Why Magni? Pure cash garment manufacturing company for NIKE (TP:RM6.90)

itjustabouttheprofit

Publish date: Fri, 03 Jul 2015, 01:14 AM

EPS estimation : (16.12+15.24) x 2

=62.72sen

PE ratio : 11 (same as Prlexus)

Target price : RM6.90

I am here to ANSWER a simple question.

Why MAGNI?

1) Future orders of main customer, NIKE

have increased by 13percents (year-to-year

comparison)

2) Reputable customer and excellence

repayment record

3) Strong currency exchange of US dollar

and lower cost of cotton lead to higher

profit margin

4) Pure cash company with 4% dividend

yield and zero borrowing

5) Lower price earning ratio compared to

peers

Background:

Magni involves in two industries:

1) Packaging - 17% of total sales

2) Garment manufacturing - 83% of total

sales

As the garment manufacturing consists of

83% of total sales of the company, hence I

will focus on the discussion on garment

manufacturing industry

Taken from: http://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download/?name=EA_DS_ATTACHMENTS&id =166298

From annual report 2014 (Page 82, Note 29

Segment Information), we have noticed

that the major customer of the company,

NIKE have contributed RM507million or

77.8% of total sales to the company. Hence

I will also focus on the discussion on

NIKE

Milestone for garment manufacturing:

1) On 1 November 2006, Magni completed

the acquisition of the entire equity stake in

South Island Garment Sdn Bhd.

2) On 31 January 2008, South Island

Garment Sdn Bhd have acquired 5% equity

interest in Viet Tien Garment Join Stock

Corporation for cash consideration of

RM8.37million.

1) Future orders of main customer, NIKE

have increased by 13percents (year-to-year

comparison)

Taken from: http://investors.nike.com/files/doc_financials/2015/q4/FY15-Q4-Combined-NIKEINC-Schedules.pdf

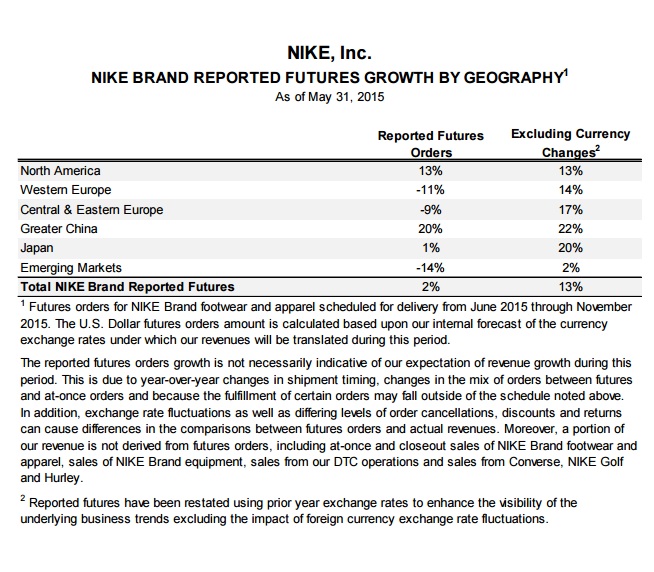

As per schedule above, we can see that there are 2 columns. First column is reported futures orders which is comparison of future order between 30 Jun 2014 and 30 Jun 2015 using US Dollar rate translated during this period. It shown only 2% increased due to the USD currency had been increased toward others currency of the world after the United States Federal Reserve has called to end quantity easing programme on end of Oct 2014.

But in the second column, it reported futures orders which is comparison of future order between 30 Jun 2014 and 30 Jun 2015 by using currency rate against USD on 30 Jun 2014. It have shown increased in 13%. The main purposes of second column is to shown the grown of future order without taking the impact of appreciation of US dollar.

In other word, the reported futures orders only increased by 2 percents is due to the currency appreciated of US dollars. It does not mean quantity of future orders have been decreased instead it have been increased by 13 percents.

Here is the graph shown on the currency exchange for 1USD for Chinese Renminbi and Euro Dollar:

With the increased in number of future orders by 13 percents, I am sure that it will gave positive impact for Magni.

2) Reputable customer and excellence

repayment record

Taken from: http://investors.nike.com/files/doc_financials/2015/q4/FY15-Q4-Combined-NIKEINC-Schedules.pdf

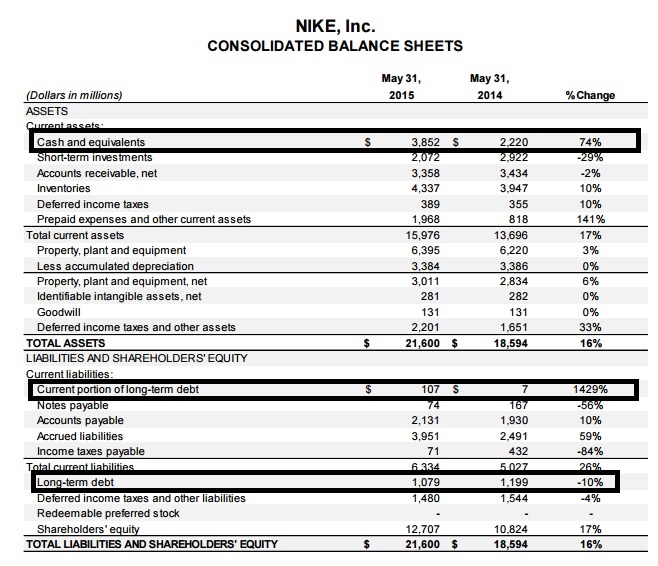

Balance sheet above shown the balance sheet for their main customer, Nike Inc. As at 31 Mar 2015. cash and equivalents for Nike Inc stood at USD3,852,000,000 and while bank borrowing stood at USD1,186,000,000 borrowing. Hence there will no repayment problem from Nike Inc. as the company have net cash of USD2,666,000,000.

Other than that, Magni have a great record of debt collection from their debtor as well as Nike Inc. As per last quarter trade receivables, we noticed that only RM82million of trade receivables while the total revenue for FY2015 stood at RM716million. By using the trade debtor turnover ratio, we can concluded that the the company able to collect the debt from debtor 42days after the sales have been completed. It is relatively fast compare to other manufacturing company which takes much longer period to collect the debts. Also the company will not faced any issued on bad debt collection. The company able to use their cash flow more efficiently.

3) Strong currency exchange of US dollar

and lower cost of cotton lead to higher

profit margin

As quarter result shown above, the company's earning per shares have been skyrocketted for the past 2 quarter. There are two factor which lead to these situation:

a) Strong currency exchange of US dollar

We know that US dollar have been appreciated against ringgit by 10% -20% since Dec 2014. Hence it have increased the sales price of garment to their customer.

b) Decrease in cost of material, cotton

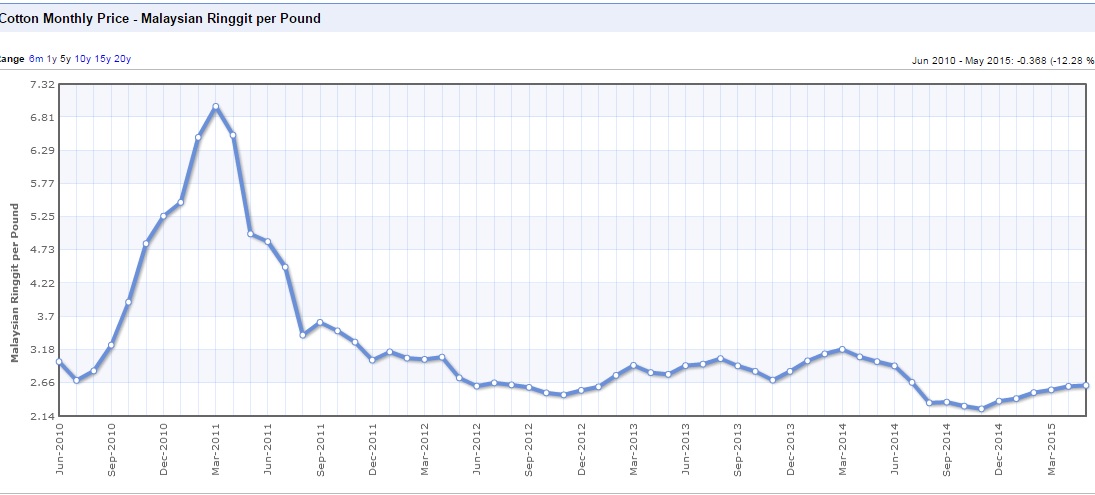

Taken from: http://www.indexmundi.com/commodities/?commodity=cotton&months=60¤cy=myr

As per graph above shown that the cotton month price (in ringgit) have been trading at RM2.66 to RM3.18 per pound between Nov 2013 to July 2014. The price have been decreased to RM2.20 to RM2.66 per pound after Aug 2014 until Jun 2015.

With the increased in sales price and decreased in cost of material. the profit margin of the company will be improved and the profit will be increased.

4) Pure cash company with 4% dividend

yield and zero borrowing

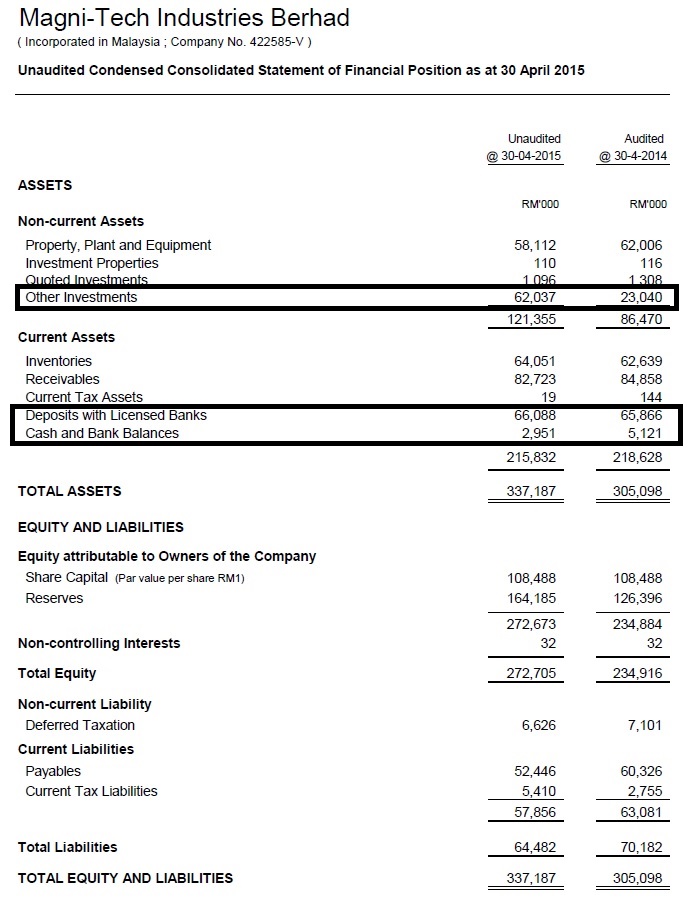

As per 30 April 2015, the company stood at RM69million cash and zero borrowing. The cash almost the same compared to previous year. The extra cash have been used for other investments such as investment in mutual funds and share market to earn extra income. As per FY2015, the company have earned RM4.3million from the appreciation of share price and dividend income from the investment in share market and mutual funds.

For financial year ended 30 April 2015, the company have declared total dividend of 15sen (interim dividend of 5sen on 30/3/2014, final dividend of 3sen and special dividend of 7sen - payment date to be decide later), it made up the company dividend yield at 4% per year.

5) Lower price earning ratio compared to

peers

I will compare some of the important factor to indicate that Magni is still undervalue:

(Using latest four rolling quarter result)

1) The closest competitor, Prlexus is currently trading at PE11 while Magni is currently trading at PE7.79. Magni better

2) Total revenue for Prlexus is currently stood at RM320mil while Magni is currently stood at RM716mil. Magni better

3) Total profit after taxation for Prlexus is currently stood at RM21.5mil while Magni is currently stood at RM52mil. Magni better

4) Profit margin (after taxation) for Prlexus is currently stood at 6.72% while Magni is 7.25%. Magni better

5) Dividend yield for Prlexus is currently stood at 2.38% while Magni is 4%. Magni better

As shown above, Magni have a lower price earning ratio, larger size of business, better profit, more profit margin and more attractive dividend yield compare to Prlexus. Hence I still consider it as undervalue.

Warning: Trade at your own risk!!! Do research before any investment decision!! Happy trading :-)

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Ultimate undervalue club

Created by itjustabouttheprofit | Dec 08, 2020

Created by itjustabouttheprofit | Sep 04, 2018

Created by itjustabouttheprofit | Jun 05, 2016

Created by itjustabouttheprofit | Apr 16, 2016

Discussions

According to annual report 2014, other investments consists of mutual fund (21%), malaysia's share (5%). 74% in unquoted shares (not listed company). For 2015, I am not sure how is the combination

2015-07-04 13:59

Be careful.

in the old days vc will issue or subscribe to inter company loans to help his other companies esp those classified unquoted

The writer will need to magnify and use a fine comb to see if the unquoted investments bore returns higher than market

2015-07-04 20:32

Net Purchase of other investments for latest fy is 52m less 14m mostly unquoted investments?

2015-07-04 21:15

tonylim: I cannot find any information about the latest purchase of other investment. It have not disclosure in the quarter report. Perhaps we need to wait for the annual report to come out before we know the portion of the other investment. The main shareholder is berjaya group. Who is VC that u mention about?

2015-07-05 01:26

Magni and Prlexus both are export theme! Both are Nike related! Both are $$$$$$$!

2015-07-05 18:31

JT Yeo: please look carefully at the beginning. I written down the multipler of 11 same with prlexus

2015-07-05 18:33

Itjust,

correct have to wait for annual report. No notes were attached to the unaudited fy 30.4.15 financial statement.

From the cash flow statement there is an increase investment in unquoted shares 52 minus 14 which is 38mil rm

2015-07-05 21:31

ya increase by 38m. Annual report expected to come out at Sep and Oct 15. You can wait until that time if u wan to know wht is the portion of other investment

2015-07-05 21:35

Audited report will come out around at end of Aug 2014 based on historical record but annual report only come out end of Sep or early 2015. You need time for auditor to perform audit work, manager review, partner review and management review before it come out. Just patiently wait.

2015-07-05 21:45

ok fair enough, even though a PE of 11 is what you consider as 'fair'. what the market considered a fair PE is a different matter, and thats the key

And i dont get the point of comparing revenue and profit of each other? Obvious magni is a bigger company thats why both numbers are bigger, but does that mean it is better? Magni has a lower ROE compare to PRlexus though.

2015-07-06 09:31

Ya prlexus might be win in roe 20 compare magni roe 19 but magni is a better company in many thing compare to prlexus. Refer my point no 5. For your information magni have a lesser number of sharss compare to prlexus. Their revenue is almost 2.5 times of prlexus yet their share price only 1.5 times of prlexus. For profit, magni also is 2.5 times of prlexus profit yet the share price only 1.5 times of prlexus. Why not undervalue?

2015-07-06 09:47

Outstanding shares has nothing to do with ROE. Then you have to explain why market decide to give prlexus higher valuation compare to magni?

2015-07-06 11:21

Ai yeo...JT Yeo! U so confuso...

are we explaining why market priced as such...or

are we explaining why its its undervalue?

2015-07-06 11:58

I really dun understand what JT Yeo wan to ask. Because of undervalue that why u need to buy this kind of share. If not then u buy prlexus la. We cannot control what is the price of prlexus but u can do is find a undervalue share and invest into it.

2015-07-06 13:08

A person that has invest in prlexus, 99% of the time they would look at Magni too, so now the question is, why people think Prlexus is worth current PE but not Magni? Why do they discount Magni compare to Prlexus?

2015-07-06 19:00

The difference you ought to understand how vc and his gang manage his companies

2015-07-06 20:43

JT Yeo, what you're trying to say here is related to Efficient Market Theory (EMT), but the fact is that no two companies are born equal. It is the inefficient pricing of such stocks by the herd that grants investors opportunities to accumulate and amass great fortunes.

We wouldn't know the outcomes until the end of the day, but right now MAGNI may stand a better chance of outperformance due to it being priced relatively cheaper.

2015-07-06 22:08

Thanks siradrian for your explanation... This is what i wanted to say. Thanks for the help and good luck in accumulating fortunes :)

2015-07-06 22:29

but both being trading at historical PE high, won't that be the same to say PRLEXUS is overvalued, while MAGNI is fair but not undervalued?

2015-07-07 05:33

May I know what is the currency used for transactions between Magni and Nike? since the geographic area is spread around few countries, are they using USD as well? (I mean for Nike in China for example)?

2015-07-21 02:19

The currency traed in USD, RMB and SGD. I have no idea how much is the percentage but from the currency risk disclosure you can know most of that is trading in USD as most of the trade debtor denominated in USD

2015-07-21 08:09

itsjustabouttheprofit...

You mentioned the fraction of sales revenue in 2014 from Nike alone was at 507M / 651 M = 77.8%

On Page 82, note 29 they mention it contributed 10% of Group Revenue..

How they mention 10 compared 78 above??

I don't understand.

2015-08-06 19:37

Maybe you dont know this. Usually the company need to disclose the major which is more than 10percent. That sentences clearly stated that only one major customer which contributed RM507mil to the company. The purpose to disclose that are more than 10percent is to inform to investor about the risk might incurrred if they lose this major customer

2015-08-06 21:30

Oh OK. I really didn't know this.

Excellent piece of Information.

Thanks itjustabouttheprofit.

My salute...

2015-08-06 21:54

soojinhou

In FY2014, the profit margin from "investment related income" is 15% (RM3.7m from RM24.4m). Also, FYQ1 ending July typically sees a huge contribution from investment, presumably due to receipt of dividends. Over the past year, Magni has pumped in RM53m into investments, causing value of investment to more than doubled from end FY2014 at RM24.4m to end FY2015 at RM63.2m. All these points to a sharp increase in "investment related income" for the next quarter. With the anticipated income boost from investment, Magni should be able to do at least 15 cents eps next quarter, making it 3 consecutive quarters of 15 cents eps.

2015-07-03 10:26