(CHOIVO CAPITAL) A very brief and conservative analysis of INSAS

Choivo Capital

Publish date: Sat, 28 Jul 2018, 01:15 AM

What has been said about INSAS that has not been said?

Well, that’s what I’m here to try and provide.

A very brief background since I’m sure most will be very familiar with the Company. This is a investment holding company that does not give much dividends. The goal of this company is to basically reinvest its cash into new investments and better businesses.

Here are some of the questions which you may have, that i feel i may have a different answer compared to most.

- Is the management right to keep dividend so low?

One of the thing about this management is that they are keeping the dividend very low. Is that acceptable?

Well, that depends on the company’s ability to reinvest the money at a good return. If they can make a decent return on every ringgit retained, it could very well be a good idea.

For the sake of this exercise, we will use the NTA as a proxy for intrinsic value since most of its value is in its shareholdings anyway.

NTA in 2009: RM1.16

NTA in 2018: RM2.533 (as they gave 6.3 sen in dividend over the years, lets add that in as well)

Just based on CAGR of NTA, it has grown by 9.07% per annum. Pretty decent. What if one were to revalue its holdings to revalued net asset?

Its main assets consist of its investment in associates, and these have 3 components

-

Roughly 19% share in Inari Amertron Bhd

-

Roughly 12.1% Share in Ho Hup Construction Company Berhad

-

Various shares in Sdn Bhd Companies which have positive equity.

Here is a brief valuation of each component.

-

The share of Inari Amertron is currently worth roughly RM1.463 billion in the market. I personally think it is somewhat overvalued at that price (mainly due to the high dividend pushing the price up). Therefore I would put a 50% discount, valuing it at 15 P/E and RM731.5 mil

-

The shares in Ho Hup, personally it’s probably fairly close-ish to fair value. Deleveraged ROA is pretty bad at 4.3% or 4.5%, which is less than FD. To be fair, might just be temporary. But still, I’ll cut 20% just to be safe. Therefore valuing it at RM19.2 million.

-

The stakes in Melium, Winfields etc. They are held at RM41.6mil. Earnings is about RM6.5mil. At roughly 6 P/E. Lazy to do a deeper valuation, but they don’t look good in terms of the capital structure. So, I’ll just whack a 35% discount to be safe. It’s now valued at RM27 mil.

All in, they are held in book at RM301 mil, but based on my calculation, it should be actually around RM777.7. This adds RM476.1m to the NTA.

NTA in 2009: RM1.16

Revalued NTA in 2018: RM3.123 (as they gave 6.3 sen in dividend over the years, lets add that in as well)

CAGR is now 11.63%. This is pretty good considering how conservative i was in my estimates.

I personally have no major qualms in the company deciding to keep the capital for future deployment for now.

Having said that, there is clearly no better use for their capital now than buying back their stock. I don’t think there is a high value activity right now for shareholders considering how low the price is.

-

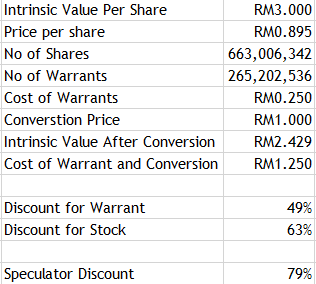

Diluted intrinsic value of the share.

For now, let’s say that the intrinsic value of the share is about RM3, using RNAV.

So which should you buy? Well, let me know what you think.

For those unfaimiliar with the speculator discount (which i my own invention, may not be useful after all), it is the price of the warrant, over the discount between the instrinsic value of the share after conversion and the conversion price.

Conclusion

Personally, I owned some Insas shares before this, and in a fit of europhia, i doubled my exposure by buying some warrants today.

For some reason, I feel like I should have probably bought the shares, but oh well, live a little. It’s still pretty cheap.

====================================================================

Facebook: Choivo Capital

Website: www.choivocapital.com

Email: choivocapital@gmail.com

More articles on Choivo Capital

Created by Choivo Capital | Dec 09, 2020

Created by Choivo Capital | Dec 05, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 03, 2020

Discussions

why give dividend when they can invest better themselves. bbought some at 80c kept for a year

2018-07-28 09:57

insas again, gosh....how many time people want to repeat about its inari stake?

2018-07-28 10:35

all repeat about the numbers, but do u really like what insas is doing? its business?

2018-07-28 10:37

Every few months there will definitely be people posting about Insas. It is the ultimate value trap and also a newbie trap

2018-07-28 11:44

Those who analyze this stocks should look at its historical P/B ratio or any other valuation yardsticks to determine whether its true value was ever fulfilled

2018-07-28 11:45

Yes,

Very good!

INSAS always seek to multiply its Surplus Cash into useful investments

Last year INSAS bought Over Rm13 millions worth of DGSB shares from Omesti at 4.5 sen. At current price of 6.5 sen INSAS already made 2 sen or 44% in less than one year. This is excellent growth performance

See

https://www.reuters.com/finance/stocks/OMES.KL/key-developments/article/3702270

Warren Buffet's Biography called "SNOW BALL" is a good example. A snow ball grows bigger and bigger as it rolls down the hill slope.

And INSAS has been growing and growing since the days when it dealt with paper work. The BOSS of INSAS was so hands on and took the trouble to sell me INSAS company car to get a better price for the company.

As for dividend? Berkshire Hathaway of Warren didn't pay any. As dividend is subject to taxes Warren does not want dilution of value. So he just kept reivesting all proceeds to make Berkshire great.

2018-07-28 12:09

I just read up Dynaquest Stock Performance Guide 2015 Ed

Insas has 20% investment in Gleneagles Medical Services

There are so many hidden treasures inside Insas. Really amazing that the market has totally overlooked and ignored its deep value

2018-07-28 14:27

Dear lizi,

Profit earned by Inari will be equity accounted to Insas. Dividend given by Inari will be treated as cash inflow to Insas. The best part is the holding cost of Inari by Insas is so low that Dato' Sri Thong is very happy to sell some everyear and report as gain from disposal of associate companies share so what wrong if people value of Insas by its Inari stake?

Thank you

2018-07-28 14:38

Sslee, exactly what u said, he happily sell some every year..will this unlock the value? Will this "sell some every year" catalyst to the share price?

2018-07-28 15:52

Dear lizi,

Nope. But it take only one hostile take over to see how Dato' Sri Thong will response and unlock the value of Insas.

Thank you.

2018-07-28 19:31

Before invest look at the man control behind..it's Thong. Will Thong unlock value to let all small potato become rich? LOL

2018-07-28 21:26

Dear Sslee, got insider news on hostile takeover? I personally think the chances is low. Private takeover by owner is more realistic, but this is not a good news to minority shareholder as takeover price may not be good. Therefore it is important not to increase your cost.

2018-07-29 19:36

Dear lizi,

I do not have inside news on hostile takeover but I did attend the last AGM and understand the dilemma of Dato’ Sri Thong. In one hand Dato’ Sri Thong cannot buy anymore Insas share as he is on the threshold of crossing over 33% and needed to prove to Bursa that he had the capital required to offer a GMO (What Datuk Tiah currently do to TAE).He is buying time and build up capital to do that.

If you look closely, only last 2 years INSAS became unreasonably undervalue because of Inari. 2016 NTA of RM 2.04 and 2017 NTA of RM 2.34. If you look into associated companies the book value for 2016 is 276 million and 2017 is 301 million whereas the market values of those associated quoted in Malaysia is value at 683 millions 2016 and 885 millions 2017. Coming year end June 2018 this value will easily break 1.4 billion. There are many sharks or wolfs around very soon they will smell the blood and go for a kill.

The coming AGM I will advice Dato’ Sri Thong he had been accumulating so much wealth into INSAS without sharing it with the minority shareholders. This wealth had growth so large that sooner or later it will attract outsiders to make a hostile takeover so be prepared.

Dear Calvintaneng,

I wish you should find time to attend Company AGM that you promote in the i3investor so that you can make friend with the board and have better understanding on the company. The 20% Gleneagles Medical Centre, Dato Sri Thong did explain this is for a special unit (Sengenics: Clinical genomics business) and the JV did not materialize and now is under members’ voluntary liquidation (Page 153)

Thank you.

2018-07-29 21:12

Yes Mr Sslee is right about the Gleneagles Medical Centre which is dormant and under voluntary liquidation.

2018-07-29 21:41

Notice that Dato' Thong has been aggressively selling off his own direct interest in Inari. Perhaps he is raising cash to do a "Tony Tiah" on Insas.

2018-07-29 21:43

then bad news for us.

TheContrarian Notice that Dato' Thong has been aggressively selling off his own direct interest in Inari. Perhaps he is raising cash to do a "Tony Tiah" on Insas.

29/07/2018 21:43

2018-07-30 15:12

Sslee

Dear all,

To whom interest to know what had been discussed during the last year 55th INSAS AGM can refer to below link:

http://www.insas.net/pdf/img-20180514.pdf

No. 11: The Board has taken note of the shareholders’ comments and will seriously consider paying additional/special dividend and to formulate a formal dividend policy in FY 2018.

Thank you

2018-07-28 08:38