Malakoff Corporation Berhad – What Do the Canaries Say?

Neoh Jia En

Publish date: Fri, 15 Apr 2022, 12:34 PM

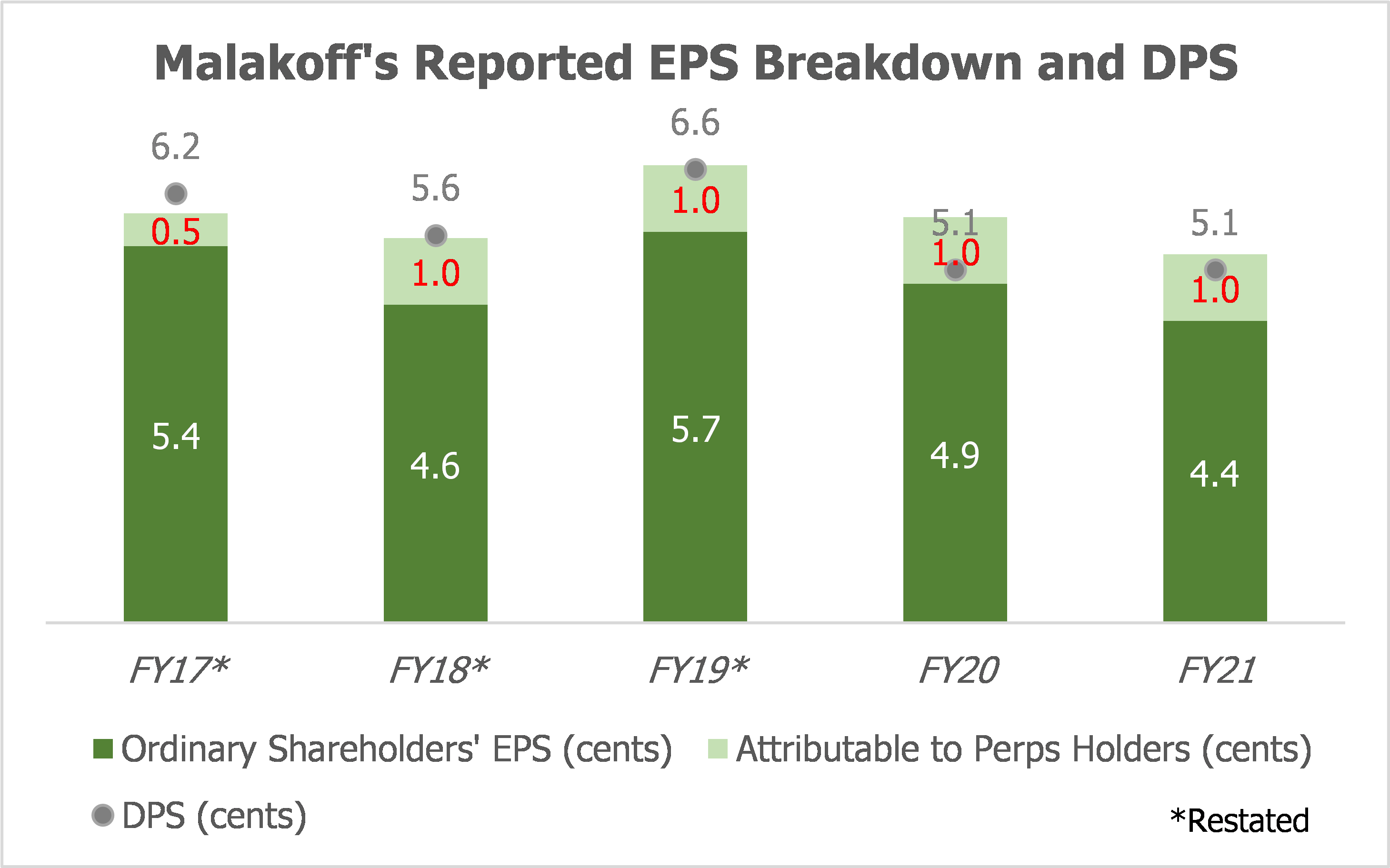

- Excluding distributions to equity-classified perpetual bond holders from profits, the dividend payout ratio of Malakoff has reached 114.0% over 2017-21.

- While its consolidated accumulated losses widened on distributions to perpetual bonds, the holding company-level retained profit of Malakoff has dropped even faster due to impairments on investments in subsidiaries.

- Since Companies Act 2016 limits companies to only pay out profits as dividends, Malakoff will likely need to reduce its dividend payout ratio once its holding company’s retained profit depletes.

Listed in May 2015, Malakoff Corporation Berhad (Malakoff) is a relatively popular name for income-seeking investors. As at February 2022, the company’s largest shareholders include funds such as Employees Provident Fund (11.5% stake), Urusharta Jamaah (10.0%), Kumpulan Wang Amanah Persaraan (Diperbadankan) (8.7%), and Amanah Saham Bumiputera (6.4%).

The lure of Malakoff, despite its lack of earnings growth, lies in its dividend yield. Since listing, the company has set a generous policy to distribute not less than 70% of its consolidated profit attributable to owners as dividends, and this target has been well met partly to maintain the company’s profile as a “dividend yielding stock.”

Owing to the clientele effect, dividend sustainability should be of interest to investors of Malakoff. While forecasting future cash flows is beyond my realm, trends in two of the company’s accounting figures are worth highlighting, in my opinion.

The long silence

As mentioned in my previous post in January, Malakoff is among the four companies that intriguingly do not deduct distributions to equity-classified perpetual bonds out of their earnings per share (EPS). Setting aside the issue of compliance with IAS 33/MFRS 133, Malakoff faces another issue that also arose from the lack of distinction between profit attributable to ordinary shareholders and to equity-classified perpetual bond holders.

Issued on 15th March 2017, the equity-classified perpetual sukuk (perps) under Malakoff’s wholly-owned Tanjung Bin Energy Sdn Bhd (Tanjung Bin Energy) amounts to RM800 million and carries a distribution rate of 5.9% per annum. This translates into annual profit distribution of around RM47 million, which will rise to RM55 million when the distribution rate is stepped-up from 2024 onwards, although Tanjung Bin Energy has the option to redeem all or part of the perps by then.

Compared to the group’s consolidated profit of around RM300 million per annum, the distribution to perps is significant but not enough to warrant immediate attention. The issue lies in Malakoff’s payout ratio and how the company communicates its dividend policy.

With its ordinary share dividend payout being based on consolidated profit attributable to owners of the company, Malakoff has not taken into account distributions to perps holders, who are also considered owners of the company. This exposes the company to the risk of overpaying ordinary shareholders.

In fact, deducting distributions to perps holders, Malakoff has paid out 104.0-120.9% of its annual profit attributable to ordinary shareholders over 2017-21. Since payout ratio is an indicator of dividend sustainability, investors should hence expect lower payout in the future.

However, as Malakoff has been reporting its payout ratio based on profit attributable to owners, the figure shown in annual reports was lower at 87.0-100.0%, or an average of 96.6%, over 2017-21. This means that the payout ratio would not have served one of its main purposes.

The misleading figure, which is adopted by the media and some analysts, could lead to market complacency. An unexpected cut in annual dividend per share may thus impact Malakoff’s share price: to adjust for a one-cent cut, which corresponds to the amount of distribution to perps, Malakoff’s share price would have to decline by 20% to match its prevailing dividend yield of 8.1% based on yesterday’s closing price of 63 cents.

To investors, two questions are of particular interest: (1) will Malakoff redeem its perps in 2024 or beyond; and (2) when will Malakoff reduce its dividend payout to match its profits? Either scenario would help to reduce the risk of mispricing in the company’s stock.

Unlike Yinson Holdings Berhad that issues perpetual bonds only for interim financing during the construction phase of its projects, there is no sign that Malakoff would redeem its perps anytime soon. The perps was issued mainly to redeem a junior term loan taken out for the construction of Tanjung Bin Energy’s coal-fired power plant in Johor, which had started commercial operation back in 2016. Refinancing the perps with debts may also lead to a breach in Tanjung Bin Energy’s debt covenant to maintain a debt-to-equity ratio of below 80%.

If so, the accounting impact from overpaying dividends could be worth exploring for insights into answering the second question.

A depleting buffer

While not noticing the distribution to perps holders, at least one shareholder has asked the right question during Malakoff’s 15th annual general meeting held on 28th April 2021, as shown in the excerpt below:

Question: Why is the accumulated loss [for financial year 2020] increased to RM348 million from RM237 million when the total comprehensive income registers a profit of RM226 million? Dividend paid out more than profit?

Answer: The accumulated losses were impacted by FY2020 interim dividend, FY2019 final dividend payout, dividend on Sukuk Wakalah and certain re-measurement of defined benefit plan liabilities. Our dividend payout in respect of FY2020 is 87% of PATMI.

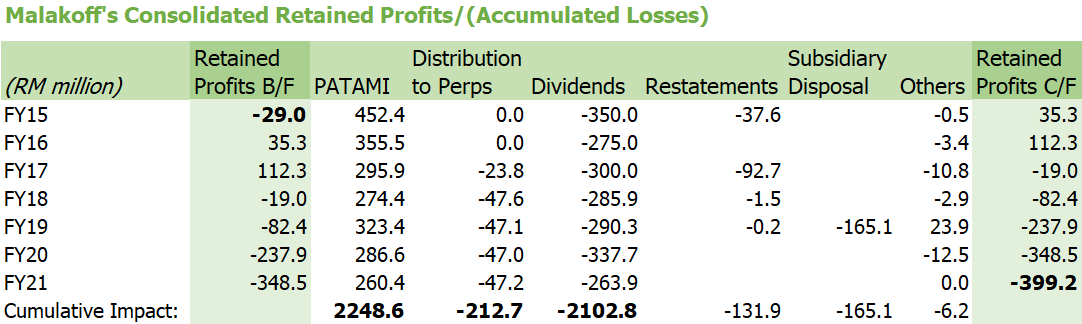

As observed by the shareholder, Malakoff’s consolidated accumulated losses have indeed widened due to dividend payments, although the management’s quotation of PATMI (which equals to profit attributable to owners) -based dividend payout ratio did not help to confirm his suspicion.

Since 2015, the accumulated losses have risen by RM 370 million, even though it should have declined by RM146 million instead if only cumulative profits and dividends paid are considered. Nearly half of the differential could be explained by distributions to perps holders.

As widely known, retained profits serves as a buffer for companies to declare dividends during low-profit periods.

In particular, section 131(1) of Companies Act 2016 states that a company may only pay dividends “out of profits of the company available.” This means that Malaysian companies may only distribute their current-year profit and/or retained profits from previous years. A stricter interpretation to allow distributions only when there is retained profit (after including/deducting the current-year profit/loss) had been proposed in 2013 but was abandoned.

If Malakoff has already been recording consolidated accumulated losses since 2018, then how and for how long could it maintain dividend payments that are larger than profits?

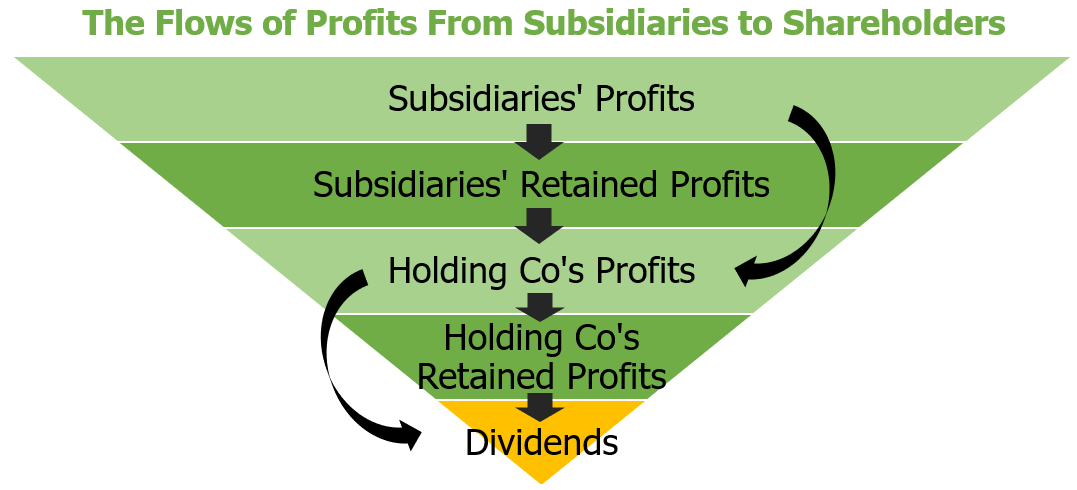

While the trend in consolidated accumulated losses does indicate Malakoff’s dividend-paying ability over the long run, the equation is more complex. Legally, ordinary shareholders’ dividends are paid out from the holding company’s profit and retained profits; subsidiaries’ profit and retained profits only affect their abilities to pay intra-group dividends to the holding company, which in turn drive the holding company’s profit.

In addition to the profit requirement, dividend declaration by any Malaysian company is also subjected to a solvency test as per section 132 of Companies Act 2016: directors may only authorize a dividend when they are satisfied that the company is able to pay its debt due within 12 months after the distribution. Coupled with other covenants and factors faced by some companies that may restrict their dividend-paying ability, the flow of profits from subsidiaries to a holding company may not be as straightforward as it seems – the holding company’s profit and retained profits play a relatively important role in determining dividend payments to ultimate shareholders.

In light of the minimal profit recorded by its holding company, Malakoff’s ability to pay above-earnings dividends could hence be attributed to its holding company’s retained profits that was boosted by huge dividends totalling RM 3,658 million drawn from the retained profits of performing subsidiaries such as Segari Energy Ventures (contributed RM 1,875 million in dividend), Teknik Janakuasa Sdn Bhd, and Tanjung Bin Power Sdn Bhd (contributed RM 585 million in dividend) in 2013. This coincided with the year when the Companies Commissions of Malaysia proposed a stricter interpretation of profits available for distributions.

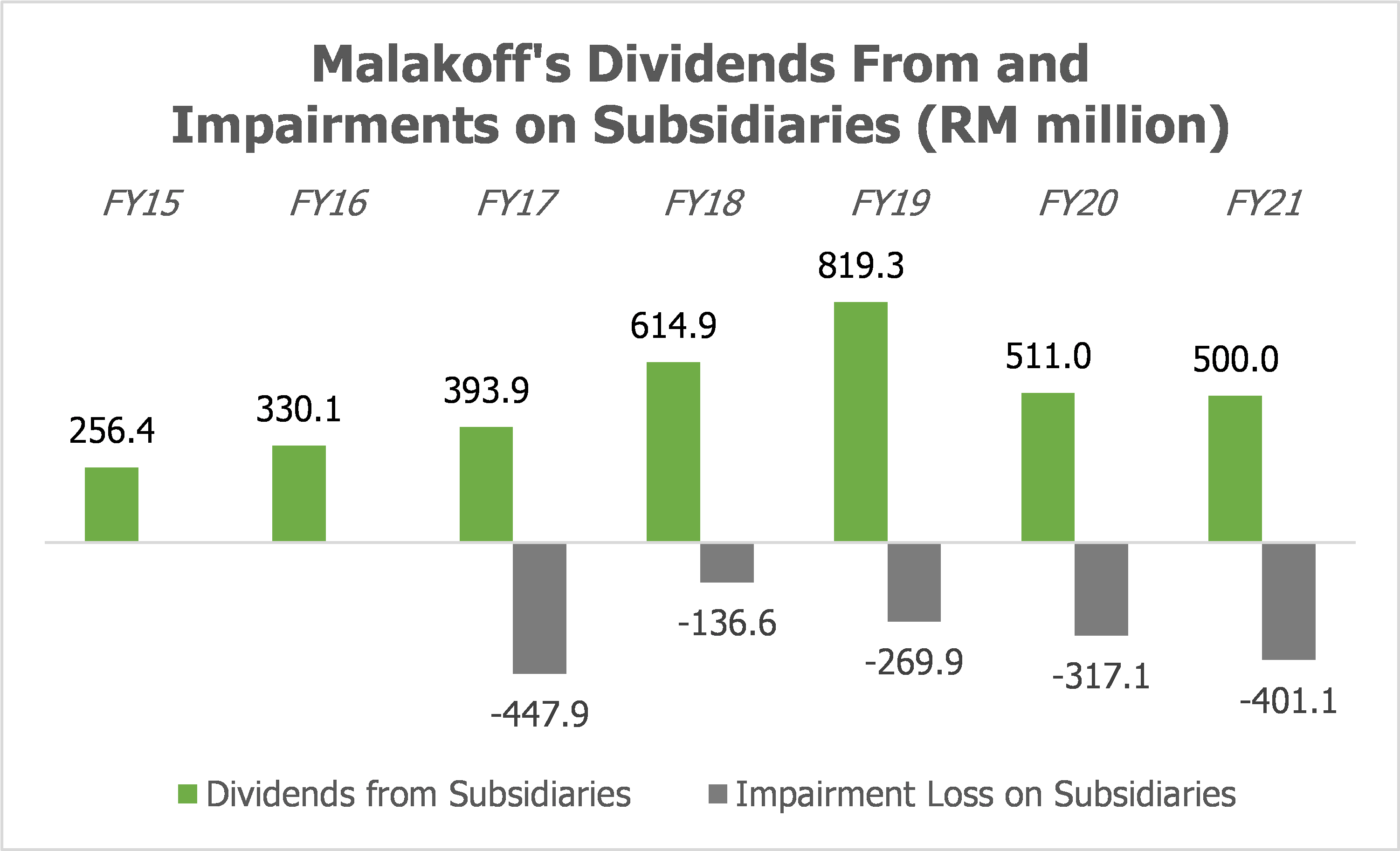

Yet, while Malakoff’s consolidated accumulated losses are widening on distributions to perpetual bonds, its holding company’s retained profits are declining even faster. The holding company’s revenue is basically dividends from subsidiaries, while its main operating cost is administrative expenses.

The lingering ghost

Since 2017, the profit of Malakoff’s holding company has shrunk considerably (relative to profits in the first two years of listing) due to impairment losses on investments in subsidiaries. Coupled with impairment losses on investment in an associate and on financial instruments, retained profits halved within five years.

Replying to a shareholder’s question regarding the decline in holding company’s retained earnings during Malakoff’s 12th annual general meeting held on 26th April 2018, management has affirmed that it was due to “the impairment of the Company’s investment in certain subsidiaries and associates which no longer match the value of its investments.”

Since impairments should be non-recurring, the persistence of such items on the holding company’s income statements since 2017 is unusual.

One possible explanation stems from Malakoff’s accounting policies on investments in subsidiaries, which are measured at cost and for which impairment testing is done predominantly on those with 10 years or less in the tenure of their power purchase agreement (PPA).

Should these subsidiaries underperform, there is risk that the decline in their fair value is not reflected via impairments before the last 10 years of their power purchase agreement. This is a valid concern in view of the consolidated accumulated losses, which reflect the deficiency in performance (since consolidation) of Malakoff’s subsidiaries. The bulky impairments seen in 2017 and 2021 support this proposition, since they were likely linked to Segari Energy Ventures Sdn Bhd (PPA expires in 2027) and Tanjung Bin Power Sdn Bhd (PPA expires in 2031) respectively.

Unfortunately, details are scant on Malakoff’s impairment assessment of its investments in subsidiaries, the book value of which has been highlighted as the key audit matter by KPMG in 2017-19. Still, a convergence between the consolidated accumulated loss and the holding company’s retained profit position could be expected as the carrying value of these subsidiaries gets converted into profits or losses with each passing year in PPA.

A buried treasure?

Since consolidated retained profits/accumulated losses do not include profits or losses incurred by a subsidiary before the holding company came to own it, Malakoff’s subsidiaries may still record retained profits on their respective balance sheet despite the accumulated losses post-consolidation.

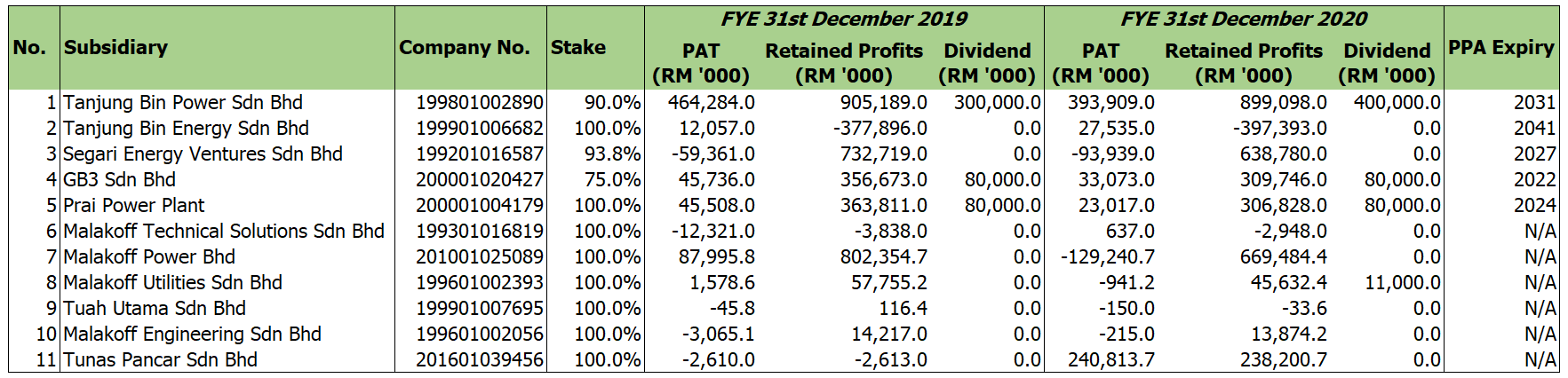

A search in the database of Companies Commission of Malaysia revealed that this is true: most directly-held subsidiaries of Malakoff still have substantial retained profits as at December 2020.

In this case, could the holding company withdraw these retained profits via dividends, much like how it did in 2013?

Assuming there is no issue with the solvency test and debt covenants of these subsidiaries, intra-group dividends that are above earnings are definitely realisable. However, it is risky to assume that these “special” dividends could subsequently improve the holding company’s profit and be distributed to shareholders of Malakoff.

With consolidated accumulated losses, retained profits of these subsidiaries are mostly attributed to their previous shareholders who sold them to Malakoff. Hence, Malakoff’s cost of investments in these subsidiaries, as discussed above, should have accounted for their pre-consolidation retained profits. “Special” dividends from subsidiaries, while will increase revenue of the holding company, may thus also result in an offsetting entry in the form of impairment losses on investments in subsidiaries.

How long can generosity last?

Given the current depletion rate in the holding company-level retained profits, it is relatively safe to say that Malakoff may have to reduce its dividend payout ratio in around 10 years’ time: dividends would grow slower than profit growth and fall faster than any decline in profit by then.

More worryingly, a reversion in payout ratio may not stop at 100% of profit attributable to ordinary shareholders, even if management do not wish to conserve cash for future investments. This could happen when the holding company continues to record impairments on investments in subsidiaries (balance of RM7,528 million as at end 2021) after its retained profits (balance of RM1,992 million) are depleted, resulting in a profit that is lower than the consolidated profit unless it could tap into the retained profits of subsidiaries without worsening those impairments.

For the sake of communications and dividend sustainability, the management of Malakoff should hence consider to at least rebase their payout ratio to consolidated profit attributable to ordinary shareholders. Generosity in paying dividends is praiseworthy (when considering the overabundance of value-destroying cash hoarders on Bursa Malaysia, and ignoring Modigliani and Miller), but overdoing it is not.

*This post was written as an extension to my previous discussions on the accounting treatment for equity-classified perpetual bonds. As at the time of writing, I hold 100 shares in Malakoff Corporation Berhad.

*For follow-ups, see my post titled “Malakoff Corporation Berhad – Part 2: A Gap in Understanding the Gap,” and The Edge Malaysia's article titled “Will perpetual sukuk affect Malakoff’s generous dividends?”

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Lorem ipsum

Created by Neoh Jia En | Feb 02, 2024

Created by Neoh Jia En | May 29, 2023

Created by Neoh Jia En | Feb 10, 2023

Created by Neoh Jia En | Dec 30, 2022

Discussions

not an issue ... malakoff has reduced its dividend payment to ~3sen from ~6sen since 2020

2022-04-15 14:25

hng33

YTL Power > Malakroff

2022-04-15 12:42