(Icon) Hengyuan Refining (3) - The Economics of Petroleum Refining

Icon8888

Publish date: Sun, 16 Jul 2017, 02:45 PM

1. Products Mix

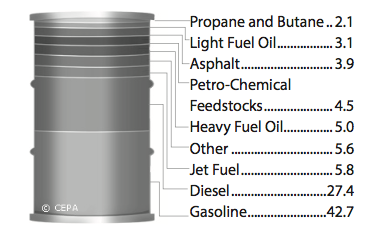

Refineries process crude oils into a broad range of refined products. Transportation fuel such as gasoline, diesel and aviation fuel account for 75 percent of output. The remaining 25 percent comprise heating oil, lubricants, asphalt for roads and feedstocks for petrochemical industry, etc.

![]()

2. Crack Spread

A major determinant of a crack spread is the ratio of how much crude oil is processed into different refined products. Each type of crude more easily yields a different product, and each product has a different value. Some crude inherently produces more diesel or gasoline due to its composition. The most common ratio in the US is three barrels of crude to produce two barrels of gasoline and one barrel of middle distillates (or 3:2:1). In Europe, a 6:3:2:1 ratio is the most common (six barrels of crude produce three barrels of gasoline, two of distillates (diesel) and one of residual fuel).

(The composition of outputs is called "Product Slate").

3. How Crack Spread Is Calculated In Real Life

As mentioned above, a refinery does not really have FULL flexibility to decide which product to produce. It is governed by the ratio it chooses. For example : if Refinery A chooses the 3:2:1 ratio, it will produce 2 barrels of gasonline and 1 barrel of diesel. Refinery A gets these products IRREGARDLESS of how good or bad their price is during that period. And that will have impact on its crack spread, which is calculated as follows :-

Refinery A's Crack Spread = (66.66% x Gasoline Crack Spread) + (33.33% x Diesel Crack Spread)

The interesting thing is that even though gasoline and diesel are both petroleum products, their fortune can be hugely different during a particular period. For example, in June 2017, China imposed fishing ban on its fishermen (an annual event). This has caused demand for diesel to drop dramatically, causing diesel crack spread to shrink. In the meantime, demand for gasoil remains high and supports a strong crack spread.

4. Product Slate and International Trade

Local refineries often cannot economically meet demand in a given region for a certain refined product: they must import from other regions or countries. For example, European demand has gradually shifted due to the large-scale conversion of domestic vehicles from gasoline to diesel. As a result, European refineries have a surplus of gasoline and a shortage of diesel. They have responded by exporting gasoline to North America (primarily the US) and importing diesel from the US. Transportation costs will help determine whether matching production to demand in this way can be profitable in the long term.

The growth of international trade in refined petroleum products is partly due to the trend to build large, complex refineries that provides felxibility to accomodate various types of crude inputs and refined outputs. These ‘merchant refineries’, like those in Singapore and South Korea, are designed for producing and competing in global markets, not for supplying local markets.

5. Conclusion

The economics of the refining business are complex. It is a capital intensive manufacturing industry operating between the two related but independent markets for crude oil and finished petroleum products. Profitable operations that deliver adequate returns on investment are a function of a complex set of variables underpinned by basic supply and demand dynamics, and shaped by competition that is increasingly global in nature.

Refiners must strive to maximize their margins by optimizing a number of variables including: the type of crude feedstocks and products; energy requirements; plant complexity and efficiency; and logistics and transportation. They operate in a business environment that is dynamic, and that comes with varying levels of commercial, technical, regulatory and economic risks.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Icon8888, great job. Trying to understand also susah. Thanks for the write up and yr indepth research. Salute to you for a great job.

2017-07-16 15:40

Icon8888 so geng...i read 3 times also cannot understand...whatever it is, I just buy

2017-07-16 21:56

i can't see a more simple business than the one that has a steady continuous flow of throughput due to steady flow of consumption...

the volatility is only on the inventory valuation due to oil price fluctuations (with zero net cumulative effects) and the refinery margin, i.e the crack spread..

crack spread is "the one and only single variable" affecting the profitability of refinery

unlike other businesses with non-continuous revenue, where the management skills , competence, competitive edge, product superiority, demand etc plays an essential role in determining the success of the business...something difficult for investors to access and evaluate

refinery is basically a money printing plant...and you can see the rate it prints just by looking at the crack spread charts..

i think if an investor can't comprehend such basic common sense (logic)...i am unable to comprehend how they are investing on other stocks...

must be some 'magic formula'...he he

2017-07-16 23:33

With so many sifus recomendation, this is rare to see in i3. Only happen in Hengyuan so onw word is BUY

2017-07-17 00:24

basically i guess icon give a buy call with erring that crack spread is not plain sailing. Could go south in a matter of next second.but i am in both hehehe.still low downside. take risk la.

2017-07-17 01:24

can a competitor of a refinery of similar complexity factor kill its margins? The answer is "NO" without killing his own margins, i,e the crack spread.

Why?

Because the technology is pretty fixed - you can't invent a new technology which can improve the operating cost...the cost are pure energy and at the max perhaps you can improve by 0.5USD/brl... simply because you cant change the law of thermodynamics.

Now...the only thing they can use to compete is the economy of scale...purely by reducing the overhead cost per unit barrel. In other words go for a huge processing capacity with same human resources.

As we can see from PetronM plans for Refinery investment, the ideal capacity seems to be in the same range of HRC..considering foreseeable crack spread, demand and payback periods.

If you go too big (refinery capacity)...you are going to have huge inventory...and like a double-edged sword...when the crude oil is down trending you will incur enormous 'stock loss' and vice versa when it goes up.

On top of the ultra-thin Crack spread for years earlier, HRC suffered huge inventory losses when the crude oil price came down from 100 USD/brl to 40 USD/brl.

Now, at current Oil price...the possible inventory loss magnitudes in future will be minimal and chances of repetitions are almost Nil.

With current crack spread, and the certainty that its very unlikely to go below 6USD/brl - considering regional refining capacities in operations, HRC is well placed for a 'giant awakening'...

2017-07-17 13:33

Posted by John Lu > Jul 16, 2017 10:22 PM | Report Abuse

Paper sifu...petronm and Hengyuan, which one u choose?

Choose BOTH! hahaha

2017-07-17 13:37

Paper sifu, alright!!

paperplane2016

11760 posts

Posted by paperplane2016 > Jul 17, 2017 10:40 AM | Report Abuse

MY TP

PETRONM-12 (54%)

HENGYUAN-18 (218%)

BELIEVE IT OR NOT!

HAHAHAH

2017-07-17 13:43

ok article and but not in-depth enough to understand the crude oil refining biz.

the article neglected to mention in-depth complexity of a refinery and the crude/blended/semi-refined grades used since it will have an impact on refining margin.

another then-popular strategy not mentioned is arbitraging between wti and brent futures.

2017-08-08 08:24

VenFx

This is Seriously in depth study over Refiner.

Kambate !!! Icon8888

2017-07-16 15:09