(Icon) How To Get Rich By Investing In Bursa Malaysia

Icon8888

Publish date: Tue, 12 Jun 2018, 05:12 PM

1. Be Realistic About Your Goal

Every now and then, you will hear people tell you wild stories about how much they had made from stock market over past few years. For example, Uncle Koon always boasted about his few hundred percent gain for Latitude, VS, etc. I do not doubt his performance (properly documented afterall). But I don't think everyone should aim for such kind of return. There are certain unique factors that allow Uncle Koon to do so well (access to insiders, Koon Bee effect, etc). Most of us do not have such resources.

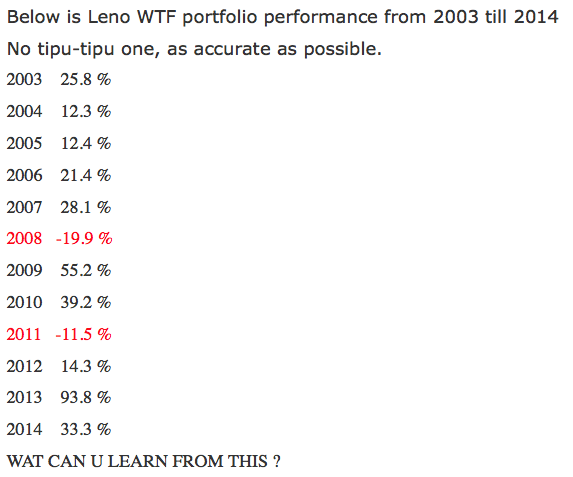

I believe the following forum member's performance is more achievable for ordinary people like us. It was posted on i3 few years ago. I liked it so much that I kept a copy of it.

http://klse.i3investor.com/blogs/WTF/67575.jsp

Key observations :

(a) No need to aim for super return. If you can achieve 10% to 20% return per annum on average, you are doing well.

(b) Don't be afraid of Market Crash. In 2008, the above author posted a loss of 19.9% (Global Financial Crisis). But he / she recovered in the subsequent year(s). It is common to experience losses during bear market (like now). Everybody also makes losses during bad time. You can't avoid it. One thing good about Bear Market is that when your portfolio shrinks, other people's portfolio also shrinks. Meaning that THERE IS PLENTY OF OPPORTUNITIES TO BARGAIN HUNT. So if necessary, reshuffle your portfolio to rope in stocks with better short term potential. When the market recovers, your portfolio will naturally recover. In a certain sense, the losses are temporary.

What you should avoid is MAKING LOSSES WHEN OTHER PEOPLE IS MAKING MONEY. In other words, try to avoid risky trades that can blow a big holes in your pocket. When the market has not crashed and you crashed, it is very difficult to recover.

2. Forget About Asset Play, Focus on Earnings

One of the most famous asset play advocate in i3 is Calvintaneng. Just check out his portfolio. There are some wins, but mostly deep losses. Why is asset play such a bad idea ? Because Malaysia investors like earnings. They are attracted to companies that make money. Every time a PLC reports losses, its share price will crash big time. When in Rome, do as the Romans do. Don't go against the tide to do the opposite. Loss making companies even though trading at huge discount to Net Assets, will get cheaper and cheaper. Avoid them.

3. Forget About Moat, Ride The Cyclicals

One of the most contentious issue when come to investing in Bursa is whether you should buy and hold forever like Warren Buffett. Based on my experience and observation, you shouldn't. Malaysia is different from the US and other developed countries. In those countries, there are many companies that have moat : Boeing, Airbus, Intel, Amazon, etc. Most Malaysia companies don't have moat. Over a period of 10 to 20 years, only a handful of Malaysia companies can consistently grow their earnings : Public Bank, Top Gloves, Sunway Group, Vitrox, Dialog, etc. If you bet on the right ones, you will do well (what is the odds that you will bet right ?). But if you bet on the wrong ones, you waste 10 years, 20 years.

It makes more sense to ride the boom bust cycles. You will be surprise how often those opportunities present themselves :-

(a) 2010 to 2014 - oil and gas (Sapura, Uzma, etc);

(b) 2015 - export (Thong Guan, Poh Huat, Hevea, etc);

(c) 2016 - Aviation (Air Asia);

(d) 2017 - Technology (MMSV, JHM, etc), steel (Ann Joo, Lion Ind, Ssteel, etc) and refinery (Hengyuan, etc).

(e) 2018 - ???

Just to make my point clear, if you are riding boom bust cycles, you need to cash out before the busts set in. No permanent holding. Just like what one prominent businessman once famously said, "everything is for sale at the right price, except for my kids". (how about his wife and parents ? I wonder)

4. Don't Look Too Far Ahead

When you pick stocks, don't pick those that have LONG GESTATION PERIOD. Based on my experience, that is the most common way people lost money (including me). For example : YTL Power's earning will get a big boost after completion of Jordan and Indonesia power projects in 2020. However, if you buy YTL Power back in 2016 (based on those long term potentials), you would have experienced huge losses as the stock has declined by closed to 50% since then.

The same is true for WCE Holdings Bhd, which is contructing the West Coast Expressway.

The Chinese says, "when the night is long, there will be many nightmares". Long gestation period exposes you to black swan events.

5. Aim Short Term, But Be Prepared To Hold Long Term

Many of the things I mentioned above, I believe most people in i3 have already been practising them. In my opinion, one thing that many people do not do is hold on to the stocks that they bought.

I have many friends that are very good at picking stocks with short term potentials (earnings growth, etc), which is exactly what I like. However, at the first sign of trouble, they dump their stocks and run for cover.

If you continue doing that, you will be so confused and stressed that you won't last long in the market. When things don't work out as envisaged, you need to be patient. Sometime, the PLCs need time to iron out the kinks.

My comments above are not simply plucked from the air. These few months, I have some free time. So I dug out all my transactions since 2010. One thing I notice is that I had not always been successful in the stocks that I bought (meaning I sold those stocks without profit, or even at small losses). However, most of those damp squids ultimately perform, albeit after some time in the future.

So the lesson learned is very clear : buy decent stocks with potential for short term outperformance. However, if things don't work out as expected, hold for two to three years. Unless the industry has crashed big time, usually you will be rewarded.

Having said so, BUY and HOLD is not something that should be blindly applied. It is subject to one very important condition : DIVERSIFICATION, which is the next topic I would like to discuss.

6. Diversification

Diversification is one of the most under appreciated aspect of investing. Every now and then, somebody will talk about it. But not many people emphatise with it. In my opinion, diversification is very important. It has the magical effect of removing stress and risks from your investing activities.

The reason people do not take diversification seriously is because of the perception that diversification will cause your portfolio to become less sexy. Here is how.

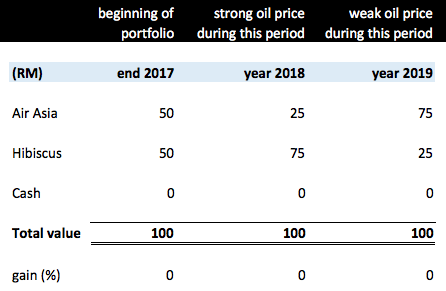

Let's say you have RM100. At the end of 2017, you invest RM50 in Airasia and RM50 in Hibiscus respectively. During 2018, oil price is strong. As a result, Hibiscus share price goes up to RM75. That is fantastic !!! However, Airasia does not do well. The high fuel price reduces its profitability. As a result, share price declines to RM25 (let's say). Due to diversification, you end up with zero return.

In 2019, the opposite happens. This round, oil price is weak. Airasia does well and its share price goes up to RM75. However, it is time for Hibiscus to suffer. Its share price declines to RM25. Once again, you generate zero return.

With your money spread out over different stocks, certain stocks' gain will some time be offset by other stocks' losses. That is what causes people to claim that diversification makes your portfolio less sexy.

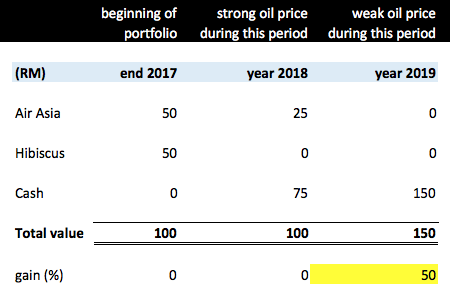

Is that claim true ? Not necessarily. Now let me tweak the model a little bit. Instead of just dumb dumb hold, I sell Hibiscus in 2018 when it reaches RM75, and I sell Airasia in 2019 after it has gone up. Now the portfolio's return looked very different - it is no more zero. Instead, the return is an impressive 50%.

Who says diversification makes your portfolio less sexy ? If it is so, that is because you have been using the wrong way to measure return.

7. Measuring Your Portfolio's Return

There is a very important lesson we can learn from the little exercise carried out above. One of the most frequently heard complain from investors is that it is very difficult to grow the portfolio. Everytime we sell a stock to take profit and reinvest the proceeds into another stock, the value of the new stock if subsequently decline, will wipe off all the gain originally made, and the portfolio reverts back to no gain. How frustrating.

Does this problem sound familiar to you ? Well, you need to change the way you measure your portfolio return. Don't put too much emphasis on book value. Instead, look at the realised gain (you can extract the information from your broker's portal). Always remember that so long as a stock is not sold, there is no loss (or gain) yet. Just ignore the fluctuation in book value, focus on the real money that goes into your pocket.

What I explain above is not an accounting gimmick for the purpose of comforting ourselves. It has a practical purpose. It allows us to ignore noises and focus on the actual return, which is the real thing that allows our portfolio to grow bigger and bigger.

Concluding Remarks

First of all, I would like to apologise to the sifus and seniors. Despite my claim of a Game Changing theory, what I write in this article is actually quite basic and based on common sense. "Game Changer" is just a marketing gimmick to attract attention.

Having said so, I would argue that simplicity is actually the strength of my investing approach. Instead of relying on what Warren Buffett and other Gurus said, I believe my approach better reflects Malaysia's market condition.

I have written several articles before about investing. However, this article is special because it covers everything from stock picking to portfolio management to perfomance measurement. I hope the information contained herein can help young people to invest their money in a proper way. That is actually the main purpose I write this article.

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Okok xuewen. Just f***ing with you. Guy wanna have fun. I mean no harm. Cheers!

2018-06-12 22:56

If you know very well that you head can not break the wall, do not do it.

Flintstone,

I know i can talk rubbish better than you but I don't enjoy talking rubbish with you

You know you can't hurt me with all your rubbish, yet you keep talking rubbish

Do you not feel very foolish doing so?

2018-06-12 22:59

You must set a good example for your children

Your children do not hope to see their father scolding vulgar words

2018-06-12 23:03

Dear Icon8888,

I have questions?

Are INSAS and TA asset paly or earning play?

INSAS earn growing profit from Inari and TA from hotel operation.

Can a share be both asset and earning play?

Thank you

2018-06-12 23:18

(Icon) Muda Holdings - My 2018 Sailang Stock

https://klse.i3investor.com/blogs/icon8888/154696.jsp

Still applicable?

2018-06-12 23:35

there is no morality in stock market.......

stock market not a church and not a law court.

the bad government of Najib created the conditions for a good run of the stockmarket 2008 to 2018.....

2008 to 2018.....stock market supported by fake money, fake news, expansionary GDP growth based on unrecorded borrowings, irresponsible government.

2018 forwards its going to be responsible government, contraction in government expenditures,

expansion phase turns to contraction phase......how are you going to handle it?

2018-06-13 01:05

sifu qqq3, that means RM will weaken against USD.....

shall we go for export stocks?

2018-06-13 01:14

the good news is foreigners holding Government bonds is only 14%....That means we can handle it, there will be no crisis, no Greek situation....and depreciation of ringgit is only a 50/50 event.

the bad news is that every thing has changed...even the strategies that applied before has to change....target prices have to reduced, 10% profits target most cases good enough, you don't sell other people will sell, stock selections more narrow, and keep the thinking cap on always.

business sense will keep you in the right stocks.....keep reviewing your portfolio.

just to make 10-15% , you have to be early and keep to the stocks with good business sense.

I do not think high NTA, or low PE stocks is of any use ..............only stocks that can attract people to keep buying is good enough to buy.

2018-06-13 01:53

improved or improving business environment is good business sense........

when Sabah bans exports of logs, who will benefit?

when no GST and no SST for 3 months, this quarter, all the car companies will have record sales.

2018-06-13 01:58

not just cars, all non perishable items (like TVs) will have record sales this quarter.

2018-06-13 03:02

4. Don't Look Too Far Ahead

it's correct, i called it growth investor. Try to look those development of new factory/production/plant which expected to complete within next 1 year and lesser , many example to prove such as JHM,Comcorp,bslcorp,kgb, few more ..within a year it will double provided that qtr rslt is improving. Another challenge would be to find the best time to sell it back. Greedy another bad chapter to cover.

2018-06-13 07:53

If there's anything Ive learned it is that people just want to be spoonfed

Hence why in the end its ultimately better to manage outside money

That said in the near-term probability of upside is tilted towards exporters - gloves, apparel, furniture (maybe) etc

You have a strong US economy and jobs data and looming Fed rate hikes coupled with the recent change in our government (lets give them some time to iron out the kinks and implement their policies...) you would expect MYR to depreciate against the USD

2018-06-13 10:21

@Icon8888 Thank you for your article

invest in bear and harvest with bull. Choose the counters intelligently and you will be rewarded handsomely.

Currently internet/technology counters gone crazy in Taiwan market. Any one can share what technology counter in Malaysia to be in the watch list? myeg?

2018-06-13 10:54

export companies faced with a lot of uncertainties. It is not going to be easy choosing the right one.

2018-06-13 11:02

Don't follow blindly. Do your own homework. Read ColdEye's books if you know Chinese. You really gain a lot of knowledge.

2018-06-13 11:03

Thks for sharing and good point "Malaysia is different from the US and other developed countries" The strategies buy on hold can used for some growth stock like Dialog, QL, AJI & pMETAL. 90% Others stock most like prescription only

2018-06-13 11:06

I guess Tun M will not let RM=4 /USD, I predict it will strengthen to 3.8. Steel counters will do very well with this as they import 90% of the raw mat

2018-06-13 11:32

Just a few opinions:

1. I agree that one should be realistic with their return instead of taking on excessive risk. But even at 15-20% CAGR can be a risky proposition for most investors.

2. How well Calvin Tan is doing with his investment aside, it has nothing to do with how well asset play is in Bursa. Imagine saying "The 100 years old uncle next door has been smoking his entire life, therefore, smoking is harmless." Calvin Tan's portfolio is nothing but one sample size. The law of small number. Using this inductive reasoning to imply whether an investment strategy i.e asset play is effective is misleading. In addition, if Walter Schloss is still alive and investing today, chances are you are going to see lots of losses in his portfolio 90% of the time. As the name imply, asset play is a game of magnitude. Frequency, you are going to see losses most of the time, but the point of asset play or cigar butt if you want to call it that name is gains from a few stocks in the portfolio should more than enough to make up the losses of the majority. And if a majority people in i3 believe in Icon and start avoiding asset play from today, won't that make asset play more attractive with higher expected value?

3. While I agree there isn't many moat in M'sia compare to US, which is common sense, that is far from saying cyclical play is an 'easy' game for most investors. How many dip their toes in O&G play right before GE13 and get killed when the bust comes? How many people ride the boom on export/furniture stocks died in 2016? And to be frank, export stocks ain't 'cyclical', that's nonsense euphoria build on currency stupidity. Things always look obvious at hindsight. To add further point, most investors are trend followers rather than contrarian, what happens when a trend followers hit on cyclical stocks? That's the quickest way to die.

2018-06-13 12:15

Icon described the nature of Bursa's rough sea behaviour...its up to the readers if they can quickly learn to surf here.

2018-06-13 12:41

ha ha...but i really appreciate Ricky's presence in i3....

we need some catalyst in i3 to stimulate thoughts

dull comments make my brain lose creativity!

2018-06-13 13:36

Just saying. I do agree with you on other points so I don't bring them up. Only raise those that is worth mentioning.

2018-06-13 13:47

Great lessons from Mahathir

Mahathir is not smarter than you and me

but Mahathir has great sense of timing and politics in his blood.

Wrote the Malay Dilemma at the right time

Left UMNO three times and each time with great timing that enhances his reputation when he returns

Keeps his ears to the ground and understands the big trends,

Loyalty to Perjuangan , not loyalty to any particular Party.

Lives long enough to come out a winner.....

Stock market the same

Don't need to be the smartest kid on the block

But you need to have a great sense of timing...and stockmarket in your blood

You have to have your own book that you can call your own, yet willing and able to review to improve your opinions, you have to keep your ears to the ground and understand the big trends.

Your Loyalty is to the Struggle, not to any external party or group,

and you do need a bit of luck to live long enough to see you triumph,

to correct your mistakes, to reinvent yourself, to try again.....

Willing to take risks , even great risks that others will avoid...taking risks is part of your Struggle. You know that failure is not the end, failure is another step to success.

2018-06-13 14:09

Tun M will not let usd=4, with the cheap money from Japan, Ringgit will strengthen to 3.8 or lower. HSR and MRT3 will be re-tender again for Japan like project in Indonesia.

2018-06-13 15:35

many roads lead to Rome.

statistically, it could be difficult to separate luck from skills......but who cares? As long as catches the mouse.

What the skills factor can do is to design the portfolio to be high beta or low beta portfolio.

Considering there are so many idiots playing the game.....surely it is believable that the game can be beat.....that a smart one can consistently come out ahead...........

2018-06-13 21:42

Rubber glove counters rise on weakening ringgit | http://www.klsescreener.com/v2/news/view/392123

2018-06-13 22:08

Semiconductor Stocks Can Still Be Massively Profitable, Despite What Wall Street Says. https://moneymorning.com/2018/06/12/semiconductor-stocks-can-still-be-massively-profitable-despite-what-wall-street-says/

2018-06-13 23:34

Microsoft Corporation and Cloud Kings Become Chip Giants

Dana Blankenhorn

InvestorPlaceJune 13, 2018

Microsoft Corporation (NASDAQ:MSFT) is getting into semiconductor design.

https://finance.yahoo.com/news/microsoft-corporation-cloud-kings-become-143408610.html

2018-06-14 09:06

Get rich investing in Bursa Malaysia? Only very few made it and even fewer kept it. You need bull market conditions to make it big taking huge bets and then have the discipline to pull up stakes when well ahead. Those I know who got real rich started a business, grew it through decades, listed it and then can play the game more on their own terms.

2018-06-14 10:41

Good take on Malaysian market and investors/traders. Hopefully our market develops further with more participants and with greater price discovery. Bloomberg Malaysia will be positive for Bursa.

2018-06-14 10:53

Most of the investors are making losses since 2015. They may have selected one or two counters that make a lot of money, but their portfolio as a whole are making losses.

2018-06-14 13:37

Orion, Netx, KimLun-W, Ambank, Orna, Muda,etc down how to be rich? Want to con us is it?

2018-06-14 13:43

The only PLC stills got 700m cash in B.S yet selling at extremely cheap after giving away special dividend is Dutaland . I think this ctr fit short term but long term holding. Other penny ctrs like ASb,ASIAPAC,FPGroup ,Handal ,Heava, INSAS,TA worth consider.

2018-06-14 16:56

Icon8888, my only question is, what is your cutloss and how you decixe as a trader.

Are you still holding muda? Did you top up? Whats your thought process then and what is it now?

Im currently in kl, do look for me on facebook if youre around and want to meet up for a coffee.

2018-06-15 04:59

Thanks Icon. Good one to share. But again to all new investors, DO NOT digest blindly. Also learn more from other experts and finally form your own methodology. Only you yourself know what you need and want.

2018-06-15 10:48

“For most of [the professional investors and speculators] are, in fact, largely concerned, not with making superior long-term forecasts of the probable yield of an investment over its whole life, but with foreseeing changes in the conventional basis of valuation a short time ahead of the general public. They are concerned, not with what an investment is really worth to a man who buys it ‘for keeps,’ but

with what the market will value it at, under the influence of mass psychology, three months or a year hence.”

- John Maynard Keynes (1935)

The malaysian markets are not that different from american ones, or other mature markets.

Humans are the same everywhere, throughout history.

If most people are spending their time predicting quarters, maybe the real edge comes from doing something else other than predicting quarters.

2018-07-01 03:40

Halite

Do not wrestle with the pig,

Both of you will get dirty

But the pig enjoys it.

2018-06-12 22:53