(Icon) Eco World International Warrants (Ewint-WA) - Bet Big, When The Odds Are Overwhelmingly In Your Favour

Icon8888

Publish date: Wed, 10 Jul 2019, 12:54 PM

1. Introduction

I first wrote about Eco World International (Ewint) in July 2018.

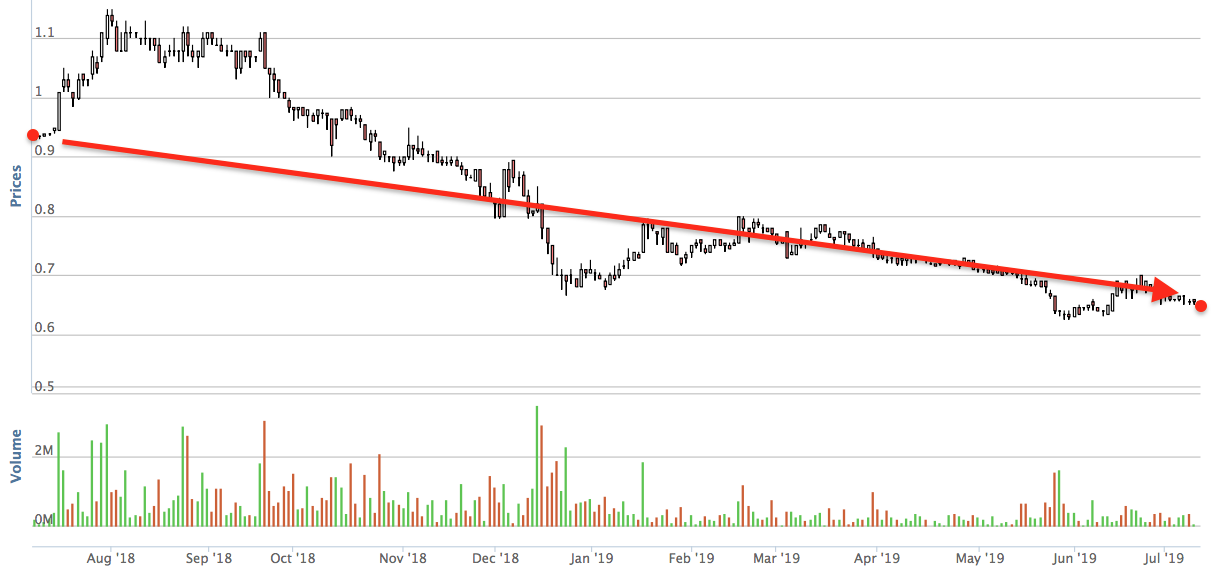

That time, share price was trading at 93 sen. It has since drifted downwards to 65 sen. A decline of 30%.

(Ewint share price)

(Ewint-WA price)

Ewint-WA on the other hand, went up from 18 sen to 30 sen plus and subsequently drifted downwards to the existing 11 sen.

2. Fundamentals Intact

Share price has dropped by 30% since my call, do I need to apologise ?

Nope. Because the Ewint group's fundamentals remain intact.

Intact is actually an understatement. Since I published my article in July 2018, the group's fundamentals had improved substantially. Most notable is its success in securing the Built to Rent (BtR) deal with Investco, a US Pension Fund, which involves the building of 1,000 BtR homes for Investco for consideration of RM2.12 bil. Based on 70% equity interest, that added approximately RM1.5 bil to its unbilled sales.

As at todate, the group's unbilled sale stands at RM6.6 bil, which will provide earnings visibility over the next two to three years.

3. Raining Durians Soon (This round it should be real)

The reason Ewint share price has dropped so much is because of its inability to deliver consistent earning since my July 2018 article.

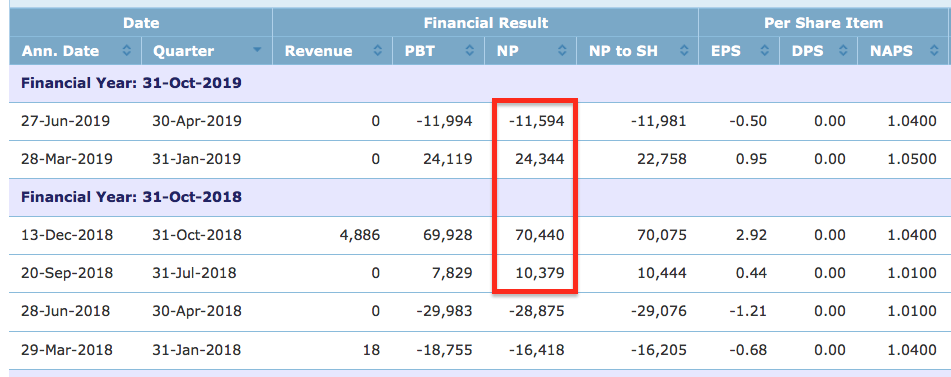

As shown above, the group reported strong net profit of RM70 mil in October 2018 quarter. However, it subsequently dropped back to RM24 mil in January 2019 quarter. In April 2019 quarter, it further deteriorated to RM11.6 mil loss.

Actually there is nothing disconcerting about its earning volatility. According to UK accounting standard, the group can only recognize profit after completion (instead of progress billing). It just happened that during the past two quarters, they have not been able to deliver many completed units to purchasers.

However, things are about to change for the better, very soon.

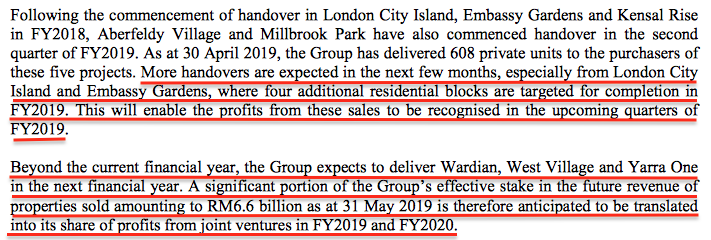

(Source : April 2019 quarterly report)

According to the company's comments above, we can expect stronger earnings as soon as the coming quarter.

4. Ewint-WA, As Resilient As A Cockcroach

In the aftermath of a Nuclear War, which specie is likely to survive ? Human being ? Tiger ? Rats ?

No, it is the cockroaches. Cockcroaches can eat almost anything, they can survive in filty environment, they don't need much sunlight, etc. They are one of the most resilient living being in the world.

Based on my experience, if you invest in the warrants of a profitable and healthy PLC, with remaining lifespan of at least two to three years, trading at closed to 10 sen, you will have almost zero chance of losing money.

The time value of money alone is worth at least 10 sen. That is the conclusion investors will draw when they look at an instrument of such nature.

Unless you are so bad luck and encounter a market meltdown triggered by lets' say, a financial crisis, such Warrants are almost as indestructible as cockcroaches.

Ewint-WA is now trading at 11 sen, it is expiring in April 2022 (3 more years to go) and have exercise price of RM1.45.

Fair enough, the conversion premium is a little bit high (140%). However, Ewint is expected to perform well in coming quarters. If that materilises, it is not difficult for Ewint-WA to go back to lets' say, 15 sen or 20 sen (a gain of how many percent ?).

Charlie Munger once said :

Maybe it is time to take a closer look at Ewint-WA.

Appendix - Eco World International (Ewint) Earning Projections

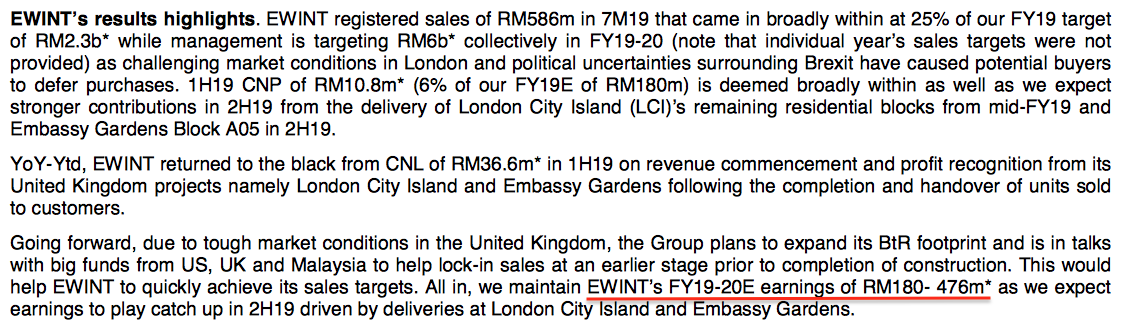

(Source : Kenanga IB analyst report dated 28 June 2019)

(Based on 2.4 bil shares, Ewint's FY2019 and FY2020 net profit of RM180 mil and RM476 mil translates into EPS of 7.5 sen and 19.8 sen respectively)

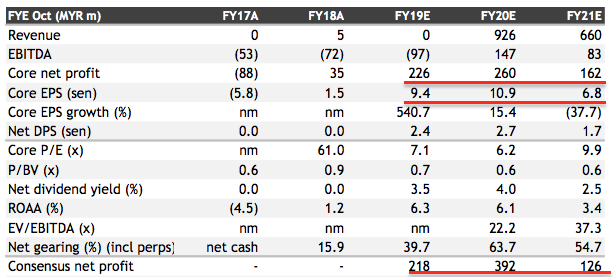

(Source : Maybank IB analyst report dated 28 June 2019)

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

It went up quite abit some time after he bought, but ended at zero, that is correct.

===

supersaiyan3 I remembered you recommend UNIMECH-WA??

Did it go to ZERO??

10/07/2019 10:50 PM

2019-09-06 11:58

15 sen now

those that have listened to my call and bought at 11 sen would have made 36% by now

just like that (click my fingers)

2019-11-25 09:37

Sold for a profit early this year bro.

===

Sslee Hahahaha,

Choivo's Insas warrant going to end up as ZERO.

2019-12-09 16:05

value88

I believe EWInt's earnings will improve in quarters to come due to the handover of completed units. I also have been eyeing this stock but hesitate to buy due to several concerns i have in mind. I list them down at below, maybe someone can help to advise. My concerns are :

I) UK may face a no-deal Brexit soon, especially after PM position is taking over by potential candidate, Boris Johnson. If that happens, the prospect of property market in UK and prospect of EWInt will be negatively impacted.

Although the coming quarters' earning result is certainly to improve, but market people may think the prospect in extended future would not be good if no-deal Brexit happens, and therefore dampens EWInt's stock price.

ii) EWInt is categorised in "property segment" in Bursa. There are many property companies in Bursa selling at low PE presently due to market has negative sentiment on this segment. Market may also give low PE to EWInt even when it shows higher earnings in coming quarters.

Anyone has any comments on my concerns above, pls share. Thanks.

2019-07-10 21:41