(Icon) Jaks Resources (2) - Ignore The Wild Talks And Hysteria. Stick To Fundamentals

Icon8888

Publish date: Tue, 31 Jul 2018, 12:44 PM

1. Introduction

I have never been so lonely before. Since publishing my Jaks article on 27 July 2018, comments poured in from friends and foes. 99.99999% are negative. Even my relative called me to express concern (which I would like to convey my appreciation, the input is helpful and I duly took note of it).

I have to admit that bargain hunting is never an easy thing to do. Looking back, I have never been successful in buying at the bottom. Most of the time, after I took position, the stock continues to decline. But if share price indeed is deviating too much from fundamentals, the stock will eventually rebounce and generate positive return.

As mentioned before, I am very much an earning person. I buy a stock only if I am comfortable that the company is delivering reasonable profit. With this in mind, I conducted a quick study of Jaks' income statement.

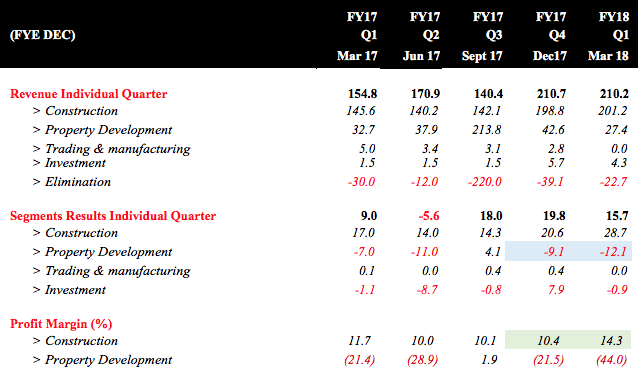

2. Historical P&L

Key observations :

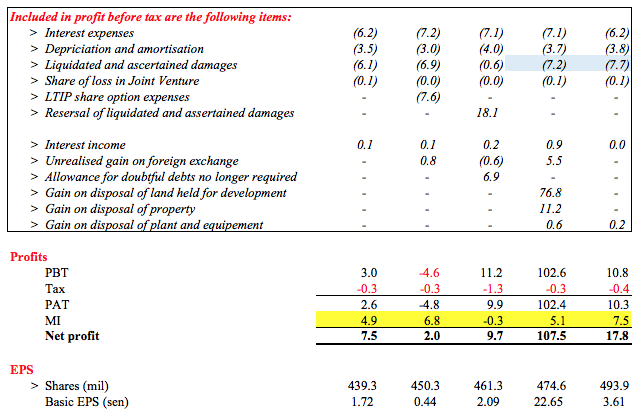

(a) Property division has not been doing well in latest two quarters, chalking up operating losses of approximately RM10 mil per quarter. Major reason is because of Liquidated and Ascertained Damages. Please refer to blue highlighted.

(b) However, Jaks only owns 51% of the property subsidiary. As such, the losses were diluted by positive Minority Interest. Please refer to yellow highlighted.

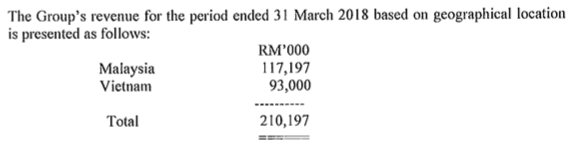

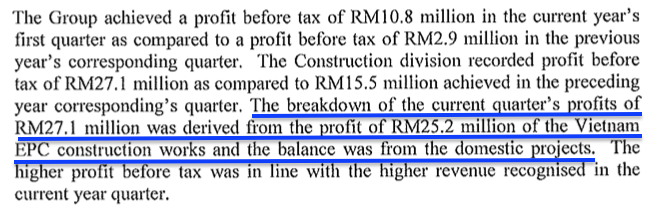

(c) Construction division is the star performer. The Vietnam power plant project commands very high profit margin of 27% (being RM25.2 mil / RM93 mil x 100%). Please refer below.

The domestic construction project only broke even. No wonder KYY has been nagging them to reduce exposure.

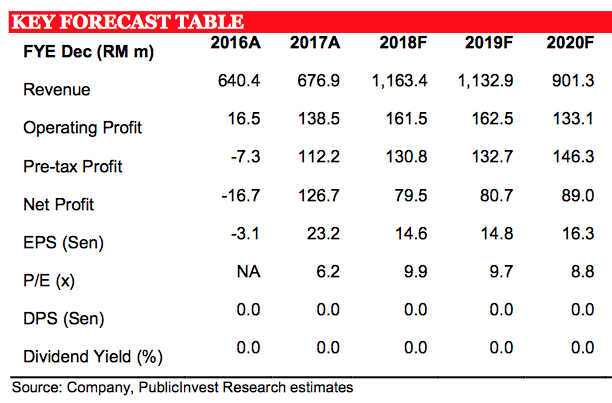

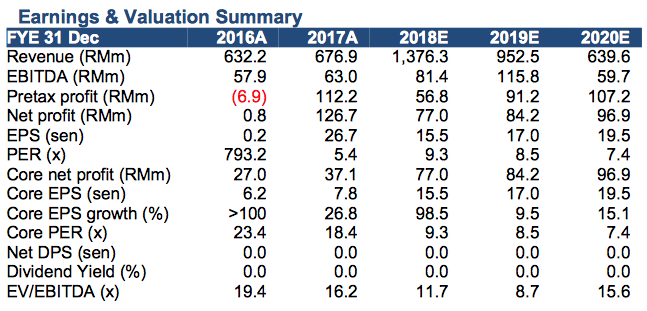

3. Prospective Earnings

Based on the above historical data, I came up with a crude financial model for Jaks' P&L.

First of all, Vietnam IPP could generate RM108 mil operating profit per annum (based on RM27 mil annualised).

Jaks' finance charges is approximately RM7 mil per quarter. This translates into RM28 mil per annum.

Property division incurs RM10 mil losses per quarter, meaning full year losses would be RM40 mil. As Jaks holds 51%, its share of losses would be RM20 mil.

Tax is quite minimum.

Putting everything together, net profit is approximately RM108 mil less RM28 mil less RM20 mil = RM60 mil.

This is more or less in line with analysts' forecast of approximately RM80 mil per annum. Please refer below.

In my opinion, my model is on the conservative side. I have assumed interest charges of RM28 mil and property division losses of RM40 mil per annum. As property division's losses might have already factored in a huge portion of the interest charges (the bulk of liability is in that division), there could be a bit of double counting.

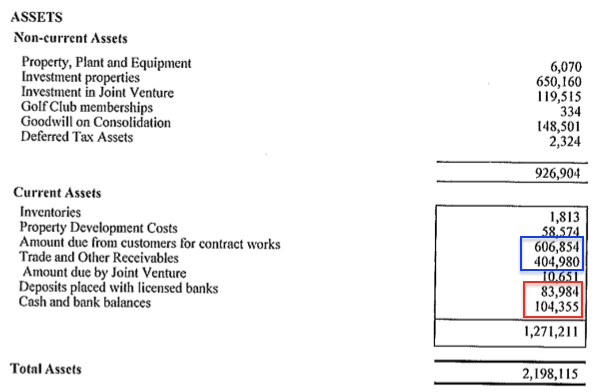

4. Balance Sheets

When buying into a stock, one very pertinent question is whether the company will be facing liquidity crunches in the near to medium term (I am not Warren Buffett, I don't hold indefinitely). Let's look at the balance sheets.

Key observations :

(a) Receivables totalled RM1,010 mil. Payables RM841 mil. Please refer to blue boxes above.

There are wild talks that receivables are bad. For me, receivables are just receivables. To jump into conclusion that receivables is equal to Bad Debt is simply fear mongering. Which PLC does not have receivables ?

Jaks has been in business for long time. I am sure they have the proper mechasim to deal with collection.

In this regard, my most simplistic interpretation is that Jaks' payables can be fully settled by its receivables. Period.

(b) Jaks has total borrowings of RM571 mil. Is this something we should worry about ? To be sure, this level of borrowing is not something to be sneezed at. But this is mitigated by RM188 mil cash (please refer to red box above).

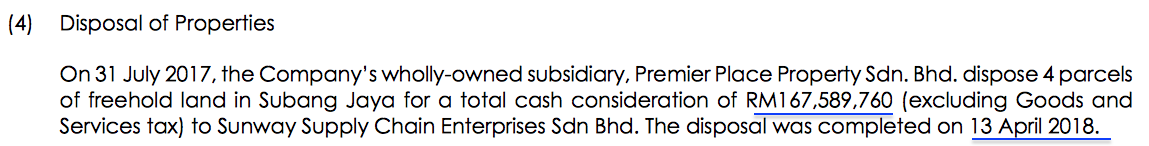

On top of that, the company completed disposal of several parcels of land to Sunway in April 2018. That will result in cash inflow of RM167 mil.

(Source : 2017 Annual Report)

This will boost cash level to RM355 mil.

The company will be undertaking a rights issue of Warrants to raise RM60 mil plus. Cash holding will hence become RM415 mil.

Of course, there is the infamous RM50 mil bank guarantee being called. I am not sure how much has that been reflected in the March 2018 quarterly report. Lets' just add the entire amount to the borrowings, which will then increase to RM621 mil.

Net borrowings will then be RM621 mil less RM415 mil = RM206 mil.

This is more manageable. I think over the next one to two years, liquidity shouldn't be a problem.

That is good enough for me. Like I mentioned before, I don't intend to hold indefinitely.

5. Dividend

Unlike toll roads that take 4 to 5 years to ramp up revenue (through growth of traffic), IPP can scale up revenue to maximum capacity from day one. So the gestation period is much shorter. Based on publicly available information, the company's 30% stake in Vietnam IPP could potentially generate RM200 mil net profit per annum upon completion.

Due to lack of information, I am not able to tell whether the profit could be distributed by the IPP to its shareholders. But the likelihood is that it could. For IPPs, the ability to distribute dividend is very much dependent upon its funding structure. Based on normal funding structure of 25% equity 75% debt (which is the case for Jaks' Vietnam IPP), the project is usually in a position to pay out dividend (just look at YTL Power, etc). Only in extreme cases such as Jimah Power (owned by Negeri Sembilan royalty and subsequently acquired by 1MDB) which has equity of only 10% (the remaining 15% funded by capital market through junior debt issuance, etc), the shareholders will not be able to enjoy dividend for long period of time.

China companies are not known for being generous on dividend. But IPP is different. The cash if not distributed will have no use for anybody. If Jaks indeed can receive dividend from the Vietnam IPP (which I believe would have been negotiated with their Chinese partner at the very beginning), the steady stream of cash inflow will have positive impact on balance sheets for many years to come.

Anybody has the relevant information, please let me know. I am happy to incorporate them in the article.

6. Concluding Remarks

Jaks' share price stabilised a bit today. A huge buyer has surfaced to mop up the shares. However, the purpose of my article today is not for chest thumping. It is too early to celebrate. There could still be a long night ahead before sunrise.

The purpose of this article is more to provide an objective analysis of Jaks' earning prospects and financial position. Hopefully this will allow people who are interested in taking position to have a better feel.

Have a nice day.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Icon, JAKS' receivables are timed bomb !!! It is NOT SAFE to assume payables can be fully settled by its receivables period.

2018-07-31 21:06

There are so many shares selling below 1 times book value, on single digit prospective pe and selling at near 52 week low with good management. Why in the world would anyone with good investment knowledge want to risk buying a lemon stock that has never performed well throughout its listing history. Remember the golden rule, always buy a stock that is well managed. This is not one of them, cheers.

2018-07-31 21:26

seem like a lot contra kaki sold their share this morning, btw, there are 25 million worth of share bought by someone just today at price 1.03 - 1.05, definitely ICON888 is not alone and a lot of them believe in the fundamental of JAKS. lets the time prove who is wrong or right....looking forward to Q2 result as it going to record high.

2018-07-31 22:28

Icon, you straight line projection on the vietnam construction profit does not reflect the accelerating pace of the activities going into 2018 and 2019. Based on the progress of similar power project in vietnam, it is likely to see 30% work done in 2018 and 50% in 2019.

2018-07-31 23:24

This dk66 sounds like one of the insider from jaks or cpecc..acceleration ... Talk cock amd mislead the followers ok lah. Or just an ordinary investor who cant bear to see jaks price slump 50%? By the time jaks kyy margin crisis he disappear. Now resurface after jaks up a few cents... Haiz.. Stock market... Macam macam orang LOL

2018-08-01 00:15

Anyway he is one the good boy praised by kyy over his sensible comments... The other one disappeared LOL

2018-08-01 00:16

When there is 20m shares buy there is also 20m shares sold... How u guys know is not their gang job? This is absoluete peanut to create scene like this

2018-08-01 00:18

Vietnam project got hidden unrelease risk news...will dip further before official news

2018-08-01 07:25

It is easy to verify my statement, just check up all the qtrly reports. Look up for the revenues from vietnam, see if there was any increase QoQ.

2018-08-01 08:11

Good article. I will buy to hold if the price ever comes back to 1.17 or break the 1.23.

KYY has just found his new partner. Koon+Icon begins~

2018-08-01 08:13

Could be the first taste of his own resipe : Sialang with margin finance from friendly IBs..haha

2018-08-01 09:12

All this articles promoting IPP is a sure earn business. It is too simplistic to jump into that conclusion without detail study of the power purchase agreement, fuel cost structure, management team (affecting reliability of the plant) etc.

2018-08-01 12:17

If a stock is sold down on margin call, I will let it drop until the margin call is over.

2018-08-01 16:06

time to have a look at malaysia furniture industry

Trump to propose 25% tariff on US$200b of Chinese imports

https://www.thestar.com.my/business/business-news/2018/08/01/trump-to-propose-25pct-tariff-on-us$200b-of-chinese-imports/

2018-08-01 17:18

Fundamental?? Nope. Fundamental proof management sucks,which why someone need to step in

2018-08-01 23:48

Stock: [JAKS]: JAKS RESOURCES BHD

Jul 29, 2018 12:33 PM | Report Abuse

Like it or not, Pacific Star has to delay by at least 3 years.

Due for completion August 2016, cannot deliver VP by August 2019.

https://www.propsocial.my/property/3891/petaling-jaya/pacific-star

BG 50 million plus LAD 10 million plus Interest on bridging loan plus Cost Increase due to Inflation plus plus plus Dying Evolve Mall..........Jaks sure go holland.

If forced selling on KYY's pledged securities continues, down trend for Jaks may take 4 months if everyday net selling by KYY is 2 million for 80 market days.

You must stay away from Jaks for at least 4 months to avoid caught by KYY factor........

2018-08-01 23:57

IPP is very capital intensive biz. It can be very highly profitable but with tremendous high risks. Financing, construction, operation, environmental, counterparty, political ect must be carefully considered. Just look at what happen to IPP plant in India constructed n partly owned by Mudajaya but turn out to be a nightmare.

2018-08-02 08:43

a good write up but Vietnam IPP investment is known for their hiccups. Jaks is a not true blue builder. imagine a single development project at PJ ( also faced problems ) that itself is speaks of the company abilities. dividend wise never known for its fat paychecks

2018-08-02 09:24

The cosrtruction job is just an arrangement with Chinese partner to reward Jaks for getting IPP license, and the so called profit is just notional, not real.

2018-08-02 09:40

If someone is willing to pay 100,000 to build a house. He is to pay you 100,000 over 10 years plus interest. It only costs you 70,000 to build the house. Is the 30,000 construction profit real? Of course it is real. You will receive the profit over the next 10 years with interest.

2018-08-02 10:01

When all the dust settled , Icon8888 will prove he is right .

I buy totally in Icon8888 view in this article.

2018-08-02 10:56

Jaks similar to Berjaya Group now, you will never know what they are doing based on the financial statements.

All you need to do is assuming & guessing. Technically you are right, but lots of hidden things are not clarified,

For example, 70%:30% JV, how much influence the management of JAKS has over the business? What about cash flow management of JV? How much $$ Jaks need to pump into JV & what is the recovery rate for cost of invesment?

DK66 If someone is willing to pay 100,000 to build a house. He is to pay you 100,000 over 10 years plus interest. It only costs you 70,000 to build the house. Is the 30,000 construction profit real? Of course it is real. You will receive the profit over the next 10 years with interest.

02/08/2018 10:01

2018-08-02 15:43

That is why i said you have to do a lot of research to find out answers to your questions, not just wondering. Always assuming the darker side of the story will not help you getting the true picture. There are answers to some of your questions in the JV agreement with CPECC as announced to bursa. There are certain answers in the CPECC website. And you need to study the latest vietnam gov't circular to understand the tariff structure. Since you don't trust anyone here, you need to do some homework to be confidence.

There is no doubt that 40% of a US$1.87b power plant in vietnam will have huge potential earnings. However, you have to be comfortable enough to buy. Otherwise, you have to let it go.

2018-08-02 20:50

I believe kyy share were force selling by the securities from the margin account.

Short term look good as some huge fund is buying at the bottom.

Long term i not confidence and need Jaks to show a better qr.

2018-08-05 02:40

Pacific star tower already almost 100% completion. The other part residence, and mall still progressing.

https://www.flickr.com/photos/huislaw/sets/72157640776462653

Once the pacific star tower 1 hand over to star, the performance bond RM 50m become meaningless as these RM 50m is fund for star to complete the balance work of its tower and any excess fund actually need to return back to jaks, therefore, if jaks already complete the tower and hand over to star, then, performance bond RM50m will be become void.

2018-08-06 10:37

Icon8888, thanks for the article , your prediction on Jaks has been accurate so far. I join you sailang at 1.12

2018-08-18 15:41

REMEMBER THIS IMPORTANT ADVICE LOH....!!

ALWAYS LEAVE EARLY MAH....!!

JAKS HAS GIVEN U AMPLE TIME....THE TSUNAMI IS COMING LOH...!!

GET THE HELL OUT...!! B4 KYY GET OUT EARLIER THAN U LOH...!!

Posted by stockraider > Jul 31, 2018 08:19 PM | Report Abuse X

Important advice to greater fools

Some even lost a large part of their original capital. Thus on the next occassion when you happen to find yourselves at this type of a ball, try to leave early. The problem is that once one is caught up in the fun and games of the party, one is apt to lose touch with reality. Chances are that believers of the Greater Fool Theory will hang on to the bitter end, only to be slaughtered. It is better to miss a few dances or a few glasses of champagne than lose one's life.

In concluding this section, an anecdote about Bernarde Baruch, generally acknowledged to be the greatest stock traders of the 1920s is related. He was once asked how it was that he remained so rich while many of his contemporaries had declared bankrupt. This was his splendid answer: 'I always sold too early.'

2018-08-18 18:03

if someone with massive baggage can run faster than someone who has light baggage, then what does it say?

2018-08-18 19:48

a self-inflict margin call is still a margin call but is done intentionally, meaning triggered it to happen intentionally

2018-08-18 19:52

Hoi. Icon8888 dan rakan-rakan baru masuk Jaks. Mereka percaya Jaks akan meletop. Saya percaya pada visi yang ada pada Icon8888. Dahalu saya ikut dia beli Orion. Saya telah kaya raya.

2018-08-18 19:58

using margin called as a legitimate excuse to sell off as part of Sun Zi Art of war..金蝉脱壳之计

2018-08-18 21:26

Plz lat icon888 last time promoted puncak as hidden gem at 1.20++ and the end puncak felt to 0.40++

2018-08-18 21:28

I also kena last time.

Posted by rogers123 > Aug 18, 2018 09:28 PM | Report Abuse

Plz lat icon888 last time promoted puncak as hidden gem at 1.20++ and the end puncak felt to 0.40++

2018-08-18 22:31

Fabien Extraordinaire

Icon, if you want to have exposure to IPP with a more trustworthy management with good track record. why dont u have a look at MFCB?

2018-07-31 20:48