(Icon) Jaks Resources (4) - Doing Reasonably Well

Icon8888

Publish date: Wed, 29 Aug 2018, 11:56 AM

1. Latest Quarter Result

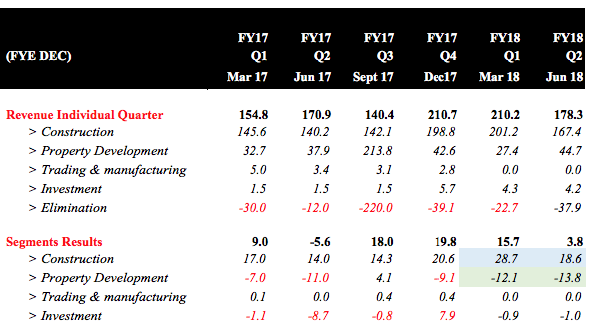

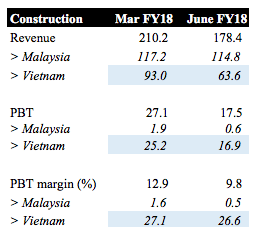

Yesterday, Jaks released its June 2018 quarter. Please refer to table below :-

Key observations :

(a) Earning declined from RM17.8 mil to RM12.7 mil. Who is the culprit ? Surprisingly, it is not the property division, which has attracted most attention recently due to the Star Media court case. The property division's operating loss maintained at more or less RM13 mil (LAD was maintained at roughly RM8 mil).

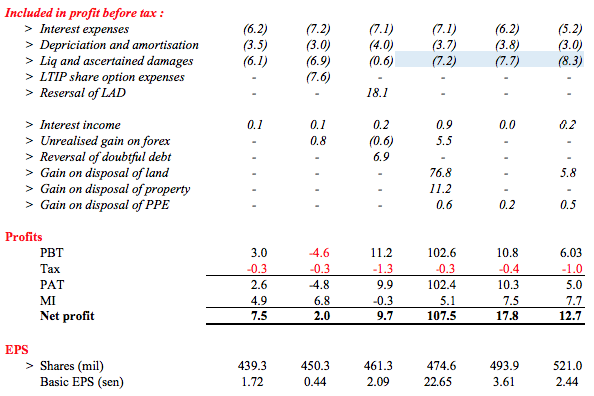

(b) The culprit is actually the construction division, which saw its operating profit declined from RM28.7 mil to RM18.6 mil, a drop of RM10.1 mil. This was mostly due to lower revenue of Vietnam IPP project, which declined from RM93 mil to RM63.6 mil. Accordingly, PBT declined from RM25.2 mil to RM16.9 mil. Please refer to table below.

The company did not provide explanation on why Vietnam IPP revenue declined. But it could simply be due to status of progress billing. Nothing to be alarmed at, in my opinion. Please note that for two consecutive quarters, Vietnam IPP's PBT margin was maintained at impressive 27%. This is important as the fat margin supports our argument (and assumption) that Vietnam IPP will be the key earning driver going forward.

2. Vietnam IPP's Construction Profit Is Merely An Accounting Gimmick ?

As we all know (as explained by KYY), Jaks' China partner was the one doing the work while Jaks was allocated a portion of the construction profit. This leads to certain forum members claiming that the construction profit is not real - it is "something that you can see but cannot touch".

Is that really the case ? Of course not.

Those profit is the building block for its ultimate 30% economic interest in the IPP. At the beginning, Jaks owns zero economic interest in the IPP. As time goes by, the construction profit allocated to it by the China partner will be automatically ploughed into the IPP as capital injection. So it is true that Jaks does not get to lay its hand on the profit. However, as construction progresses, its economic interest in the Vietnam IPP will gradually increase. At the point of completion, it will own 30% of a 2 x 600 MW IPP, without the need to inject much capital.

How can it be not real ?

3. Next Quarter Result Could Potentially Be Bad

Next quarter result might factor in losses related to the RM50 mil Bank Guarantee (if they loss the court case). But it is a one off exceptional item. I think most investors will ignore it and focus on the actual operating figures.

4. Any Regret Buying Into Jaks ?

Nope. So far so good. Price has declined to around 95 sen. But that is peanuts compared to my average cost of RM1.00+.

My investment thesis for Jaks remained unchanged. Balance sheet remained reasonably sound with RM460 mil interest bearing debt backed by RM220 mil cash. The group is unlikely to get into financial difficulty.

I am happily holding on, with my eyes on end 2019 for potential 100% gain.

Have a nice day.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

KYY one hand said he stopped disposing Jaks but another hand keeps disposing (see the company announcement).

Yes, Jaks' ownership on IPP increase when the construction is progressing. Forum member claims the profit is not real because it is not a real cash that Jaks received from the progress of construction but just the increase in the equity owned in IPP, that's why it is not "real".

Whether the Vietnam IPP can make money after its completion in 2020 is a doubt but not confirmed. Btw, take caution that the 10 years-cycle big bear may come before year 2020.

2018-08-29 12:44

JAKS JV with CPECC for the IPP is 70:30 with the option of increasing the stake, so saying that they own zero equity at the start is not true

There is a very simple and elegant explanation as to why the 'construction profits' are not real, but that is for another day

2018-08-29 12:52

No one believes in international accounting standards ? Auditors will allow the recognition of "fake profits"?

2018-08-29 13:41

Who are those Auditors on Xinquan and other CHina Co's ac?

Do they follow international ac stds?

2018-08-29 14:20

theres other factor that is more important than the number in the book.

if all the number is so accurate. how ppl wash money? how ppl corrupt?

2018-08-29 14:27

yongyos Free lunch for big frog jumping here and there without laying a brick and paying a sen for 30% stake in vietnam power plant.... Very good.

29/08/2018 13:25

Is the above statement true?

Besides, I just wonder why nobody cares to clarify the details of IPP with OTB...

Sifu received an invitation to have a site visit on the IPP in vietnam (and maybe he enjoyed more on Kara Ok at night...)....and the answer is a big NO No..

Maybe u guys should belanja him a cup of coffee before sailang non stop in JAKS...

2018-08-29 14:30

a lot of negative comments

this is because share price is down

just wait until it goes up to 1.50, then everybody will come out and say this is the next Public Bank

2018-08-29 14:43

Posted by Icon8888 > Aug 29, 2018 02:43 PM | Report Abuse

a lot of negative comments

this is because share price is down

U sure or not...I see no less negative comments even price was high at RM1.80+

2018-08-29 14:47

Many (including myself lah) have been giving not so positive comments when the price was Rm1.20 to Rm1.80...

The comments made are mainly on KYY's modus operandi n IPP wawasan 2020 dreams...not really related to price movement leh

2018-08-29 14:49

yongyos Free lunch for big frog jumping here and there without laying a brick and paying a sen for 30% stake in vietnam power plant.... Very good.

29/08/2018 13:25

Btw, is the above true?

If yes then how did they get such a nice contract in the first place? Somebody open his legs ah

2018-08-29 14:52

not referring to you lah... I am referring to those other cynics... You are my most respected Koon watcher. I always follow your advice one..

==========

CharlesT

U sure or not...I see no less negative comments even price was high at RM1.80+

29/08/2018 14:47

2018-08-29 14:53

I bought but not much,wanna sell later....hehe,do some day trading only lah

2018-08-29 14:56

Last time Hng33 used to make a lot of trading gain (2 to 3 cents) on JAKS taking full advantage of Koon's pockets

But after Koon decided to leave then more difficult to trade so..and Hng33 has to pay back all his earlier gains

2018-08-29 14:58

yeah, bcoz last time they tried to milked him and quite succesful, but then he changed his plan.

2018-08-29 20:41

godhand

so far so good. hope u are right good luck

2018-08-29 12:02