(Icon) AAX (3) - Which One Is Better Bet ? Air Asia or AAX ?

Icon8888

Publish date: Sun, 03 Apr 2016, 01:49 PM

Executive Summary

(a) Air Asia has market cap of RM5 billion, almost 4 times of AAX's RM1.2 billion. Out of curiosity, I made a comparison of Air Asia and AAX's operational and financial performance to try to figure out what set them apart.

(b) As expected, Air Asia emerged as the superior party with better business model and stronger financials. However, to make money in the stock market, buying good stock is not enough, we need to buy GOOD STOCKS WITH POTENTIAL FOR STRONG CAPITAL GAIN. From this perspective, both Air Asia and AAX offers equally exciting opportunity.

1. Aircrafts

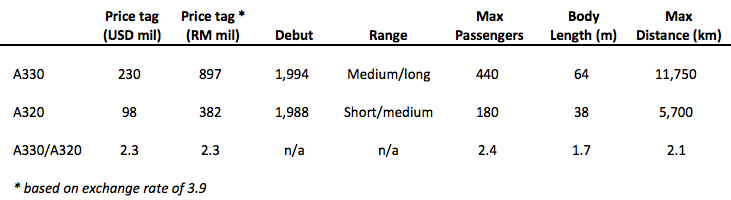

AAX's fleet comprises mostly A330 while Air Asia uses A320. The major details are as set out in table below, which is self explanatory.

(A330)

(A320)

You can try count the windows if you want to feel the length difference.

2. Balance Sheets

In FY2015, AAX generated revenue of RM3.1 billion, approximately 0.5 times of Air Asia's RM6.3 billion. Naturally, I expect AAX's balance sheet to be around half the size of Air Asia. But the actual fact is very different.

As shown above, AAX's total assets is only 0.19 times that of Air Asia. Its shareholders funds is 0.14 times. Its borrowings is only 0.13 times.

With less than 0.20 times balance sheets size, AAX is generating 0.5 times Air Asia revenue. Is AAX a more efficient operator ?

Not really. If a baby needs to drink 8 ounces of milk per day and you only feed him 4 ounces, there will be consequences. Please read the next section to find out more.

3. Cost Structure

I used common size analysis to compare the two group's cost structure. Common size figures are derived by dividing respective group's expense items by its own revenue. That will allow us to feel the relative weightage of each item.

Key observations :-

(a) Staff cost weightage is more or less the same for both groups.

(b) Air Asia owns most of its aircrafts while AAX relies on leasing. As such, AAX has lower depreciation charges then Air Asia. Because of the same reason, AAX has higher operating lease than Air Asia (460% higher).

(c) Both groups have more or less same fuel usage.

(d) AAX has higher maintenance weightage than Air Asia (29% vs. 14%). Exact reasons unknown. One possibility is that it is due to AAX's longer flight distance. If that is the case, then that will be one of the major factors (negative) differentiating a long haul from short haul carrier.

(e) AAX has lower net interest expenses than Air Asia (as a percentage of revenue, 2% vs. 8%). Does that mean that AAX has stronger financials ?

Not necessarily. In my opinion, an aircraft company's reliance on debt is manifested in interest expenses as well as leasing charges (a strong company at least can borrow to buy aircrafts, a weaker one probably doesn't even have the credit credentials to borrow. It can only lease, which is more expensive).

Compared to Air Asia, AAX has significantly higher leasing charges. If you take both lease charges and interest expenses into consideration, AAX's total is higher at 25% (= 23% + 2%) while Air Asia's total is only 13% (= 5% + 8%).

4. Some Technical Terms

It is common for airline companies to disclose certain operational figures in their accounts. To be able to understand how an airliner functions, you need to know the follow terms :-

(a) Operating Lease - Instead of buying the aircrafts, an airliner can lease them from leasing companies, the two largest of which are International Lease Finance Corporation and GE Commercial Aviation Services.

Operating leases are generally short-term (less than 10 years in duration), making them attractive when aircraft are needed for a start-up venture, or for the tentative expansion of an established carrier.

(b) Wet Lease - The aircraft is leased together with its crew. Such leases are generally on a short-term basis to cover bursts in demand, such as the Hajj pilgrimage. Usually, a wet-leased aircraft operates as part of the leasing carrier's fleet and with that carrier's airline code.

(c) Load Factor - It measures how full a flight is. For example, if an aircraft can carry 100 passengers and there are 80 passengers on board, load factor is 80%. The higher the load factor the better.

(d) Available Seat Kilometers (ASK) - Total number of seats is not reflective of an airliner's capacity. You must multiply it by the distance that it can travel (based on flights).

For example : an aircraft with 100 seats and travels 400 km from KL to Penang will have ASK of 40,000. However, the same airacraft used to travel 2,500 km to Hong Kong will have ASK of 250,000. As passengers pay for distance travelled, the higher the ASK, the higher the revenue generating capacity.

Usually, ASK goes up when an airliner purchases (or lease) more aircrafts. Sometime when ASK is too high (resulting in low Load Factor), the airliner will try to cut it down by disposals or wet lease (happened to AAX last year).

(e) Revenue Passenger Kilometers (RPK) - Measure of traffic by multiplying the number of revenue-paying passengers aboard the planes by the distance traveled.

The higher the RPK, the better. However, yield (Revenue/ASK or RASK) is also important. If RPK goes up but RASK comes down, revenue does not necessarily go up (price war).

(f) Cost / ASK - Arrived at by dividing operating cost by ASK. The lower the figure, the higher the operational efficiency.

Sometime, to eliminate the distorting effect of fuel, Cost / ASK ex fuel is used. That will provide insight into how an airliner has been managing its cost.

As the bulk of an airliner's cost is denominated in USD. Strengthening of USD will result in Cost / ASK hike even though operational efficiency has improved, and vice versa. As a result, Cost / ASK in USD is sometime more reflective of the real picture.

5. Operational Parameters

This section is very interesting. It clearly illustrates the differences between AAX and Air Asia's business models.

Key observations :-

(a) Revenue - AAX's fleet size is 30% of Air Asia but it generates closed to 50% revenue size. But that is because AAX flys longer distance. As such, the figures are meaningless for comparison purpose. As for load factor, both groups have more or less the same level of 80%.

(b) Unit Passenger Revenue - AAX's average flight distance of 4,844 km is approximately 4 times that of Air Asia's 1,232 km. Yet its average revenue per passenger of RM599 is only 3 times that of Air Asia's RM207.

In my opinion, the inability to set ticket price proportionate to distance must have been one of the major factors depressing profit margin.

The question then is why is it that AAX can not increase the ticket price ? Malaysians are not that well off, but RM392 (being the difference between 599 and 207) is not really that big an amount. Nowadays, it is common for a medium size family to spend more than RM200 to have a dinner in restaurant (tilapia not a problem, sea cucumber might cost more).

That might be the case. However, if you multiply the figures by two (return trip), then you will immediately feel the pain. An Air Asia return trip will cost you RM414 (RM207 x 2), but an AAX return trip will cost you RM1,198 (being RM599 x 2). If AAX further increases the fee to RM828 (to reflect the 4 times longer distance), return trip will become RM1,656. Even for a small family of 3 (parents and one kid), the amount becomes RM4,968. This amount is not small. It will make many families hesitate and think twice.

I believe the above analysis clearly demonstrates the constraint faced by AAX when come to pricing. Supply and demand dictates that it cannot raise its price too much or else risk losing relevance in the market. This is the Achilles heel of Long Haul Low Cost Carrier.

(c) Profit / ASK - Apart from December 2015 quarter, AAX's Profit / ASK has always been negative (average loss of 0.29 US cents per kilometer). High fuel cost as well as strong USD (in 2015) were two of the major reasons.

Air Asia is different, despite high oil price, it has consistently been profitable (in actual fact, very profitable) with average profit of 0.91 US cent per km.

This is consistent with discussion in (b) above about the different pricing power of long and short haul LCC.

6. Concluding Remarks

(a) According to industry report set out in AAX's IPO prospectus, there were only four long haul low cost carriers in the world (back in 2012). The only logical conclusion is that the business must be quite difficult until not many people bother to venture into it.

(b) My analysis confirmed that AAX's business is indeed not easy. To be specific, there are two major factors that weigh on AAX :-

(i) Undercapitalised Balance Sheets - It is obvious that AAX's balance sheets is a bit small for its existing scale of operation.

This is probably by design - Tony Fenandes must have known that Long Haul LCC is not easy (if Icon can figure that out, I am sure Tony Fernandes can also). To minimize risk exposure, he probably decided not to commit too much capital.

The end result is that AAX needs to rely heavily on operating lease, which is more expensive and adversely affect profit margin.

(ii) Nature of Business - Section 5 above highlights how AAX is constrained by lack of pricing power. There is nothing much the company can do. The only way to mitigate this problem is to manage cost.

I have no doubt about the Air Asia Group's ability and passion to be efficient and cut cost. Unfortunately, in the past few years, many things were beyond their control. High oil prices and Ringgit depreciation inflicted a heavy toll on the AAX group.

(c) Well, having told such a long story, what exactly is my stance when come to AAX ?

I AM POSITIVE ABOUT THE GROUP.

First of all, I can live with AAX's existing reliance on Operating Lease. Fair enough, it is more expensive. However, to get rid of that would require massive expansion in equity base, which will dilute EPS. If AAX can manage the financial risk, I am happy to keep the existing capital structure intact. Don't fix something if it is not broken.

Secondly, oil price has recently fallen to very low level. Different people have different opinion, but my view is that it will remain low for an extended period of time - US' shale oil reserve is 4 times that of Saudi Arabia (!!!), and shale oil production is someting that can be ramped up within a short period of time, should demand beginning to outsrip supply due to certain reasons. How can oil price spike ?

Low oil price not only reduces expenses, it will also encourage usage of air travel. As cost declines, airlines can pass on some of the saving to consumers. Many routes that are previously not viable will now attract more passengers. A virtue cycle.

Thirdly, let's not worry too much about competition (Malindo ?). I think the world is pretty big. When a pie is growing, everybody can have a share, no need to fight to the death.

Last but not least, in my previous article, I highlighted that 80% of AAX's operating expenses are denominated in USD (Air Asia's net exposure is only 30%). If that is the case, there should be HUGE earnings upside for AAX if the Ringgit strengthens. Air Asia has stronger fundmentals, but AAX might be able to deliver greater positive surprises.

I love Lucy and I love Ann, both also I want to marry.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

This is the best article from so many version of airasia or AAX article from different writer...great job icon8888!!

2016-04-03 14:09

Stock of the century I guess. Later all pension scheme fund will come and share a pie.

2016-04-03 15:03

Withdraw all my pension fund to load on this Dream together with F.tony. Sound too enthusiastic ? Wakaka

2016-04-03 15:06

F.Tony better hurry, no time for kissing a virgin. Fund are flow in fast aftef Icon8888 articles, Pplane will only getting red eyes without doing anything.

2016-04-03 15:20

Posted by 3iii > Apr 3, 2016 02:23 PM | Report Abuse

Simple approach. Avoid airlines. Gruesome businesses.

3i is correct!

Warren Buffet avoids airlines

Grand Champion Master SIFU Dr Neoh wrote against investing in Airline stocks in his excellent "STOCK MARKET INVESTMENT" Book.

One more thing:

This year El Nino is the hottest on record!

Now there is HUGE EVAPORATION OF MOISURE FROM PLANET EARTH.

Soon LA NINA Will Come With Sweeping Tornado, Hurrican & Typhoon

Typhoon is {Tai Fung or "BIG WIND" In Chinese)

So All Air planes are in DANGER OF CRASHING OR BEING SWEPT AWAY BY THYPHOON!!!

If just one or two Air Asia Planes get swept away -

Both Airasia and AAX will face double Limit Down!

Please play safe!

Stay away from Air line stocks.

2016-04-03 15:24

Calvintaneng counters mostly on earth, Icon8888 reaping to the sky. Why still fighting ? For what,, Scratching my head.

2016-04-03 15:29

Tell you what I SEE,

Airplanes incur HUGE CAPITAL OUTLAY.

Once purchased All Expensive Planes start depreciating & depreciating. So the logic is the get as much revenue as possible. Then in a crowded market all airlines try to capture market share on lower and lower and even giving FREE SEATS.

There is NO Pricing Power.

So high cost and low profit UNLESS you overload the plane and over work the pilots. Then?

Then due to fatigue 3 planes were lost (2 MAS & One Airasia)

So how the business model be good.

Just THINK carefully lah

2016-04-03 15:35

Hehe, KoonBee really focus recently. May the luck be enriched with JingHengMonyet .

2016-04-03 15:39

icon, for oil percentage of oil aax n AA is better if u compare under barrel per ask, it was bcoz AA n AAx having very dufeerent position on oil hedge, AAX oil having larger percentage on ocst, so AAX benefit more under low oil price compare to AA. very informatic and detail analysis anyway, alwats appreciate your contribution on this forum.

2016-04-03 16:13

Not too long ago aax has issue to pay staff salary

Base on that u know what type of company is aax

It can go bankrupt easily

2016-04-03 21:23

Great article!! AAX benefit more or less to AA is no a issue, the most importance is they are both benefit from LOW Oil and weak USD.

2016-04-03 22:02

Why nvr mentioned debts? Compare loan cost, how good is de, loan to capital, income to assets, to capital

2016-04-03 22:21

AAX's competitor is not Malindo, they are Singapore Airlines, Brunei Airlines, BA, Qantas, Cathay, everyone is tough.

By the way, icon can you write something else other than Lucy and Ann? Appreciation of Ringgit must have benefit many other importers, USD debtors, etc.

You know, last wave i sold AA 3 weeks before the crash, now just happy to stay on ground.

2016-04-03 23:25

I bought both too. Here is my bad comment on airasia and AAX.

1)My concern on the revenue. The drop in USD means the revenue in USD also drop (if sell to foreigner, but no impact on the sales to local people).

2) Another concern is diluted in EPS, with the capital injection, the earning per share will be diluted.

However, there is some good point to buy airasia and aax.

1) Cost also drop (oil consumption). But loan in USD and interest expenses will be significant reduced.

2) Another concern is the capital injection. Other than the reduction in interest expenses, i do not see any positive contribution to EPS as they also used part of the money to build airasia headquarter. This will increase depreciation expenses for Airasia.

3) Tony Fernandes "sai lang" mean he is confident with Airasia.

Conclusion, I rather this proposal did not happened as it will only bring interest saving of RM10mil, which is less than EPS 1sen. But the impact of dilution is huge for minority shareholders

2016-04-04 13:41

Meanwhile, to recap some news on A330-900neo https://www.flightglobal.com/news/articles/singapore-a330neo-passes-detailed-design-review-421961/

2016-04-04 17:43

Which airline will do well will depend on how AAX can sort out its operating margin. Currently operating margins in AAX is 2%, AirAsia is 18%. Even a Greek airline like Aegean airline can do 10%. AAX and Airasia need to follow the Ryanair model and its achievement of 41% operating margin.

All Tony needs to do is to look for a clever CFO who understands Connectivity,Routes (& Airline Freedoms of the Air) and Margins. When AAX can achieve ave 15% operating margin, then it will be a 1 Ringgit share price.

2016-04-06 05:31

Great article and good comments, but if you love Ann and Lucy and want to marry both. Convert.

2016-04-07 09:26

Koon Bee

Icon, thumb up!! Another great article...we need more writer like icon in i3!!

2016-04-03 14:07