: Tue, 29 Mar 2016, 11:58 AM

According to Alliance DBS Research, more than 75% of Air Asia X's expenses are denominated in USD.

As Air Asia has same business model as AAX, I wonder whether it has a similar cost structure ? To find out how the strengthening of Ringgit will affect Air Asia, let's take a closer look at its historical P&Ls.

If I am not wrong, the yellow highlighted items should be mostly denominated in USD.

For revenue, the final quarter of aircraft operating lease was unusually high. I normalised the figure by annualising January to September 2015 figures to arrive at USD248 mil as full year estimate.

For expenses, the FY2015 fuel figure was based on USD82 per barrel. In FY2016, the likely price per barrel should be USD59 (Air Asia has hedged 50% of its requirement at that price). Based on 6.28 million barrels, fuel expense should be USD371 mil.

Based on the adjusted fuel cost, total expense would be approximately USD1.25 billion, out of which USD631 mil will be denominated in USD. This represents approximately 50% of total expenses.

However, after being offset against USD248 mil operating lease revenue, net Dollar denominated expenses is only USD383 mil, representing 30% of expenses.

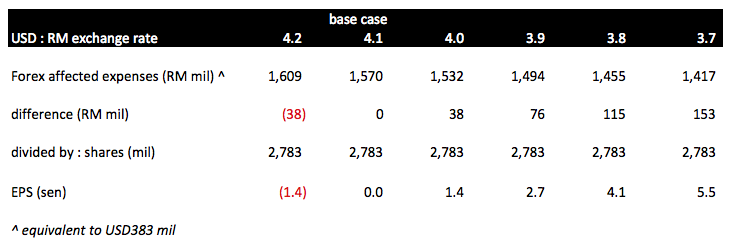

To determine the impact of USD movement, I did a quick sensitivity analysis based on base case of 4.1 and USD383 mil :-

According to table above, every RM0.10 movement in RM vs USD will result in RM38 mil changes. Based on 2.783 billion shares, approximately 1.4 sen impact on EPS.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

he need someone to get his portion of share as high as possible, that's simple!!!

2016-03-29 12:20

I have a bit of exposure in Air Asia. Naturally I will like to know more about the group and share it with others. Even though that is the case, I try to be objective when writing about a stock. At the end of the day, it is the profit that matter. If they can't deliver good result next quarter, no amount of writing can push up the price.

2016-03-29 12:23

if they promote when AA at low price e.g. 0.80, that is honest, caring & sharing person...trustable person

if they promote after the price rocket already, that's mean...u know what I mean...

I think in market, they need to find loser to make them a winner, that's normal, therefore, we also cannot blame ICON, he need to earn for living to find loser to compensate her winner

2016-03-29 12:24

Not really, did you read my article "three ways to punt the market" ? Air Asia currently has momentum. As such, even though it has gone up from 80 sen, there is room for further gain (as EPS is strong). In that article, I called that "Surf Riding".

The article is as below, if you are interested

http://klse.i3investor.com/blogs/icon8888/87192.jsp

2016-03-29 12:35

Icon8888, when MYR weak they have forex loss and now should be forex gain with stronger MYR, But how much? are you have calculation?

2016-03-29 12:39

Icon8888, thanks for your analysis. Now AA is flying on its own engines with strong tail winds Oil and Ringgit pushing it higher

2016-03-29 14:59

As Air Asia has same business model as AAX, I expect a similar cost structure

DANGEROUS ASSUMPTION

2016-03-29 15:18

we need to be patient. contra players tend to hit and run ( same as counters @ push & dump ). Both AA and AAX was push down by allegations of irregular accounting . Similar to murky water CEO write up on olam international. AA & AAX ( Tony ) came up with clear picture what they did with their lease and write back between AA and AAX subsidiaries.

With the stronger ringgit and the inflow of E-visa from China. AA and AAx can expect better volumes plus lower fuel prices. The coming quaters will confirm whether the turnaround of both AA and AAx. Both counters have not recover their last year share pricing. AA ( > RM 2.00 ) AAx > 80 ( after their rights )

2016-03-30 11:28

lux88

Icon,looks like u promote AA actively, AA is your largest portfolio?

2016-03-29 12:13