(CHOIVO CAPITAL) Ragret Del Luna: 10 PE Glove Companies (SUPERMX - 7106)

Choivo Capital

Publish date: Fri, 22 May 2020, 09:49 PM

For a copy with better formatting, go here, its alot easier on the eyes.

Ragret Del Luna: 10 PE Glove Companies (SUPERMX - 7106)

========================================================================

Well, the picture is self-explanatory. No prizes for guessing the "Del Luna".

Looking at history, missing out on some major bull and goreng runs, appears to be a real talent of mine.

Lets list them out.

Construction, Technology and Petroleum Refining (2017 Bull Run)

Semiconductors and Steel (2017-2018 Bull Run)

Oil & Gas Supporting (2019 Bull Run)

FAANG & SP500 (2016 to 2019 Bull Run)

And now, the Gloves and Covid-19 (2020 Bull Run)

For some of them, I either buy way too little (less than 5%) or sold far too early. I guess some reflection is in order.

So, how do we begin? Well, I guess I’ll talk about 3 things.

- The Bull Run for Rubber Gloves.

- The Nuances of the Various Factors that really drove prices.

- Why Glove stocks are at 1X Forward PE.

(As many of you may notice by now, talking/writing is a specialty of mine, while making the decisive decision to sell some of some of my other holdings and leverage up to buy Glove Stocks, is clearly not.

And this is despite understanding the factors I’m about to explain to you, being privy to certain information’s from a Top Glove management meeting 2 weeks before results came out, as well as confirming things with my friends in Top Glove and Hartalega.

Its really a talent I tell you)

The Bull Run for Rubber Gloves

Well, if you’re one of those who are wholly unaware of what has been happening in the KLSE in terms of rubber glove companies, well, you must be one hell of an investor.

If you never really understood the meaning of “MooNing” as often used in the cryptocurrency space, well, the rubber stocks such as Supermax, Careplus and Comfort (along with their structured warrants) have risen far faster in the last month that Bitcoin etc ever did in a one month period.

Its ascension is quite literally a rocket shooting vertically towards the moon.

(Again, aihhh)

Quadrupling or more in less than 1 month.

I could elaborate, but that would be the equivalent of explaining water to fishes. There is quite simply no need to.

The Nuances of the Various Factors that drove Prices

- Unprecedented Level of Demand for Rubber Gloves

Not much needs to be said here, every time someone gets swabbed for a COVID 19 test, one pair of gloves will be thrown away, and this applies to even mass testing’s, house visits, contract tracing etc.

Demand became so strong, that glove companies today take a 20% deposit (this is unprecedented) on any orders made today, with delivery only happening 1 year from now (earliest).

- Structural Capacity Constraints

Unlike Personal Protective Equipment (“PPE”), Face Masks, or Sanitizers, there are some very structural constraints built into the supply for Rubber Gloves.

In the last few weeks, we would be reading news of some Tom Dick Or Harry, making all of the above items (except for Rubber Gloves) every other day.

There is that little girl helping to weave PPE (along with many other textile companies), alcohol companies that have decided to pivot and create hand sanitizers, Louis Vuitton and Razer (a computer accessory company) now produce face masks, and car companies like Ford now create ventilators.

The list goes on.

But we don’t hear news like these for gloves. Why is this the case?

Why don’t I hear rubber tappers or condom manufacturers going into glove manufacturing?

Its simple, in order to qualify for surgical gloves, you need FDA approval, a process which can take longer than a year for new companies.

In addition, in order to produce these gloves at an economical level, you need machinery and factories that can produce at least a few billion of them per year.

This means any additional capacity, can only come from the incumbents like Top Glove, Hartalega, Supermax etc

And these additional capacities can only arrive earliest by year end, with the additional supply likely to be nowhere near enough.

In the case of increasing production capacity of rubber gloves, its one of those things that just take time, no matter how much money you have to pour into it.

Like making a child, one cannot impregnate 9 women in order to have a baby born within 1 month.

- Price Increases

So limited supply, meets unprecedented demand, coupled it inability to increase capacity quickly.

What does this mean?

Price increases for OEM surgical gloves at the rate of 5% or so PER WEEK. With own brand prices increasing by 200%-400%.

- Lower Costs

Due to the virus, demand everywhere else is much lower. Which means much lower costs for the glove companies.

Rubber Prices are down 30% from the start of the year.

Butadiene (For Nitrile Gloves) are down 50% from the start of the year.

Labour Costs is down or even as people have no other jobs to go to. Staff are also a very easy to train unlike the textile industry.

Gas prices are down still down around 40% from the start of the year due to lower demand.

- Everything else is shit.

There is a phrase in a Leonard Cohen song I quite like,

“There is no decent place to stand in a massacre.”

Well Leonard Cohen have not met rubber glove companies during a virus caused global economic shutdown.

They don’t just survive or maintain earnings, they actually thrive!

If what you’re looking for, is potential for upward price movements in the short, mid (or, at a stretch) long term, there is quite simply very little else to look at in the market today.

Even hospital revenues are technically down, as other surgeries are all down from people either delaying their surgery out of fear, or reduced by management in order to make capacity for Covid Testing.

Needless to say, whether you’re a fund manager, retailer or institutions, everyone piled into the rubber glove companies

- Record KLSE Transaction Volume, Record Retailer Participation

One thing our broker or banker friends would have noticed the last one of two months, is record draw-down of personal loans, house refinancing (a lot of them are for investment into stocks according to a friend at RinggitPlus) and new account creation for new brokerage accounts.

In the day for "Work From Home", gambling/trading in stocks have proven to be a popular hobby.

Even the best of them like MPLUS is lagging a little, with Maybank's brokerage accounts being close to unusable.

In any event, these new retail participants are more than able observe the meteoric rise of the rubber glove companies, and are certainly more than capable of doing first level analysis of the business and share prices.

And thus, we have today. Share price increases of 5X or more for some of the companies.

Why Glove Stocks are at 10 forward PE

Now, the answer behind the clickbait title.

Many of you may be wondering, he siao liao?

Heart pain until don't know how to read already?

Isn’t Supermax etc all more than 70PE?

Well, quick question.

What happens to the bottom-line when increase in revenue is due to Margin Expansion versus Increase in Volume?

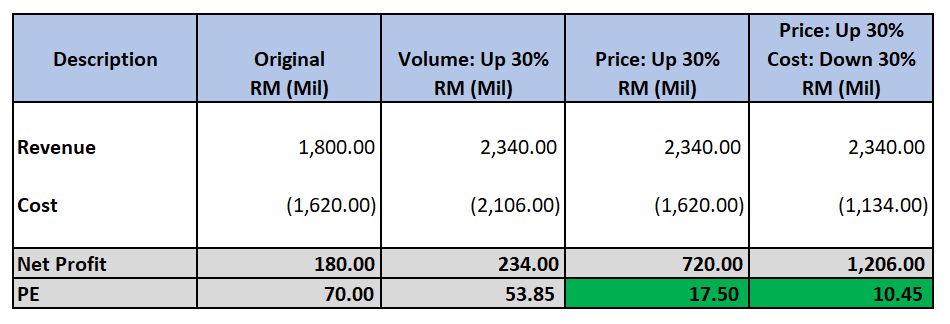

Lets do a very high level analysis with SUPERMX's numbers.

And there you go, 10PE. A real bargain (depending on how you look at it).

So, what is the market pricing in now for Glove Stocks?

Well, the market is basically saying that COVID 19 and its other mutations will be with us for the next 2-5 years at minimum, and that demand for everything will be low, except for rubber gloves and a few other select industries.

A stagflation or depression basically.

Well, if you think that is the case, it may even be at a slight discount.

Again, do note "Target Price" and "Intrinsic Value" are two very different things.

Conclusion

Personally, I do wonder how i failed properly identify and consider the above factors. The information is all there and i even gave some thought to it in March.

How did i airball so badly and fail to purchase even 5% for myself?

Well, after some consideration, i think the main reason for it is that i tend to instantly discount/ignore stocks that are rising, especially if they are popular and Koon Yew Yin is talking about it.

This has also been one of the fundamental reasons why it took me so long to buy companies like Google, Facebook, or even the SP500 index/ Investing Overseas.

And so, by error of omission instead of commission (the favorite excuse of every value investor when he fails) , here goes another fortune slipping from my fingers.

Aihhhhh. Oh well, at least I’m still young.

Additional Anecdote

In the week before the quarterly results, me and an acquaintance (he is a trader) were discussing on glove companies and the above 10PE scenario.

We were discussing it as a trade, and this excerpt of our conversation was quite illuminating for me.

Choivo: Well, it looks like the market is not pricing in the fact that earnings may be double or quadruple. There appears to be a significant enough gap. So, what’s your trading plan? I think i may actually put 20% on it.

Acquaintance: Well, buy up to about 30% of portfolio over the next few days.

Choivo: Are you sticking to the 10% Cut loss?

Acquaintance: Yes. Gambling must have a cut loss.

Choivo: You know, I’m curious, is it even possible for you to be an investor?

Acquaintance: You know, i don’t think so. If prices drop by 10%, I cannot tahan and will cut loss instantly. In addition, if price does not move up within one or two days, I also cannot tahan and will cut straight.

Choivo: I wonder, if market drop 10% the next day, despite how right this thesis sounds, would you still cut?

Acquaintance: Yes. I will cut. If price drops 10%, it means market is telling me I’m wrong, so I will cut.

Choivo: And if it goes up 5% after it drops?

Acquaintance: I will buy back straight away.

Choivo: Why?

Acquaintance: Because Market is always right. Market is telling me now that my rule in that case was wrong, and I should not have cut loss, so i will buy back. I have no problems chasing back.

Choivo: And if it keeps doing that?

Acquaintance: Well, I’ll keep doing it, key thing is to minimize the loss and maximize the gain. If it’s going up, I won’t cut, unless I think everyone is way too happy, and everything that I know, the public also know.

Choivo: You know, I really wish I was your broker.

You know, one thing i did last year was to read the entire Market Wizard series on Traders. I can definitely see some niche that i think i am capable of doing.

However, I do wonder if its possible for me to buy something for more than its worth, in order to sell it to someone for a higher price.

Ie: Buy High and Sell Higher.

I’m not sure if I was capable of buying it at RM4.6.

But, in any event, I should have been more than capable of reading into the situation enough to buy a 10% - 15% position when Supermax was RM1.5 or so.

Oh well, you live you learn. I hope it sticks this time.

Disclaimers: Refer here.

====================================================================

Facebook: Choivo Capital

Website: www.choivocapital.com

Email: choivocapital@gmail.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Choivo Capital

Created by Choivo Capital | Dec 09, 2020

Created by Choivo Capital | Dec 05, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 03, 2020

Discussions

Glad it was useful for you.

====

probability Good info which i was actually trying hard to figure out earlier. Thanks Jon!

2020-05-23 03:28

It took me a long while to adjust my mentallity towards koon bee play..

U r younger than me i hope u r less stubborn than me too

Making money is rule no 1 in stock mkt

2020-05-23 06:43

Philip ( buy what you understand)

I hope your post is not saying what I think it is sharing. That everyone should be buying more glove stocks with made up numbers of suddenly pe10. The ability to rationalize is to know when to go against the herd, and when they are leading you to water. This requires you to put ego out the door.

In any case, I have sold my entire long term holdings in topglove, my second longest holding. When everyone is asking silly prices for my stock, it is time to head out, and find out where everyone is forgetting.

You are welcome to join a telegram group my daughter set up for me, tme/philipcapitalmanagement

2020-05-23 07:10

Haha Ahchoi is saying he spends night and day reading all the foreign companies annual report and bought:

1) Google

2) FB

3) Stoneco

4) Berkshire

5) Master

6) Visa

7) Aercap

8) Netflix

And day-dreaming “Should I talk about yesterday? When I found out that it was that precise moment, where I made the correct decisions to not to throw all caution to the wind, and jump in with nothing but my underwear left, was the absolute bottom? (My thesis was that margin and forced sales are over, and its time to buy, it appeared to be accurate). And that if I had done so, i would likely not need to head back to the office come the end of the movement restriction, with so many of my high conviction purchases up by 200-300%.”

But miss our “Jaguh Kampung” glove stocks that actually went up 200-300% in 1 month. So he still heading back to the office after the MCO

2020-05-23 08:55

I think Philip did the the right thing to sell Topglove........but he should be buying Supermax

2020-05-23 09:09

Eh, it depends on its a one off event or a permanent change. For some companies i believe its a permanent change, for others is only a one off event. When this is over, who will still be running at full capacity?

2020-05-23 09:20

If you go to any pharmacy (my experience in overseas), they sell you gloves in boxes, if you check the brand, it has a local company name.

The name is something that you have not heard of - no connection to Malaysia, but the gloves are definitely from Malaysia.

This shows the distributors buy from Malaysian glove makers and hike up with a significant margin to make money themself (likely much higher margin than the manufacturers).

As such, if you can have your own brand (OBM) like Supermax, it would certainly make a huge difference on profit.

Most importantly, it means Supermax has the competitive advantage of killing other distributors (competitors) being the manufacturer themself.

This vertical integration is indeed very powerful.

There would be no reason for PE rating of Supermax to be not comparable to other big players like HARTA

2020-05-23 09:23

May be Supermax should buy a Rubber plantation too, so that they can have their own latex - will be useful to gain competitive advantage at times when oil price shoots up raising raw material Butadiene price (synthetic rubber)

2020-05-23 09:37

Philip ( buy what you understand)

This post below is the reason why I'm holding on to QL and selling topglove. Is you opinion that I should be buying Supermax based on greed and fomo? Or based on intrinsic value and looking term growth.

The prices now are speculative prices with future earnings baked hard into current prices.

I prefer to buy companies selling at a nice relative valuation to future prospects.

Or you believe the prices, volume and demand will go higher and at the same rate 5 years from now? That earnings will continue to quintuple next year and stay that way, and shortage will still be unresolved years from now?

>>>>>>>

supersaiyan3 Eh, it depends on its a one off event or a permanent change. For some companies i believe its a permanent change, for others is only a one off event. When this is over, who will still be running at full capacity?

23/05/2020 9:20 AM

>>>>>>>

probability I think Philip did the the right thing to sell Topglove........but he should be buying Supermax

23/05/2020 9:09 AM

2020-05-23 09:42

Philip ( buy what you understand)

This level of speculation and greed is horrifying. Can you really think that harta performance and Supermax performance over time is comparable?

>>>>>>>>>>

probability If you go to any pharmacy (my experience in overseas), they sell you gloves in boxes, if you check the brand, it has a local company name.

The name is something that you have not heard of - no connection to Malaysia, but the gloves are definitely from Malaysia.

This shows the distributors buy from Malaysian glove makers and hike up with a significant margin to make money themself (likely much higher margin than the manufacturers).

As such, if you can have your own brand (OBM) like Supermax, it would certainly make a huge difference on profit.

Most importantly, it means Supermax has the competitive advantage of killing other distributors (competitors) being the manufacturer themself.

This vertical integration is indeed very powerful.

There would be no reason for PE rating of Supermax to be not comparable to other big players like HARTA

23/05/2020 9:23 AM

2020-05-23 09:44

Thanks Chovio for a great writeup. Got more info from your article. For others, a 2 year bumper profit run is enuff to propel supermax to another level. And move supermax from a 30 million /qtr to a 70 million/qtr business even covid is over. With the next propelling move coming from its contact lens business. i am confident it will keep supermax in the 90 million profit /qtr in 3 yrs time.that is enuff to mantain its price at rm6 at pe 20.even after covid is over.

for how high supermax can run during this covid fever.

to match current topglove marketcap since they might b earning same profit for coming qtr...supermax will hav to reach rm21. or topglove price need to adjust down to supermax price. or they will meet halfway.

2020-05-23 09:47

the above assumption is unique to supermax only...other glove counter i am not confident.

2020-05-23 09:52

Philip ( buy what you understand)

If you didn't know Supermax well enough 1 year ago to invest in it, what makes you think you suddenly know supermax well enough today to give such glowing opinions? You are basing multiple years of performance off a singular black swan event.

Wouldn't it be more rational to invest carefully, and to buy it when it was at reasonable valuation rather than heavy speculation?

2020-05-23 10:05

phiip ur recent stock pick kinda no good --> pchem , yinson , gkent

i wanted to ask you what you plan to buy next, but no bother la

2020-05-23 10:09

i kinda wanted to recommend you some stocks , but you sure pijak my stock pick 1 , so i oso no bother do it lol

2020-05-23 10:13

philip..yes i am limited on my knowledge and is craving for more information as well. Whether it is valuable or not is a developing event. my reasonable valuation keeps changing from 1 yr ago until covid strikes, when it develops into pandemic, the valuation keeps changing.

With more information unfolds, the market is more intelligent in keeping the correct valuation.I am jus investing ahead of market and sharing my insight on this.Since most fund invest based on past information and is slow in action. Forward earning is the way to outpaced them.I do not recommend ppl to follow me, but i am just a learner.

2020-05-23 10:15

Value investors prefer to look for good stocks which can post 20% growth a year for next 10 years.

They dont like cyclical stock which can go up 200% a year

2020-05-23 10:21

haha CharlesT now also know how to play KoonBee stocks.

Philip recent bought HKG China Feihe also on the down trend as China moves to impose controversial Hong Kong security law.

2020-05-23 10:27

I knew KB games since many years ago...only recently managed to convince myself to join the game

2020-05-23 10:31

Haha CharlesT,

If you can’t beat them join them. Welcome to the music chair club but remember don’t be caught without a chair when the music stop.

2020-05-23 10:37

Philip sifu, kindly enlighten all of us here what special characteristics that a company like Harta has against Supermax to cause such difference in PE.

Exclude the recent effects of Covid 19, i believe it boils down to competitive advantage concept you had introduced in i3

please break it down for us to digest...

TQ

2020-05-23 10:58

Kenanga latest projection of $ 230 m and $ 400 M for FY6/2020 and FY6/2021, very aggressive already.......................and then of course, the appropriate PE for abnormal profits............lol............

2020-05-23 13:16

for all the last 10 years Harta has always had the best metrics in terms of costs, margin, ROCE, cluster, first in nitrile........and I guess IR..........

2020-05-23 13:20

Supermax Outlook:

==========

Plant 12 consists of Block A and Block B, each consisting of 8 double former lines with 2.2b pieces each (total 4.4b pieces).

As of now, for Block A, its remaining 3 lines started commissioning in end March 2020 on top of the 5 lines already in commercial production.

For Block B, all 8 lines are expected to be fully commissioned by 2H 2020. Upon full commercial production by 2H 2020, installed capacity will rise 13.4% to 26.2b pieces per annum.

............

Recall, it had completed the acquisition of a piece of land in Meru, Klang on which it plans to build three plants namely Plant 13,14 and 15 which will contribute another 12bn pieces of gloves to its total installed capacity over the next few years.

The 3 plants would add 12.0 billion pieces per annum to the Group‟s installed capacity from 26.18 billion gloves to 38.18 billion gloves when these 3 plants have completed commissioning and in commercial production fully by CY2022.

............

On March 11th , 2020, the Company had also entered into an agreement to purchase another piece of industrial land in Meru, Klang, on which the Company plans to build plant #16. Construction work has already commenced on 2 plants and work on a 3rd plant would commence soon.

............

Total = 42 Billion gloves/annum

2020-05-23 13:46

Philip ( buy what you understand)

Ok. There is an option in i3 to maintain your portfolio so as to compare your recommendation versus your results, do you use that?

FYI based on my 2019 started portfolio I have been holding 25% of my portfolio in topglove , and sold it recently as well as star media, documented transactions.

I do not do stock picks, I just share the stocks that I do buy.

I would say my performance is ok,

As I also bought:

Pchem at 4.09

Serba at 1.12

Gkent at 0.46

Yinson at 4.56

At huge volumes on margin. You know that the transactions cannot be deleted or edited right? It's all up there you can check individual transactions.

So looking at the results based on these averaged down figures, do you think I did well or not? When everyone is frozen and scared to buy, I bought when blood was on the streets. And I bought just these few stocks instead of 50 stock picks.

So, how did you do during this period? More importantly how did your recommended stocks do during this period?

>>>>>>>>>>

Posted by lazycat > May 23, 2020 10:09 AM | Report Abuse

phiip ur recent stock pick kinda no good --> pchem , yinson , gkent

i kinda wanted to recommend you some stocks , but you sure pijak my stock pick 1 , so i oso no bother do it lol

2020-05-23 14:02

Philip ( buy what you understand)

In a simple word: patents.

Let me bring up an article from 2010 that caught my attention, and caused the rise of Hartalega huge profit margins.

https://www.theedgemarkets.com/article/hartalega-bullish-after-tillotson-suit-dismissal

https://www.theedgemarkets.com/article/hartalega-bullish-after-tillotson-suit-dismissal

Have you been to Hartalega glove factory before? I went in 2015,

and topglove one in 2009 to understand what makes them different from kossan and supermax and comfort etc.

Basically for medical nitrile gloves they have to meet certain size and quality specifications for US supply.

Hartalega has a patented production processes method that allows them to meet those specifications and yet produce commercially at a cheaper rate than all of its competitors, even topglove, and sell at a higher price.

That is why harta is worth 30 billion.

And a very simple question. What is asp for harta vs asp of other nitrile gloves producers.

That is a competitive advantage that supermax does not have. For it to be valued at 8 billion is an exercise in speculation.

I have held topglove for over 10 years and even I have never seen such speculation. Do you really think supermax is worth that much, or this fervour is sustainable?

>>>>>>>>

Posted by probability > May 23, 2020 10:58 AM | Report Abuse

Philip sifu, kindly enlighten all of us here what special characteristics that a company like Harta has against Supermax to cause such difference in PE.

Exclude the recent effects of Covid 19, i believe it boils down to competitive advantage concept you had introduced in i3

please break it down for us to digest...

TQ

2020-05-23 14:21

this is my 2020 stock pick competition lists

https://klse.i3investor.com/servlets/pfs/131542.jsp

but in real life i only holding 3 stocks , myeg , scomnet , atrium

the reason i split 50/50 , 50% for the 3 stocks , 50% for 5 stocks , 10% each in the competition is because ... i dono .. diversify more , don't concentrate too much , i copy TKW style, 10% for each stocks

but turn out, the stock i hold in real life rebound nicely , i think it will continue going up, what do u think?

2020-05-23 14:33

Thanks for the discussion Philip. More clarification below:

.................

Q1:

'Hartalega has a patented production processes method that allows them to meet those specifications and yet produce commercially at a cheaper rate than all of its competitors'

This means the product is the same, but the production method is different. Do let us know the magnitude of the reduction in production cost/margin expansion due to this if you are aware. My guesstimate says 95% of the COP can only be the raw material which should be the same for all competitors.

Q2:

'Basically for medical nitrile gloves they have to meet certain size and quality specifications for US supply.'

Guess the above is the reason why ASP of Hartalega higher than its competitors - for having a niche market. This could be the better explanation for the higher profit margin, unlike COP. Do let me know if there are other reasons you are aware.

2020-05-23 14:43

Philip ( buy what you understand)

I will not comment on what I think, as you seem to think I, will pijak your stocks pick. But the more important question is, did you have confidence in your 3 stocks to buy even more when the big discounts came? Or did you hold, wait and see what was going to happen? Or did you take out margin, sell father mother and go all in your 3 stocks during the super discount fear day.

How you buy is just as important as what you buy.

Look at Jon Choi, looking for alpha overseas, when he could have made huge gains in Malaysia by investing in stocks that he knew well locally.

But fear and worry and thumb-sucking is what really separates profitable investors from article writers.

Not only stock picks, but volume, position size and sell picks.

When you see most gurus don't post their portfolio, hide behind xx stocks and XX stocks, then you know they don't actually do as well buying stocks and give excuses as to why they don't maintain a portfolio. Because a trackable portfolio will reveal how well they manage equity, how much risk they are bearing, how they cut losses, and how they ride winners.

2020-05-23 14:45

Dear Philip,

Result speak for itself so let us compare the past 4 quarter results of Supermax at RM5.75 VS Hartalage at RM 10

Quarter: Revenue: PBT: NP: NP to shareholder: NP margin: ROE: EPS

Supermax:

31-Mar-2020 447,247 95,277 72,349 71,056 16.18% 5.90% 5.42

31-Dec-2019 385,497 41,829 30,022 30,165 7.79% 2.69% 2.31

30-Sep-2019 369,941 32,443 24,960 24,747 6.75% 2.14% 1.89

30-Jun-2019 375,964 16,198 14,004 15,059 3.72% 1.38% 1.15

Hartalage:

31-Mar-2020 777,898 137,575 115,711 115,579 14.87% 4.58% 3.43

31-Dec-2019 796,550 159,697 121,661 121,273 15.27% 4.94% 3.60

30-Sep-2019 709,424 137,327 104,206 103,867 14.69% 4.42% 3.09

30-Jun-2019 640,101 121,654 94,254 94,063 14.72% 4.07% 2.81

So any particular reason why Supermax quarter end 31-March 2020 NP margin jump from 7.79% to 16.18% and EPS 5.42 overtook Hartalage 3.43.

Topgrove

29-Feb-2020 1,229,777 130,374 116,012 115,683 9.43% 2.92% 4.52

30-Nov-2019 1,209,100 125,452 111,757 111,426 9.24% 4.32% 4.36

31-Aug-2019 1,189,594 81,160 80,076 80,052 6.73% 3.29% 3.13

31-May-2019 1,190,235 82,239 75,188 74,665 6.32% 3.01% 2.92

2020-05-23 15:08

Perhaps the recent covid outbreak, forced U.S to use Supermax gloves though it had not met the special specification needed earlier..

Who knows, this may catalyze a new breakthrough market for Supermax permanently...

Perhaps we can look it at it another way, Harta has the risk of losing the margin in the future if Supermax is able to penetrate the same niche market

2020-05-23 15:13

why the sudden jump in profits in supermax not harta?

I guess it has to do with consignment stocks...

OBM stocks overseas stocks are considered sold in period....

whereas Harta sales are to agents.......

different timing

2020-05-23 15:28

ya man , i have high confidence at the 3 stocks i hold, i did buy more during price plunging hahahaha..

2020-05-23 15:49

Enough of poster, research data and advertisement for season one.....

......(pause first and start writing for articles to be posted when its price in tge range of RM10-15, i.e. Calvin's calf turns a little cow - giving milk, bonuses, biggest dividend ever, eyc)

2020-05-23 17:13

son Choivo ,

u do have high passion in equity investment.

u do know a lot a lot.

most importantly learn from the v BEST, the 1st ancient guru from wall street u must to excel every yr.

there r 2 cycles on klse.

every cycle u n we must catch the Ms u stocks early !?!

2020-05-23 17:35

U r young talented n honest!

Experiences will gets U far one day.

Honestly, I bot 100% into comfort n made double returns. However, ti's did not happen in my young days.

Do not b dismay, there r plenty opportunities ahead of u.

2020-05-23 17:47

https://klse.i3investor.com/servlets/ptres/55259.jsp

based on this cimb recommendation still hv room to profit, wld u even consider to trade supermax. Another opportunity now ???

2020-05-23 23:03

seems many here still surprised by the high margin for supermax. My calculation shows supermax margin for next qtr is 31%. Hope will raise anyone attention.

My projection for qtr 3 with profit from 75 mil to 100 mil. my projection was off a bit becoz supermax sold old stock at cheaper pricing n bumper profit appears only in march onwards. Supermax starts backward billing now which commands highest price getting stock first will boost margin many fold.New lines online since march will further boost sales as well.

2020-05-24 10:46

when we hear the word vaccine - we need to understand two things:

(1) How good is the vaccine - 100% effective?

Can the vaccine has 100% effectiveness? Even if 1% is not effective, Considering this - would FDA allow it to be used worldwide?

Dont forget its mutating rapidly. Vaccine for current virus may not be effective for the mutated version.

(2) Does the vaccine has - 0% side effects?

Almost all vaccines has side effects and you cannot know what is the side effects till you use it and see the effects after a year.

Say the side effects is minor. Would u still get yourself immunised? After all, the cases are not that high and the risk for young and healthy is almost nil.

..............

Considering the above, would the world quickly implement a newly discovered vaccine without thorough long terms side effects studies and enforce it?

the risk vs gains would not justify such enforcement easily unless they are absolutely 100% sure it is effective and has ZERO side effects.

In my opinion, the above is the reality and you would not hear vaccination enforced for the next 2 years at the least.

Governments would rather encourage self protection measures till then.

2020-05-24 14:10

For supermax to invest RM50 million in share buy back tell us something we don't know.

2020-05-25 09:09

Seriously, PE 10 ???

By going 95% now, they probably have to cut ties with some existing customers. Question is what they will do post Covid19 or several years from now (when their additional capacity comes in).. The competitors will not be HARTA, TOPGLOVE, KOSSAN but the big international names. If SUPERMAX can compete then it's re-rating and game changer.

2020-05-25 14:01

You/Me/We have huge case of cognitive dissonance.

But there are few rational answers, just that some are more rational than the other, depending on tolerance,position size & ideology.

The past few days, 240m ringgit greedy money heading to the moon.

On one had, you argue with Ms.Market, though you are right, it's only in the future you're exonerated.

I'm taking Ms.Market to dinner, making her pay for my meal, then ghosting via stop-loss.

Which is more accurate?

QL will increase in value 98% probability in 3 years.

Supermax will increase in value, 98% probability in 18 hours.

2020-05-29 06:57

qqq33333333

hottest thing in town...all welcome to speculate............

2020-05-23 01:48