(CHOIVO CAPITAL) The Art Of Gambling in Speculative Stocks.

Choivo Capital

Publish date: Sun, 28 Jan 2018, 04:28 AM

For the most part, I come from an investor's perspective. And my current portfolio reflects that.

However, this means that i usually miss out on the “Goreng” or speculative gains, and also the “Goreng” or speculative losses, which also tend to be more extreme.

Why is this the case? Why do speculative companies go up and down by a higher percentage?

In my opinion, this is because, the companies that usually gain in the most (marginally) in terms of market capitalisation (share price) in turnaround scenarios of once forsaken industries, tend to be companies which have either incredibly speculative capitalisation structures or high operating cost.

This is quite the interesting paradox, as one would think that a well managed and well capitalized company should take better advatage of this.

However, in the event of a downturn these "rubbish" companies also tend to fall the most. Which makes sense?

This was a phenomena confused me a little, and so i decided to dissect and understand it further. Espeacially since, from what i have observed in i3, the top performers of the last few years, Ooi Teik Bee and Icon8888, tend to like or recommend these quite a bit.

What is a speculative share ?

In my opinion, these shares usually have one or more of these characteristics. And it is precisely because they have these characteristics, they often prove to be bad investments over a long period, espeacially if one overpays.

1) They have speculative financial structures.

This means that the company is often very heavily levered. Where the, EV or Enterprise Value (Market Capitalization + Borrowings (Loans and Bonds) + Minority Interest – Cash and Cash equivalents) of the company, consist of 30% or less of the market capitalization.

With the remaining 70% or more being made up of either senior securities, such as bonds, sukuk issues. Or, borrowings and loans from banks.

2) These are companies that have very high operating cost or bad cost structure compared to the rest of the industry.

For example, the average palm oil company might have an average cost of RM750 per tonne, this company on the other hand have a cost per tonne of RM1,000

3) They tend to be penny stocks and worth less than RM1 per share.

Now, there is a very special distinction you must make sure to identify.

It needs to have fallen into becoming a penny stock.

Not because there was a share split, or was issued at less than RM1 recently etc etc.

Why the gains much higher when compared against good companies over the short term?

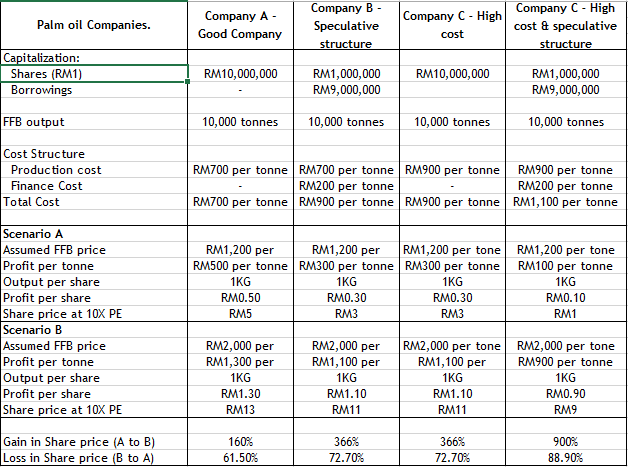

Referring to the table above, one can see that it’s as if, the more “rubbish” the company, the higher the speculative gain!

Let’s analyse it down section by section.

Now remember, this is a speculative venture into speculative shares. So one would have to abandon the value investor perspective (I'm inoculated since birth against this unfortunately... or fortunately?), and instead of looking at shares as fractional ownership of a business, one now has to look at it as a bet in a casino.

1) They have speculative financial structures.

From a gambling perspective, if one thinks that, for example, that oil prices are going to in a significant manner over the next few months, the best companies to bet on are the companies with very high borrowings.

Why? Because in this case, the majority of your bet is financed by the banks!!

While the majority of the profit that may materialize due to higher oil price, belongs to you, the shareholder.

If the enterprise value of the company consist of 10% market capitalization and 90% borrowings. It’s as if the banks are funding and taking on 90% of the risk for your gamble.

As an equity holder who bought in at that valaution, it’s a heads I win, tails you lose situation. One of the very few moments you have in life you can screw over and take advantage of a bank.

Let’s look at MASTEEL, a speculative stock recommended by one of the best speculators in the KLSE, Ooi Teik Bee.

In March 2016, continuous losses have caused it to hit a low of RM0.3. At that point, it had market capitalization of RM95 million and net borrowings of RM340 million. Enterprise value consisted of 22% market capitalisation, and borrowings 78%. The banks were effectively financing and taking on 78% of the risk of your bet.

Quite lucrative.

When he first recommended it at RM0.5, I’m guessing in June 2016? Not too sure as I don’t subscribe to him. The company had just made its first profit in 2 - 3 years.

Net debt was still RM340 million, but market capitalization have now risen to RM158 million. At this point, enterprise value consisted of 32% market capitalisation, and borrowings 68%. Not as lucrative, but still pretty good.

From what I know, it’s still in his Miss Universe list today.

At today’s price of RM1.68, market capitalization is now RM530 million, with net debt at RM324 million based on latest quarterly report.

In this case, if you are still gambling, the banks are now only financing 32% of your bet, with you paying the remaining 68%.

At this price, it is no longer that attractive as a bet, but may still be acceptable as an investment. And as such, one should sart thinking of it in investment terms.

From that perspetive, considering the rise in earnings, the drop in debt of just RM16 million is pitiful.

And even if we assume that earnings remain the same as the previous record quarter, it would take around 4 - 5 years for the company to clear its debts. I don’t believe that steel price is going to stay at this level for 4-5 years, and that no competitors will come up.

For the record, until 2017, MASTEEL have never made more than RM30 million per year. What has changed then?

Well, Ooi Teik Bee did say that the prices of steel bars in China is now actually higher than Malaysia.

I am not sure how true that is, but that was due to forceful capacity rationalization to reduce pollution. These factories may very well start up these excess capacities again. And, lets not forget Ancelor Mittal in India. Steel can still be shipped.

The economy is dynamic, prices of commodities or cost based items do not stay high forever. At this current price, i’m not that sure if it still deserves to be in his Ms Universe list.

2) These are companies that have very high operating cost or bad cost structure compared to the rest of the industry.

A rising tide lifts all boats. As we can see in the table above, the marginal difference due to positive developments, is much higher for a rubbish company than a good one.

Lets use a student as a metaphor.

The rubbish company is like a student, who is failing in Bahasa Melayu SPM and cannot go to University. To suddenly being able to go to Sunway University, because he asked for a remark and passed then.

That is a huge difference job prospects etc.

While the good company, is a like student who was able to go to National University of Singapore, but suddenly got accepted to Harvard. He is still a top performer either way. His prospects is now just slightly better.

Also, the first student was probably more underestimated than warranted, and the first may have been a little overestimated to begin with.

3) They tend to be penny stocks and worth less than RM1 per share.

There was a study that was published in the April 1936 issue of Journal of Business of the University of Chicago.

It observed that in bull markets, low priced issues tend to rise faster than higher priced issues, and in bear markets, they tend to drop alot more as well.

Psychologically, its easier for a RM0.3 stock to rise to RM1. Compared to a RM30 stock rising to RM100.

Remember, you are speculating here. So sentiment and detachment from logic matters.

A value based critique of this approach.

Looking at shares as fractional ownership of a business.

If one were to purchase a business in full, one would be taking into account the loans held by the company and if it’s capable of paying it back.

One would also look to see how good the company is compared to its competitors, and ignore price per share, while focusing instead on the value of the company.

This speculative approach, completely discounts and ignores that.

The speculator does not care if the profit/cash ultimately goes to the banks or the investor. He just wants to see the higher profit figure.

The speculator does not care about the long term prospects or earning sustainability of the company. Good times and high prices never last as the market is dynamic.

The speculator wants to ride the train of goreng. Where high P/E is given to companies that have a temporary record earning., before the sudden fall when earnings go back to normal. Optimally, before that happens, the speculator hopes to be long gone by then.

The Bursa is full of companies who have risen to incredible highs, with incredible p/e’s given to the record high earnings of mediocre and cyclical companies, before the inevitable crash or drop.

One can see it every day in the comments that ask "I chased high, now i stuck, what should i do?".

As always, when speculating, thread with additional caution. Never forget that you are a speculator.

A probability of a disaster goes up when a speculator mistakes himself as an investors and puts the vast majority of his or her net worth into such speculative stocks.

One would not take 70% of your net worth, or worse borrow money to go Genting, and likewise, one may very well be a fool to put more than 20% of your net worth or go on margin into MASTEEL.

Anyway, for the gamblers out there, at todays prices, a bet in SAPRNG is 24% financed by market capitalisation and 76% by the banks. Might be worth a punt.

Personally, im probably staying away. Its too hard to determine the value of its intangible assets and oil/gas reserves.

Cheers

====================================================================

Facebook: Choivo Capital

Website: www.choivocapital.com

Email: choivocapital@gmail.com

More articles on Choivo Capital

Created by Choivo Capital | Dec 09, 2020

Created by Choivo Capital | Dec 05, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 03, 2020

Discussions

Please read the below link.

https://klse.i3investor.com/blogs/koonyewyinblog/145620.jsp

Quote

With due respect to Mr Ooi Teik Bee who follows his FA and TA system so rigidly that he would not buy Jaks because it does not comply to his buying principle.

Unquote

It is very clear Ooi Teik Bee will not recommend speculative stock.

Thank you.

Ooi

2018-01-28 10:38

This quy is up to something....talking lots of rubbish disguised as an analytical piece...probably wants to scoop on the cheap as result of panic selling after reading his article...well scums come in all form without substance...

2018-01-28 10:41

Jon Choivo, pls provide your analysis why MaSteel is a speculative stock. Pls provide detail analysis. Don't just talk. Very disappoint your standard drop to longkang level.

2018-01-28 11:39

Dont know about presently.. but Masteel financial statements got craps previously... if not mistaken auditors qualified its value of inventories... tainted history on integrity

2018-01-28 11:55

Mr Ooi,

Lets get a few things straight. I respect you quite a bit. When it comes to your picks, at least the ones that get publicized. I make sure to study it in depth.

And as a sign of respect, i will reply you thoroughly

Just because one is a speculator with some investor mindset, does not mean one cannot get the kind of track record you did.

Richard Dennis, one of the best commodities speculators in the world, turned USD1,600 (actually only USD400 was used since he paid USD1,200 in fees for a seat at the exchange), into USD 1 million in just slightly over 3 years. A far better record than yours!

And just because one is a speculator, does not mean one is inferior to an investor. A market must have both.

I would consider you as one of the most best, and most thorough speculator in i3.At least among those known in the public sphere. The depth of your research is quite good for one, at least in KLSE.

How do we differentiate between investing and speculating? Often the lines between them are so incredibly blurred. For some clarity lets ask Graham and Dodd, the fathers of value investing.

"An investment operation is one which, upon thorough analysis, promises safety of principle and a satisfactory return. Operations not meeting these require are speculative."

Wow, this is still quite blurred. One could very much argue that you still fall into the realms of investor. Well lets ask further. What is intrinsic value?

"The value which is justified by the facts, e,g, the assets, earnings, dividends and definite prospects, AS DISTINCT, let us say, from market quotations established by market manipulation or distorted by psychological excesses"

Well considering that, in your own words, you rely on TA first. You clearly do not meet the second when it comes to establishing intrinsic value. As you do rely on sentiment first and foremost.

In any event, track records over such short period means nothing. The only somewhat reliable short term test, is how you perform during a recession, when the tides recede. I would like to see your record then. Would you hold if the price of MASTEEL drops 80% over 3 days? Are you that confident of your assessment in its intrinsic value?

I know i am for my holdings.

Let me simplify it by giving you a rule of thumb that i use for myself when determining if its a speculation or investment, and if i would buy it.

If you were as rich as koon yew yin, or lets say, richer than him. And you have a few billion in the bank.

Would you privatize Masteel at the current price? Would you pay the 540 million AND take on the 314 million in debt? With its future profits being the only way you would get your money back? I doubt it.

You are only recommending it because it fits your profile for sentiment and short term prospective earnings, and you intend to earn your keep by selling it off to others once your target is met, and not through the prospective earnings of the company.

I'm sure that if you were rich enough to be able to privatize a company at current market prices, you would prefer say, Plenitute, that's a very easy one, don't even need to think. Or better yet, Puncak! The cash in the company is 3 times than your investment (i personally do not hold this), or even INSAS.

Maybe we are thinking in terms of good business, instead of NTA companies. Well in that case, might as well privatize Latitude, Liihen, Orient or maybe OKA at current prices.

One would is unlikely to go and consider buying up the entire Masteel or AYH with those debt levels. Masteel have 20m in cash and 340M in debt, talk about leverage.

Unless of course, you have research that is so deep and thorough that you know for a fact the long term future for MASTEEL is just that fantastic.

You are right, i did start a fund, and i am looking for investors. But i as i wrote in my letter. The type of investor is very important.

The people who follow you far from fit this criteria. They often only know the price of a stock, and whether it goes up or not. They need a weekly update on the TA of the stock, and industry, and when the price drop even a bit, you are suddenly inundated by emails and calls asking you why the price drop.

I did get some inquiries after my previous posts, but i turned them all down. I like to sleep well at night.

KCCHONGNZ's followers however, i think some might fit my criteria! Hahahaha!

Cheers.

2018-01-28 12:42

I think Choivo has written a wonderful piece but I think any share also can speculate / trade, including blue chips

and any share also can invest, including loss making and penny stocks, it depends on what you know and believe.

2018-01-28 14:24

Dear Jon Choivo,

Extract from MASTEEL Q3 financial report.

MASTEEL Financial position as at 30 Sept 2017:

Non-current assets: RM 608,035,000

Current assets: RM 677,751,000

Non-current liabilities: RM 47,061,000

Current liabilities: RM 609,235,000

NTA: RM 2.03

The current MASTEEL price is still below the 30 Sept 2017 NTA. So is MASTEEL a speculative Stock?

If so how about SENDAI and JAKS?

Please forget about getting KCCHONGNZ’s followers you are not even half his standard. KCCHONGNZ write with facts and style, you wrote with rubbish. I would rather listen to CALVINTANENG bottom fishing then you on value investing.

Thank you.

2018-01-28 14:40

sl

with current liabilities so close to current assets....Masteel is a rather risky company with bankruptcy risk on any bad fortune.

2018-01-28 14:55

KYY has warned about the over supply of properties and over building....

to each his own, I guess.

2018-01-28 15:15

Choivo, your theory is very interesting. It is good to see someone introduce new theory on stock market.

However, it somehow seem not not make sense in business world. Especially when you mentioned that the higher the bank borrowing / market cap, the better to speculate as bank is taking higher risk.

You need to understand that, most of the loan was taken prior to the collapse of oil price. Bank would not lend them so much money if bank knowing that oil price will be dropped so much.

Just refer to swiber, kinsteel, perwaja, all of them have very high borrowing, and they end up with bankruptcy.

2018-01-28 15:22

the theory of borrowing / EV is a sound one for shareholders

bankers have their evaluations . when circumstance change, bankers change even more like taking away your umbrella.

2018-01-28 15:40

agreeable on author observation on OTB. Malaysian is result oriented instead of process oriented. OTB will still continue to thrive with tonnes of its subscribers until...

2018-01-28 15:42

Albukhary,

Precisely! You got it =) Which is why i say it is a gamble, because from an owner's perspective, its very hard to justify the purchase, but from a gambler's one. Its quite attractive.

Remember, when buying these kind of stock imagine you are going to genting, except, maybank will cover 70% of your loss and give you 100% of the gain (technically).

Its an attractive and admitted gamble.

On the borrowings part. You are also correct. Most banks borrowed the money during boom times, not taking into account reversion to the mean? Why? Greed and a lack of fear due to management being agents and not owners!

Except for public bank (and to a small extent Hong Leong Bank), the banks in malaysia are not owned by the person running the bank! So for example, as a CEO of say Maybank, my goal is to do my job in an acceptable or great manner in the medium to short term, take my fat bonus and run away.

I dont care if 5-10 years down the line the company cannot pay back the loan i give. I have already taken my bonus and go to another bank already.

Public Bank on the other hand, Teh Hong Piow holds the control and his entire net worth is in the bank. I guarantee you, any loan above RM50- RM100mil, he will look personally.

Brightsmart,

You are right. In times of boom, a lot of method work better than value investing. Momentum lah, growth lah, etc etc. But during recession, value investing works the best. And over a long period of time (10-50 years), this is the method to follow.

But lets be honest, value investing is really the only of investing. Value investing is paying less than what something is really worth.

So you could say the real worth of the book value, current earnings, or if you're a growth guy, future earnings, or if you're a venture capital guy, future market share or position in the market.

Everyone have their predilection and biases. I have never met an investor who was a growth and bull investor, up until the very peak where he disposed exactly on time. And then as the price fall, he becomes a value net net investor etc etc.

Chances are he lost a good part his gains during the fall.

As i wrote in my previous article, the majority of gains is due to large asset buybacks by the central banks of the big 4.

I remember seeing a chart, where they showed the net worth of a person who only invested in S&P500 versus the person who invested only in Fixed Deposits for 50 years. At the peak of the 2008 crisis, the compounded net worth of the person who invested in the S&P500 actually fell below that of the person who put it into fixed deposits.

Wow. Incredible.

Before the subsequent rally due to large asset buybacks that saved everyone.

Its like Datuk Quek's (Hong Leong Boss) son. He open startup, take RM15 million from daddy, burn it all but still ok in the end, since he was saved by his father.

Investing with the mindset that there will always be someone out there to save your ass is not the right way to go about it i reckon.

2018-01-28 17:19

I'm no OTB subscriber, but if I'm not mistaken, he had invested in companies like Hevea & GKent. Even if these 2 companies are not superb from FA viewpoint, they definitely don't qualify as speculative counters. As such, making a sweeping statement that OTB is one of the best speculators on the KLSE is not only inaccurate, it shows a personality that is reckless, arrogant, and most of all, ignorant.

There's just one word to describe this article - rubbish.

2018-01-28 17:23

Choivo, your theory is very interesting. It is good to see someone introduce new theory on stock market.

However, it somehow seem not not make sense in business world. Especially when you mentioned that the higher the bank borrowing / market cap, the better to speculate as bank is taking higher risk.

You need to understand that, most of the loan was taken prior to the collapse of oil price. Bank would not lend them so much money if bank knowing that oil price will be dropped so much.

Just refer to swiber, kinsteel, perwaja, all of them have very high borrowing, and they end up with bankruptcy.

2018-01-28 17:28

Here is just another kampong kid trying to make it to big time by stepping on the shoulders of OTB.In i3,we get a few dozens of these kids every year.

2018-01-28 17:32

Nobody says he never bought good companies as well.

The problem here is, there is an ugly tint to be called a speculator.

Well, if you want, feel free to call him a trader. A mid term trader. A sentiment with FA trader. A momentum trader. Or even fund manager.

But lets not jump straight to calling him a investor much less a true blue value investor.

How can you be an investor if you have a cut loss? Shouldn't the companies you like become more attractive in the event of a fall in price? Shouldn't it be called a "Buy more!" price?

It very dangerous. Imagine the last person to buy the shares in Masteel before the fall because OTB tell him the share price is cheap at 8 P/E conveniently forgetting to mention its a cyclical stock, at peak earnings and huge debts.

Unless he got infinite money and can average down to kingdom come. He will definitely make quite a severe loss. And even if he an average down, it will be a long long time before he see's a profit.

2018-01-28 17:32

George Soros is a world class speculator, and today he also hold Berkshire Hathaway. But don't forget, he is a speculator, and one that have not died in the market yet.

And here's the funnier thing, for the last few decades, he has barely speculated anymore, except with small amounts of money. The vast majority of his wealth is in long term holdings.

Makes you think.

2018-01-28 17:35

脑残的作者。please show us your TRADE record before attacking others and give unfair view on MASTEEL. Otherwise don't bullshit here

2018-01-28 17:43

you know in bursa how many company has debt even higher than the current asset? Why must say Masteel?

2018-01-28 17:46

I think you even never face bear market like OTB sifu. please don't act expert. 收皮啦!

2018-01-28 17:48

otb situ has many years of experience. you just fresh and immature in stock market

2018-01-28 17:50

So far koon bee is still the no 1 stock winning formula in bursa,whether in good FA stocks(investment) or speculative stocks...

2018-01-28 17:53

Long bar manufacturers is cyclical counter, need use cyclical strategy here, if treat all counters same and use same strategy, it cannot works

2018-01-28 18:25

cresbinvest,

You are right as well. There is a chinese saying, the old man has eaten more salt than the young man have eaten rice.

However, it would be foolish to automatically assume what your elders say is correct, and it would also be foolish to assume what the younger person is saying is wrong.

Your idea and analysis needs to stand on its own. Not on the other's reputation.

If your way of investing is by relying solely on reputation and track record. How can you criticize if a rural Malays votes BN solely based on their track record?

Every time BN wants vote, just point at KLCC and say we built that. What have the opposition built? Nothing!

It does not make sense!

CharlesT,

You are also correct. However, what is your analysis period? The last 4-5 years? OTB himself said his returns was rubbish until 4 years ago when he learn some FA from Kcchongnz.

What is 4 to 5 years in the history of the markets, very close to nothing. Especially if they are bull years.

As i said, lets see how effective this theory is during a recession. Alot of things that work during periods of good time, turn out to just be spurious correlation when shit hits the fan.

KYY also likes to sell. he was almost scared out of his wits when Hengyuan move abit. In the last few recessions, he was not in the market, allowing him to buy in then. Both for the Hong Kong crisis and the his KLSE record in the last 4-5 years.

Now that both of them appear to be 100% in the market, it would be very interesting to see their record in the next impending one.

YLR33,

Yes! Question is this. When the price have gone up 500% or more over the last 2 year. What part of the cycle are you at? The peak or the bottom? =)

2018-01-28 19:13

According to definition base on TA, the index is below 200 days SMA, it is a bear market.

In KLSE, 2013, 2014, 2015, 2016 and most part of 2017, I will consider in last 5 years, KLSE is a bear market most of the time.

Please look at the my performance in last 5 years, my performance will be measured equally well whether it is in bear market or bull market.

I considered 2015 is a bear market, I made > 100% gain on my investment. Looking at VS, Hevea, Hevea warrant. Latitud, Liihen and G kent, I made > 100%, 200% or even 300% on some of aforesaid stocks. 2015 is confirmed to be a bear market.

I am very confident, even in bear market, I will perform well. There are some stocks will perform well in bear market. I will be able to spot them.

In 2017, my performance is not very good until I found Hengyuan, I made > 100% gain on Hengyuan. I have the ability to win big on Hengyuan because I found it both good in TA and FA. I buy big on Hengyuan.

Thank you.

Ooi

2018-01-28 19:55

Posted by Ooi Teik Bee > Jan 28, 2018 08:22 PM | Report Abuse X

The last 4-5 years? OTB himself said his returns was rubbish until 4 years ago when he learn some FA from Kcchongnz.

Ans : The above statement is not true.

I had done very well since 2009. I had made big gain from Gamuda-WD.

My performance was even better after I learned some of FA from Mr KCChong Sifu.

Thank you.

Ooi

2018-01-28 20:25

This kampong kid sure can write well.But bursa is not about theory,bursa is a battleground.One need real war experience to survive.Suggest you go apply to one of the local uni college for job.Maybe you can curi makan with your half baked theories.

2018-01-28 20:29

Dear Mr Ooi,

On the statement with KCC, i'm fairly certain you said something to that respect in one of your comments i read a long time ago. But i'm not going to argue that point or find the time to go find it again. Consider it my mistake.

You have done well since 2009?

Well, so did my mom who took out all the money in 2008 to buy a house, and just started buying after the crisis. And her style is very crude, just see if she knows the name of the company, and roughly whats the average historic price of it based on her experience. If the price is low, just buy every month, no need to think, don't even need to read annual report.

With respect, 2009 to now is a bull market. Every bull market have their minor bear moments, every bear market/recession have bull moments.

There were even bull periods in the recession of late 2007 to 2009.

In 2007, after the initial fall of some CDO's, the federal reserve governor said that the impact is limited, and there was a few weeks of constant rises, where EMA was probably positivetive.

Until the fall of Lehman brothers, when it drops again, before the federal reserve governor say, it is only limited to Lehman due to Lehman being more risky. That there is no systemic risk. So market go up again, cause people not see got discount!

Until they take Bear Sterns out on the street and shoot it in the head. Oh boy the suddenly, definitely got systemic risk and everyone die for you to see.

I am not denying the brilliance of your bet on Masteel at 0.5, or that it was the best among all the rebar companies.

Yes you made 100%. But i doubt the people who buy Masteel now will make 100% (especially over a 5 year period), i may very well be wrong.

I can think of a lot of your Ms Universe picks who, if your followers buy late (despite it still being in the list), they will have lost money.

What i really want to see, is your returns from 2009 to 2030. I hope you really are that good, and all your followers become very rich. But in my own humble perspective, i'm not that certain. Again, i may very well be wrong, and i hope i'm wrong. Its sad to see people lose money.

On you being a speculator or whatever nice things others or you want to call yourselves, Trader, momentum trader etc.

I stand by it. The concept of cutting loss and letting your winners run come fundamentally from a gambling perspective. This was appropriated into trading in equities or commodities. Why? Because in these scenarios, the fundamentals means very little, but the movement in price does. Which makes it very much like gambling.

The investor is someone who buys more and more as prices go down, and sells more and more as prices go up.

A trader or speculator, attempts to time the market, to buy it when prices have moved up already (but before the boom), and to sell when prices are starting to move down (but before the crash). This can often work in the short term.

But it fails in the long term, or when capital is too much. Doing it consistently is the difficult part. I can barely think of one more other than George Soros who did this, and even he stop doing it d.

Good luck. i hope you keep making you and your investors more money.

2018-01-28 20:57

No need fight. Show yr prove track record. If no track record say wat also no use.

2018-01-28 21:04

FA or TA , no problem , as long we make money , nothing wrong with being a speculator , or investor , at the end , it's still a bet .

2018-01-28 21:17

True. There is nothing wrong. Every market need a speculator, if everyone like warren buffet kiamsiap as hell, market no need exist d.

But its important to know the pro and cons of your position. Which people often do not.

Posted by simplasimon > Jan 28, 2018 09:17 PM | Report Abuse

FA or TA , no problem , as long we make money , nothing wrong with being a speculator , or investor , at the end , it's still a bet .

I'll show it to you when it becomes meaningful, with both bull and bear periods. I think in 2023 - 2025. We should have had 1 or more years of bull before the crash.

In any event, i show you also no point. Its not like you're paying me RM1,000 for a subscription, nor am i asking you to invest with me.

I'm also primarily process based. So if that is your first question, not that interested in you as an investor d. Its a question i expect to be asked by my investors, but only at the end of the discussion.

Posted by Babihutan88 > Jan 28, 2018 09:04 PM | Report Abuse

No need fight. Show yr prove track record. If no track record say wat also no use.

2018-01-28 21:29

Jon u only kena identify urself as investor or speculator only if u r setting up a fund for identification purpose untuk pelanggan tahu u investors fund or speculative fund. Orang sendirian buat apa limit urself to investor or speculator? Hybrid je

2018-01-28 21:47

Yg penting make profit. Ikut je perangai share tu. Klau speculative share u speculate. Klau investment grade u investlah.

2018-01-28 21:50

Yg real master sifu maestro xda gerakan gerakan dgn nama nama bombastic. Ikut hati je

2018-01-28 21:58

ok ah jon, gooding. You can't deny that OTB sifu has an edge, and it is not gamble when the sifu has an edge on the market and he consistently profiting from the market, not 10%, 20%, but >100%.

I agree that if we want to measure by 'investor' yardstick according to Graham, we all failed that category. In fact, we can rename this place as i3gambler.com.

The concept of cutloss is not from gambling, but from trading as a business. I suggest you to read more on what professional poker, trader has to say about their own business. A gambler will lose his money because he is a gambler. In fact, an investor may also risk lose a great sum of his money if the company fails to live up to the expectation down the road.

See Buffett. He admitted wrong on IBM, sold Disney too early, and burned himself in some other cigarbutt's trade. He too sold early, not giving the time like 10, 20 years for things to marinate. So to define the word 'investing' strictly on Graham's sense may not be helpful, because situation changes so fast that even an investor runs for the exit when shtf (read coldeye when he says just dump quick to the buyer when crash came).

Whatever the intention of your article, I guess it has already sparked some conversation here. I may be interested in your fund. Keep it up to post helpful stuff for the i3 community, give OTB sifu the respect by letting him to define who he is.

As for masteel, alex sour grape in out kena burn 1.5x, now train jalan d.

2018-01-28 22:17

A gambler goes on until he eventually loses all, an investor knows when to cash out his chips.

2018-01-28 22:52

bro contrarian,can u post the 40 stocks recommended by focus magazine? I was busy to go and buy a copy today

2018-01-28 23:36

it's sad to see that a young person who sounds brilliant yet shows such narrow mindedness. hate to see talent get wasted so some advice below, whether you understand and/or accept is up to you.

1. in life, attitude and interpersonal skills often are more important than academic brilliance, i.e. EQ>IQ. of course, best case is to have both

2. labeling others is dangerous especially when you don't know them well. this is also often an act of arrogance, thinking you can put complex personalities into categories

3. technical trading is not just about charts and indicators. good traders would know it's about market psychology. last I checked, psychology is still a globally accepted university subject (but I never think it's exact science, because humans just don't behave all the same). again judging something without spend time understanding it is reckless

4. all stocks will suffer in a crisis, just the extent of it. you may think that your stock picks will survive it but you forgot all your assessments were done based on pre-crisis assumptions. during real crisis, say blue chips like Nestle could also fall 80% because nobody can be really sure of when economy and consumption will rebound. and also partly because in crisis, unit trust and ETF investors will redeem their investments and fund managers will be forced to liquidate the holdings. so to think that fundamental picks will survive crisis is just naive

5. surviving a crisis cannot settle who is superior between fundamental and technical investor. so what if a trader sees signs of market peaking and sold all his shares early while you keep averaging down until almost bankrupt as the market tanked 50%? his process better than yours? traders > fundamental investor? every crisis there will be investors and trader who go bankrupt

6. investing is better practiced than preached. it's not all about the intelligent investor or fundamental value investing. one may argue that ultimately everything can be classified as high or low risk investing. then it's all about risk-adjusted returns. if others are taking slightly more risks yet get significantly higher returns than you, you are simply not as good as you think

7. The biggest flaw for fundamental value investing is assumptions. I am a fundamental investor and I love this great quote "investing is a probabilistic decision based on imperfect information on an uncertain future". that's why there will always be different views of what is the fair value of a company. so if you think the company is worth RM4.00 and today it's RM4.50, so you sell as you think it's overvalued and would revisit if it falls below RM4.00. I may think it's worth RM6.00 and so now I would label you as a trader who try to time the market, would that be fair?

8. Managing other people's money is totally different ball game and learning on the process is simply reckless and irresponsible. if you haven't been able to manage your own money well, then don't take others' money as you may discover one day you might lose more than just money. there's no set criterias to meet before you manage others' money but based on this article, maybe not yet

2018-01-29 01:17

Half truths about value investing. Sound like a typical young inexperience investor who just finish reading a few investment books.

2018-01-29 09:20

Ooi Teik Bee

Post removed.Why?

2018-01-28 10:25