What Is The Potential High Return Stocks?

RicheHo

Publish date: Tue, 15 Sep 2015, 04:31 PM

Most people like to ask, what stocks are able to give a high return in short period?

As an investor, I can’t answer you on this but I can tell you what type of company you should focus on - company that acquired another profit making business.

Acquisition is a corporate action in which a company buys most or all of the target company's ownership stakes in order to assume control of the target firm. Acquisitions are often made as part of a company's growth strategy whereby it is more beneficial to take over an existing firm's operations. Acquisitions are often paid in cash, the acquiring company's stock or a combination of both.

What is the effect of business acquistion to a company? How powerful is an acquisition?

I would like to share about two examples.

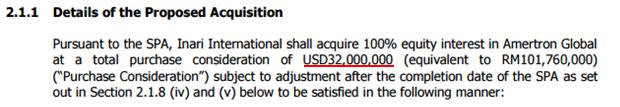

Inari Amertron Berhad was formed following the merger and acquisition of two EMS providers: Inari Berhad and Amertron Limited.

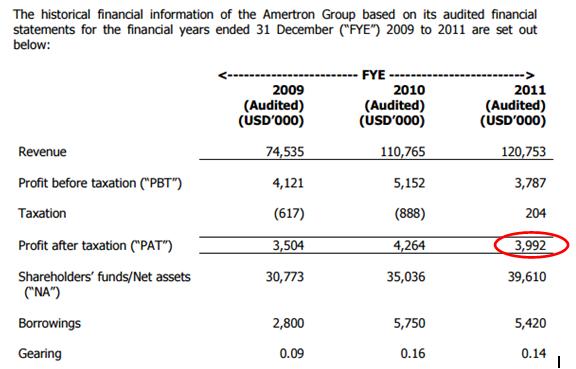

The following is the annual result for Amertron Group before acquired by Inari. Based on three year average, Amertron was able to achieve USD4m profit after tax, which is equivalent to MYR12.7m (USDMYR = 1 : 3.18) during that time.

That’s mean if Inari successfully acquire 100% of Amertron, they will take all its net profit into account in the next financial year! With an additional of MYR12m+ a year, definitely Inari financial result will fly! Let’s have a look at Inari financial result before and after acquistion.

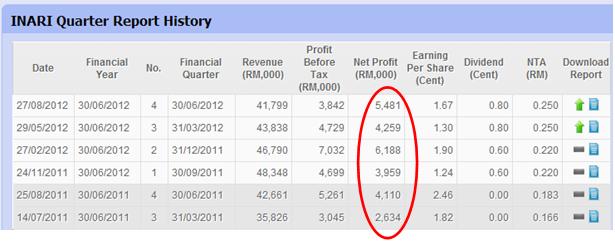

Before

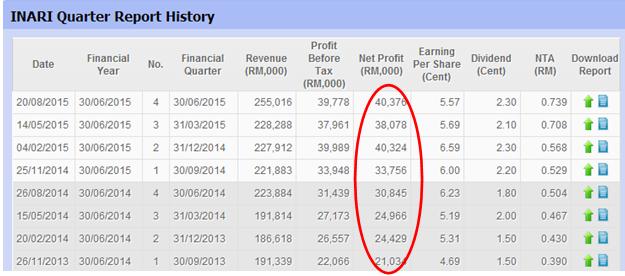

After

Basically, Inari net profit had increased 400% in addition with the robust of the industry!

Furthermore, don’t forget the acquisition is only costs USD32m! With only USD32m, Inari can make extra USD4m a year! The PE ratio for this acquisition was only 8!

The below is the price chart of Inari. Its price went from MYR0.40 to MYR3.30 today, 700+% increase over the 3 years! This is crazy.

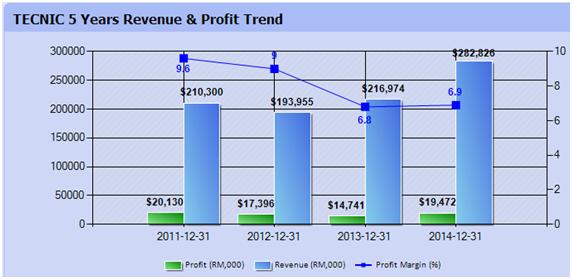

Another example is SKP Resources (“SKPRES”). On 2014, SKP acquired whole three subsidiaries under Tecnic Group Berhad.

The cost of this acquisition was MYR200m!

TECNIC net profit on FY14 was MYR19.5m, that’s mean SKPRES will have additional MYR19.5m net profit taken into its financial result after acquisition! The PE for this acquisition is 10.20, still acceptable.

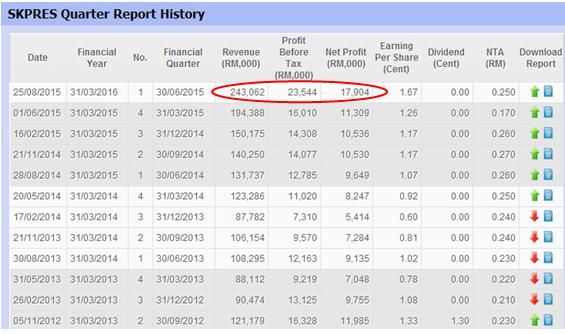

The net profit of TECNIC was only taken into account on FY15. As above, SKPRES’s revenue and net profit had increased significantly.

Have a look with SKPRES price chart as well. After the acquisition, its price moved up from MYR0.70 to current MYR1.40, equivalent to 100% gain in less than a year!

From the two examples above, it proved that acquisition of certain profit making company will lead the company to a new milestone. In term of its price and financial result, both also will go to a new high level. Definitely, this is the company that we need to focus on and catch.

All you need to do is to carry out some simple homework by reading its circular. If you willing to spend some time to understand some important details, with this small effort and knowledge, you might easily earn up to 2-3x return!

So, what will be the next potential company that probably carries out the same things? Which will be the next Inari and SKPRES?

This? The rest I will leave it for you to study.

Just for sharing.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-07

INARI2024-07-05

INARI2024-07-05

INARI2024-07-05

INARI2024-07-05

INARI2024-07-05

INARI2024-07-05

INARI2024-07-05

INARI2024-07-05

INARI2024-07-05

INARI2024-07-05

INARI2024-07-05

INARI2024-07-04

INARI2024-07-04

INARI2024-07-04

INARI2024-07-04

INARI2024-07-04

INARI2024-07-03

INARI2024-07-03

INARI2024-07-03

INARI2024-07-03

INARI2024-07-03

INARI2024-07-03

INARI2024-07-03

INARI2024-07-03

INARI2024-07-02

INARI2024-07-02

INARI2024-07-02

INARI2024-07-02

INARI2024-07-02

INARI2024-07-02

INARI2024-07-01

INARI2024-07-01

INARI2024-07-01

INARI2024-07-01

INARIMore articles on Road to Success

Created by RicheHo | Mar 18, 2017

Created by RicheHo | Feb 19, 2017

Created by RicheHo | Feb 16, 2017

Created by RicheHo | Jan 08, 2017

Discussions

通常等你真正证实某间上市公司的盈利增长的时候估计已股价已经是升得有一段距离了,所以说除了分析以外,眼光和一些运气也是很重要

你的分析是很不错的。。。。不过拿过去的资料来做分析有时会分分钟很容易自己讲自己爽

有时讲了一大堆后。。。。然而并没什么卵用

2015-09-15 17:17

Not to forget there is also similar M&A where company purchases remaining shares of its subsidiary (especially a profitable subsidiary). For instance Latitude.

Which will be the next? Hint: A company involves in semi conductor industry.

2015-09-15 17:25

HAha...y so many hints? just directly tell out the company and lets evaluate together

2015-09-15 17:30

Tom, if you do some homework during the proposed acquisition, you will foresee the company future earnings. By that time, I believe the company shares price had just started to move. Of course, this is just a case study but with proven result.

2015-09-15 17:31

RicheHo, by inverting this, wont you agree, since this deal looks so good for Inari investor, is it fair to say Amerton shareholders are the 'loser' in this for selling the whole business for so much less? And the minority shareholders in Amerton has been 'sell short'?

2015-09-16 08:04

JT Yeo, hmm I had no comment on this since I only focus on Inari. Either Amerton shareholders are 'loser' or 'winner',doesn't important to me.

2015-09-16 15:21

The logo shown in the article above belong to Fututech :)

RicheHo is sharing his knowledge with us, I wonder why there are people still could come out harsh words after receiving his sharing..

RicheHo, don't get frustrated ya, keep up your good work.

2015-09-16 19:18

The penny stocks ... provided that one doesn't get trapped by a crashing one ...

2015-09-16 19:24

You do have something to share :) is time for me to dig deeper like you :P

2015-09-16 19:24

thanks for the sharing.. there are also company making less profit/ lost after acquisitition activity. it is hard for us to predict the new company will bring the profit/lost to current company..

i will have a look to yr hint.. thx

2015-09-17 19:04

kai8994

Interesting logo :D

I give hint - Fxxxtxxx Bhd

2015-09-15 17:15