(Icon) Hengyuan Refining (1) - Trading At Unbelievably Low Forward PER of 1.5 Times

Icon8888

Publish date: Wed, 12 Jul 2017, 12:43 PM

1. Extremely Strong Profitability

Hengyuan Refining Company Bhd ("HRC") was previously known as Shell Refining Company Bhd. In February 2016, Shell International announced that it was disposing 51% equity interest in HRC to Shandong Hengyuan Petrochemical Company (a company from China). The disposal was completed on 22 December 2016.

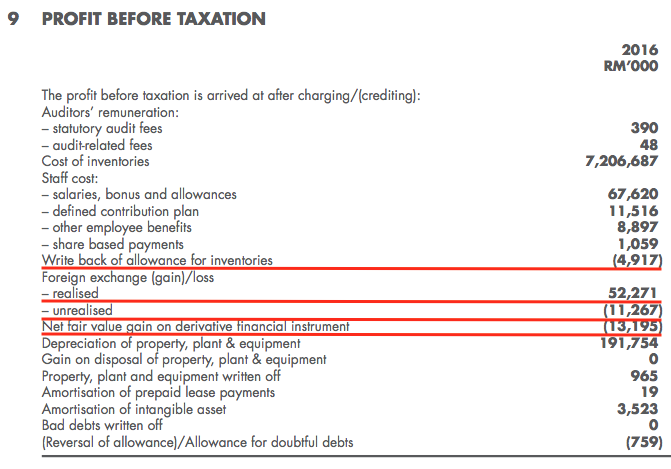

Shandong Hengyuan's acquisiton of HRC was very timely. In FYE 31 December 2016, HRC chalked up extremely strong earning of RM335 mil. Based on existing market cap of RM1.7 billion, historical PER was 5.1 times only. All of the profit was from operation (as a matter of fact, exceptional items resulted in losses of RM23 mil).

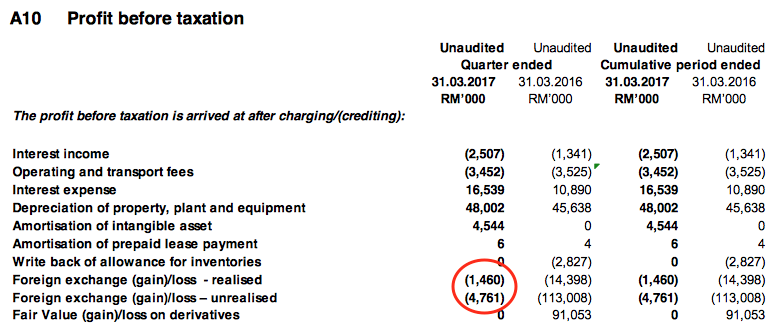

And that was not the end of it. In March 2017 quarter, Hengyuan reported a staggering RM279 mil net profit. Again, the bulk of the profit was from operation with minimal impact from exceptional gain (RM6 mil forex gain).

If annualised, full year net profit would be RMRM1.116 billion. Based on latest market cap of RM1.7 billion, forward PER would be 1.5 times only.

(Note : The 1.5 times forward PER I mentioned above was for the purpose of attracting readers' attention only. If you ask me, it would be silly to invest in HRC based on March 2017 quarter's net profit annualised. I believe a more appropriate figure would be FY2016's RM335 mil, which still translates into very attractive PER and justify a buy)

2. Credibility Not An Issue

The financial figures looked very attractive. However, do those figures have problems ? Not that I discriminate against companies from any particular country, but in general, Malaysian investors had bad experience with entities linked to Country C.

XQ was one good example (if you don't know what is "XQ", please ask Uncle Koon). XQ's balance sheet displays huge amount of cash, but have difficulty submitting quarterly report recently. The stock's market cap has shrunk dramatically since mid 2014 and is now facing delisting. Many investors cry also no tears.

Is HRC's super good profit genuine ? Will it gulung tikar one day ? I am also very jittery. However, after going through HRC's FY2016 annual report, I am HIGHLY convinced that HRC is a totally different story. Please refer to reasons below :

(a) Malaysia Based Operation

Unlike other companies that went into trouble, HRC's operation is fully based in Malaysia. There is no doubt that the refinery, the pipes, the tanks, the warehouse, the computers, the tables, the tea lady, the sexy secretary, etc are all there. No Potemkin Village.

(b) Board Composition Assures Check and Balance

HRC's Managing Director is a Kwailo. I am not a Kwailan, but having a Westerner as the MD does give me a big boost of confidence.

And then, there is Yvonne Cheah....

This lady below was previously from MIDA and was ex Director of Tenaga and Maybank. Very credible person.

If you are not convinced by my reasoning above, you can go check all those Country C companies that get into trouble and see their Board composition. The Board of those companies are overwhelmingly populated by Country C nationals. You can hardly find any independent figures there.

(c) The Bankers Are There

One quick test of whether a company is fake is to see whether it has banking facilities in its balance sheets. This is because fake companies will never dare to deal with banks. Fake companies can tell bull and cock stories to minority shareholders, but they cannot do that to bankers. THEY WON'T DARE TO GO NEAR BANKERS BECAUSE BANKERS WILL PUT THEM UNDER THE MICROSCOPE TO STUDY.

If you don't believe me, you can check the balance sheets of those troubled Country C companies. I have checked a few. None of them have banking facilities. The one that has borrowing is with a Country C bank, and the amount is very small.

But HRC is different. It has RM1.4 billion borrowings. Don't tell me those bankers are blind and stupid. Banks are VERY PARTICULAR about honesty, integrity and credibility. If they suspect that you are a conman, they won't touch you with a ten feet pole.

(d) Shandong Hengyuan's Commitment

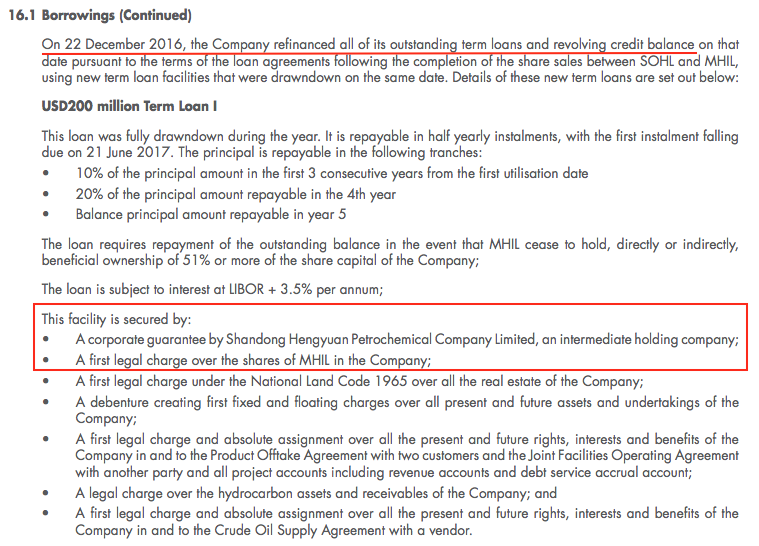

In December 2016, HRC refinanced its borrowings by drawing down USD200 mil new borrowings. The new borrowings are secured against, inter-alia, the HRC shares held by Shandong Hengyuan.

What I am trying to say is that Shandong Hengyuan has to make sure that HRC is in good shape. Or else, the bankers will force sell / confiscate their HRC shares (held through subsidiary Malaysia Hengyuan International Ltd (MHIL)). With this kind of arrangement, do you think Shandong Hengyuan will mess around with HRC by for example, faking financial figures ?

3. Concluding Remarks

I am attracted to the stock because of its low PER. Before me, a few other bloggers have already written about Hengyuan and Petronm (which is in more or less same industry). There is a lot of information in those articles, especially those related to crack spread. I suggest you go through all those articles before you commit your funds to invest in this stock. That will give you a more comprehensive and balance view.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

@

ken HRC is not red chips.. The board of director, 4 Malaysian, 2 Chinaman, 1 Angmo. Management team all Malaysian, 4 Melayu, 1 Indian and 1 Chinese.

guess what?

angmo solo operation. The rest 6 ppl wait and collect money lol

2017-07-12 16:28

the bank has no worries on providing HRC 1.3 Billion...why?

the inventory is oil..its been on planet earth for billions of years..

instead depreciating (or decomposing)...it appreciated drastically on 20th century...he he

2017-07-12 17:25

A word of caution: Are the last two quarters' profits sustainable?

I suspect earnings were boosted by inventory profits during a period of rising crude oil prices.

The coming quarter's earnings will be crucial given it coincide with falling oil prices.

2017-07-12 18:42

For a layman one can visualize like this (corrected):

with a crack spread (composite of Jet fuel, Gasoline, Fuel oil etc) margin of 9 USD/brl, with throughput turnover of 30 days, they are actually raising their Oil inventory value by 9 USD in one month's time.

meaning if you have 800 Million worth of Oil inventory (say current price is 50 USD/brl Brent), in 30 days you had increased its value to 944 Million...

Value Addition is 144M per month! 432M in a quarter..

(this is no bullshit figure, this is indeed your expected gross profit if you have not stock loss at current refinery margins)

(for professionals they can use 1 Billion worth inventory with an increased throughout by 20% to maintain the same turnover of 30 days ...and see the jackpot numbers if they like!)

This means, in a quarter (3 months), the refinery is actually increasing the value of their oil by 3 x 9 USD/brl = 27 USD/brl!!

Oil value has a bottom threshold ~ 40 USD/brl due to shale oil...

so why do you or the Bank need to worry?

Meaning even if Oil price drops by 27 USD to say 23USD/brl...you have a one time zero gross profit.. thats all.

2017-07-12 19:00

probability no its not sustainable as the refining margins is increasing..

12/07/2017 18:53

Prob... Assuming it's not sustainable... it's a bit mischievous of Icon8888 to annualise Q1 2017 earnings, and come out with a headline "...1.5x PER...", isn't it?

2017-07-12 19:14

There are only 3 options for earnings not to translate as cash (temporarily)...

its either they got stuck as receivables (1), inventory oil (2) or over enthusiasm to pay the suppliers (3)...

none of them can continuously be recurring...

you can't shut of your anus hole and keep eating continuously.

2017-07-12 19:29

Infact Depreciation of HRC is more than double the rate of PetronM per unit shares..it has all the reason to blast with FCF soon!

2017-07-12 19:32

WHY COMPLAIN ICON WRITE UP ?

AFTER RAIDER CAREFULLY READING ICON WRITE UP IS GOOD, IF NOT GREAT LOH..!!

ALTHOUGH WHEN COMPARE WITH PROBABILITY, PEOPLE SAY LACK DETAIL LOH, BUT RAIDER WILL SAY THIS LOH...ICON WRITE UP IS NOT COMPLICATED...HIT THE POINT LOH...!!

YES...IF U WANT TO STUDY MORE...THAN U LOOK AT PROBABLITY WRITE UP LOH..!!

BUT ANY HOW ICON ARTICLE...IT IS BUY BUY BUY AND BUY LOH...!!

NO WONDER HRC MOVE UP LOH...!!

YES PROBABILITY & RAIDER HAD BEEN HIGHLIGHTING HRC ITS UNIQUE INVESTMENT ADVANTAGE FOR MANY WEEKS...BUT DID NOT HAVE FAST SPRINT IMPACT LIKE ICON LOH...!!

ICON HAS HIS STRENGTH....RAIDER DO SALUTE LOH...!!

THATS WHY LATELY ALMOST ALL ARTICLE COME UP BY ICON ON STOCK, RAIDER IMMEDIATELY JUMP IN AND BUY AND MAKE MONIES MAH...!!

2017-07-12 23:31

This low PE refinery stock is getting more and more attention.

The down side is very limited.

The upside is tremendous...

2017-07-13 00:15

Posted by paperplane2016 > Jul 13, 2017 12:06 PM | Report Abuse

So P/E 1.5 is RM5.80, eps=3.86?

P/E 5=19??

PAPERLANE,

FINALLY UNDERSTAND HRC VERY BULLISH INVESTMENT MATRIX LOH...!!

BUT IF HRC PE = PET DAG PE 23X LEH ?

2017-07-13 12:12

Raider bro, I get this. But my concern is on the borrowing. It will be eating their bottom line. End up working hard for banks only.

Which is why I am more comfortable with PETRONM. But SHELL has higher potential for sure. If they succeed in pairing down borrowings.

But to be clear, its not apple to apple comparison here. If I am not wrong:

HENGYUAN-listed Refinery ONLY.

PETDAG-PURELY PETROL STATION ONLY.

PETRONM-Mix of Refinery+Petrol Station

Which why I like pteronm for Balance play. If refinery margin goes down, covered by Retail margin. If retail margin stress, sometimes refinery get better. Balance play is important. Either one might be higher risk to me.

2017-07-13 13:56

and P/E x23 for Petdag is similar to Consumer Sectors like AEON, etc. So the same P/E might not be applicable if my above point is correct.

Normal refinery P/E not sure how much, mixture of both that's why PetronM deserve higher P/E. example P/E 10 for mixtures, P/E 8 for pure refinery? P.E 20-25 for Pure retail?

2017-07-13 13:58

which Icon highlighted historical P/E 5 is average. That's why we should be conservative applying only P/E 5 for Hengyuan. which TP should be near RM18-19.00

2017-07-13 13:59

Conservative PE applies to HY deriving TP rm18 to rm19

HY is rm5.84 now! So..

.

2017-07-13 14:08

This stock is considering as Buta Money...

Ah kong Ah Mah Ah lian boy it also can Profit!!!

2017-07-13 14:10

Only 300million shares, with 9 billion revenue and cross 1 billion net profit. ...simply can RM10 if condition continue improve.

2017-07-13 14:30

Posted by paperplane2016 > Jul 13, 2017 01:59 PM | Report Abuse

which Icon highlighted historical P/E 5 is average. That's why we should be conservative applying only P/E 5 for Hengyuan. which TP should be near RM18-19.00

RUBBISH PE 5X....!!

THIS TYPE OF LOW PE NOT SUSTAINABLE LOH...!!

RISK FREE RATE IS 3% TO 4% LOH...!!

IF U BORROW...U CAN RATE OF 5% LOH....!!

JUST IMAGINE U JUST BORROW RM 1 MILLION AT 5%PA AND DUMP IT AT ALL HRC FOR 10 YRS..!

SO PE 5X RETURN ON RM 1M ...WILL GIVE RM 200K PA

COST OF FINANCING RM 50K PA

SO BUTA BUTA U MAKE RM 150K PA FOR NEXT 10 YRS.

THE LIKELY LOW PE FOR HRC IS ABOUT 10 TO 12X LOH...!!

2017-07-13 15:15

JN88, you are one of the most stable performance guy, will you pick Hengyuan in 2018 portfolio? I guess most will.

2017-07-13 15:15

between Hengyuan and Petronm. anyone willing to share the risks and benefits investing in them? which one is the more attractive option?

2017-07-13 16:37

paperplane2016: I love my Airasia so much cant let go, Hengyuan spotted by someone during February this year. But I love the shares volume.

2017-07-13 16:51

Worst of all, ChongJiauJau aka the "banana salesman" was very cocky before but he has since deleted all comments and his personal cocky comments. I found out also the loser named "probability" also deleted all his cocky comments entirely wiped clean!!!! WTF? so probability and ChongJiauJau is actually same dude. Both accounts erased/deleted clean all their bragging cocky comments. Now I see what kind of loser this probability is! cowardly deleted all his cocky comments...I wouldn't caught him red-handed if he didn't delete those his bragging comments!

2017-07-14 07:49

When did Hengyuan pay dividend for the last time? 2013?

When do you expect Hengyuan to pay dividend again? 2023?

Like all Red Chips, if you still think Hengyuan is making 5 ringgit or 10 ringgit a year, and expect windfall dividend, you might as well wait for Xinquan to declare a 10 sen dividend.

Sama-sama lah, all are red chips.

Don't believe, check CAP, Maxwell, CSL, Xinquan, Xinghe, Kanger, CNOuhua, all were PE 1.5x, and all cannot afford to pay dividend.

Later on fire will break out in their factories/ refinery.

Be careful, when major shareholders start to unload, it will be like Maxwell owner selling her share at 2 sen...........

2017-12-31 19:39

Play safe.

Take profit now.

Let the greedy fools have their arms chop off...........

2017-12-31 19:42

Posted by Vince Sinclair > Jan 1, 2018 10:44 AM | Report Abuse

I refer to Felicity's articles posted on 29/12/2017, the day when Hengyuan's share price fell 9.24%. She started by "reminding" readers "not to be misled". She then confidently concluded that "Hengyuan is no Nestle, Dutch Lady, BAT. Not even Oldtown. It is not even Top Glove or Hartalega or Airasia. Hengyuan is Not near".

First, Hengyuan supplies most of its petroleum products to Shell. In the same way, how many consumers do you think will ask "eh, who's the major supplier that supplies the parts in this DYSON vacuum cleaner that we're using?" Or, "hey, which is the semiconductor company that supplies the parts on this iphone that we're using?" I guarantee less than 10% of consumers worldwide would bother to ask such questions. Yet, an investor who had the foresight to invest in SKP Resources (major supplier for DYSON) back in 2012/2013 would have made multi-fold returns on their investment. My point is, it's not necessarily companies with strong brands that will make you money in the stock market. In this respect, Felicity's "brand" talk is just shallow and superficial to be taken seriously. How many people knew SKP Resources compared to DYSON? How many people knew Foxconn compared to Apple?

Second, the present Mgmt officially took over the business on 22/12/2016. In just 1 year,. what kind of "miracle" do you expect them to produce? Did Nestle, D Lady & AirAsia become the successful companies and "safe" investments that they are today in just 1 year?

No! It took them years, if not decades. So, why be so harsh on the new Mgmt of Hengyuan?

On the high debt, please remember that the new Mgmt did not amass this debt, IN ADDITION HENGYUAN BORROW & REFINANCE THEIR SHORT TERM TRADING ADVANCES OF SHELL PARENT BEFORE THE TAKEOVER.

THUS They INHERITED it from the previous mgmt. C'mon, do you expect them to pay down this debt in just 1 year?? To divert a little, did Geely turn Volvo into a disaster after acquiring the latter?

Have you heard about how the new Proton CEO dealt with the low quality of kangkung served in Proton's cafe? Do you think these Chinese would spend hundreds of millions, even billions and let their business ventures fail?

Hengyuan's parent company in China has been in existence for close to half a decade. They are now producing Euro-6 compliant products.

In terms of technological know-how and experience in running the business, they are definitely not any inferior IN FACT BETTER IN TERMS OF COST EFFECTIVENESS compared to their Western counterparts.

In fact, the contrary is true. If not, Hengyuan won't be buying over Shell's refinery. It would be the other way around. And don't undermine the importance of technological know-how. Look at how Shale technology disrupted the whole O&G industry.

On dividends, many argue that Petron is a safer investment because it pays dividends. Really? How sustainable is their dividend payment? Petron is gonna spend USD 1.5 bil on its refinery in Msia. Hengyuan is spending RM 700M. In the case of Hengyuan, it's only a matter of time before they start paying dividend, DON FORGET HENGYUAN IS GENERATING CLOSE TO RM 1.2 BILLION FREECASHFLOW PA AND IT IS SITTING ON CASH IN THE BANK RM 900M, ALTHOUGH THEY HAVE RM 1.3 BILLION DEBT AND CAPEX REQUIREMENT RM 700M, THIS IS EXPECTED TO BE FULLY REPAID IN 2018 BASING ON THEIR EXISTING CASHFLOW .

IT IS ANTICIPATED U CAN GET YOUR DIV IN LATE 2018 OR EARLY 2019, WITH WHISPER AMOUNT OF PAYOUT RM 0.40 PER SHARE LOH...!!

THIS DIV WILL BE INCREASING TO EVENTUALLY RM 1.00 PER SHARE IN 3 YRS TIME LOH...!!

2018-01-01 22:06

paperplane2016

haha.............icon need to fight many experts, tough lah. he just know insider news lah, goring this and tht only. what crack speed margin, he totally blank

2017-07-12 15:28