(Icon) To Outperform The Market, You Need To Be A Contrarian

Icon8888

Publish date: Sat, 09 Feb 2019, 05:06 PM

October 28, 2016

1. Bill Gurley: “Being ‘right’ doesn’t lead to superior performance if the consensus forecast is also right.”

Andy Rachleff elaborates on the point made by Gurley: “What most people don’t realize is if you’re right and consensus you don’t make money.” It is a bit strange that most people don’t realize this truth and yet it is common sense: you simply can’t be part of the crowd and at the same time beat the crowd.

2. Jeff Bezos: “You just have to remember that contrarians are usually wrong.”

This point made by Bezos is the reason why most people follow the crowd. Michael Mauboussin explains this tendency with a simple example:

“Being a contrarian for the sake of being a contrarian is not a good idea. In other words, when the movie theater’s on fire, run out the door, right? Don’t run in the door…. Successful contrarian investing isn’t about going against the grain per se, it’s about exploiting expectations gaps. If this assertion is true, it leads to an obvious question: how do these expectations gaps arise? Or, more basically, how and why are markets inefficient?”

Mauboussin explains why some investments get mispriced so badly:

“Because if the crowd takes something to an extreme, either on the bullish side or the bearish side, that should show up in your disconnect between fundamentals and expectations. And that is what allows you to make a good investment… Again, the goal is not to be a contrarian just to be a contrarian, but rather to feel comfortable betting against the crowd when the gap between fundamentals and expectations warrants it. This independence is difficult because the widest gap often coincides with the strongest urge to be part of the group. Independence also incorporates the notion of objectivity—an ability to assess the odds without being swayed by outside factors. After all, prices not only inform investors, they also influence investors.”

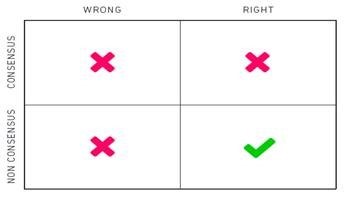

3. Andy Rachleff: “Investment can be explained with a 2×2 matrix. On one axis you can be right or wrong. And on the other axis you can be consensus or non-consensus. Now obviously if you’re wrong you don’t make money. The only way as an investor and as an entrepreneur to make outsized returns is by being right and non-consensus.”

It is the existence of a gap between expected value and market price that Mauboussin talked about above which should drive investment decision making. If you have views which reflect the consensus of the crowd you are unlikely to outperform a market since a market by definition reflects the consensus view. Buffett puts it this way: “Most people get interested in stocks when everyone else is. The time to get interested is when no one else is. You can’t buy what is popular and do well.”

Charlie Munger is more direct and colorful in his explanation: “For a security to be mispriced, someone else must be a damn fool. It may be bad for world, but not bad for Berkshire.” Sometimes waves of social proof and other dysfunctional heuristics create a significant gap between price and value. This does not happen often in areas within a person’s circle of competence, but it does happen. For some investors, spotting a gap like this happens only once or twice a year and that is just fine with them. In those instances these investors bet big and the rest of the time they do nothing. Some people, like day traders, think they can spot gaps between expected value and market price several times a day and make a profit after fees (this is almost always a triumph of hope over experience).

4. Howard Marks: “To achieve superior investment results, your insight into value has to be superior. Thus you must learn things others don’t, see things differently or do a better job of analyzing them – ideally all three.”

Being genuinely contrarian means the investor is going to be uncomfortable sometimes. Some people are good at being uncomfortable, and some are not. Peter Lynch said once: “To make money, you must find something that nobody else knows, or do something that others won’t do because they have rigid mind-sets.”

Successful investing is the search for the mistakes of other people that may create a mispriced asset (Howard Marks). In other words, one person’s mistake about the value of an asset is what can create an opportunity for another investor to outperform the market.

This search is best done by people who are curious and hard working. Great investors hustle, have a huge scuttlebutt network and read constantly. They are constantly trying to learn more about more and know that the more that they know, they more they will know that there is even more that they don’t know. If you are not getting more humble over time, you have a flawed system.

It is Mr. Market’s irrationality that creates the opportunity for investors. Markets are often wise, but they are not always wise. The best returns accrue to investors who are patient and yet aggressive when they are offered an attractive price for an asset. Seth Klarman says: “Successful investing is the marriage of a calculator and a contrarian streak.” The most effective way to get free of social proof when the time is right is to have done the homework in advance and stay within your circle of competence.

5. Jeff Bezos: “Outsized returns often come from betting against conventional wisdom, and conventional wisdom is usually right. Given a 10% chance of a 100 times payoff, you should take that bet every time. But you’re still going to be wrong nine times out of ten. We all know that if you swing for the fences, you’re going to strike out a lot, but you’re also going to hit some home runs.” “In business, every once in a while, when you step up to the plate, you can score 1,000 runs. This long-tailed distribution of returns is why it’s important to be bold. Big winners pay for so many experiments.”

It is magnitude of success and not frequency of success that matters for an investor. Bezos is talking about convexity in investments. All a founder or venture capitalist can lose is 100% of what they invest in a startup and yet what they can potentially gain is potentially many multiples of that investment.

(Icon8888 comment for item 5 : you don’t need to get all your stocks in your portfolio right. Sometime a few of them will turn bad. But if you have one or two multi-baggers, that will help to cover the losses and elevate the performance of the entire portfolio. In other words, don’t be afraid to take risk. It is ok to make some bad decisions. But try not to be too concentrated)

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Posted by qqq3 > Feb 10, 2019 04:03 PM | Report Abuse

kc...QL is a multiple bagger.......since you did not / could not benefit from the sustain arise of QL, what can I call you?

There are 900+ stocks listed in Bursa. Why must everyone buy QL? How shallow is the thinking of a 60+ year old "accountant".

No other stocks are multi-baggers? How long have you been in the stock market? If you don't have any multi-bagger, does it mean that there is none?

But seriously, the most important thing for anyone here was not following your sailang and margin in Sendai and Jaks in the last two years.

Those who have not being cheated by you in Jaks and Sendai will most probably doing all right. Like me, I did reasonably okay.

2019-02-10 16:15

Fortune Bull > Feb 10, 2019 04:13 PM | Report Abuse

Honestly, i would give QL value at 3.00! And that's the best price i could come out with!

=======

without Family Mart, it is quite possible that QL is presently traded at $ 3-4 range.....but now, it has all the right image, reputation, story and track record to support at current range....

2019-02-10 16:24

Posted by qqq3 > Feb 10, 2019 04:19 PM | Report Abuse

KC

no QL, never mind...it is just an example.....but....

when was the last time you bought a share that shows some sustained multiple year rise?

Multi-year rise? You got ah?

But is multi-year rise of a share the most important thing? Let me show you a couple of examples and see if this "accountant"can grasp it or not.

Stock A, from 2013 to now at multi year high,

Year Beginning Return End value

2013 100000 2% 102000

2014 102000 5% 107100

2015 107100 6% 113526

2016 113526 3% 116932

2017 116932 7% 125117

2018 125117 1% 126368

Stock B, a little volatility, more than 10% below its high last year,

Year Beginning Return End value

2013 100000 35% 135000

2014 135000 25% 168750

2015 168750 -5% 160313

2016 160313 35% 216422

2017 216422 40% 302991

2018 302991 -10% 272692

Can see which is a better investment or not, "äccountant"?

2019-02-10 16:46

Posted by qqq3 > Feb 10, 2019 04:19 PM | Report Abuse

KC

or every one of your purchase, sooner or later also collapse just like everyone of OTB purchase?

You mean like Jaks and Sendai which you have been shouting sailang and margin the last two years at RM1.80+ and RM1.40+ collapsed within a few months to 50 sen and 60 sen?

No woh.

2019-02-10 16:48

u held the shares or not KC? or just theory?

big difference between theory and actually holding a share.....

2019-02-10 16:53

S= Qr

no Q, there is no way u can make any meaningful money in stock market ....kc.....

and from all your 6000 postings, I can see u got no Q

2019-02-10 16:57

Dear all,

I had completed 30 slides in Microsoft Office PowerPoint “Love triangle (FA-BS-TA). Intrinsic value of INSAS” All are welcome to ask questions during my presentation on the upcoming Investment Bloggers day 2019 conference on 2nd March 2019, Boulevard Hotel Mid Valley, KL.

In year to come I intend to give another presentation how I turned my 700K+ Xingquan total loss into building a portfolio of 10+ million by learning how to invest from all the Sifu in I3.

Thank you

P/S: Posted by Icon888810/02/2019 15:25: SS Lee damn upset now. He toiled for 3 days 3 nights tearing QL apart to try to figure out its moat and intrinsic value, only to find out it is insider info.

I repost below comment: I’m actually very happy to have Mr. Philip in i3 to give a different view on investing.

Dear Mr. Phillip,

Allow me to correct you, this forum is not toxic nor unhelpful, there are so many Sifu in this forum spending their valuable time and give free different opinion/view base on past performance (facts and figures), projected future earnings growth and etc. Many of the i3 community benefited from these diverse views so that many readers can make an informed decision on adding or selling their holding.

My biggest investment mistake was not knowing the existing of this i3 website much early thus committed many of my early mistakes on stock picking. Yes there are always many free advice given some helpful some hurtful but I take it all with open minded and thank them all.

I know that everyone love a success story even better a comeback success story like you and like you I am going to write my success comeback story 5 year from now.

The only one thing I request from you is please double check on your figures/facts as some of those figures/facts you quote on QL were wrong. You have enjoy a successful 9 years ride on QL stock and I hope you too have learned something from different opinions/views offered by Ricky, Jon and many other Sifu on QL near future growth and their reasons. No doubt QL is great company but do not deserve a PE of 50+. I wish you continuous success on your investment.

Remember: Praise and PLPs are cheap as it make one feel great, good and big headed only criticisms allowed us to see our weakness.

Thank you

2019-02-10 18:28

ted by Sslee > Feb 10, 2019 06:28 PM | Report Abuse

Remember: Praise and PLPs are cheap

==========

what is that supposed to mean, sslee?

2019-02-10 18:48

if sslee knows stock market is more than Insas and Insas like rubbish.....I will be surprised already....

2019-02-10 18:50

kc...look at your best student, that sslee....All he knows is rubbish like Insas.....I blame you personally for bringing up such rubbish students.....

2019-02-10 18:54

Good luck sslee. I hope your investing future goes well. And thanks for the well wishes. I monitor my suck very closely, have been for the last 9+ years. I usually wait until the quarterly report to make my judgements instead of what happens in between, but point taken. I really don't think you know how to invest for the long term, but I supposed everyone has to learn and start from somewhere. I hope one day you will read my article and learn to apply more than just one simple metric like nta and p/e into your investment analysis.

Have a great investment bloggers day! Do us old men proud!

2019-02-10 19:02

sslee....U are a novice...U know it, I know it, we both know it....Why do u behave like you are an old hand in the stock market game?

That is a very dangerous thing to do.....

2019-02-10 19:05

Posted by qqq3 > Feb 10, 2019 06:54 PM | Report Abuse

kc...look at your best student, that sslee....All he knows is rubbish like Insas.....I blame you personally for bringing up such rubbish students.....

Insas is one of the most undervalued stocks in Bursa. SSLee has analysed it with facts and figures which I fully agreed. I believe it is a matter of time its value will be unlocked.

His investment skill is thousand miles ahead of you.

Don't just quack quack quack here and quack quack quack there. Do a well written article to articulate why Insas is a rubbish stock. Best compared with your quack quack quack stocks of Jaks and Sendai which you have been shouting sailang and margin for the last two years and nothing else. I will be very happy to discuss with you there.

And SSLee is a very well-mannered, with very good characters and a man filled with humility.

Compared with you, a man with a skin thicker than the skin of crocodile in PLP, propagating sailang and margin in the stock margin to the newbies and the public with zero investment skill, but to buy the stocks of Jaks and Sendai touted by you. You should be ashamed of yourself.

So stop attacking SSLee.

And also stop attacking others like OTB, whom in making money in the stock market, you can't even smell his fart. He never evne respond to any of your attack.

2019-02-10 19:35

kc...U are one of those responsible for SSlee and his rubbish stock picks.....That is a wrong lesson for everybody....wrong approach to stock market....and only novice loves such stock ......

so , what are u good for except getting novices to follow u and your Insas?

2019-02-10 20:29

kc...u hate blue chips, u specialize in small untested small caps. That is the first impression I get and still true up to today......Your own money, nobody cares.

U talk 3 talk 4 but your money are in rubbish stocks. ....luckily, this forum got people like 3iii and Philips who show, genuine investors in good quality stocks is actually the easiest way to make money.......participating in the growth of good quality companies as the Bursa is intended to be.......

kc...u are teaching the public the wrong approach to the stock market....Bursa do not need people like u........

2019-02-10 20:37

kc...u are a pure hypocrite...talk 3 talk 4....talk East Go West....all your sweet words good for getting young girls and novices.....too bad not suitable for making money in stock market....

2019-02-10 20:46

Posted by qqq3 > Feb 10, 2019 08:29 PM | Report Abuse

kc...U are one of those responsible for SSlee and his rubbish stock picks.....That is a wrong lesson for everybody....wrong approach to stock market....and only novice loves such stock ......

so , what are u good for except getting novices to follow u and your Insas?

The return of stocks of Jaks and Sendai touted by you everyday with sailang and margin, lost 69% and 56% respectively. Many newbies and novice were cheated by you and lost all their savings in these two stocks.

So who was the culprit touting rubbish stocks for the last two years?

What are you good at except PLP and cheating?

2019-02-10 21:00

People lost money in Jaks and Sendai is because they are lousy ....none of my business.....Who doesn't know I am a trader.? I never say please pay me a fee.......

2019-02-10 21:04

Posted by qqq3 > Feb 10, 2019 08:37 PM | Report Abuse

U talk 3 talk 4 but your money are in rubbish stocks. ....luckily, this forum got people like 3iii and Philips who show, genuine investors in good quality stocks is actually the easiest way to make money.......participating in the growth of good quality companies as the Bursa is intended to be.......

kc...u are teaching the public the wrong approach to the stock market....Bursa do not need people like u........

I am motivated by others as below, and not you.

Posted by 3iii > Feb 10, 2019 01:50 PM | Report Abuse

Listen to icon, kc and Philip.

Posted by (S = Qr) Philip > Feb 6, 2019 12:27 PM | Report Abuse

*KC you make a good point as usual.

2019-02-10 21:12

Posted by qqq3 > Feb 10, 2019 09:04 PM | Report Abuse

People lost money in Jaks and Sendai is because they are lousy ....none of my business.....Who doesn't know I am a trader.? I never say please pay me a fee.......

You cheated them and shouting to their ears everyday for the last two years to sailang and margin on Jaks and Sendai, and as you have boasted over and over again that you had made huge gain from the two stocks.

Which is better, avoided huge losses in Jaks and Sendai by paying me a fee for advice the last two years, or get it for free from you touting the stocks and lost a fortune being cheated by you?

2019-02-10 21:16

S = Q r

If I am novice , I will be extra careful dealing with internet sifus.....

and kc....your own Q is so small ( almost invisible).....the S must be very limited.......

2019-02-10 21:21

Hmm, i smell something sarcastic here.....not sure if smell it wrong or what...

Smell too much fine ebony ass cause my nose malfunction...

=============================================================================

Choivo Capital,

Icon8888, all these angmoh theory too academic. Not practical. Only work in foreign markets and not Malaysia. Hahaha.

Thanks. This was really useful. Would appreciate the title of the book or blog you got it from.

2019-02-10 21:21

Dear Sslee, everytime i read your comment or article is like my mum is nagging me for not turning off the water tap of the toilet...too long gas...

but one thing i do like about you is that you have 2 fine ass, that is why they call u SSLee (Ass Ass Lee).

==========================================================================

Sslee,

Dear all,

I had completed 30 slides in Microsoft Office PowerPoint “Love triangle (FA-BS-TA). Intrinsic value of INSAS” All are welcome to ask questions during my presentation on the upcoming Investment Bloggers day 2019 conference on 2nd March 2019, Boulevard Hotel Mid Valley, KL.

In year to come I intend to give another presentation how I turned my 700K+ Xingquan total loss into building a portfolio of 10+ million by learning how to invest from all the Sifu in I3.

2019-02-10 21:23

Its CNY, argue winning no point, doesnt increase your wisdoms.earn money be happy. No need ask so many questions.

2019-02-10 21:24

Posted by qqq3 > Feb 10, 2019 09:21 PM | Report Abuse

S = Q r

If I am novice , I will be extra careful dealing with internet sifus.....

and kc....your own Q is so small ( almost invisible).....the S must be very limited.......

Everybody, not only novice, even including "super investor" must be wary about cheat who would profit from relentlessly asking you to sailang and margin Jaks and Sendai, and at the back he profited hugely from his activities, at your expense, which he out-rightly boasting about.

Especially for one using 3 qs plus a cube. There are so many Qs, or quacks.

And you know what is a quack? It is

an unqualified person who claims accounting knowledge or other skills"

2019-02-10 21:36

Dear all,

I repost: Jan 20, 2019 10:28 PM |

Dear Flinstones,

Your advice noted with thanks. I derive no pleasure and in fact feel sad that despite my attempt to save his soul and hitting hard at his conscious and even using reverse psychology of subjecting him to shame and turning the table on him by subjecting him to troll or fact on what damage he had done to those chasing high in JAKS and SENDAI as oppose to what he himself trolling KC and OTB with inflammatory and digressive, extraneous, or off-topic slanders.

I admit my attempt is futile and he will remain as what he is with no remorse and shame. He is now no-more my problems, as from now, I will not read any comments or blogs of “You-Know-Who”. He is in my past and I should leave the past in the past. He is now an invisible to me. I shall grow wise and move on

Thank you.

P/S: I will let my result do the talking in 5 year time. By the way, the fact I was invited as speaker when I only started my first i3blog on Feb 2018 speak volumes of my sincerity and eagerness to share and learn from all i3 Sifu. As for quack, quack, quack he only good at PLP and still taking every opportunity in flattering and PLP Mr. Philip and 3iii as genuine investors in good quality stocks and KYY with S=Qr excellent Q when in-fact KYY make his biggest mistake in JAKS all because of trap set up by------. How can one be so thick skin and without shame when he admitted he is only a chicken trader, trading on those rubbish stocks and occasionally hoping to get some crumb from his master. I rest my case.

Posted by paperplane > Feb 10, 2019 08:55 PM | Report Abuse

Sslee, how to attend tht. Sounds interesting

Dear paperplane,

I think the event is open to public.

I received the below invitation email:

I'm excited to share with you that I3investor and ShareInvestor Malaysia are jointly organizing an Investment Bloggers' Day 2019 Conference. It will be held on Saturday, 2nd March 2019, from 10am to 5pm at Boulevard Hotel, Mid Valley Kuala Lumpur. We would like to invite you to be a speaker during the event. We will be allocating speaking slot with tentative duration of 45 minutes for your session on that day.

I replied that I accept the invitation by I do not think I need the 45 minute. Later I received this email:

I am Lew Cheong Teck, local partner of i3investor in this region.

Thanks for accepting the invitation. We have allocated 25 mins slot for you.

Once the time slot has been confirmed, we will let you know.

Thank you

2019-02-10 21:49

still think PH is great? read this: https://www.freemalaysiatoday.com/category/nation/2019/02/10/asias-top-tower-runner-sour-after-putrajayas-lack-of-recognition/

PH bloody farking racist! A champion is sidelined because of his race! WTF!!!!

2019-02-10 21:58

KC...stock market got more than Jaks and Sendai...and Insas......open your eyes.....

like that already want to be subscription seller.....

2019-02-10 22:10

sslee...good luck to your flock of novices in Insas.....but I don't think luck alone is enough.....

2019-02-10 22:12

Posted by qqq3 > Feb 10, 2019 10:10 PM | Report Abuse

KC...stock market got more than Jaks and Sendai...and Insas......open your eyes.....

like that already want to be subscription seller.....

I hope you can answer my question below and not keeping on quack quack quack.

Which is better, avoided huge losses in Jaks and Sendai by treating me for a roti canai and teh tarik for 6 months for advice the last two years, or get it for free from you touting the stocks and lost a fortune being cheated by you?

2019-02-10 22:19

After all the quarrelling n arguments ,at the end of the day,who makes the most money win.This after all is an investment forum.Dun hold grudges,learn even from your detractor if he has something worth learning.Wish you all a happy cny.

2019-02-10 22:26

kc...wrong.....the better choice is to be like Philips.....for my 20+ son, for novices, stock market should be treated as a place to take part in the growth of good quality companies....

only good management stocks

...very low turnover of portfolio

....learn to say NO....

learn to say NO, including learn to say NO to internet sifus.....

for trading and speculations.....leave this to the full time traders, the professional traders and the retired people.......

getting novices involved, like getting this SSlee involved...how long before all his money disappears?

2019-02-10 22:26

Qqq3 should disappear in i3 for good. But cant i guess. There is no life beyond i3 for him.

2019-02-10 22:32

cheoky > Feb 10, 2019 10:32 PM | Report Abuse

Qqq3 should disappear in i3 for good. But cant i guess. There is no life beyond i3 for him.

======

maybe all your money disappears sooner than I disappear.....

2019-02-10 22:34

learn ur TA.....surely can find 20-30 plus shares that u can buy....earning money on a daily basis is not difficult lor.....dont fall in love with particular shares then keep praying it will go up forever or go every where promote like mad.......

2019-02-10 22:35

Cny your son never come back home ar? I accompany my parents breakfast. They got no time to press their phone le. You want me buy u a breakfast? Gong xi fatt cai ya

2019-02-10 22:39

cheoky > Feb 10, 2019 10:39 PM | Report Abuse

Cny your son never come back home ar? I accompany my parents breakfast. They got no time to press their phone le. You want me buy u a breakfast? Gong xi fatt cai ya

=======

my son still stays with me...26 years old already ,

2019-02-10 22:44

Before you criticise other like a bulldog, why not motivate your 26 years old son go on his own? Still stay will you, wings cant grow la. Cant be as dynamic as you le. Or he is 16?

2019-02-10 22:51

cheoky > Feb 10, 2019 10:51 PM | Report Abuse

criticise other like a bulldog,

=====

good......all true some more.

2019-02-10 22:58

Better not loh...!!

qqq knew he will be imparting stupid knowledge to his children mah..!!

Posted by qqq3 > Feb 10, 2019 10:58 PM | Report Abuse

cheoky > Feb 10, 2019 10:51 PM | Report Abuse

criticise other like a bulldog,

=====

good......all true some more.

2019-02-11 10:08

Icon8888 comment for item 5 : you don’t need to get all your stocks in your portfolio right. Sometime a few of them will turn bad. But if you have one or two multi-baggers, that will help to cover the losses and elevate the performance of the entire portfolio. In other words, don’t be afraid to take risk. It is ok to make some bad decisions. But try not to be too concentrated)

Partly true that u don't need 100% of ur stocks to perform. Not so true that one or two multi baggers can elevate your portoflio (only true if you have constructed your portofio based on equal weightage).

End of day, your portoflio outperformance depends on portfolio weighting, more so than stock selection.

2019-02-11 11:46

Fabien and I are almost like twins

there is very little to disagree when come to investing

we are from the same universe

2019-02-11 11:48

Correct mah....!!

People like 3iii and Philip are like pondan wants everything to win loh...!!

As a result u become pondan...not daring enough & lost many opportunity mah..!!

By right big overall gain is the answer mah...!!

Just like football if your score is 5-2 is it not better than 2-0 leh ?

Posted by Fabien Extraordinaire > Feb 11, 2019 11:46 AM | Report Abuse

Icon8888 comment for item 5 : you don’t need to get all your stocks in your portfolio right. Sometime a few of them will turn bad. But if you have one or two multi-baggers, that will help to cover the losses and elevate the performance of the entire portfolio. In other words, don’t be afraid to take risk. It is ok to make some bad decisions. But try not to be too concentrated)

Partly true that u don't need 100% of ur stocks to perform. Not so true that one or two multi baggers can elevate your portoflio (only true if you have constructed your portofio based on equal weightage).

End of day, your portoflio outperformance depends on portfolio weighting, more so than stock selection.

2019-02-11 11:55

qqq3

The purpose of good fundamental research is to find a share that can give you good multiple year rise.

Other than that....it is just wagging shares....its about caveat emptor and trade at your own risk......and try to benefit from some changing emotions/ sentiments.......

2019-02-10 16:14