(Icon) It Is The Future Earning That Matters, Stupid !

Icon8888

Publish date: Thu, 23 Jun 2016, 06:44 AM

First of all, I would like to clarify that the title of my article is not meant to scold or insult anybody. It was borrowed from Bill Clinton's presidential campaign in the 90s.

"IT IS THE ECONOMY THAT MATTERS, STUPID"

Clinton was campaigning against President George W. Bush (Senior). The word "Stupid" was used to drive home the message that of all the issues that are relevant, it is the economy that determines whether the country is heading in the right direction. As we all know, Clinton won the election.

Ok, now let's get back to the main business.

In this article, I will discuss the stock picking strategy of several forum members in i3 - Icon8888, Stockmanmy, Uncle Koon, KC Chong, Calvin Tan.

On surface, these few people have different ways of picking stocks. But I would like to argue that if you strip away all the intricacies, they all reveal a similar set of beating hearts.

To find out more, please read on.

1. Icon8888 - Laser Beam Focus On Future Earnings

Icon pick stocks based on the expectation he has for the PLC's future earnings. I think this has been made very clear through his various articles, no need to further elaborate.

2. Stockmanmy - Brutally Honest

Stockmanmy joined i3 not too long ago. He started by advocating that successful stockpicking is related to concepts like "sound portfolio management", "successful investors must have conviction", etc, etc.

But I believe those are no more his core ideologies. Last week, in his article "so you want to become value investors ? (6)", he loudly declared that "the best predictor of share price is earning growth".

THAT, put him in the same camp as Icon.

(But Icon doesn't endorse the harsh way he treated KC Chong in his article)

3. Uncle Koon - Ate Dead Cats

In Chinese, "eat dead cats" means being held responsible for mistakes / crime not committed by you.

When come to Uncle Koon, I must tread carefully. Many forum members are VERY angry with him. The crowd is not always rationale. There is currently a sentiment of "If you are not with us, you are against us" in the forum. Whoever that dares to side with him or stay neutral will be deemed as public enemy.

Well, I don't want to play any part in this messy affair. However, I would like to broadly dissect the issues into two major components :-

(a) Uncle Koon misbehaved YES, I agree with this. A lot of the things that Uncle Koon had done in the past is not beyond reproach, especially his non diclosure of changes in major shareholding. Naughty !!! Evil !!! Bad !!!

(b) Uncle Koon caused us to lose money NO, he didn't.

Actually, item (b) above is the reason I rope in Uncle Koon for discussion in this article. The message is this :

"What caused you to lose money is not because of the various little things that Uncle Koon had done. Those little things are irritating. But they played very minor role in your misfortune.

What caused you to lose money is the PLC that you invest in DIDN'T DELIVER STRONG PROFIT AS EXPECTED".

Let's take Can One as an example.

Quarter Result:

| Quarter | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) |

|---|---|---|---|

| 2016-03-31 | 204,891 | 10,953 | 5.70 |

| 2015-12-31 | 236,260 | 13,938 | 7.25 |

| 2015-09-30 | 242,353 | 27,446 | 14.28 |

| 2015-06-30 | 216,568 | 23,670 | 14.77 |

| 2015-03-31 | 191,292 | 15,053 | 9.88 |

If you compared the earnings table and the chart above, Canone share price experienced strong run around November 2015, after releasing two consecutive quarters of strong results - June 2015 quarter's strong profit caused certain people to start accumulating. September 2015 quarter's strong profit "confirm a trend", resulting in massive buying by the investing public.

However, after a good run, Canone share price started declining in February 2016. That was actually due to the release of December 2015 quarterly result, which was below everybody's expectation. Share price declined further in May 2016 after the release of another quarter (March 2016) of depressing results.

See the correlation ? Strong earnings caused share price to go up, weak earnings caused share price to go down.

What was Uncle Koon's role in this ? Very minimal. We don't know whether his selling (secret selling ?), if any, caused Canone share price to decline. But without Uncle Koon, the same would have happened. Some other investors would have filled his role and pressed the Sell button.

There are two sides to every coin. The same is true for price going up. Uncle Koon went around town to claim credit for "helping many people to make money". I would like to contend that the majority of the credit should go to the PLC. It is their sterling performance that make those people rich, not Uncle Koon. Uncle Koon is a tour guide that brings you to a good restaurant. It is the skill of the cook that impress you, not the tour guide.

Summary conclusion - It is not my intention to defend Uncle Koon for his "misbehavior". It is also not my intention to deny him the credit that he deserves. The main purpose of me writing this section is to highlight the major role corporate earnings play in determining share price.

Bear this in mind the next time you want to buy a stock - "It is the future earning that matters, stupid"

4. KC Chong - The Republican That Secretly Votes For Democrats

When come to KC, what is your impression of his style of investment ? How about the following stereotype ?

(i) He analysed PLCs by using HISTORICAL financial ratios such as Earnings Yield, EV / EBITDA, ROIC, etc. Based on those ratios, he makes decisions to buy, hold and sell.

(ii) Very averse to making prediction about the future. His famous quote is "there is no statistical significance that anyone can predict the future".

In a nutshell, "KC relies heavily on past performance of PLCs to guide his investment decisions".

Is that really the case ? If I ask 100 people here in i3, probably 99 will say Yes. If I ask the same question to KC, he probably will say Yes too !

I used to have that perception too. However, yesterday I went through 221 articles posted by KC in his blog, printed some out and read them carefully. After doing that, I have a different understanding of KC (which KC himself probably isn't aware of).

My hypothesis : "Contrary to his own belief that one should not invest based on prediction of future, KC subsconsciuosly does so".

In other words, "prediction of future" does play a significant role in KC's stockpicking.

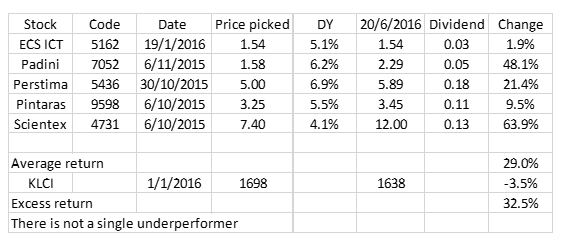

What made me came up with such hypothesis ? Just look at his recent stock pick, which he displayed in one of his recent article :-

The interesting thing about the table above is not what is in there. The interesting thing is what is NOT there.

The portfolio above, which has performed very well (29% return), contains two retailers (ECS ICT and Padini), two manufacturers (Perstima and Scientex) and a contractor (Pintaras).

IT DOES NOT CONTAIN ANY PROPERTY DEVELOPER, PLANTATION COMPANY, OIL AND GAS COMPANY OR AUTO COMPANY, ALL OF WHICH ARE CURRENTLY FACING CHALLENGING OPERATING ENVIRONMENT.

If KC's style is indeed PAST driven, he would have included some of those companies in his portoflio. Many stocks in those industries are trading at depressed level and should be flashing Buy signals from historical ROIC, EV multiples or Earnings Yield point of view.

(Before I proceed further, let me get one thing straight - KC CHONG WILL NOT LIE TO US. The last thing in this world that I will do is to suspect that KC is being hypocritical by preaching about the importance of the past while secretly investing based on the future. What benefit does he get by twist and turn like that ?)

In my opinion, KC sincerely believes in what he taught, that one should place relatively high weightage on the past. Of course, there is no way I can know how he ended up with this style. Maybe due to his passion of learning from Gurus ? Maybe it gives him more comfort ? Maybe his previous success reinforced his belief ?

Whatever it is, and irregardless of whether KC agrees with me or not, my observation is that most of us, when come to picking stocks, will steal a glance at the future, even if we openly declare that we are not interested in it.

We Might Be More Similar Than We Think

Now let's go back to discuss the recent skirmishes between Stockmanmy and KC Chong. Stockmanmy complained that KC relied too much on a bunch of historical financial ratios. According to him, it is better to invest based on future earnings. KC stood his ground and countered that "there is no statistical significance that one can predict the future".

So, who is right ? Whose method is better ?

In my opinion, it is a false choice - neither is more superior than the other. THE TWO METHODS ARE MORE SIMILAR TO EACH OTHER THAN THEY THINK.

Let's take Scientex as an example. Both Stockmanmy and KC like this stock.

Stockmanmy is very straightforward, he believes future earnings is key. Scientex delivered strong earnings recently. Stockmanmy thinks it is likely to continue in the future. So it is his type of stock - BUY.

KC is different. He will pull out his spreadsheet and start crunching numbers. Finally the numbers came out, he looked at it, nod with satisfaction and called his remisier to place a Buy order.

On the surface, the two are different - Stockmanmy placed a Buy order without paying attention to ROIC, EV/BITDA, EY, etc while KC ran all those numbers, satisfied with them, only then he placed a Buy order.

However, if you think about it, that difference is actually superficial.

KC Chong is not a computer. He did not scan through all 3,000 counters in Bursa (compute their ROIC, EY, etc) to single out Scientex. What motivated him to take a close look at Scientex in the first place ? It is actually the AWARENESS of the bright prospects of Scientex that prompted him to study it. He most likely get the leads from bits and pieces of information that he gathered from various sources :-

(i) Scientex recently announced a strong set of results;

(ii) Details about Scientex's capital expenditure program; and

(iii) Details about how the recent weakening of Ringgit has made Scientex's export business very profitable.

In other words, before he ran the financial ratios such as ROIC, EY, etc, KC has more or less already known that Scientex will have strong future earnings. Those ratios merely confirm what he suspected and gave him additional comfort.

In other words, KC is more "future oriented" than he is aware of. That makes him more or less the same as Stockmanmy.

That is why I said the two gentlemen shared more similarities than they are aware of.

5. Calvin Tan - NTA Based Investing

Calvin's style of investment is the exact opposite of what I describe in this article. He invests mostly based on NTA.

Calvin claims that he has high success rate, but many people might not agree with him on that.

One successful case often quoted by Calvin is Super Enterprise, which he has been calling for buy at around RM1.00. Super Enterprise subsequently went up to RM3.80 when an American company offered to take it over by cash.

Is this the long awaited proof that picking stocks based on NTA works ? I am curious, so I undertook a study of Super Enterprise's case. To my surprise, my study leads to an exact opposite conclusion - buying stocks based on NTA does not work, it is earnings that matters.

To understand how I arrive at such a conclusion, please refer to table and chart below.

Quarter Result:

As shown in the chart above, from 2011 until early 2015, Super Enterprise's share price stagnated at around RM1.00.

In April 2015, Super Enterprise received an offer from an Amercian company to take it over at RM3.80 per share. Share price spiked to reflect the unlocking of value.

The offer from the American buyer did not come out of no where for no reason.

By Q4 of 2014, oil price started declining sharply. As Super Enterprise uses petroleum byproducts as raw material, its profit margin improved substantially. In the December 2014 quarter, Super Enterprise reported an all time high EPS of 7.57 sen.

My guess is that the American buyer saw the bright prospect of the industry ahead and decided to act decisively to take over Super Enterprise (probably as a way to quickly expand production capacity).

I made the following key observations from the above case :-

(i) Despite trading at deep discount to NTA, investors are not interested in Super Enterprise. During the 4 year period from 2011 until 2015, stock price stagnated at around RM1.00.

(ii) The moment Super Enterprise's earning prospect showed sign of improvement, the stock immediately attracted attention from the American buyer, which is a competitor operating in the same industry.

Based on the foregoing, can you blame me if I say that when we pick stocks, the most important thing to look out for is future earning, and not NTA ?

What About Benjamin Graham ?

I can refuse to believe that NTA based investing has high success rate, but this is the same method that Benjamin Graham has been preaching. Is Icon8888 saying that Benjamin Graham was wrong, and Icon8888 is right ?

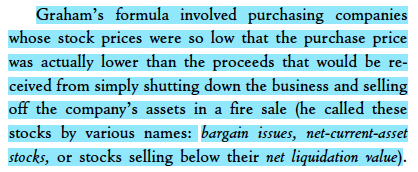

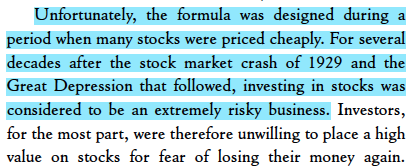

Not really. Graham was not wrong. His method worked well during his time (the 1930s). However, as the field of Finance evolves over the years, Graham's method might have become a littlle bit obsolete. I did not simply jump into that conclusion. Joel Greenblatt was the one that said that (in his book) :-

Expectation of Modern Day Investors

During Graham's time (1930s), finance theory was still in its infancy. A company's value is in its tangible assets. However, over the subsequent decades, finance theory has evolved substantially. With the advent of the concept of Time Value of Money (and its spin offs, Discounted Cash Flow and Net Present Value), it was increasingly recognized that profit and cash flow stream is more reflective of a company's intrinsic value than tangible assets.

Concepts like these are well understood even in developing countries like Malaysia. Nowadays, investors are increasingly paying more attention to dividend. To pay out dividend, the company must be generating profit.

With common understanding like that, no wonder modern day investors crave profit and are indifferent towards NTA.

6. Concluding Remarks

(a) In this article, I try to convince readers that the best way to pick stocks is to focus on a company's future earnings.

(b) However, the million dollar question is "can ordinary investors like us predict future earning ?". Based on my experience so far in the market, most of the time we cannot predict the future. However, occasionally, a window will open and allow us to see things with relatively good clarity. When a window opens in front of you, you should act on the opportunities.

One good example is Air Asia. The group's operating environment has improved substantially recently. This was followed by its controlling shareholders willing to commit huge capital to increase their shareholding. Putting all these together, there is reasonable odds that the company will do well going forward. It is rational to seize the moment and overweight the stock.

(c) As for NTA based investing. My experience so far has not been positive. As far as I am concerned, I prefer to stick to earning related methods.

However, there is still one anomaly that prevents me from declaring that NTA method is dead - Walter Schloss. Walter Scholss is a very successful investor and he did it by investing in stocks trading at deep discount to NTA. I tried to study his portfolio but unfortunately cannot find a book that can provide the details. I will write about him if I can find out more details in the future.

Have a nice day.

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Calvin has been made a Titan because he predicted that the palm oil can hit RM6k/tonne.

2016-06-23 12:46

totally rubbish, no tell what stock good to buy now ah??? what to sell??? why write long2?????? hahaha just kidding

ps: i learned it from goreng_goreng, thank you

2016-06-23 13:38

Icon bro you say future earning later people say you are same to bomoh.

When I doing nasi lemak business, I'm also speculating, calculating the expected customers that may be coming to my gerai gerai.

Hence, the best way investing in stock is future earning for me.

Nasi lemak selling = stock investment .

2016-06-23 13:42

Icon, If you haven't read "The intelligent Investor", I recommend this book to you. Understand 1 thing.

1. Graham's method of investing focuses on cigar buff investing & net net investing. Both of them are a double edge sword, as while companies may be selling cheap, they are not necessary a good investment. The quality factor is not the concern there. This is what is happening to Calvin's method of investing. It is not totally wrong, but very risky. That's why I don't discount his method of investing, but not a fan of it.

Buffett used to have this method of investing until his investment firm grew to a sizable size, but this causes him to start losing money later. Later, his partner and lifelong friend Charlie Munger, advises him to shift his method from "Buying companies selling at a cheap price" to "Buying good quality companies at a fair price". Hence Buffett come to where we know he is today.

This is also how he come to say he is "85% Fisher, 15% Graham" today, instead of 100% Graham.

Another person who does this is Fong Silling. He always advises people to own high quality companies. Does this help clarify anything?

2016-06-23 14:03

I must say I am thoroughly entertained by your piece. I agree that no one should blame KYY for their own investment decisions. If you want to win in this game, you work hard and research hard before KYY buys. If you are merely a follower than you only have yourself to blame. If you want to win, you have to be ahead of KYY, not follow him.

2016-06-23 14:20

You're welcome, my friend. No need to be so formal with me since we're friends right? And oh, one more thing. The tagline "It Is The Future Earning That Matters, Stupid" is not entirely true.

I don't always agree with Ricky Yeo's statement, but what he says is correct this time. Lemme explain why.

Warren Buffett’s investing principles focus on return of equity, ROE. This is his thought.

“Customarily, most investors measure annual company performance by looking at earnings per share (EPS). Did they increase over last year? Are they high enough to brag about? For his part, Buffett considers EPS a smokescreen. Most companies retain a portion of their previous year's earnings as a way of increasing their equity base, so he sees no reason to get excited about record EPS. There is nothing spectacular about a company that increases EPS by 10%, if at the same time, it is growing its equity base by 10%. That's no different, he explains, from putting money in a savings account and letting the interest accumulate and compound. Worse still, there are many companies borrow huge amount of money to improve EPS, but the marginal return is way below its borrowing costs".

While I read this from other investing blogs, KC has wrote about this before.

http://klse.i3investor.com/blogs/kcchongnz/88007.jsp

2016-06-23 14:21

It is the many many parts to put together to have a giant elephant. When one touch on one part of them, please continue to explore other parts too . A missed of any part will not make the elephant a complete and powerful one.

2016-06-23 14:52

Amazing. One of the best pieces of writing I have ever come across. Better than WSJ, fund house reports, investor books. You really have a gift.

2016-06-23 14:58

Posted by Ooi Teik Bee > Jun 23, 2016 08:18 AM | Report Abuse

It is the future earning drives up the stock price. It is the future growth on EPS, but not the past earning. The past earning is to determine how good is the management. A good management always able to deliver the good result.

Thank you.

RAIDER COMMENT;

OF COURSE, IT IS THE FUTURE EARNINGS LOH...!!

BUT THEN WHY LOOK INTO PAST EARNINGS ?

U LOOK INTO PAST EARNINGS TO DETERMINE THE QUALITY OF EARNINGS AND ITS STABILITY AND SUSTAINABILITY LOH....!!

IF U TALK TO SOME TEACHERS....THEY WILL TELL U THAT THE TOP 10 STUDENTS USUALLY PROGRESS WELL AND SCORE WELL IF THEY PROGRESS TO THE NEXT STAGE OF ITS FORM.

THE SAME APPLY TO STOCK MAH....!!

2016-06-23 15:06

aiyo...touching parts and exploring....hmm stocks are as tricky as women... if only the objectives are as straight forward as it is for men...he he...

Objective: Find a stock which has the potential to give you 'future value of cash pile' (a) as much as possible compared to the 'cash you have taken out to buy the stakes' (b) within a time frame years of your concern (t) - that's all. i.e the CAGR = (a/b) ^ - 1/t

all discounting using cost of capital are just a comparison of the average return you can make from the market at large...and all variables you use...name it what ever you want...has only that one objective of predicting the future cash pile with the time frame you are concerned.

variables:

- management

- roic

- salesman competence

- USD exchange rate..

- dividend payout..

- cash pile

- debt risk

- cash conversion cycle..

- whatever you want..

2016-06-23 15:08

A very provocative article that invites much intelligent discussion. We can learn much from it. Thanks, Icon8888.

2016-06-23 15:17

The differ between growth investing and value investing are those growth oriented investor really depend on future earning prediction of companies. They believes what past is past, and future matters. Value oriented investors tend to look the past performance to measure sustainibility of company. If the company cannot achive sustainibily in the past, how can they perform in future. They care the downside risk most of the time. Thus, IV is and MOS is top priority of value investor.

2016-06-23 16:43

Aiyo..

Dont put yourself with and compare to the others la

Others are looking for good quality earnings... you are looking at unaudited quaterly earnings...

Very different la.. stupid

2016-06-23 16:59

Stockmanmy.. cannot do it...

Is there anyone who can????

Who can... to harness... to simplify... to structure... to do the necessary... on how to identify growth companies... into a step by step approach..... that is simple yet reasonably reliable to use..

Anyone??

r°Moi Stockmanmy

You could well be on to something good...

All you have to do now is... to harness... to simplify... to structure... to do the necessary... on how you identify growth companies... into a step by step approach..... that is simple yet reasonably reliable to use..

r°Moi is waiting for it

.

21/06/2016 08:33

2016-06-23 17:04

there are sifus offering TA for a fee

also sifus offering FA for a fee

too bad no sifus offering BA.

not Bachelor of Arts............Business Analysis.

too bad.

we get so many incomplete analysis

Equity Analysis stands on a tripod

But i3 produces bipod analysis.

not all

sometimes, we do get bloggers who cover all 3 legs

what I cannot stand are spreadsheets of FA without any BA.

2016-06-23 17:08

.

Stockmanmy is getting better by the day...

May you be getting closer and closer to enlightenment...

And... be able....to harness... to simplify... to structure... to do the necessary... on how to identify growth companies... into a step by step approach..... that is simple yet reasonably reliable to use..

r°Moi is waiting for it

.

2016-06-23 17:12

Haha share price move based on future profit. I agreed with this.

A good example is Gtronic. Why Gtronic which have a excellence result in the past drop about 50% from the highest? It is because the prediction of future profit will be drop.

Another example is FLBHD. Why FLBHD will shoot up to RM3.xx in the past but now only RM1.9x? It is also because of prediction of future profit will be drop.

2016-06-23 17:23

More like the prices have ran ahead of the fundamentals....

And... relying heavily on unaudited quaterly earnings...

2016-06-23 17:26

Prediction = Speculative. It is the poison that killed many people on the wall street during dot com bubbles. Nowadays, those poison start to appear again. History keep repeated itself.

2016-06-23 17:43

look for a trend

run with the trend

iamvirtualinvestor > Jun 23, 2016 05:43 PM | Report Abuse

Prediction = Speculative.

2016-06-23 18:16

Speculator = Trader go with trend. Earning surge > people comes buying > price surge > trend ceeated > they buy high and think to sell higher until the trapped on top of trend. While an investor against them. Buy when no one care about the stock.

2016-06-23 18:34

THE KEY IS DOES THE BIZ MODEL EMPOWERS THE COMPANY TO EARN SUSTAINABLE INCREASING EARNINGS AND GIVES A RETURN HIGHER THAN ITS COST OF CAPITAL.

2016-06-23 19:29

INVEST AS LONG AS THE RETURNS ON CAPITAL EMPLOYED IS HIGHER THAN ITS COST OF CAPITAL.

2016-06-23 19:32

trader , speculators, investors are all advised to run with the trend...

look for a trend , follow the trend...not just price trends, there are many many other sources of trends. find the strongest trends,

find a revolutionary trend if you can

find Alvin Toffler if you can.

iamvirtualinvestor > Jun 23, 2016 06:34 PM | Report Abuse

Speculator = Trader go with trend

2016-06-23 20:18

In order to get prediction(of earning growth) correct, one has to do a lot, a lot of homework. I wonder how many of genuine investors out there are really doing this consistently and seriously? Not to mention majority of investors who still have 9-5 daily job. Besides the regular job, I believe many of us still have other things to take care of: family, friendship, love, sports and many more.

I really salute those who devote themselves fully to investment/trading. I might not be able to do that.

So, choose the investing method that best suits your life style.

2016-06-23 23:32

that is the best question of them all.

I tell you, better than the fees paid to TA sifus and the fees paid to FA sifus

iamsoonoob > Jun 23, 2016 10:25 PM | Report Abuse

this year what trend?aside from airlines,what others trend?

2016-06-24 01:09

The trends only comes visible to him...when everyone already jump into the boat shouting happily...thats when the trend comes obvious to him...he he...by then its too late already...

again...its all about 'being in the game of your own competence'. Being the tip of the knife which cuts...

even in economics - its all about MVA 'Market Value Addition'. This is the 'price-P' you pay above the 'Book Value-b' of a firm...i.e the discounted cash flow of the EVA's - economic value addition due to competitive advantage.

This is the price you pay for stocks too...

2016-06-24 12:32

with Brexit.....UK will be heaven on earth, a very prosperous, enlightened country

in 20 years time, UK sterling will be a very sought after reserve currency.

Goodbye, sick Europe

Welcome UK growth after unshackled from the chains of Brussels.

2016-06-24 12:36

If you see those playing on TA...like connie & Skyhawk...they will make money coz they are really good in their fields...

Business big shots like KYY will have the first insights of the BA - so called by stockman..

Similarly those who are really good in forecasting its near term earnings will have the advantage like Icon...

Its impossible to come out with a theory or strategy which can benefit almost everyone....

You really need to be different than others and you really need to be damn sure you know what you are doing better than others.

2016-06-24 12:38

betui. all this carnage n uncertainty is only temporary. look at iceland....bad but now ok dy.

uk will get better n more competitive...and the pound will rise again.

now is the best time to buy uk pound, property stocks etc as all are throwing

2016-06-24 12:39

Wah r°Moi is impressed

You are about the only one that knew Brexit was done deal 5 days ago..

Impressive!!

probability The trends only comes visible to him...when everyone already jump into the boat shouting happily...thats when the trend comes obvious to him...he he...by then its too late already...

2016-06-24 12:46

ha ha..that one pure gamble la...got psychological bias due to vested interest also..he he..

2016-06-24 12:49

As a summary we need to make the correction on the Title, it should be:

‘its the CAGR of the 'Current cash + Future Excess Cash accumulation' within a period t' over the 'Cash you forked out' to claim the stakes of the cash pile.....that matters – goblok!

but speculation has a way to make the price move quite unrelated to the reality of the above 'CAGR potential'....and it all depends on the mentality of the influential majorities....the players….as everyone does not have access to the same information and the same intelligence for information processing.

2016-06-24 13:13

but I if we are talking about the key influential parameters that drives the price in the short term...its the E-arnings growth...nothing beats that.

2016-06-24 13:33

trend....

trend is simple.

it is solidly red.......hahahahaha

just sell every thing including your backside....why argue?

2016-06-24 15:01

good for you

leno > Jun 24, 2016 03:43 PM | Report Abuse

when stock manny say SELL ... leno will BUY like no tomolo ... HAHAHAHAHAH

2016-06-24 15:46

NOBY

You are right that earnings matter. Actually most net nets that eventually go up in price due to some catalyst such as they manage to record some improvement in their earnings or maybe declaration of special dividend or privatization. However, the difference vs chasing growth stocks is that you buy them during the most pessimistic time when they are the cheapest and sell them once people get excited about them again.

There are many successful net net investors around. You can check out this blog on some examples on what to look out for when investing in net nets.

https://www.netnethunter.com/net-net-blog/

2016-06-23 12:39