(Icon) Careplus - A Potential Multi-Bagger

Icon8888

Publish date: Thu, 01 Jun 2017, 11:31 AM

1. Special Mention

Thank you koko888 for introducing this stock to us through his earlier artcle.

https://klse.i3investor.com/blogs/koko888/124155.jsp

You can say that koko888 lit the fire, and I am now trying to fan the flame.

2. Spike In Revenue and Earning

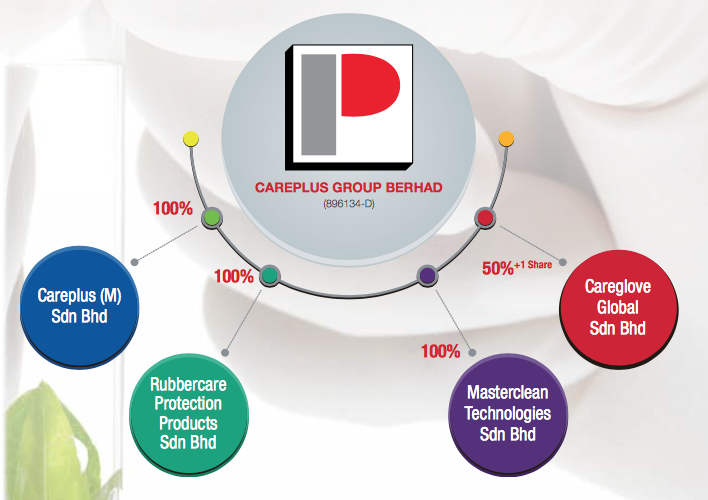

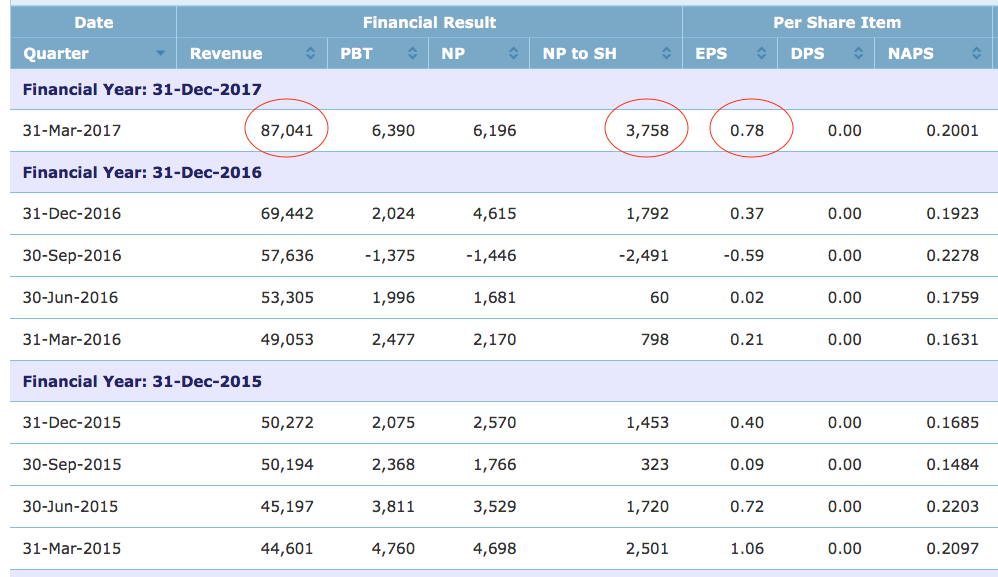

Careplus is a glove manufacturer listed on ACE, industry peers of Top Glove, Kossan, Supermax, etc. Since IPO in 2010, it has been growing by leaps and bounds. In 2016, it undertook further expansion by adding 6 more lines. In the quarter ended March 2017, its revenue and profit grew significantly as positive impact from the additional capacity started trickling in. Please refer to table below.

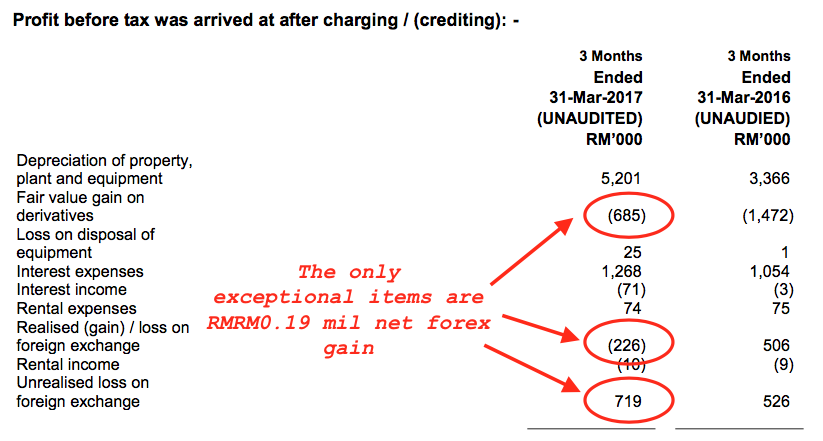

The March 2017 quarter was purely operational, with very little exceptional items.

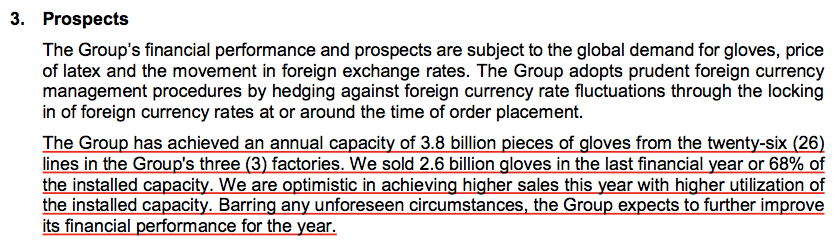

The company is positive about coming quarters' earnings.

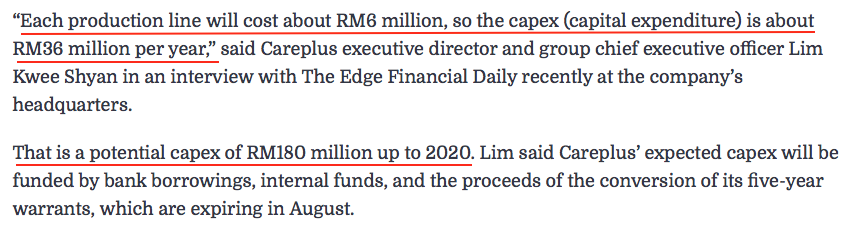

3. Further Expansion Ahead, All The Way Until 2020

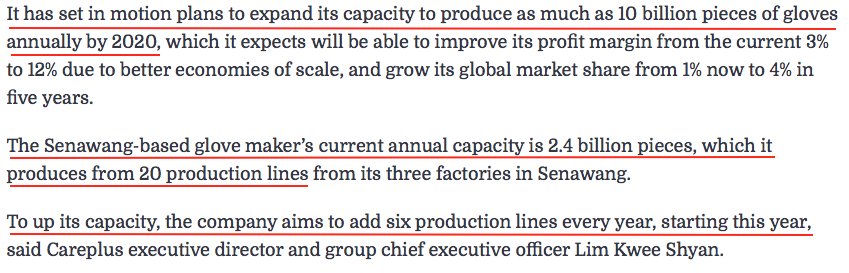

In an interview dated February 2016, Group CEO told The Edge that from 2016 until 2020, they plan to add six production lines every year. At the end of the expansion program, capacity will increase from 2.4 billion pieces to 10 billion pieces (note : as at end 2016, capacity is 3.8 billion pieces). Please refer to article below.

http://www.theedgemarkets.com/article/careplus-ups-capacity-boost-profit-margin

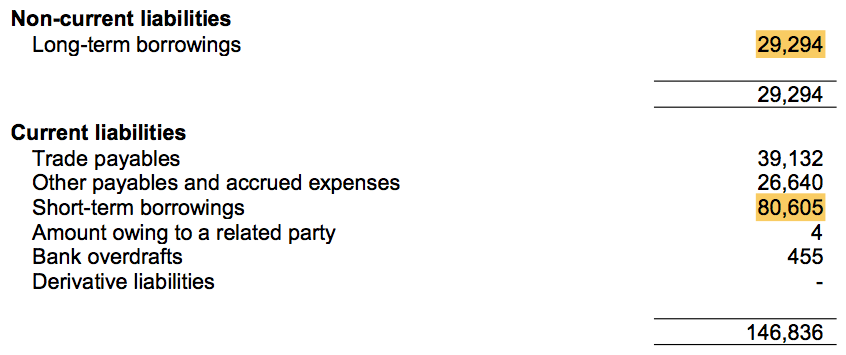

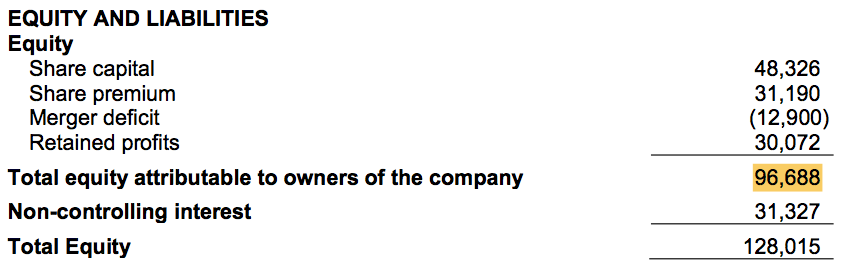

4. Balance Sheet Not Strong, But Not Really A Problem

As at March 2017, Careplus has net gearing of approximately 1 time. To be honest, its balance sheet is not considered strong.

However, Malaysia has certain competitive advantages when come to glove manufacturing. Many of our glove companies are world leaders in the industry. As such, I am not particularly worried about Careplus' financial strength, especially now that it is showing signs of thriving.

Having said so, according to the February 2016 interview, the capacity expansion porgramme required total funding of RM180 mil. Can Careplus afford it ?

It is actually not as intimidating as it looked. First of all, Careplus' March 2017 figures had already factored in RM36 mil capex (incurred in 2016). The remaining amount would be RM144 mil.

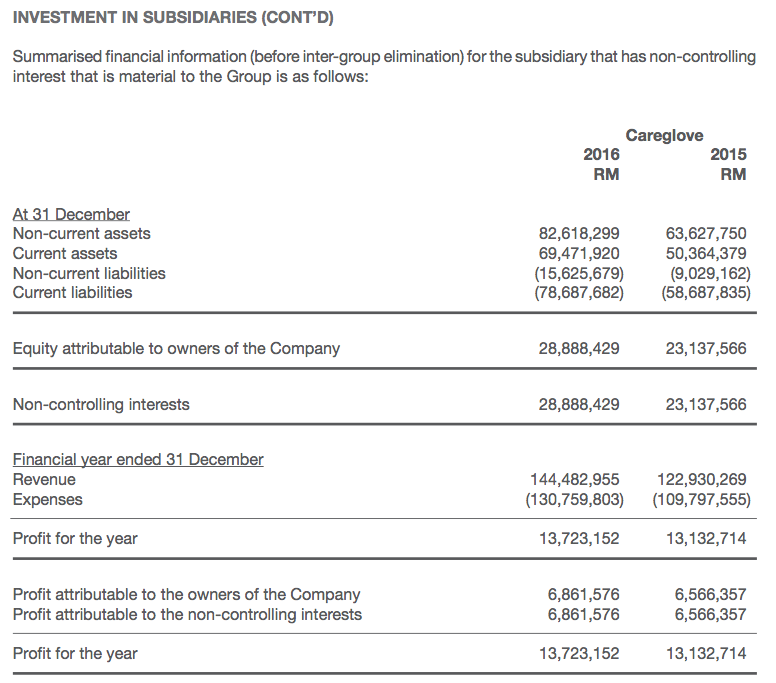

Secondly, if I am not wrong, a substantial portion of the funding might be borne by its 50% owned subsidiary, Careglove Global Sdn Bhd. According to FY2016 annual report, Careglove's assets and liabilities accounted for a substantial portion of Careplus group's balance sheets. It was also a major earning contributor to the Group. As such, Careplus could end up funding only 50% of the capex, while the remaining 50% by Careglove minority shareholders.

Lastly, there is also a likelihood that Careplus will undertake a private placement in the future to raise equity funding. The company's major shareholders collectively hold closed to 50% stake. As such, they are in a position to tolerate placement related dilution.

(Speculative angle : will Careplus capitalise on its strong earning to ramp up share price to facilitate private placement ? Let's wait and see)

Anyway, let's not worry too far ahead. Careplus' management has been in this industry for a long time. They should know how to assess and manage the financial risk associated with the expansion.

5. Concluding Remarks

Careplus' recent quarter strong earning attracted our attention. We also think that it is likely sustainable as it was driven by capacity expansion, which will last until 2020.

The capacity expansion not only increases revenue, it also improves profit margin due to economy of scale.

If we are lucky, Careplus will enter a virtue cycle over the next few years :-

(a) capacity expansion increases revenue and profit margin;

(b) higher profitability attracts investors' attention. Re-rating leads to PE mulltiple expansion;

(c) the company leverages on strong share price to undertake placement to raise equity funding;

(d) cheap equity funding facilitates further expansion (through a combination of equity and borrowing), which will further increase earnings. And the cycle repeats itself.

We are currently at early stage of breakout growth. Will the above blue sky scenario materialise ? Nobody knows. Investing is challenging because we need to make decision based on incomplete information. There is no assurance that Careplus will indeed evolve into another Top Glove, Supermax, or Hartalega. You have to try your luck. In stock market, no risk no return.

Appendix - The Edge Interview Dated February 2016

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

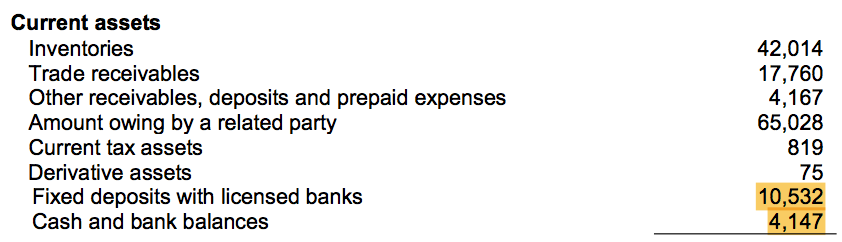

hmmm... mind to share with us, what's your opinion on the carepls balance sheet? especially on the current ASSET?

2017-06-01 14:00

this counter is potential merge by golve taiko espeically topglove.. wait for luck !

2017-06-01 17:00

It's in a good industry riding on the giants' big name. but track record, brand, customer relationship is not there. unlike the big boys, maybe it's too optimistic to assume additional capacity will directly translate into additional sales.

the angle I think most investors are counting on is if the one quarter strong results continue and annualised PE gets closer to the big boys. potential upside maybe, but multi-bagger may be a bit exaggerated

2017-06-01 17:20

a lot of weird stuffs going on in this company, weird stuffs that Top Glove and Hartalega do not need to resort to.

when doing an analysis of this company should highlight those weird stuffs....

1 they set up a 50% subsidiary to be the sales agent for South and Central America...transfer pricing issues and minority interest taking up all the 2016 profits and huge amounts of 2017 profits.

2 classified as amounts owing by related party $ 60 million is a company with common directors and maybe sales agent.

this company no transparency and very weird...Top Glove and Hartalega never have to resort to such stuffs.

2017-06-01 18:53

not a single fund manager in the top 30....

if you are a professional fund manager, would you get yourself involved in such a weird set up?

on the other hand, it is weird no fund manager in this glove making company..this could have been an ideal company for venture capitalists and seed capital investing.

2017-06-01 19:02

Valid points by both expert here. I just wanted ato know who is the owner, are they credible, are they honest people. To be management is everything.

2017-06-01 19:39

Totally agreed. Not only that...they can screw up a business too..

Posted by Icon8888 > Jun 1, 2017 07:40 PM | Report Abuse

that is why people said accountants are bean counters... they picked up all kind of nonsenses from accounts and magnify them by 100 times

paralysis by analysis

accountants can never been good investors, I have said it many times, and I am saying it again

2017-06-01 19:46

Especially when Accountants try to influence MD's decision...never allow an MD purely from a commercial background - they are only good at acquiring...organic growth will be killed.

2017-06-01 19:49

Icon sifu, this CEO can trust or not? I can also blow water with the media I have this installed capacity in future but whether it will come true or not seems like a risk

2017-06-01 19:50

so, you guys are pretending those concerns not exist? hmm... for trading, still ok la~~ investment? hmm... what if they impair it? well, you guys may ady taken profit... happy go lucky

2017-06-01 19:50

yes icon

stock market...many a times, ignorance is bliss.

many a times , ignorance comes back to bite you.

how to know which is bliss?

2017-06-01 20:13

The MD is reliable. I say this because i have bought this counter years ago till its bonus issue and had been following their developments

2017-06-01 20:23

It's a ace counter,so funds and institutions will give it a miss....my 2 sen!

2017-06-01 20:32

stockmanmy, just give your best blessing to them ba~~ they choose to ignore... as long as profit $$, then okay dy... argue so much also bo use... since they dont care...

2017-06-01 20:50

Seems to be a good upward trend. May buy tmrow at 37.5 cents if available. Or else buy 38 cents, no harm.

2017-06-01 20:57

majority in i3 don't analyse...they vote on popular contest...as if this is a political forum.

mrcibaiii > Jun 1, 2017 08:57 PM | Report Abuse

sohai counter got so many like... real sohai

2017-06-01 21:02

This counter is not a popular one lah. It has been dead for many months until they made a turnaround finally.

Earnings improved also get condemned.

2017-06-01 21:06

Many giving negative perception on this counter. Helpful for me to pick up at a slightly low price. Earlier I overl looked Icon8888's write up and recommendation.

2017-06-01 21:13

Actual sohais have missed the boat. Now proving that they are genuine sohais waiting to pick at a very low price ha ha ha

2017-06-01 21:16

looking at the chart and QR , I will buy a little to earn a cup starbuck coffee

but to keep for long term and hoping to make big money i scare i can't sleep well every night

2017-06-01 21:52

go see for yourself the factory then pretend try to buy their gloves....more will meet the eyes.....Brazilian connection? failing from the start....don't believe? go ask same industry players....

2017-06-01 22:26

they put a middle man in between....they can do what ever result they want....no transparency.

2017-06-01 22:31

D & O is another company I like a lot.

But alas, they only have 50% of the core operating subsidiary. ...making the share over valued.

if only D & O has 100% of the subsidiary.......

2017-06-01 23:17

Thanks for sharing. I've done thorough studies on the company's info, financials, industry prospect, shareholding analysis and management team analysis. I decide to buy tomorrow and I have a high TP on this stock. Thanks icon8888 for sharing. I have made my first bucket of gold with the stocks you recommended. Thanks.

2017-06-02 00:48

And it's a fate I believe to get to meet such as 'gui ren' in life. If there's a chance, Icon8888 (ps: this is not a confess), I would like to buy you a good meal as appreciation and have some blow water session on stocks, or life. If you don't mind, perhaps you can share your email address to me here. I'll send you an email :)

2017-06-02 01:06

Wow. Now wanna take credit on jhm. Carepls please. We talking carepls. What so unique about their gloves that people buy from them instead of top four. Kossan, top glove, harta, Supermax. I believe they also can do what carepls did. And perhaps do it better and cheaper

2017-06-02 07:51

icon

just say your analysis of Careplus is incomplete....and end of story.

good analysts must highlight all unusual and not so normal stuffs.

up or down is caveat emptor.

2017-06-02 08:01

Icon8888, I may not have Rm30mil - Rm40mil you are flushed with, but I can beat you with my younger age. Power of compounding will make it possible for many to overtake you. Hehe

2017-06-02 08:04

Don't attack icon8888. We have to admit that he has been contributing a lot in the i3. I have lots of respect for him.

2017-06-02 08:10

Careplus has a loan of RM65 mil to a related party, an increase of RM10 mil YoY.

This is larger than even its paid-up capital.

There may be a good reason for this, otherwise it sounds problematic and even suspicious.

2017-06-02 08:34

icon

some accountants may feel uncomfortable with Sendai borrowings....but I think buying a turnaround stock especially one that is involved in almost all the iconic structures in Asia can be a very lucrative bet.

2017-06-02 09:59

My comments were not a critique. I brought up unusual stuff here because Careplus is the subject here, not Eversendai. It's not double standards as I've not even looked into the latter.

To put it into perspective, my view is Icon8888 writes excellent analyses.

2017-06-02 10:05

Careplus makes into top volume list.

that is when contra kakis itchy fingers.

2017-06-02 10:28

One quarter results for 2017 better than the profit for the whole of previous year. This thing cannot happen in the glove industry. Moreover, amount owing by related company is worrying.

2017-06-02 12:18

Hi, cckkpr. Respond to your amount owing by related company, that is not borrowing, but the sales to related people. In simple words, it's same as trade receivables, they sold to related parties, for transparency purpose, it's being recorded in that way. Please read PAGE 87 in Annual Report 2016.

This company has bright future where the recent record high profit mainly comes from CORE EARNINGS. And double positive effects with CAREPLUS's capacity expansion + better margins due to economoies of scale.

Valuation wise, annualise latest EPS, PE is at 12x at 38 sen. For big glove players, industry PER is between 23x to 28x like Topglove, Harta etc. For small glove companies, the PER should be around 15 - 20x. Assume PER 15x, at annual recent EPS, the share price should be at RM0.47. Why multi-baggar? Because the huge capacity expansion plans + better margins with lower cost per unit will drive the earnings exponentially.

It's a no-brainer buy at this level.

2017-06-02 14:18

this is also to show math teacher I am not a fake accountant.

aseng > Jun 1, 2017 09:53 PM | Report Abuse

stockmanmy,

you are very sharp , a good accountant

2017-06-03 08:37

Icon8888 sifu, any further comments on the fundamentals in view of recent development?

2017-09-11 07:33

stockmanmy

no risk no gain...and why not?

and this one don't even have the old Lion and Parkson baggages to carry.

2017-06-01 12:33