(Icon) Lion Industries (1) - Top Pick For Steel Recovery Play

Icon8888

Publish date: Thu, 11 May 2017, 11:59 AM

1. Principal Business Activities

Lion Industries has three major business operation :-

(a) Amsteel Mill in Klang manufactures long products such as bars, rods, etc;

(b) Antara Steel Mill in Johor manufactures light sections such as angle bars, flat bars and U-channels; and

(c) Hot Briquetted Iron plant in Labuan which converts iron ore into HBI, a substitute for iron scrap.

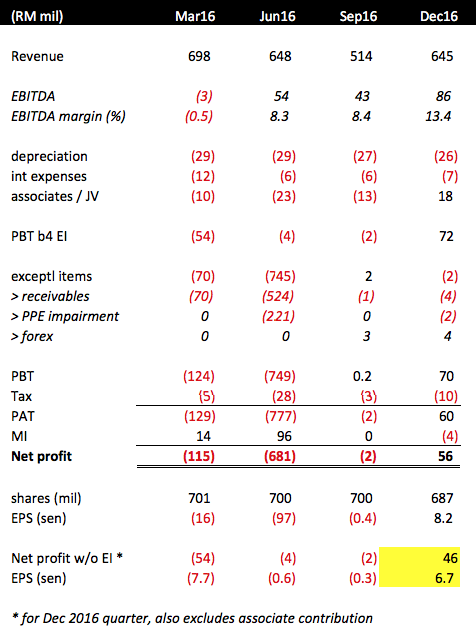

2. Strong December 2016 Quarter

On 23 February 2017, Lion Industries released a strong set of result for the quarter ended December 2016 (Note : March 2017 quarterly result yet to be announced).

Key observations :-

(a) Lion Industries' turnaround started in June 2016 quarter. Its EBITDA turned positive. However, due to huge impairment losses, the group reported huge loss of RM681 mil.

The impairment of receivables was mostly due to amount owing by Megasteel, which has since ceased operation. The group is not expected to register similar huge impairment going forward.

(b) The group's performance continued to stabilise in September 2016 quarter. With the absence of exceptional items, it broke even in that quarter.

(c) The group's performance improved substantially in the December 2016 quarter. Revenue grew while EBITDA margin widened susbtantially to 13.4%.

The company did not provide detailed explanation for the dramatic improvement. My guess is that it has benefited from higher iron ore price.

As shown in table above, during the quarter, iron ore price increased from USD55 per MT to USD80 per MT.

How would that benefit Lion Industries ?

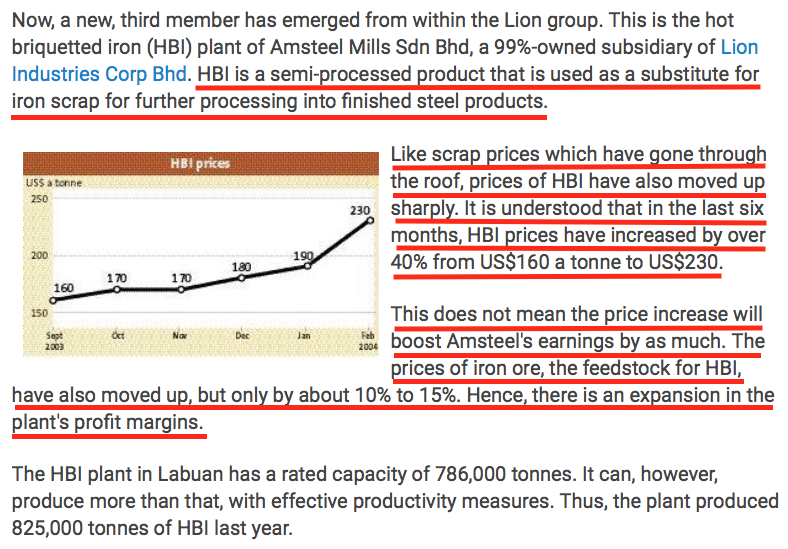

This is because as iron ore price increases, scrap price also increases. The Hot Briquetted Iron ("HBI") produced by Lion Industries' Labuan plant is substitute for scrap. As such, its price will also go up.

Scrap price will usually increase faster than iron ore price as there is infinite amount of iron ore in the ground but supply of scrap is more limited.

As a result, when iron ore price goes up, even though Lion Industries' operating cost will increase, if the selling price of its HBI has gone up faster, it will be in a position to reap windfall gain.

I didn't cook up all these information. It was based on an article dated 2004 posted on The Star. The article might be a bit old, but the concept should still be valid.

(d) Lion Industries has a 23% stake in Parkson Holdings Bhd. In the December 2016 quarter, Parksons reported net profit of RM73 mil due to gain on disposal. This has resulted in RM18 mil positive contribution to Lion Industries' P&L. To be prudent, we should exclude this item.

(e) After making the necessary adjustments, Lion Industries' core earning for the December 2016 quarter should be RM46 mil, which translates into EPS of 6.7 sen.

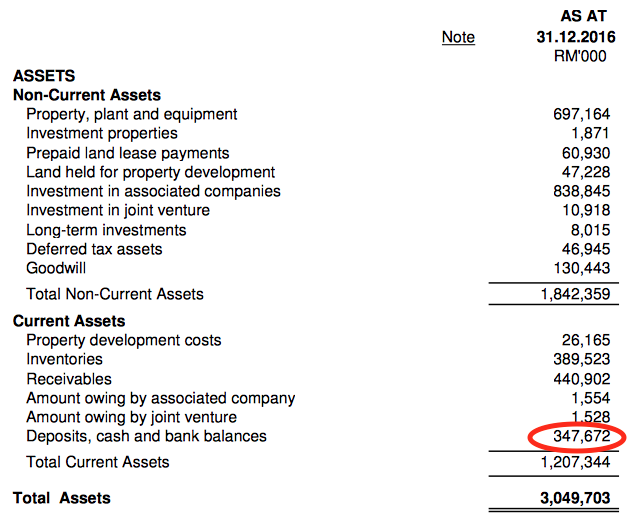

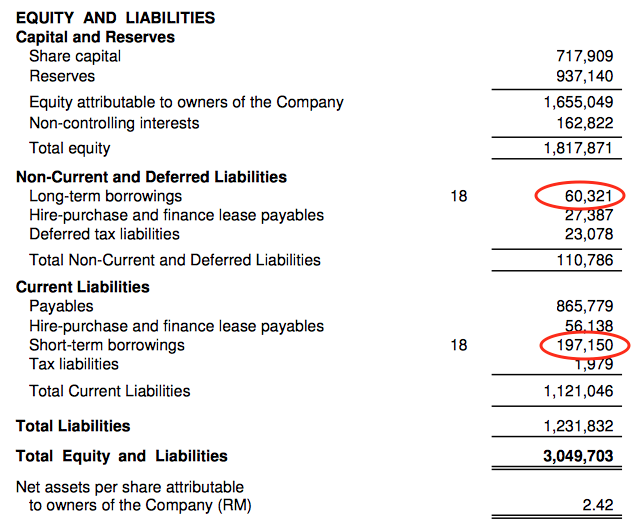

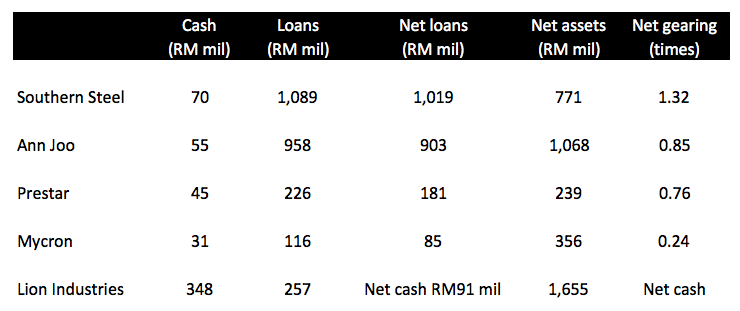

3. Surprisingly Strong Balance Sheets

I always have this impression that the Lion group of companies are mired in debt. I rubbed my eyes in disbelief when I went through Lion Industries' balance sheets. The group has net cash of RM91 mil !!!

Compared to other industry players, Lion Industries' balance sheet is considered very strong.

With such balance sheet strength, the group is in position to pay out high dividend now that it has returned to profitability. Will it do so ? We will soon find out in coming quarters.

4. What To Expect In Coming Quarter ?

I am cautiously optimistic about the coming quarter's result. Iron ore price remained strong in the three months ended March 2017 (major correction started in April 2017). If my hypothesis in Section 2 above is correct, the group's HBI division should continue to do well.

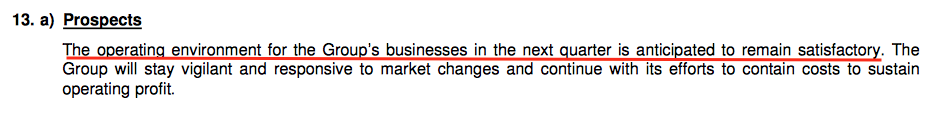

In the December 2016 quarterly report, this is what management said about prospects :

(Source : December 2016 quarterly report)

To have a feel of whether management was serious about what they said, or they simply put in something to entertain shareholders, I dug out past few quarters' commentaries on prospects.

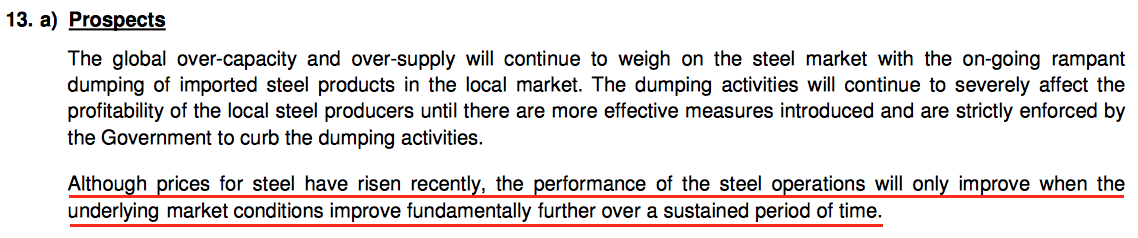

(Source : March 2016 quarterly report)

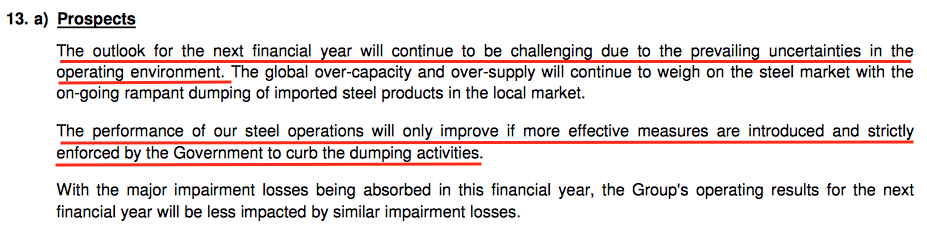

(Source : June 2016 quarterly report)

(Source : September 2016 quarterly report)

Well, I would say that managment passed my little test with flying colour. Everything they said in the past 3 quarters closely reflected what followed subsequently.

In March and June 2016 quarters, they cautioned that operating environment remained challenging, and the results subsequently validated what they said.

In September 2016 quarter, they guided for better performance and that was exactly what happened when December 2016 result was revealed.

It seemed that they were quite careful with their words. What do you think ?

5. Should We Worry About June 2017 Quarter ?

If you take a careful look at the iron ore chart in Section 2 above, you will notice that iron ore price has declined substantially in April 2017. How will that affect Lion Industries' profitability ? Should we be concerned ?

In my opinion, the decline should result in lower profitability at HBI division (no more windfall gain). However, Lion Industries' milling division (Amsteel mill and Antara mill) should benefit from lower input cost.

The steel industry is very complicated. It is affected by many factors which changed from time to time. I simply don't have the resources and expertise to predict how the group will perform in the June 2017 quarter.

However, I believe the group will still report healthy profit. Southern Steel does not have an HBI division to benefit from. However, in the latest March 2017 quarter, it still reported a sterling set of result (even when scrap price was so high). With stronger balance sheets (and hence lower interest expenses), there is no reason to believe that Lion Industries cannot achieve the same performance going forward.

6. Ann Joo's Pretension

In its latest annual report, Ann Joo bragged profusely about its blast furnace (it also has electric arc furnace, just like everybody else). Most steel players use scrap as raw matertial. When scrap price is high, Ann Joo's blast furnace provides it with the flexibility to switch to iron ore, which is usually cheaper.

Because of that, recently Ann Joo's share price has run ahead of other industry players - the Ann Joo Premium.

Sorry to burst your bubble, Ann Joo. Looked like you are not the only one with that flexibility. Lion Industries' HBI plant serves the same purpose. Furthermore, Lion Industries' balance sheets is much stronger than you.

How about some Lion Premium, huh ?

(I put in the above for fun. Ann Joo shareholders please don't be offended)

7. Concluding Remarks

I am relatively late to the steel industry re-rating. There were previously many uncertainties that stopped me from putting serious money in the sector. However, the government recently imposed a 3 year anti dumping duty on foreign steel import. With that, the industry's operating environment has improved substantially. I believe we are far from approaching the end of the positive cycle and it is still not late to take position.

Lion Industries attracted my attention because of its strong core EPS of 6.7 sen in previous quarter. At current price of RM1.00, even if EPS halved in subsequent quarters, I believe the stock will not collapse in a big way.

It also has strong balance sheet. With a bit of luck, shareholders might even enjoy some dividend going forward.

After taking into consideration the above, I would like to nominate Lion Industries as the TOP PICK for steel play.

Target price of RM1.50 by end 2017.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

william cheng delisted amsteel and put under lionind and conned amsteel shareholders

2017-05-11 12:02

why do they need to sell their factory if their balance sheet is so healthy??? Did you miss out account payable?

2017-05-11 12:07

Good write up by icon8888. You should be drawing the big fat pay these stupid analysts earned in the brokerages. None has written anything on this stock till todate. Finally, someone is recommending an undervalued stock for followers in this blog to make some decent profit. Thanks Icon8888 for a job well done, cheers.

2017-05-11 12:19

Icon888, don't forget bro, they still have slightly more than 5% treasury shares to reward shareholders as dividend in-specie.

2017-05-11 12:44

yes genius......but with 1000 shares to choose from must go and choose William Cheng counter?

2017-05-11 13:07

people still don't understand...investments is not about spreadsheets and formulas.......

good investments are about good business and good people, first.

2017-05-11 13:10

go ahead.....

myongcc5 > May 11, 2017 01:11 PM | Report Abuse

manmy, tis is great chance to make money. Nowadays, I advocate: Never love or hate any stock, our focus is to make money, I do not know about u

2017-05-11 13:12

myony......reminds me...even rational people can be found donating money to JJPTR.

2017-05-11 13:16

Icon8888, to be fair, inventories level should be included too and we know these inventories will be sold and convert to cash. Ex, Annjoo has 800+ mil of inventories if compared to Lion 300+ mil.

2017-05-11 13:28

talking about morons is donating money to William Cheng after all that has happened.

I will give a better alternative....Alcom...they are giving back 50 sen in cash per share......that is what I call good management, They are even borrowing money to give to shareholders.

they must be very positive about this year profits and cashflows to even propose such a move.

2017-05-11 13:34

I don't know whether you will make or lose money on Lion Industry, but I sure will make money on Alcom

myongcc5 > May 11, 2017 01:37 PM | Report Abuse

Manmy, now I understand u, .....u r empty vessel

2017-05-11 13:39

Thanks Icon...hope this will lift up the all other steel players too

Have not gone through in detail to comment much.

Currently i am sensing some visibility in Mycron Steel.

2017-05-11 13:40

Because steel products have no expiry date and its recyclable characteristic make inventories info a relatively useful/safe indicator when assessing a steel company.

2017-05-11 13:42

If people don't factor in the human element in investment decisions, the people, the management......

you should be just trading the momentum and charts and forget about writing any stuffs about the company.

2017-05-11 13:49

Mycron I have, CSC I have , also Ann Joo.

YKGI can consider as a candidate for turnaround.

even Hiap Tek is a candidate for turnaround. With the sharp drop in iron ore prices, the steel companies should be able to repeat their 1H 2016 performance.

2017-05-11 13:54

sorchai manny, jaks management is non human factor? or x factor (mystified it when you cant explain it). You dont day day show how pandai you are la, sien lo. Learn from icon mastery and earning money la. Dont know shut up? it is an art you belum master i opined.

2017-05-11 13:55

what is wrong with Jaks management?

I have met them , the second generation management that is taking Jaks to great heights.

d by cheoky > May 11, 2017 01:55 PM | Report Abuse

sorchai manny, jaks management is non human facto

2017-05-11 13:56

cheoky

you are mesmerised by people...

I only talk facts and follow the money.

2017-05-11 13:58

B fair to WC Who can withstand d onslaught of Alibaba n steel dumping by China cos But d worst is behind now Loss in Parkson China can b cover by capital gain Now taiko 3 yrs protection

2017-05-11 14:00

lets say Lion Industry makes some money.....is it his or yours?

OrlandoOil > May 11, 2017 02:00 PM | Report Abuse

B fair to WC Who can withstand d onslaught of Alibaba n steel dumping by China cos But d worst is behind now Loss in Parkson China can b cover by capital gain Now taiko 3 yrs protection

2017-05-11 14:02

WC very deep into steel The Malaysia steel king

Tat is Y last time WC die n tis time WC fly

2017-05-11 14:03

Lion is roaring back. The future of steel Ind is very bright in Malaysia with so many infrastructure projects going to launch. If you don't buy steel stocks now is your loss. Lion will roar back to it glory day.

2017-05-11 16:02

Add some confidence now,

seeing icon8888 sifu start bullish on STEEL.

STEEL will be my 2nd half 2017 major play .

2017-05-11 16:14

Just the early stage of 3 years....imagine the share price of Long Steel Big 4 par with Glove Big 4

2017-05-11 16:56

long steel big 4 mainly sells in Malaysia....Glove Big 4 sells in the whole world.

leoting Just the early stage of 3 years....imagine the share price of Long Steel Big 4 par with Glove Big 4

2017-05-11 18:01

@Stockmanmy none of the industry can keep growing with continuous increasing capacity...China also export steel to whole world, at the end...

2017-05-11 19:07

Icon8888, I m totally agree with your calculation but u miss one important point.

Lionind have geographical advantage compare with others rebar on the ECRL 55B. This will even boost their earning.

My estimation target price as per below:

EPS 6.5 X 4 X PE 8 = RM2.08

Deeply Undervalue.

CHELSEA

2017-05-11 19:26

the world is better than malaysia alone

leoting > May 11, 2017 07:07 PM | Report Abuse

@Stockmanmy none of the industry can keep growing with continuous increasing capacity...China also export steel to whole world, at the end...

2017-05-11 19:31

looks promising in many aspects except bad history from william cheng counters. at least i still being conservative with his counters after all the cheeky things he had done

2017-05-12 13:45

stockmanmy people still don't understand...investments is not about spreadsheets and formulas.......

good investments are about good business and good people, first.

fully agree

2017-09-07 10:56

I hope I am not the last one invest in lionind.

After one year of bumpy experience, lionind still holding at rm1 as this article posted.

It shall be stronger. With one year consolidation, lion should wake up now

2018-08-12 16:45

speakup

amsteel shareholders got f*cked by william cheng

2017-05-11 12:01