(Icon) Bumi Armada - A Not So Good Company Selling At Cheap Price Can Be A Good Buy

Icon8888

Publish date: Sun, 30 Jun 2019, 08:44 PM

1. Introduction

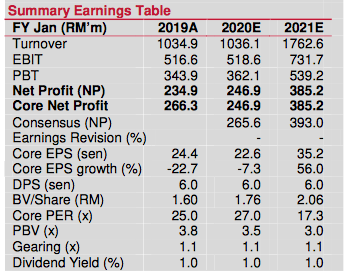

According to Kenanga Investment Bank, Yinson is expected to experience spike in earning in calender year 2020 (FYE Jan 2021). Its historical and prospective PER is 27 times and 17 times respectively.

(Source : Kenanga IB analyst report for Yinson dated 28 June 2019)

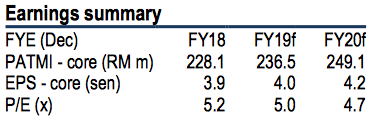

On the other hand, according to Hong Leong Investment Bank, Armada is trading at historical and prospective PER of approximately 5 times. (Armada share price 22.5 Sen as at the date of this article).

(Source : Hong Leong IB analayst report dated 3 June 2019)

It is true that Yinson has stronger balance sheet (net gearing of 1.1 times) compared to Armada (net gearing of 2.7 times). But as long as Armada can service its debt obligations (recent indications are that they can), maybe we should not let balance sheet weakness completely shut us down.

Let's take a closer look.

2. Historical Profitability

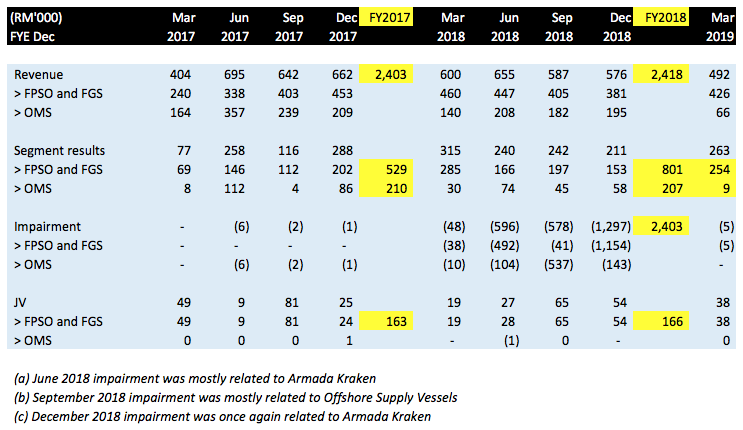

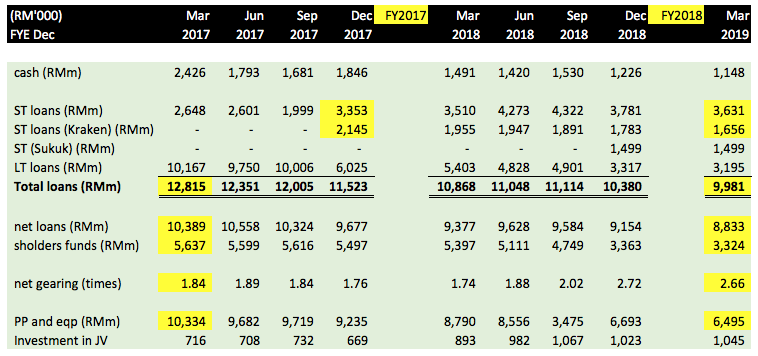

The followings are Armada's historical P&L from Q1 of FY2017 until Q1 of FY2019 :

Key observations :

(a) annual revenue of approximately RM2.4 bil. Existing order book is approximately RM20 bil (firmed order book). Simple calculation shows that it should last around 8 years, even without additional contracts secured.

(b) Annual interest expense of approximately RM500 mil. As borrowings outstanding is approximately RM10 bil, effective interest rate is approximately 5%.

(c) In FY2017, the group has property, plants and equipment (PPE) of RM9.5 bil (year average) and depreciation charges of RM576 mil. This translates into PPE lifepan of 16 years.

The group made huge provision for impairment of RM2.4 bil in FY2018. Divided by 16 years, depreciation charges will be lowered by RM150 mil per annum (or RM40 mil per quarter). A quick check shows that this is indeed the case as Q1 of FY2019's depreciation charges has dropped to RM105 mil (from approximately RM150 mil in Q1 of FY2017).

In an earlier annual report, management has indicated that impairment is actualy not a bad thing. Apart from lowering depreciation charges (augurs well for future profitability), it also puts the group in better position to bid for contracts at lower price, thereby enhancing its competitivenss (OMS segment).

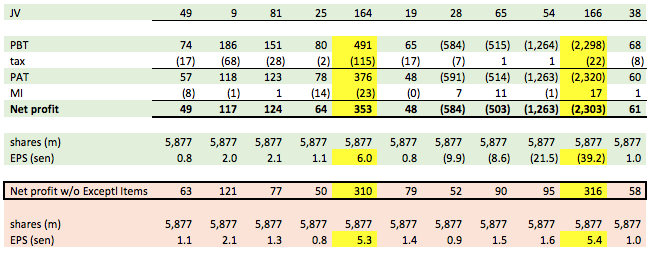

(d) The group reported net profit (without exceptional items) of RM310 mil and RM316 mil for FY2017 and FY2018 respectively.

FY2017 revenue was driven by relatively strong OMS (Offshore Marine Service) contributions. The OMS division's order book is closed to being depleted. Going forward, we should be happy if it can just break even.

Following completion of 4 vessels in FY2018, contribution by FPSO and FGS (Floating Gas Storage, referring to the vessel chartered to Malta for Liquified Natural Gas storage for power generation purpose) has picked up, as evidenced by higher FPSO and FGS revenue of RM801 mil in FY2018 compared to RM529 mil in FY2017. In Q1 FY2019, this division's revenue further increase to RM254 mil (if annualised will be RM1 bil revenue). The group's FPSO related revenue is likely to further increase once Kraken's operational issues are fully resolved and achieves final acceptance status (no idea by how much).

As shown in table above, the group's earning capacity is approximately RM300 mil per annum (without exceptional items).

(e) Not to be overlooked is the group's 3 Joint Ventures in India and Indonesia. These joint ventures made consistent profit contribution of approxmiately RM160 mil per annum to the group in FY2017 and FY2018.

The joint ventures' contribution is not limited to equity accounting. A study of the group's cash flow statement shows that they occasionally flew cash up to the goup through a combination of dividend payment and capital repayment.

3. Balance Sheets

The followings are the group's balance sheet details over past two years :-

Key observations :-

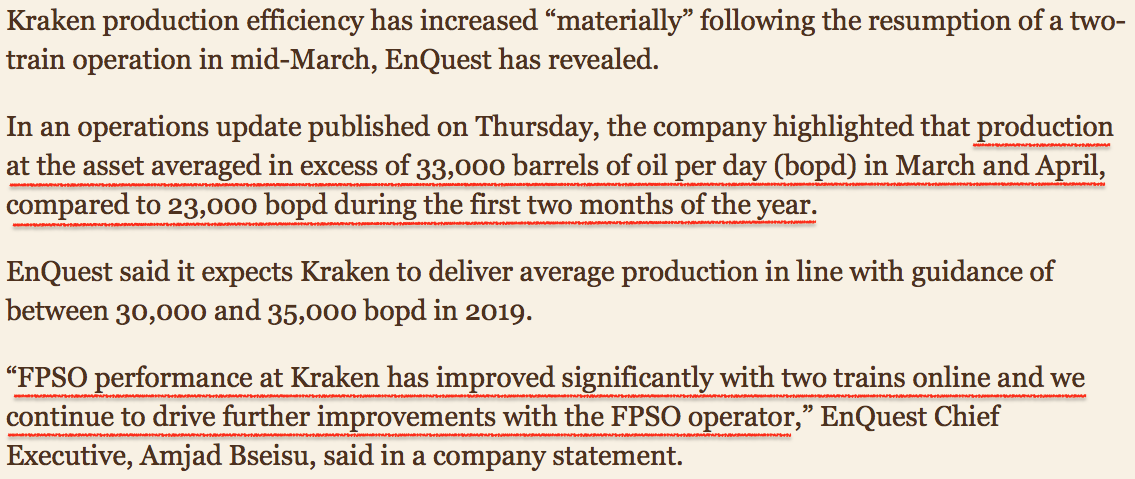

(a) Armada Kraken was deliverd to client, Enquest, by mid 2017. However, it was not able to achieve final acceptance status within the designated timeframe (meaning the vessel has not been able to perform according to full specifications). This caused it to breach the financing covenants, resulted in its long term loan being reclassified into short term loan.

There are some good news though. In March and April 2019, Armada Kraken has managed to improve its performance materially. It is not known when the vessel will achieve final acceptance status, but at least it is heading in positive direction.

Please note that since breaching the loan covenants in Q4 of FY2017, the company has been paring down Armada Kraken's loans by RM486 mil (from RM2,145 mil to RM1,656 mil). Please refer to table above.

(b) On 24 April 2019, the company announced that it has successfully negotiated with lenders to refinance RM2.72 bil short term facilities into a single long term facility with RM1.07 bil and RM1.65 bil maturing in two and five years respectively. This removed a major risk of default.

(c) During the 2 years from Q1 FY2017 until Q2 FY2019, the group pared down net loans by RM1.56 bil (from RM10.39 bil to RM8.83 bil). This is equivalent to RM750 mil repayment per annum.

(d) Following huge impairment of RM2.4 bil in FY2018, property, plant and equipment declined from RM10.3 bil in Q1 FY2017 to RM6.5 bil in Q1 FY2019. Due to huge losses, shareholders funds also declined from RM5.6 bil to RM3.3 bil (a decline of RM2.3 bil). As a result, despite reduction in loans by RM1.56 bil (as mentioned above), net gearing increased from 1.8 times to 2.7 times.

4. Cash Flow

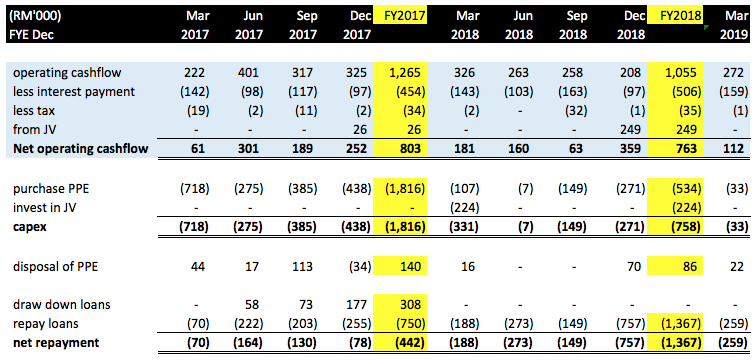

The followings are cashflow details :-

Key observations :-

(a) The group generated net profit of approximately RM300 mil per annum. However, depreciation charges was approximately RM500 mil per annum. Added that back, net operating cashflow (already factoring in interest payment of approximately RM500 mil per annum) would be approximately RM800 mil per annum (ignoring changes in working capital as it tends to even out over years).

(b) In FY2017, the group incurred capex of RM1.8 bil. In FY2018, the amount was approximately RM758 mil. Going forward, capex is expected to be a lot lower as all the vessels had been completed and delivered (unless further capex is required to rectify Armada Kraken problems, which I think is unlikely to be big as material improvement has been achieved recently).

(c) In FY2018, the group's 3 joint ventures (2 in India, 1 in Indonesia) flew up a total RM249 mil cash to the group by way of dividend and capital repayment. Going forward, it is difficult to tell whether the same quantum can be maintained. However, for two consecutive years, these joint venture stakes have been contributing net profit of RM160 mil per annum to the group. I think going forward, dividend payment of RM100 mil per annum is a realistic assumption.

(d) In FY2017 and FY2018, the group disposed of assets amounted to RM140 mil and RM86 mil respectively. The group will continue to dispose of assets in the future to raise cash.

(e) Over the two financial years (2017 and 2018), the group made net repayment of RM1.809 bil. This worked out to be RM900 mil per annum.

5. Concluding Remarks

At current market cap of RM1.26 bil, Armada is trading at prospective PER of approximately 5 times. The group has weak balance sheets, but long term charters provide it with strong earning and cash flow visibility.

Going forward, I think the most important factor to watch is Armada Kraken. If they managed to resolve all the problems faced by this vessel (indications are that they are heading in right drection), the stock will experience a major re-rating.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

The title explains "A Not So Good Company Selling At Cheap Price Can Be A Good Buy"

Guess, the author suggest never mind fundamental, integrity, competitiveness and relevance of the company in current business environment. The criteria of "cheap" is enough for a GAMBLE. In that case, there are almost 85% companies in KLSE which fits that criteria. So, please gamble because it is cheap.

2019-07-07 12:16

Don get principle wrong loh....!!

It is not gamble mah.....!!

It is intelligent investment with big margin of safety with great prospect of big profit from upside rerating Loh...!!

Posted by DickyMe > Jul 7, 2019 12:16 PM | Report Abuse

The title explains "A Not So Good Company Selling At Cheap Price Can Be A Good Buy"

Guess, the author suggest never mind fundamental, integrity, competitiveness and relevance of the company in current business environment. The criteria of "cheap" is enough for a GAMBLE. In that case, there are almost 85% companies in KLSE which fits that criteria. So, please gamble because it is cheap.

2019-07-07 23:32

>>>

Posted by DickyMe > Jul 7, 2019 12:16 PM | Report Abuse

The title explains "A Not So Good Company Selling At Cheap Price Can Be A Good Buy"

Guess, the author suggest never mind fundamental, integrity, competitiveness and relevance of the company in current business environment. The criteria of "cheap" is enough for a GAMBLE. In that case, there are almost 85% companies in KLSE which fits that criteria. So, please gamble because it is cheap.

>>>>

Thanks for highlighting.

2019-07-08 08:09

Posted by DickyMe > Jul 7, 2019 12:16 PM | Report Abuse

The title explains "A Not So Good Company Selling At Cheap Price Can Be A Good Buy"

Guess, the author suggest never mind fundamental, integrity, competitiveness and relevance of the company in current business environment. The criteria of "cheap" is enough for a GAMBLE. In that case, there are almost 85% companies in KLSE which fits that criteria. So, please gamble because it is cheap.

=========

contrarian plays are for the pros.

2019-07-08 08:55

One who sells dignity, ethics and moral values in exchange of money are also called "pros".

2019-07-08 09:57

A good company deserves a higher valuation. It is possible that you paid a slightly higher price than you wanted to pay for the stock, which lowers your overall rate of return, but time is on your side and your long holding time minimizes the impact of the higher purchase price to your overall return. Also, you will always find the opportunity to add to your position at lower valuations, though not necessarily at lower prices.

Deep value investing investors need to be cautious and aware of this approach's inherent problems. Those companies dropping and appearing in the deep-bargain screener probably deserved to be traded by low valuations. Their stock prices were likely low for the right reasons, and buying these would likely have resulted in steep losses.

2019-07-08 10:55

both my detractors and supporters, we come back again in one year and see whether Armada is more than 22 sen

time will tell who is Warren Buffett who is Moron Buffalo

argue so much no use

2019-07-08 10:59

i thinks it's not about good or bad company and it's not about buying actually... just a lower price stock is good for trader gain fast profit in more quantities shares in hand to gain in single movement uptrend per day...

2019-07-08 11:07

lurhays > Jul 8, 2019 11:07 AM | Report Abuse

i thinks it's not about good or bad company and it's not about buying actually... just a lower price stock is good for trader gain fast profit in more quantities shares in hand to gain in single movement uptrend per day...

======

I can support that.

2019-07-08 11:21

without sochais like 3iii and Philips that cannot differentiate good buys from good companies, when will we have chance to make money ?

we should welcome their existence

2019-07-08 11:29

>>>

Posted by stockraider > Jul 8, 2019 12:26 PM | Report Abuse

I thought u r the real SOHAI....!!

>>>>

Alright, what raider is pointing out is he is the smart ass.

Investing requires the qualities of temperament way more than it requires qualities of intellect.

2019-07-08 13:11

Its not being evaluated in such a way. Different price offer of different company cannot determine which one is better off than one another

2019-07-08 14:27

Posted by Mabel > Jul 8, 2019 12:03 AM | Report Abuse

So it's pretty clear that Armada is oversold and Yinson has done a great job selling perception.

Let's give this train until end of this year and look for the thing that was advice earlier...

For this coming Quarter Report, we should be looking at 4 things:

1) Profit growth

2) Debt reduction with cashflow generated

3) Restructuring of ST debt to LT debt

4) Impairment reversal as highlight by stockraider.

At this rate with 0.3x P/B, I would say very limited downside risks for Princess Armada.

With the latest data we received from stockraider, I'm beginning to believe that it's not going to be gradual climb. It will rocket like KNM..

Hence either you HOLD or accumulate when the trading starts tomorrow.

2019-07-09 23:00

FOR ARMADA THE FOLLOWING ARE THE GOOD NEWS;

1) Debt has been restructured from ST to LT

2) Kraken is improving

3) Significant OPEX cost reduction

4) Winning the huge ONGC contract

5) Profit is expected to grow next the next few quaters

AT THE MOMENT ARMADA OUTSTANDING ORDER BOOKS RM 21B LOH...!!

2019-07-09 23:02

Correctloh...opportunity to collect cheap cheap loh...!!

Without epf dumping, u cannot collect cheap cheap mah...!!

Once dumping over, shoot up like rocket mah...!!

Posted by InvestorKING > Jul 9, 2019 7:01 PM | Report Abuse

Be careful EPF will have big dumping soon....

2019-07-09 23:05

U don understand loh....!!

It depend on whether oil major commit on business expansion and capex loh....!! They decide on their business plan on long term basis about 5 yrs ahead and commit & implement way ahead of oil price movement mah.....!!

But armada order books in Rm 21 billion todate, that means revenue generation no problem for armada loh....!!

Good prospect & strong turnaround play for armada mah...!!

Posted by SuperPanda > Jul 9, 2019 8:17 PM | Report Abuse

pearlwhite has a point on the debt vs profit, you cant the deny some of the facts she brought up

thats why its very important to note the recovery for o&g company like armada is all depends on oil market

if oil market continue in slump anytime from now towards next year, then most o&g not only in msia but across the globe will be dead

2019-07-09 23:06

ARMADA IS ANOTHER CLASSIC INVESTMENT BASED ON MARGIN OF SAFETY LOH..!!

IN ARMADA CASE THE INVESTMENT ANCHOR ARE ;

1. TUNAROUND PLAY

2. HUGE NTA DISCOUNT

3. STRONG EARNINGS RECOVERY LOH...!!

ARMADA IS MUCH BIGGER COMPANY THAN YINSON AND ITS LATEST QTR EARNINGS IS SAME AS YINSON AT RM 62M...BUT YET YINSON IS VALUE AT RM 7.0 BILLION WHEREAS IS ONLY AT RM 1.2 BILLION.

U CAN ACTUALLY TAKE ADVANTAGE OF COMING RERATING OF ARMADA TOO

2019-07-12 10:06

3iii has totally misunderstood the concept of investing

he is like Rosmah, only buy expensive, branded stuffs

he thought expensive means good

2019-07-12 10:09

Yes 3iii & Philip chose the Panda style investment loh...!!

We he survive on one single source of food

We chose the Grizzly type of more flexible investment loh...!!

On the other hand we can survive on all kind of food source mah...!!

Posted by Icon8888 > Jul 12, 2019 10:09 AM | Report Abuse

3iii has totally misunderstood the concept of investing

he is like Rosmah, only buy expensive, branded stuffs

he thought expensive means good

2019-07-12 10:14

At this price it is quite impossible to buy loh...it is like u always chasing your tail or shadow loh...!!

Just pay mkt price & buy armada it has great prospect loh...!!

Posted by InvestorKING > Jul 12, 2019 11:10 AM | Report Abuse

Get ready to buy at 0.22-0.225

Posted by stockraider > Jul 12, 2019 10:27 AM | Report Abuse X

I already says pessimistic tp value Rm 0.50 and more optimistic value tp rm 1.70 mah...!!

If u check back my previous posting here, i already explain the basis why loh....!!

Posted by itch > Jul 12, 2019 10:24 AM | Report Abuse

Agree stockraider, but what is your TP for Armada?

2019-07-12 11:16

Posted by Icon8888 > Jul 12, 2019 10:09 AM | Report Abuse

he is like Rosmah, only buy expensive, branded stuffs

================

not like Roshmah...........if investing is participating in the growth of excellent companies, then it makes sense that the portfolio is made up of excellent companies.................

every thing else is speculations/ trading.

Rosmah do not buy stuffs for investments, Rosmah is just a bitch

put it also this way, assuming there is some truth about efficient market hypothesis, then, for the masses, its makes sense that his portfolio is make up entirely of high quality companies so as to participate in the growth of the country / the companies themselves............

speculations and trading.....leave it to the pros.

2019-07-12 11:27

Rubbish loh...if u buy stock like Armada and insas with big margin of safety for long term is investment loh...!!

If u buy overvalue stock like Nestle & QL is speculation loh...!!

Notice different ??

Posted by qqq3 > Jul 12, 2019 11:27 AM | Report Abuse

Posted by Icon8888 > Jul 12, 2019 10:09 AM | Report Abuse

he is like Rosmah, only buy expensive, branded stuffs

================

not like Roshmah...........if investing is participating in the growth of excellent companies, then it makes sense that the portfolio is made up of excellent companies.................

every thing else is speculations/ trading.

Rosmah do not buy stuffs for investments, Rosmah is just a bitch

put it also this way, assuming there is some truth about efficient market hypothesis, then, for the masses, its makes sense that his portfolio is make up entirely of high quality companies so as to participate in the growth of the country / the companies themselves............

speculations and trading.....leave it to the pros

2019-07-12 12:37

neither armada nor insas qualifies as high grade investment propositions, whether one wants to trade / speculate...............or contrarian play, leave it to the pros.

2019-07-12 12:50

The new FPSO will result in YINSON borrowing even exceeding Armada on an absolute basis, that means Yinson gearing will be very high loh...!!

That confirm armada mkt cap Rm 1.4b order books Rm 21b a better investment compare with Yinson mkt Cap Rm 7.2b order books Rm 4b loh.......!!

Rightfully armada should be value much higher than Yinson loh...!!

The good news for goreng Yinson will definitely raised & confirmed armada investment profile as a strong margin of safety & turnaround stock loh...!!

2019-07-13 12:33

Posted by DickyMe > Jul 13, 2019 12:00 PM | Report Abuse

(S=QR) Philip "Sapura and Armada share price crash is because debt generation and interest repayments has increased, while their profit margins and revenues has dropped tremendously. ***With looming maturity of borrowings to be repaid in the very near future***, and no one willing to buy their bonds, it extend loans, their only option is to do rights issue, warrant or cash call. "

https://klse.i3investor.com/servlets/stk/7293.jsp

Posted by stockraider > Jul 13, 2019 12:42 PM | Report Abuse X

It is true or not ??

If it is true then what about Yinson with gearing even higher than armada and with order books even lower than armada leh ??

REMEMBER SHARE PRICE IS WHAT U PAY, AND VALUE IS WHAT U GET LOH...!!

ALWAYS GO FOR MARGIN OF SAFETY LOH...!!

Posted by stockraider > Jul 13, 2019 12:31 PM | Report Abuse X

The new FPSO will result in YINSON borrowing even exceeding Armada on an absolute basis, that means Yinson gearing will be very high loh...!!

That confirm armada mkt cap Rm 1.4b order books Rm 21b a better investment compare with Yinson mkt Cap Rm 7.2b order books Rm 4b loh.......!!

Rightfully armada should be value much higher than Yinson loh...!!

The good news for goreng Yinson will definitely raised & confirmed armada investment profile as a strong margin of safety & turnaround stock loh...!!

2019-07-13 12:46

This is the right investment Perspective Of Icon loh....!!

Always Look forward & look at the current & future strong improvement & recovery trend loh...!!

This is how u make big monies loh...!!

Icon is right a real sifu that can capitalised on the strong tuenaround loh...!!

Posted by Icon8888 > Jul 13, 2019 4:40 PM | Report Abuse

Almost every oil and gas counters got caught

Just check out their balance sheets

9 out of 10 are saddled with debts

Icon8888

17450 posts

Posted by Icon8888 > Jul 13, 2019 4:42 PM | Report Abuse

You can keep harping on armada's once in century mistakes, or you can come down from your moral high horse and capitalise on the opportunity to buy it cheap

Your money your call

2019-07-14 00:13

Armada a truly quality company and about same standard as Yinson loh ??

1. It achieved the latest same qtr profit as yinson.

2. It has slightly lesser gearing compare to yinson

3. It has more fpso than yinson

4. Armada revenue is twice of yinson.

5 Armada equity is twice of yinson.

MOST IMPORTANT INVESTMENT PREPOSITION : ARMADA is 7 times cheaper than yinson.

2019-07-16 10:50

Where is this Mr Know All ? Hiding in Kalimantan ?

(HK1997 again) Philip everybody else are stupid

you are the best.

Icon8888 is the wonderful sifu.

Hard to comment here when everything anyone says which is not music to your ears tends to have a sharp retort.

Then again, when someone has put money into the stock and writes an article, the last thing they want to hear is the voice of reason.

It is far easier to surround yourself with nodding heads and smiling voices saying what a brilliant investor you are!

So kudos icon8888, you really are the best at understanding numbers and making assumptions from financial reports. Love reading your articles. I'll just keep quiet and agree with your remarks and articles and skip over the few glaring errors in your article.

Yeah, good article icon8888, make it count. Don't waste all that effort with a small position, make it count!

30/06/2019 9:47 PM

2019-09-13 15:59

No right Nor wrong Only to Win

Hihi !

Cant be so sure

Market is bery smart

Sifu more smart

Philip love branded high class stuff only.

On 2nd think high class is safer ?

When disaster come, no one are safe for sure.

2019-09-13 16:05

No right Nor wrong Only to Win

Yaa, he still young

No harm to be humble

Benefits everyone

2019-09-13 16:08

Remember the next immediate target is rm 0.40....then the next tp will be rm 0.50 to rm 0.60 loh...!!

The longterm tp of armada is rm 2.00....if it matched with yinson current share price loh...!!

2019-09-13 18:00

Changes in Sub. S-hldr's Int (Section 138 of CA 2016)

BUMI ARMADA BERHAD

Particulars of substantial Securities Holder

Name EMPLOYEES PROVIDENT FUND BOARD

Address Tingkat 19

Bangunan KWSP

Jalan Raja Laut

Kuala Lumpur

50350Wilayah Persekutuan

Malaysia.

Company No. EPF ACT 1991

Nationality/Country of incorporation Malaysia

Descriptions (Class) Ordinary shares in Bumi Armada Berhad ("BAB Shares")

Details of changes

No Date of change

No of securities

Type of Transaction Nature of Interest

1 10 Sep 2019

6,000,000

Acquired Direct Interest

Name of registered holder Citigroup Nominees (Tempatan) Sdn Bhd - Employees Provident FD BD (RHB INV)

Address of registered holder Citigroup Nominees (Tempatan) Sdn Bhd Level 42, Menara Citibank, 165 Jalan Ampang, 50450 Kuala Lumpur.

Description of "Others" Type of Transaction

Circumstances by reason of which change has occurred Acquisition

Nature of interest Direct Interest

Direct (units) 326,326,300

Direct (%) 5.553

Indirect/deemed interest (units)

Indirect/deemed interest (%)

Total no of securities after change 326,326,300

Date of notice 11 Sep 2019

Date notice received by Listed Issuer 13 Sep 2019

Remarks :

The registered holders of the 326,326,300 Shares as follows:

1. Citigroup Nominees (Tempatan) Sdn Bhd - Employees Provident Fund Board - in respect of 247,982,300 BAB Shares

2. Citigroup Nominees (Tempatan) Sdn Bhd- Employees Provident FD BD (RHB INV)- in respect of 6,000,000 BAB Shares

3. Citigroup Nominees (Tempatan) Sdn Bhd - Employees Provident FD BD (CIMB PRI) - in respect of 47,495,500 BAB Shares

4. Citigroup Nominees (Tempatan) Sdn Bhd - Employees Provident FD BD (ARIM) - in respect of 7,000,000 BAB Shares

5. Citigroup Nominees (Tempatan) Sdn Bhd - Employees Provident FD BD (ABERDEEN) - in respect of 17,848,500 BAB shares

2019-09-13 18:52

Armada have the following good news & catalyst and its share price will keep shooting upwards on sustain basis loh...!!

1. Armada equity and contract on hand much bigger than yinson.

2. Armada latest to qtr earnings has exceeded yinson. With its last qtr earnings exceeded yinson profit 2x.

3. Armada borrowing has been reduced by 1 billion & coming down further.

4. The new ceo has initiated alot of wealth creation initiative.

5. Most importantly armada share price already breakout from rm 0.30 resistance after very long consolidations and expected the momentum to carry it higher loh...!!

6. EPF has been regularly buying armada recently with large quantities.

Yes u will see better days for Armada, just hang tight loh...!!

2019-09-14 12:07

2 years repay back 2.0b debt. latest 2 qtr 487m repay. Strong cashflow generated from operation.

2019-10-20 20:01

Fm 0.20 to 0.55 in few months time...any sane investors oredi cut win long ago...

After hiding for more than 6 months now only post this rubbish for what leh

2020-03-15 11:24

Better spend more time checking on global covid 19 movements...

When covid 19 is gone then oil price will come back n....

2020-03-15 11:26

stockraider

Post removed.Why?

2019-07-07 11:49