(RICHE HO) MClean - Transformation and Reborn with Profit Guarantee

RicheHo

Publish date: Sun, 28 Feb 2016, 11:04 PM

MClean Technologies Berhad (“MCLEAN”)

Corporate Information

|

Symbol & Code |

> MCLEAN (0167) |

|

Listing Market |

> Ace Market |

|

Industry |

> Trading-Services |

|

Share Price |

> MYR0.225 |

|

No. of shares |

> 178.78m |

|

Market Cap. |

> MYR40.23m |

|

Par Value |

> MYR0.25 |

|

FYE |

> 31th December |

Background

- Incorporated as a private limited company in Malaysia on March 2010

- A precision cleaning service provider in Singapore

- Listed in Ace Market on May 2011 with IPO price of MYR0.52 per share with MYR0.25 par value, whereby it came with free warrants (MCLEAN-WA)

- Had a reputation and long-standing working relationship with major hard disk drive (“HDD”) industry players provides the leverage and benefit to secure continued cleaning jobs in Singapore as well as neighbouring HDD hubs such as, Malaysia, Thailand and China

- Its precision cleaning services activities are predominantly carried out in its own in-house clean room facilities

- Its customers are mainly HDD main component suppliers and manufacturers

- Its services are catered primarily to the Singapore, the People's Republic of China and the Malaysia Markets

Financial Highlights

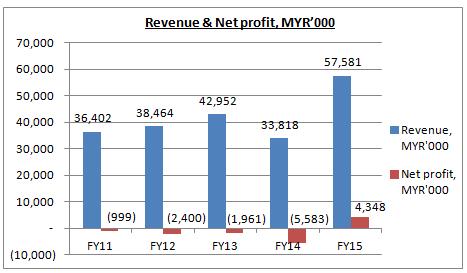

MCLEAN had been making losses over the past 4 years, from FY11 to FY14. It had enlarged its losses in FY15.

According to MCLEAN’s explanation, it was due to the change in product mix and the corresponding increase in operational costs like salaries and rental expenses. Another main factor is the Technical Assembly Services division had not received any order in year 2014 and the resources had been re-allocated to Precision Cleaning Division.

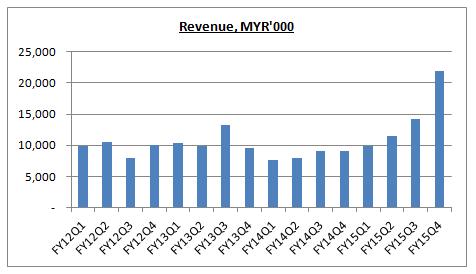

MCLEAN’s revenue had improved significantly in latest quarter FY15Q4. It was also the highest over the past 16 quarters. It was because the revenue of the new 55% acquired subsidiary, DWZ Industries, had been consolidated into MCLEAN’s financial result.

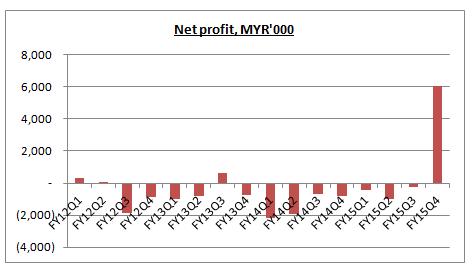

In term of net profit, MCLEAN had only made profit for 4 quarters before out of 16 quarters. Its net profit in FY15Q4 had also improved sharply, which contributed by the excess of net fair value over acquisition cost of MYR7.46m for DWZ Industries.

Financial Strength

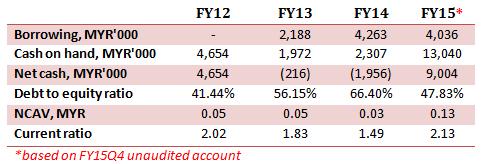

For a penny stock like MCLEAN, its financial strength is considered healthy.

After acquisition of DWZ Industries, MCLEAN had turned into cash positive position as well, with current net cash on hand of MYR9m. Its debt to equity ratio had also dropped to below 50%.

Besides, its current ratio of 2.13 indicates that MCLEAN is liquid enough to meet its short term obligation.

Acquisition of DWZ Industries

In Jun 2015, MCLEAN had entered into a conditional share sale agreement to acquire 55% equity interest in DWZ Industries Sdn Bhd (“DWZ”) Shares from Décor Industries Pte Ltd (“DECOR”) for MYR14.09m to be fully satisfied through the issuance of 56.37m new MCLEAN Shares at an issue price of MYR0.25 each.

FYI, DWZ is principally involved in the business of surface finishing for electrical & electronic industries, while DÉCOR is principally involved in the business of providing electroplating and metal precision engineering.

The acquisition of DWZ represents a strategic investment to enable MCLEAN to be entitled to future earnings from DWZ and is in line with MCLEAN’s plan to diversify its existing business and to reduce its dependency on the existing precision cleaning and washing business. In other words, this acquisition had provided an opportunity for MCLEAN to venture into surface finishing business and hence provide an additional income stream for the Group.

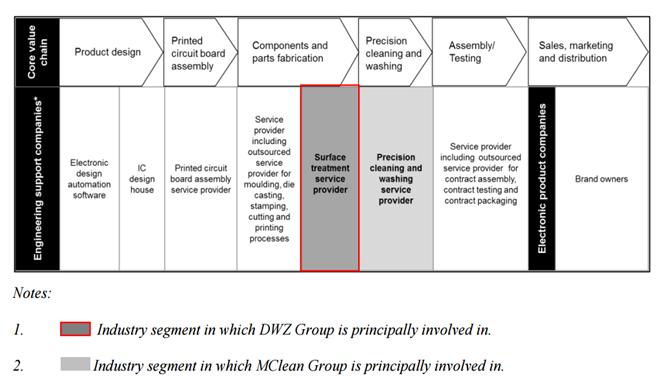

The below is the global value chain of electronics industry for year 2015.

This acquisition will lead to an increase in growth opportunities arising from the complementary synergies of the vertical integration.

The provision of both precision cleaning and washing services, as well as surface finishing services will attract new customers as customers would be able to realize greater convenience and cost savings by leveraging on MCLEAN as a single solution provider for both these types of services.

In addition, while these two businesses have separate processes, both of these businesses serve the HDD and electronics industries and thus, there will be avenues to combine industry knowledge and share technical capabilities to increase the overall quality of services rendered.

Strength of DWZ is as below:

- Ability to offer a comprehensive range of surface treatment and finishing services to customers

- Diversified customer base from various industry segments

- Commitment to providing quality surface treatment and finishing services

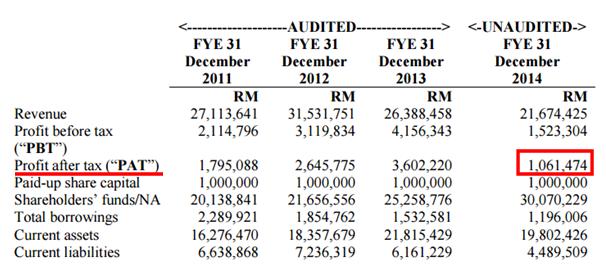

The below is the summary for DWZ’s financial highlights.

As we can see from above, DWZ had been making profit over the past 4 years. Its unaudited profit after tax in FY14 is MYR1.06m.

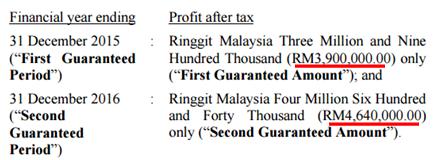

In this deal, DÉCOR had guaranteed that DWZ shall achieve not less than the following amount, which extracted from MCLEAN’s circular.

If DWZ fails to achieve the amount under the profit guarantee, DÉCOR will need to pay 55% of the shortfall between the actual audited after tax profits of the DWZ Group and the amount under the profit guarantee.

Overall, MCLEAN will likely to have a profit guarantee of MYR2.15m in FY15 and MYR2.55 in FY16, based on its 55% equity interest in DWZ.

Industry Overview

Overall, the global HDD market has been growing at a CAGR of 4.0% over the last 6 years, from about USD28.3b in year 2009 to about USD34.4b in year 2014. In recent years, much of the growth of HDD sales has been largely driven by the Asia Pacific market due to the proliferation of E&E devices in the region.

In year 2014, the HDD market in Asia Pacific comprised approximately 53.8% of the global HDD market, which is an increase from 46.6% in year 2009. The HDD market in Asia Pacific illustrated a healthy CAGR of 7.0% between year 2009 and 2014, growing from USD13.2b in year 2009 to approximately USD18.5b in year 2014.

New CEO

Upon completion of the acquisition of 55% equity interest in DWZ Industries, MCLEAN announced the appointment of Mr. Lim Han Kiau as the Group Chief Executive Officer (“CEO”) of the company.

![]()

Mr. Lim has extensive experience in both precision cleaning as well as surface finishing which will allow him to bring synergy to MCLEAN leading the way to a new phase of business expansion.

Mr. Lim, a Singaporean aged 55, is a well-respected businessman with extensive experience in the metal surface treatment industry. He is the Chairman of DECOR which still holds 45% equity in DWZ Industries, post-acquisition.

Other than that, he has been instrumental in this success and is an innovative and creative business leader with a proven track record in both management and operations. He has built strong client and customer relationships over his 30-year tenure in Surface Treatment Services via the DECOR.

On the left: Mr. Lim Han Kiau, new CEO of MCLEAN

On the right: Mr. Jason Yeo, executive chairman of MCLEAN

Conclusion

Two quarters ago, MCLEAN was still a poor fundamental company which made losses for 3 years consecutively since listed on Ace Market.

However, DWZ Industries had came to rescue MCLEAN from continue falling. After acquisition of this surface finishing company, MCLEAN had totally turned over its fundamental. It had transformed itself into a leading precision cleaning and washing solutions in the HDD value chain.

In addition with the join of Mr. Lim as CEO in the board, MCLEAN had changed its top management and business segments. MCLEAN is in the process of transformation and reborn.

MCLEAN is very likely to have a profit guarantee of MYR2.55 in FY16. To be pessimistic, I believe MCLEAN can at least deliver MYR2m in this year.

However, in term of its own precision cleaning business, MCLEAN definitely needs to cut down its administrative expenses and improve its profit margin, in order to make profit.

In term of technical, as at 26th Feb 2016, MCLEAN had the largest trading volume over the past one year, with an up of 2.5 cent. If it is able to breakout from its resistance 0.23, MCLEAN is possible to go higher to 0.27 and 0.30.

You may contact me at richeho_92@hotmail.com for any enquiry.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-06

MCLEAN2024-07-02

MCLEAN2024-07-02

MCLEAN2024-07-02

MCLEAN2024-07-02

MCLEAN2024-07-02

MCLEAN2024-07-02

MCLEAN2024-07-02

MCLEAN2024-07-02

MCLEAN2024-07-02

MCLEAN2024-07-02

MCLEAN2024-07-02

MCLEAN2024-07-02

MCLEAN2024-07-02

MCLEAN2024-07-02

MCLEAN2024-07-02

MCLEAN2024-07-02

MCLEAN2024-07-02

MCLEAN2024-07-02

MCLEAN2024-07-02

MCLEAN2024-07-02

MCLEANMore articles on Road to Success

Created by RicheHo | Mar 18, 2017

Created by RicheHo | Feb 19, 2017

Created by RicheHo | Feb 16, 2017

Created by RicheHo | Jan 08, 2017

Discussions

Try apply a 20% cost savings on previous financial results as see what you get...

MClean to make cost-savings from synergy of about 20%. This is due in part to MClean leveraging on DWZ’s facilities, which will have a lower cost.

“We plan to do the lower value-add services, such as Label and 3D barcode removal, in Malaysia. This will be the bulk of the work. We will do the remainder of the high value-add work in Singapore. We should be able to save a great deal by warehousing in Malaysia as the cost is much lower,” says Yeo.

2016-02-29 00:21

Kaninah, richche you wanna to kill us ah? http://www.theedgemarkets.com/my/article/petronas-demands-rm46m-mclean-tech-pipeline-damage

2016-02-29 22:15

Wow, today news! @.@ i just read. This is the things that we can't predict.

2016-02-29 22:24

RicheHo,

drop by to send you a regards.

Good evening. Always enjoy in reading ur article.

When opportunity arises I shall introduce some great projects to you.

Keep in touch.

Take care

2016-02-29 22:25

my god, hopefully this will be like Nestle sued Century, and slowly 不了了之,haha

2016-02-29 23:07

Ivan Lim

good article

2016-02-28 23:47