(CHOIVO CAPITAL) SUPERMAX (7106) – The Greatest Fool?

Choivo Capital

Publish date: Sat, 05 Sep 2020, 06:08 PM

For a copy with better formatting, go here, its alot easier on the eyes.

(CHOIVO CAPITAL) - SUPERMAX (7106) – The Greatest Fool?

========================================================================

“Now shoulda woulda coulda, means I’m out of time

‘Cause shoulda woulda coulda, can’t change your mind

And I wonder, wonder, wonder what I’m gonna do

Shoulda woulda coulda are the last words of a fool”.

“Beverly Knight: Shoulda Woulda Coulda”

On 22 May 2020, I wrote this article.

Ragret Del Luna: 10 PE Glove Companies (SUPERMX – 7106)

When that article was written, SUPERMAX was at RM5.75.

When I wrote that article, i was filled with regret at not buying the week before, despite having discussed in depth with a trader friend of mine on the Average Selling Prices (“ASP”) price increases, and felt that it was not fully priced in.

The plan was to put around 20% – 30% of my portfolio in.

I even made the choice of choosing SUPERMAX out of all of them, though for all the wrong reason (ie it was the shittiest and when speculating you want the worst of the lot ). It was the best option due to them having the largest percentage of Own Brand Manufacturing sales, enabling them to raise prices with wanton abandon.

As many can guess by now, especially if you know me, and the type of person i am, as well as my weakness in staying out of speculating despite the edge being so clear; you would know that i did not buy a single share. I Shoulda Woulda Coulda done it. but i didn’t.

Instead, I just sat at the sidelines, going about my daily life, trying to ignore the sight, sound and clamor of it going up.

Talk about an exercise in futility, when you are part of 2 – 3 investment or trading group. SUPERMAX was the only thing anybody can talk off then.

Back then, I thought the price would go to maybe RM7 – RM8 and that’s it. As i felt that the previous increase from RM1.8 to RM5.7 have already incorporated a significant portion of the gains.

In addition, i was a little too emotional at missing out on the initial rise, and thus too focused on what i missed out on, and thus to see what it would become in the short term, when all the factors I listed in my blog post above,

- Unprecedented Level of Demand for Rubber Gloves

- Structural Capacity Constraints

- Price Increases

- Lower Costs

- Everything else is shit.

- Record KLSE Transaction Volume, Record Retailer Participation

converge and act together in ways that will feed back on each other and become what Charlie Munger would call a “Lollapalooza Effect”.

Also known as, SUPERMAX, RM24.44

It got so insane and the volumes so high, that Bursa actually crashed multiple times the last few months.

If I was more rational, I think it would be possible for me to buy at RM5.75 (or 1 – 2 weeks earlier) and sell out at probably RM17 – RM18

And so, there i was, starting the SUPERMAX journey as the Greatest Fool.

So why this article? To inform you of my stupidity?

Well, there is that and more.

Where can the Share Prices of SUPERMAX / Glove Companies go from here?

This I guess is the million-dollar question (it would be a literal question for some) on many people’s mind right now. Let me answer this question in 2 perspectives.

What is the market sentiment and the news like today? How it will be like in the future?

When I first wrote my article in May, we were just coming off the one of the sharpest stock market crashes in history, and the subsequently, one of the sharpest stock market recovery in history.

And at that point, there appeared to be nothing but good news in the horizon for glove companies. COVID 19 seemed like it was getting worse and worse, and the consensus then was that the vaccine is at least 1-2 years off.

(I disagreed with the vaccine bit, because that was a problem where, with enough political will and money, it will be solved. This is not pregnancy, where its impossible to get a baby in 1 month by getting 9 women pregnant)

It was so obvious that anyone could see it (and everyone did), which resulted in an unprecedented level of capital inflow into glove stocks.

And as share prices go up, along with the news of the worsening of COVID-19 around the world, as well as the increase of glove ASP’s by glove companies, this fed a certain positive feedback loop for the stock prices of glove companies.

Today, 3 – 4 months later, things are quite different.

China and Russia have effectively pushed their vaccines to final trials and is likely to mass produce them by the end of the year.

Yes, the Russian vaccine is effective. And yes, that is a picture of Putin riding a bear with a gigantic needed that was posted on his Facebook (since deleted).

And i guarantee you, regardless of whether FDA or EURO approval is obtained for the vaccines above, even if it was rushed out with potential side defects. Countries will use it, because the trade offs is far worse, as many can see from the current economic fallout.

If i am frank, i think Sweden strategy of not doing anything (or maybe just a 2 – 4 week lock-down to allow the public healthcare system to get up to speed) was the right way to go.

And from current news in the US, i think they too will release a vaccine by year end, whatever the costs.

And as every day passes, the risk of a vaccine being released increases (and do note market prices in the future and not the past).

Its safe to say, the future news is not in favor of the present holders of glove companies stocks.

And in terms of sentiment.

Like how people tire caring about COVID-19 and following about the health and safety procedures, the endorphin high of owning glove stocks and watching it march steadily upwards have also worn off.

With 3 – 4 months to respond, the previously constrained capacity for glove production also does not seem so constrained anymore, with numerous new and old players planning to expand to take advantage of the price increases and incredible returns (for now).

If I were a betting man, COVID 19 was only a good thing for the glove companies in the short term, but a horrible thing long term wise.

Even before this, if you were to discount the ban on vinyl glove production by China.

Margins and ASP’s on gloves have been falling for 2 years. With COVID-19 basically bringing forward a ton of capacity expansion plans, funding the less efficient players to enable them to last longer, and attracting a lot of new players.

I expect supply to normalize in 3-6 months from now, before it goes into an oversupply situation, and prices plummet.

And this oversupply, resulting in lower prices is likely to be a structural issues that the industry is going to need years to shake off.

2 years from now, the share price of SUPERMAX is going to be far lower than the current price.

Does anyone still remember HENGYUAN, the lesson it taught in terms of financial results of temporary ASP increases, and its current vs previous share price?

The second perspective is this.

Who is the current and future owners of glove stocks

A few months back, back when Dayang was all the rage, i wrote this article.

The Art of Trading DAYANG Profitably Around Mr Koon Yew Yin and Mr Ooi Teik Bee.

One of the key ideas there i wrote about was about the “Diversity of Participants” which i think is very relevant today and i will elaborate it here again using SUPERMAX as an example.

Every market or individual stock is a complex system that is typically filled with a diverse group of participants who are irrational in one way or another.

They consist of people having different ideas and different views of things. Long term, short term etc etc, and all these individuals are a little or very irrational towards one end or the other.

For example,

The long-term investor may decide not to trade even though it may make sense for this quarter, allowing the trader to trade and make that profit.

The trader’s inability to sit still and hold, allows the long-term investor to buy it from them and hold it, making the money from the long-term growth of the company. Etc etc.

Despite the irrationality of their participants, their diversity ensures that they are all irrational in different directions, giving a net effect of zero, allowing the wisdom of crowds to prevail over the long term.

This ensures that the market is efficient and accurate most of the time. This means that over the long term, movements in share prices are usually in line with movement in earnings.

However, this diversity can often undergo phase transition, and thus result in boom or bust in the short term. What is a phase transition? This is where small incremental changes in causes lead to large-scale effects, or the “Grand Ah-Whoom!” moment.

What is this Grand Ah-Whoom! moment?

Imagine this. Put a tray of water into your freezer and the temperature drops to the threshold of freezing. The water remains a liquid until—ah-whoom—it suddenly turns into ice. Just a small incremental change in temperature leads to a change from liquid to solid.

The Grand Ah-Whoom! moment, occurs in many complex systems where collective behavior emerges from the interaction of its constituent parts. And this includes the behavior of the stock market.

In complex systems with human beings like the stock market, diversity is the most likely condition to fail first.

As you slowly remove diversity, nothing happens initially. Additional reductions may also have no effect. But at a certain critical point, a small incremental reduction causes the system to change qualitatively.

Taking SUPERMAX for example,

At the beginning before the COVID 19 boom, their active participants (Most majority shareholders do not really deal in the shares, and if they did, it is usually quietly. For this illustration I am going to ignore that subset) consist of mainly,

At RM1.8-RM2

Cyclical Value Investors (say 20%)

People who were trapped (say 70%)

Geniuses who saw the potential impact of COVID 19 on the stock (10%)

This results in the shares being quite undervalued, as the people who were trapped do not want to top up and the cyclical value investors, are there by virtue of their cheapness. While the geniuses, by virtue of being geniuses, and the rarity of geniuses, are the smallest portion.

As the boom starts, the market participants become increasingly diverse as new participants buy the share from the current participants, and the price slowly approaches fair value, the participants now consist of say (figures are just for illustration, they are likely to be different),

RM4.5-RM6

Cyclical Value Investors (15%)

People who were trapped (15%)

Growth Investors (15%)

Koon Yew Yin & TY Yap & Ooi Teik Bee & Other Goreng Insiders (5%)

Koon Yew Yin & TY Yap & Ooi Teik Bee & Other Goreng Outsiders (20%)

Geniuses who saw the impact of COVID 19 on the stock (10%)

Shrewd Traders (20%)

As the boom rushes along, the “Cyclical Value Investors” and “People who become trapped” becomes increasingly smaller portions of the pie. It’s also very possible that some people turn from “Cyclical Value Investors” to turn into “Shrewd Traders”, especially as the retailers (foolish and shrewd) and fund money looking to ride the wave come in.

And so the boom continues, and the shifts continue. Soon, our participants consist of

RM12-RM14

Growth Investors (5%)

Koon Yew Yin & TY Yap & Ooi Teik Bee & Other Goreng Insiders (5%)

Koon Yew Yin’s & TY Yap & Ooi Teik Bee’s Other Goreng Outsiders (30%)

Shrewd Retailers (Usually Momentum Traders) (15%)

Foolish Retailers (25%)

Fund Money (20%)

It is around this point, as the price climbs higher and higher territory, that the Koon Yew Yin & TY Yap & Ooi Teik Bee & Other Goreng Insiders, fund managers, shrewd retailers and growth investors may start selling as well.

Soon the price shoots way past fair value, as well as past the moon and mars, at which point, the shrewd individuals sells out and it looks more like this.

RM20-RM24

Koon Yew Yin & Other Foolish Insiders (2%)

Koon Yew Yin’s & TY Yap & Ooi Teik Bee’s Other Goreng Outsiders (30%)

Foolish Retailers (58%)

Fund Money (10%)

At this point, population diversity falls, invisible vulnerabilities and risk start to build despite the price constantly marching upwards or staying even.

Why?

Because every single one of these participants use extremely similar trading strategies, and as they keep buying, their common good performance is reinforced.

How do you know you’re at this stage?

“When everyone in the stock cannot think of even one bad thing that will happen, or about the company, and the comments all sound the same.”

This makes the population very brittle, and a small reduction in the demand for Supermax/Glove shares could have a strong destabilizing impact on their prices.

I’m sure you guys have noticed how some days, the share price drops like crazy before recovering.

It is at this point that risk is at absolute highest.

Why?

As most of the market participants have the same strategy, in the event the thesis, or in this case, the news that is coming out is not as positive they expected, or worse, a vaccine is released.

It’s not just some of the market participants who want to sell, but, ALL OF THEM.

And as prospective buyers are likely to be market participants with similar trading or investment strategies, demand dries up instantly as well.

In the meantime, even if positive news comes out (by positive i mean any delay in vaccine or Covid 19 mutation), it will not increase by much as everyone who wants to buy the stock already has it, and has exhausted their cash and credit lines.

In this case the expected value calculation is highly negative, it probably looks something like this.

20% Very Good News of Vaccine: Down 60%

50% Good Vaccine News: Down 20%

20% Vaccine Delay News: Up 5%

5% Covid-19 Mutation News: Up 10%

5% Vaccine Delay and Covid-19 Mutation News: Up 20%

Expected Value: (0.20-0.6)+(0.50-0.2)+(0.200.05)+(0.050.1)+(0.05*0.20)= -19.5%

This means all outcomes considered, this has a negative expected value of 19.5%, the week when this news come out, and its likely to fall further as people sell.

Now as you can see in my elaboration earlier, often the goreng artist like Mr Ooi and TY Yap is very shrewd, and would have sold a large portion of their position as prices go up and inform their followers (Or at least Mr Ooi did, no comment on what TY Yap did, whom i consider more one of the most unsavory characters in the Malaysian market. But if you read the news online, you would have an inkling) .

This is where you may see some “consolidation” in terms of chart movements, which is where TY Yap & Mr Ooi & Other Goreng Insiders direct followers, shrewd traders and fund managers are transferring their shares to the foolish retailers.

Mr Koon on the other hand, often considers himself an investor and does not learn from his lessons and, to be blunt, swallows his own bullshit.

He will hold on longer, or wait for margin calls to force him to sell.

In 2018, he was burnt properly in 2018 from Jaks and Sendai and ended up losing more than half his networth and had to sell land in Ipoh, because he swallowed his own bullshit and was over leveraged.

Before making it and more back frying Dayang in 2019.

Before losing 90% of his net-worth in 2020 from swallowing his own bullshit and being over leveraged. An information he would like the public to forget today, considering that his blog post for that was deleted.

And now, he appears to have made most of it back from the rubber gloves, and looking at his constant postings (reading my article on how to trade around OTB and KYY, this is the stage where he is all in and no more money left to buy), and appears to have again swallowed his own bullshit and is again over leveraged.

I wonder what will happen this time.

History does not repeat itself, but it sure does rhyme.

While the foolish retail participant who are now out in record amounts due to the work from home initiatives, who is in reality a trader, but foolishly considers himself an investor, will likely make the fatal mistake of averaging down, often on margin.

Turning a bad trade, into a mediocre and fatal investment.

And with time, diversity returns, and the foolish retailer, turns into people who are trapped. And as prices fall further, with the cyclical value investors return.

Conclusion

There is a saying that many traders, especially the shrewd ones, live by.

“Do not try and make the last dollar”

And this is for good reason.

For most of these momentum or goreng trading strategies, the key ingredient for it to work, is to attract the greater fool to purchase the stock. And it is a very viable strategy.

And the last dollar is there to attract the greatest fools who will take the steaming pile of shit from everyone else.

And as each day passes, and as the stock prices increases, the average level of foolishness increases.

And so, if you are trading this strategy, the question you need to ask yourself is,

“Who else haven’t buy?”

“Who are the other greater fools left?”

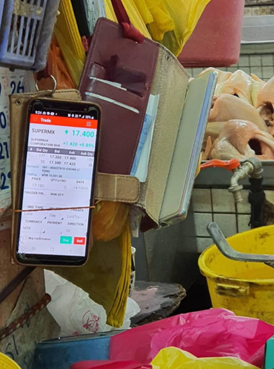

Well, the below picture that was released one month or so ago, when Supermax was RM17.4.

For me, this is as great an indicator of where you are in the cycle as you are ever going to get.

If I was implementing this strategy, this was a sign that we are near the top.

If the uncle selling chicken in pasar also buy d, who else is left to buy from you?

Do you think they are greater fools left?

Well, when this all started, i was the greatest fool. And i hope that you, the person reading this, will not be the greatest fool when the clock strikes 12 and the music stops.

I am likely wrong at this very specific point in time (in fact given my track record, it may go up on Monday), but as each day passes, the probability of me being right increases.

With that, i end this. I hope things end will for you. And if you are still holding and currently have some gains and losses. I hope this piece helps you make up your mind.

Good luck, 走好,不送.

============================

There is an old story about the market craze in sardine trading when the sardines disappeared from their traditional waters in Monterey, California. The commodity traders bid them up and the price of a can of sardines soared. One day a buyer decided to treat himself to an expensive meal and actually opened a can and started eating. He immediately became ill and told the seller the sardines were no good. The seller said, “You don’t understand. These are not eating sardines, they are trading sardines.”

Like sardine traders, many financial market participants are attracted to speculation, never bothering to taste the sardines they are trading. Speculation offers the prospect of instant gratification; why get rich slowly if you can get rich quickly? Moreover, speculation involves going along with the crowd, not against it. There is comfort in consensus; those in the majority gain confidence from their very number.

Today many financial-market participants, knowingly or unknowingly, have become speculators. They may not even realize that they are playing a “greater-fool game,” buying overvalued securities and expecting — hoping — to find someone, a greater fool, to buy from them at a still higher price.

Seth Klarman

=====================================

Disclaimers: Refer here.

====================================================================

Facebook: Choivo Capital

Website: www.choivocapital.com

Email: choivocapital@gmail.com

Telegram: https://t.me/philipcapitalmanagement (This is Phillips Telegram Chat, but i consider it the best telegram to follow for Malaysia Markets period. Its amazing how we got here given our history. He's one of the few with whom where i find myself more wrong than right whenever we argue/discuss)

Whatsapp: Email me, for Whatsapp, i can only accept up to 256 people (unlike telegram where the limit is 20k). So i try to be more selective for this.

<blockquote class="wp-block-quote has-text-align-left" style="box-sizing: inherit; quotes: " "="" "";="" color:="" rgb(102,="" 102,="" 102);="" font-style:="" italic;="" margin:="" 0px="" 1.8em="" 1.5em;="" font-size:="" 1.1em;="" font-family:="" palatino,="" "palatino="" linotype",="" lt="" std",="" "book="" antiqua",="" times,="" "times="" new="" roman",="" serif;"="">

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Choivo Capital

Created by Choivo Capital | Dec 09, 2020

Created by Choivo Capital | Dec 05, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 03, 2020

Discussions

Few things i do agree with u...

Do not try n make the last dollar...

Will not hold any single share of supermax (or maybe will hold 1 lot for sentimental reason)in 2022 (or even SH 2021)

2020-09-06 09:40

Chewck631 u r wrong..99% of those co who claimed they want to venture into glove biz r mainly to goreng their share prices..especially those penny stocks..

2020-09-06 09:42

WHO recommends wear a mask whn having sex

The more careful n wary r putting on condom too

Hidden demand KAREX

2020-09-06 09:55

Though do not wish tis on my worst enemy

Whn WHO or Fauci say even jz 'U can't rule out semen carrying Covid...' KAREX wil fly

2020-09-06 10:14

U do no want to b looking back in 6 month time n having to Shoulda Woulda Coulda bot KAREX whn it was below RM 1 while squeezing ur balls hard

2020-09-06 10:18

Choivo Capital, no offence but arguing politely. You should get more experience in stock market before managing others money.. Write this decision in your dairy and look back in 2021 and you will know how inexperience you are in managing your friends and relatives money. Sorry ya.

2020-09-06 10:34

What drives the glove bull run?

The Covid19 pandemic. The virus does not care about human sentiment. Why does the gloves have more to run... because there are more humans to infect. Currently 26 million people have been officially infected.... increase that by a factor of 10 to account for people who are asymptomatic... and it is just 260 million people. There are 7800 million people alive and humanity does not have immunity to this virus. Do not look at this like an economic bull run with greater fools, look at this as a pandemic with doctor having to contend with contaminated environment and hospitals that are flooding with Covid19 patients. It is bad in developing nation because they are poor and it is bad in developed nation because hospitals are not build to have excessive spare capacity. There are another 7500 million people more to go.

Vaccine typically take 5-10 years to develop. So saying we have a vaccine in 1 year is as you say expecting 9 pregnant women to give birth to a baby in 1 month. Politicians may say it time to throw a party. CEO will claim it can be done. And scientist will say we will do our best. But really the fastest vaccine ever developed took 4 years (mummps). Ebola vaccine with all modern tech of the last 2010s took 6 years to develop and test (It applied for FDA approval in December 2019).

Finally sure, you maybe willing to use the Swedish model, please consider 2 factors. (1) While the mortality rate of Covid19 is on average ~1%, this is only true if your hospitals are fully functional. 20% of people infected need medical care... as simple as antibiotics to as severe as ICU. When hospitals are pushed to their limit, the mortality rate goes up. Hospitals run of out essentials and common items, drugs, oxygen, even stuff as common as gloves. At its height the mortality rate of Covid19 in Italy was 8%, and people were saying China was hiding the true deaths as it had reported only 3.4% mortality rate.

(2) 1% mortality rate is still 1% of 7800 million people, that means 78 million people dead. More deaths than the 1918 pandemic. More deaths than WW2. In malaysia, it mean 310,000 deaths. Sweden has 20x more deaths than its neighbors. In New York, there were so many dead people, that the crematorium had to run 16 hours a day 6 days a week. Excess bodies had to be buried in mass graves and there were still bodies found rotting in the sun because Covid19 infected bodies could not be processed fast enough.

2020-09-06 10:34

i hope you understand what you are writing in your blog here since it is read by many.i hope you do some in-depth research before coming up with such.

2020-09-06 10:51

Just because someone write something against the counter you holds you called him a fool and no in-depth research and tons of non sense. Ever asked your self that the author could be right and you are at the wrong side ? Ever asked yourself the price that you paid was much higher than the value that you get ? If you are saying the gloves companies are cheap because they can hike the ASP forever then who is the greater fool here ? Does TG shall wiorth 80 bil just because you expect that it can make 4 bil annually in the coming 2 years ? Did you ever ask yourself TG shall be valued on par with MBB even though MBB made 6 bil annually for the past 5-6 years. If it is not greater tool to push up the price I don’t know what else. But having said that if doesn’t mean you shall avoid glove counters because you could very well make more money but selling it to others who are willing to pay you higher premium. It is a hefty price that you are going to pay if you are actually speculating while thinking that you are investing in a heart company. Don’t confuse yourself . Just because you bought a fundamentally good company and paying a hue premium for it that is not consider speculating . What will you say if someone bought TG at 50,75 or even 100 isn’t him speculating that the ASP will be higher and higher forever ? This round the market maker is making a killing .

2020-09-06 11:17

Very simple strategy, buy when there is panic selling. TAKE profit when it hits new high. In between, trade wisely, medium term still very bright for glove companies. Covid-19 is here to stay. So called upcoming companies trying their luck can't survive the competition, they just put up a lot of hypes to unload their shares.

2020-09-06 11:18

CIMB Research maintain BUY on SUPERMX. - YES, A SCREAMIN BUY CALL, FOLKS-DONT MISS THE BOAT

TARGET PRICE = RM13.5

------------------------------------------------------------------

Date: 05/09/2020

Source : CIMB

Stock : SUPERMX

Price Target : 13.50

Price Call : BUY

Last Price : 9.60

Upside/Downside : +3.90 (40.63%)

2020-09-06 11:22

https://www.webmd.com/lung/news/20200805/who-says-theres-no-silver-bullet-for-covid-19

WHO: There's No 'Silver Bullet' for COVID-19

https://seekingalpha.com/article/4369775-covidminus-19-real-results-are-long-way-away

COVID-19: The Real Results Are A Long Way Away

We still don't know just how long this pandemic will last - will one vaccine emerge that gives the immunity? Or will we have to endure life with the virus for years or decades to come?

No matter how promising early studies or phases are, there's always a chance for the final phase to have one serious adverse effect or not hit a target antibody response, causing all the work to go out the window.

Trial completion will take time, and interim and preliminary data provide mere glimpses of the overarching study. but keep in mind the risks that are associated with pushing vaccines through unprecedented fast timelines, as hope for a vaccine by the winter far exceeds the endpoint timelines of next year and beyond.

https://www.news-medical.net/news/20200826/Study-COVID-19-vaccine-should-be-at-least-8025-effective-to-prevent-ongoing-pandemic.aspx

''Some are pushing for a vaccine to come out as quickly as possible so that life can 'return to normal.' However, we have to set appropriate expectations. Just because a vaccine comes out doesn't mean you can go back to life as it was before the pandemic."

The new computational model finds that a COVID-19 vaccine will have to be at least 80 percent effective to achieve a complete "return to normal"

https://www.statnews.com/2020/08/28/covid-19-reinfection-implications/

Scientists are reporting several cases of Covid-19 reinfection

https://www.gatesnotes.com/Health/What-you-need-to-know-about-the-COVID-19-vaccine

from the blog of Bill Gates

What you need to know about the COVID-19 vaccine

https://www.channelnewsasia.com/news/world/covid-19-surgical-gloves-ppe-makers-struggle-booming-demand-13083368

COVID-19: Surgical glove makers struggle to keep pace with booming demand

https://www.statista.com/statistics/711286/value-of-the-global-ppe-market/

Value of the personal protective equipment market worldwide from 2019 to 2027

https://www.theedgemarkets.com/article/vaccine-makers-plan-public-stance-counter-pressure-fda

Vaccine makers plan public stance to counter pressure on FDA

Some of the articles that perhaps you need to consider before making a fool of yourself and jeopardize your reputation. Tq

2020-09-06 11:23

https://www.webmd.com/lung/news/20200805/who-says-theres-no-silver-bullet-for-covid-19

WHO: There's No 'Silver Bullet' for COVID-19

https://seekingalpha.com/article/4369775-covidminus-19-real-results-are-long-way-away

COVID-19: The Real Results Are A Long Way Away

We still don't know just how long this pandemic will last - will one vaccine emerge that gives the immunity? Or will we have to endure life with the virus for years or decades to come?

No matter how promising early studies or phases are, there's always a chance for the final phase to have one serious adverse effect or not hit a target antibody response, causing all the work to go out the window.

Trial completion will take time, and interim and preliminary data provide mere glimpses of the overarching study. but keep in mind the risks that are associated with pushing vaccines through unprecedented fast timelines, as hope for a vaccine by the winter far exceeds the endpoint timelines of next year and beyond.

https://www.news-medical.net/news/20200826/Study-COVID-19-vaccine-should-be-at-least-8025-effective-to-prevent-ongoing-pandemic.aspx

''Some are pushing for a vaccine to come out as quickly as possible so that life can 'return to normal.' However, we have to set appropriate expectations. Just because a vaccine comes out doesn't mean you can go back to life as it was before the pandemic."

The new computational model finds that a COVID-19 vaccine will have to be at least 80 percent effective to achieve a complete "return to normal"

https://www.statnews.com/2020/08/28/covid-19-reinfection-implications/

Scientists are reporting several cases of Covid-19 reinfection

https://www.gatesnotes.com/Health/What-you-need-to-know-about-the-COVID-19-vaccine

from the blog of Bill Gates

What you need to know about the COVID-19 vaccine

https://www.channelnewsasia.com/news/world/covid-19-surgical-gloves-ppe-makers-struggle-booming-demand-13083368

COVID-19: Surgical glove makers struggle to keep pace with booming demand

https://www.statista.com/statistics/711286/value-of-the-global-ppe-market/

Value of the personal protective equipment market worldwide from 2019 to 2027

https://www.theedgemarkets.com/article/vaccine-makers-plan-public-stance-counter-pressure-fda

Vaccine makers plan public stance to counter pressure on FDA

Some of the articles that perhaps you need to consider before making a fool of yourself and jeopardize your reputation. Tq

2020-09-06 11:26

CGS-CIMB (5 September) BUY call TP 13.50

https://klse.i3investor.com/files/my/blog/img/bl6339_supermx_2.jpg

Affin Hwang (3 September) put overweight on Glove , BUY call

https://ibb.co/G2y0K8V

UobKayHian (4 September) put overweight on Glove , Buy call

https://ibb.co/28qKc4f

2020-09-06 11:42

Half past 6 article

you didnt buy because you missed the boat, if you cant adapt, then buy others like XOX, M3Tech, Lambo.

Choivo aim supermax but no aim tan sri counter ?

scared your theory wont work with TG is it ?

This common sense article, chicken seller uncle also know how to blow water

2020-09-06 11:44

"I expect supply to normalize in 3-6 months from now, before it goes into an oversupply situation, and prices plummet." -- wrong analysis.

The actual fact is: Cumulative deaths expected by January 1 total 2.8 million, about 1.9 million more from now until the end of the year. Daily deaths in December could reach as high as 30,000.

Twindemic is coming, the whole year of 2021 vaccine is just 杯水车薪,小水无法救大火

2020-09-06 12:03

You can write very well my brother.

To me, you sound like a geek more than an investor.

Meet more people, learn from others who are more experienced than you.

The more you know, you'd realize the less you know.

Good luck with your fund!

2020-09-06 12:09

HERE WE GO AGAIN - WHEN CLOWNS MISS THE BOAT THEY TEND TO BE JEALOUS & BITTER AND END UP WIRTING RUBBISH. THEY JUST COULDNT BELIEVE THEY MISSED AN OPPORTUNITY OF A LIFETIME.

SUPERMAX HAS SOLID FUNDAMENTALS , EXCELLENT BUSINESS MODEL- OBM & ODN, GOOD EARNINGS ( FOR THE NEXT 4 QUARTERS) WITH 1.1 B IN PREPAYMENTS , A LEAD TIME OF 600 DAYS AND A PROJECTED PAT OF 680 MILLION FOR THE NEXT QUARTER.

MOST SCIENTIST BELIEVE THAT WE HAVE TO LIVE WITH THIS PANDEMIC FOR A LONG TIME AS AN EFFECTIVE VACCINE MAY NOT BE AVAILABLE - DUE TO MUTATIONS & REINFECTIONS. HENCE LONG TERM OUTLOOK FOR GLOVES ARE BRIGHT.

SUCH HALF BAKED NARRATIVES AND NONSENSICAL COMPARISONS WITH TULIPS & SARDINES REFLECTS HIS INABILITY IDENTIFY A MULTI BAGGER. YUP, A SORE LOSER.

CHOIVO, ITS STILL NOT TOO LATE TO GET ON BOARD AS SUPER IS FAIRLY VALUED AT RM15-18.

2020-09-06 12:56

the greater fool theory is sound but only when exuberance mania is everywhere. of course u cannot predict it but i would think only next year would the party end.

i believe when u see major sh starts selling then u will know. especially from supermax n top glove owners. they will surely dispose some no?

2020-09-06 13:06

according to many news sources i think the party will only end by end of next year. with oversupply, competition from locals, china etc. asp prices tapering out. lesser profit growth etc.

2020-09-06 13:17

WHO says widespread coronavirus vaccinations are not expected until mid 2021

The organization is stressing the importance of rigorous checks on their effectiveness and safety.

NONE of the candidate vaccines in advanced clinical trials so far has demonstrated a “clear signal” of efficacy at the level of at least 50% sought by the WHO, spokeswoman Margaret Harris said.

2020-09-06 15:06

Glove oversupply in 3 months? LOL!!

Good article but that sentence alone discredit everything

2020-09-06 16:03

You can know the stupidity of the person by the questions he asked and the wisdom by the answer he gives

2020-09-06 16:12

Actually it is quite simple, when Supermx/Top Glove next quarter exceed the research houses' consensus with double digits, and ASPs still has no sign of peaking in Nov or Dec, share price will move up (moratorium issue is temporary knee jerk).

2020-09-06 20:25

Choivo, I think you missed an important point that there may be a worldwide conspiracy led by the mainstream media to heighten the fear of Covid-19 in order to destroy the world economies. CDC just admitted that in US, actual deaths from Covid-19 were only about 6% of the total announced earlier. The other 94% deaths had on average 2.6 additional causes, such as cancer, heart and lung diseases, etc. Cases of people of having died from car accidents with Covid-19, were reported dead from the disease. CDC has also bluntly stated that there have been more deaths from suicides and drug overdoses than from Covid-19. These falsified reports in the US have very much to do with the US Elections in November. Cheers!

2020-09-07 06:19

Almost Everyone agree the party will end some time next year right? Look around !!!! Maybe people r starting to leave. Don’t be the last to leave oh.......... the last few to leave will have to clean out your account!

2020-09-07 07:17

Petronas is not only reporting loss, but they are also jumping into the glove mania by investing into the set-up of the glove-related industry.

2020-09-07 08:50

what petronas is making is like what luxchem is making, but on a much much larger scale

2020-09-07 09:40

https://www.cdc.gov/vaccines/hcp/acip-recs/general-recs/administration.html

*Note: This guideline is pre-Covid*

General Precautions

Persons administering vaccinations should follow appropriate precautions to minimize risk for disease exposure and spread. Hands should be cleansed with an alcohol-based waterless antiseptic hand rub or washed with soap and water before preparing vaccines for administration and between each patient contact (1). Occupational Safety and Health Administration (OSHA) regulations do not require gloves to be worn when administering vaccinations, unless persons administering vaccinations have open lesions on their hands or are likely to come into contact with a patient’s body fluids (2). If worn, gloves should be changed between patients.

2020-09-07 09:57

Glove export to US on decreasing trend

https://importkey.com/i/supermax-healthcare-inc

2020-09-07 12:32

Distribution Phase my friends. It will sideline and once awhile spike up to attract more fish then after 6 month it will start drop until normal. Sometimes may take years.

Not much flesh now only bone if you want.

2020-09-07 12:52

I beg to differ.

Even when WHO's prediction of mass vaccination starts in mid 2021 comes true, it is only a beginning phase because it can take years to produce ample vaccines for the world populations.

The world economy will only start the real recovery journey when efficacious vaccines are available beyond 2021.

And to declare the Covid-19 pandemic is over, it could be another few years after 2021. In fact, WHO has predicted earlier that this pandemic would only be declared over most probably in 2025.

Then only the glove demand and supply will reach an equilibrium. However, the post covid-19 ASP for the big 4 will remain high and stable, due to the structural shift in demand and the new normal caused by this once in a century pandemic.

So from now till 2021/2022, we have a golden chance to witness the explosive PATs by the big 4 in the coming qtrs, and this is also once in a century, may be.

2020-09-07 14:13

I disagree, based on:

1. HY is a trap (or collateral damage, it was never the intend of the owner to make money from goreng?), the owner from China make up the numbers, get loan, and reporting bad numbers even since. Evidence by top directors + CEO resigned (immediately after something goes wrong). JAKS (in JAKS, the owner never say they can make so much money, only KYY+ talk about their ambition), SENDAI got net cash?

Bear in mind i said similar thing about HY even before the rise. I hate to earn dirty money like that.

2. I think you are making a mistake without study in depth on the company, the technology, the pandemic, etc (or maybe you did? kindly share your insight). We may defer in opinion/conclusion but at least you study on the company first. I mean, don't talk about sentiment only, in the longer term, its always about the company.

3. Nobody knows about the future, who knows if somebody crash a plane into it tomorrow. However, based on available information, Supermax will do superbly over the next 12 months at least, it is equally risky to invest in the recovery.

4. Even after this pandemic, other disease may come. This is not a one-off event, the transmission is just amazingly fast, and therapy is so difficult. In the future, to prevent such event from happening, worldwide precautionary measure is pushing the glove industry to grow superfast year after year.

You know? China always has weird diseases, swine fever, h5n1 and we Malaysia as a country (and the rest of the world), never allow to import any livestock or uncook meat etc from China, because they will always have outbreak, forever. Only this time this pandemic is so strong due to its manmade nature. They may make more because it looks like they are winning the war.

2020-09-07 16:02

Philip ( buy what you understand)

1. Supermax will have superb results there is no doubt about it. However... does the results match the euphoria and forward looking investments dollars to put into it moving forward? Can supermax next quarter reach 800 million? next quarter after that 1600 million? how about next quarter after that? Yes, one may not know the future, but paying the price today assuming that every year will be covid-19 year is not rational.

2. study or not, one thing is for sure: either you believe there will be a vaccine, or you believe that there will not be a cure. The probabilities of a vaccine coming out is far more likely than not, considering the entire world is rushing to produce a vaccine. The question to ask is simple: if no covid, how much will be the glove demand moving forward? If covid continues to exist... well.. different story.

3. Yes, other diseases will come, but that is not the question to ask. The question to ask is moving forward, by 2021 and on, how much more glove capacity will exist in the world? As supply will undoubtedly overload demand, how much will the price change versus supply? It is silly to assume that no one else has the capacity to produce gloves, and moving forward at such great margins, no one else will want to join in the game.

2020-09-07 16:13

My long term fair value of supermax is maybe at RM2.

Good luck, unlikely to touch it in the interim.

2020-09-07 16:55

@supersaiyan

https://choivocapital.com/2020/05/22/ragret-del-luna-10-pe-glove-companies-supermx-7106/

https://choivocapital.com/2020/03/28/lessons-from-golconda-a-reflection-on-moving-forward/

I wrote about supermax before the super run up in May and the virus in April.

2020-09-07 17:04

Philip, there is a big problem in your assumption. If you think Supermax double its profit every quarter, then in a year it will be 16 times growth, one way to value it will be 1600 times PE. That will be roughly RM1000.00 Per share. If you do a DDM, NPV, etc whatever 201 stuff you will get "infinity" as an answer.

I am quite sure nobody think Supermax worth RM1000, yet.

Supermax only need RM800m next QR, then slowly towards RM1b profit. At 20 times PE, assuming 4b net profit per annum, that will be 80b market cap. That will make Supermax worth slightly more than RM30.

(At RM2 a share, if Supermax make 4b profit, that would be PE of 1.4?? Possible, but not probable. )

Choivo, I got Supermax and glove fairly early too. What i mean is to advice you to do the calculation just as you did with Airasia. Don't jump into conclusion without working it through.

Let the numbers speak. Kossan, Harta still talking about USD30-40 ASP, Supermax is aiming USD280 now. Kneel to figures.

Remember bitcoin? Monopoly money can worth USD30k.

My guess is a half year pandemic will consume 2 years production of glove. It looks like it will go on for another 9 months at least, that will create excess demand for another 4 years at least.

2020-09-07 18:31

hi jon, good evening....

let me share with you a very good article in i3.....

https://klse.i3investor.com/blogs/ss2020_vaInv/2020-07-20-story-h1510636040-Bonus_issue_of_Top_Glove_Hartalega_Kossan_and_Supermax.jsp

-so your opinion would be long term holders are idiots? the greatest fools too? :p

-you use 'supermax/glove companies'... so your article also meant Top Glove too? :)

lastly....

i think in life there's 3 situation....

1)you fall in love, you chase and you succeed....

2)you fall in love, you chase and failed....

3)you stand by the side wondering if the girl is perfect before you decide to go after, but then the girl left.....

jon, i am not guru or sifu, neither am i a multi-millionaire... but i can tell you this - please, please.... don't always choose 3

hahahaha.... good luck!

2020-09-07 18:53

looking at his article i can deduce that jon is one of the most neautral and human investor in this forum.

2020-11-18 20:39

chewck631

The very fact that so many companies want to jump on board the gloves band wagon indicate that the demand will continue to grow for sometime. Cannot be all these companies hire fools to research and decide on such huge invest!!

2020-09-06 09:39