(Icon) Portfolio Management

Icon8888

Publish date: Thu, 31 Aug 2017, 01:03 PM

1. Angler, Drift Wood and Surf Rider

On 1 December 2015, I wrote the article "Three Ways You Can Punt The Market".

https://klse.i3investor.com/blogs/icon8888/87192.jsp

In that article, I explained that there are three ways you can pick stocks :-

(a) Angler

2. Drift Wood

(c) Surf Rider

2. How I Manage My Portfolio In Real Life

The above information is more than just theory, I actually manage my portfolio based on a combination of the 3 methods.

My portfolio comprises of stocks with 3 different investment horizon :-

(a) Immediate Term

For immediate term play, I am basically a Surf Rider. I go through newspapers, forums, analysts reports, etc regularly to identify stocks that can perform in the near future.

Some examples of Immediate Term Play are Hengyuan, Careplus (wrong pick), Crest Builder, Lion Industries, etc.

Some of the stocks perform, some don't. I am afterall just an armchair analyst and do not have insider information. Only God is perfect. I am not God.

Despite the imperfection, the performance of my Immediate Term Portfolio is usally quite good. I give credit to my participation in investing forums such as klsei3investor.com. The forum has so much useful information (blog articles, comments, analysis, etc) that I am able to have abundant good candidate stocks to pick from.

Having said so, one must have strong stomach. No matter how good a company is, its profitability might go up and down over different quarters. Sometime it takes as much as 6 months to 1 year for the stock to start performing. Downside potential can also be sizeable. This is natural because so many investors are chasing these hot stocks. Once the earning disappoints, there is tendency to rush for the exit.

(b) Medium Term

For medium term play, I see myself as an Angler.

There are many stocks that have good potential over the next 12 to 18 months. However, as Malaysian investors are short term focused, these stocks are usually ignored.

For example : WCE Holdings (highway under construction and will only be completed by end of 2018), HSL (RM2.8 billion order book expected to start contributing strong profit only by second half 2018), Supermax (contact lense business will drag down earning until probably second half 2018).

If you are lucky, the price of these stocks will stagnate until closed to the catalytic event (and then go up). If you are not lucky, negative events or negative sentiment might occur during the holding period and cause price to trend downwards. Due to absence of strong earning, the latter is very likely to happen. Most of the stocks in my Medium Term Portfolio is now experiencing losses (price has come down).

For these stocks, you probably need to adopt a different book keeping method : Stop reflecting the latest market price when computing portfolio return. Instead, freeze the stocks' value at your cost of investment. Only make provision for permanent impairment when a negative event happens and adversely impact fundamentals.

For illustration purpose : I bought WCE at RM1.50 few months ago. It has now declined to RM1.28. If I reflect this in my portfolio, my portfolio gain this year will decline by 7% from 30% to 23% (lets' say). That will make me nervous. However, if I ignore the price change (as I know WCE fundamental has not deteriorated), then my portfolio return will not be affected. Then I feel better and continue to hold on.

Am I manipulating figures to make myself feel better ? Not really. This is actually how accountants do things in real life. If PLC A holds stake in PLC B, daily fluctuation of share price of B does not have impact on the P&L of A. Only if something bad happens to B only then the accontants will step in to review and see whether there is a need to provide for impairment. We should practise the same. By eliminating the noises from daily share price fluctuation, it makes our task of managing portfolio less stressful. And because of that, it gives us the courage and confidence to make longer term investment, instead of purely involved in short term plays (short term is not necessarly a bad thing, but comes with pros and cons as explained above).

(c) Long Term

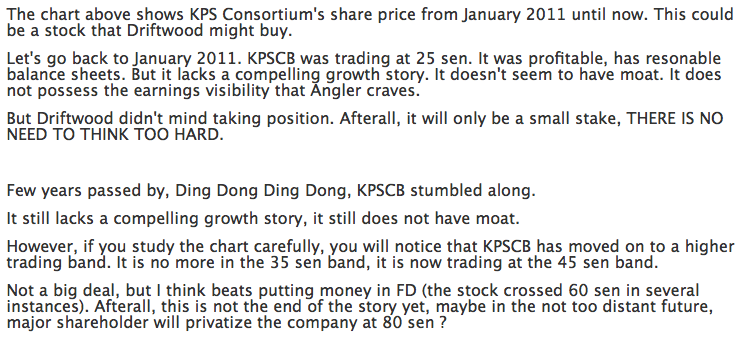

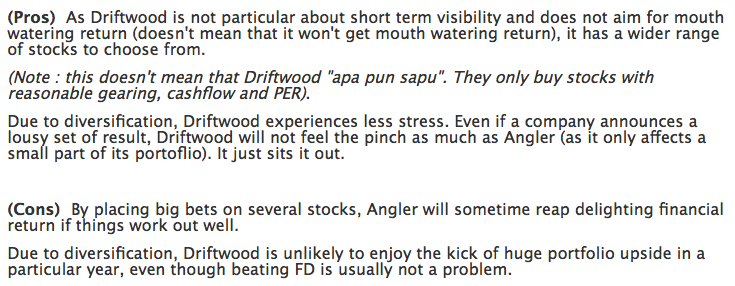

Long Term Portfolio is bascially stocks that I hold for let's say 3, 4 or 5 years. Unlike Surf Rider and Angler, I don't have insights of catalytic events that might happen in the future to re rate those stocks. Basically, it is a Drift Wood strategy of dumb dumb hold.

One of the myths in the market is that "if you hold long term, you can make money". Is that true ? Yes or no. If you hold Public Bank long term, you are cool. But if you hold BJ Corp for long term, you are fool.

If that is the case, how do I pick long term plays ? I actually get them from my short term and medium term portfolios. As mentioned in (a) and (b) above, I behave as Surf Rider and Angler to identify stocks that can do well in the not too distant future. These stocks usually will deliver result in 6 to 12 months time. Once it reaches my target price, I will sell lets's say 70% of my holdings and keep the remaining 30% for long term exposure. These stocks are usually good quality stocks (as proven by their ability to go up and reached target price). This is better than picking stocks blindly and hold them for long term without good reasons and hoping that one day miracles will happen.

In other words, be a smart Drift Wood. Don't dumb dumb hold for the sake of dumb dumb hold. Only long term hold those stocks that have proven themselves.

3. Concluding Remarks

In this article, I propose that we should have a combination of stocks that spread out over different investment horizons. It will allow us to reduce our risk as well as stress level.

Short term plays yield faster return, but is usually crowded space and is more volatile. It can also be stressful.

Channeling some money to buy stocks that nobody pays attention (Medium Term Play) is one good way to mitigate the abovementioned negative points. But be careful not to buy stocks that need very long gestation period (the longer the holding period the more chance of black swan events). Preferably the stocks should have potential to be re-rated within 12 months. Once you bought them, ignore the short term price fluctuation so as not to give you unnecessary stress.

When a company is doing well, it can potentially last for multiple years (such as Air Asia). Long term plays hence allows us to capture maximum benefit from good quality stocks. By selling 70% (lets' say) of the initial holding at target price, original cost of investment will be reduced to very low level. This creates a conducive environment to hold long term and potentially benefit from multibaggers.

Making money in stock market is easy. The difficult part is how to do it year after year. A good portfolio management strategy not only reduces your risk but also helps you to manage your emotion, making investing less stressful and also sustainable over the longer term.

Have a nice day.

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Hi icon sifu. How are you performing so far? I did not follow your stock calls but most of them seems to be not performing well. What went wrong? And how should readers trade in this case? Tq for explanation in advance.

2017-08-31 13:29

Thank you Icon8888 for a very interesting and informative article. Many of us I think have been doing this without being able to describe & put it into perspective as u have written & explained it so well in words. Unconsciously I have being doing this but not realizing the 3 different actors(Angler, Drift Wood and Surf rider). My 3 stocks die die hold since 2012 ......Aeon Credit, Panamy and Nestle. Sold off some like Petronas Gas, Axitia & Digi. Thanks for the article

2017-08-31 13:33

when your capital size becomes big..you have to evolve accordingly to different strategies...

2017-08-31 13:43

read my article carefully lah, it already answers all your questions

Flintstones Hi icon sifu. How are you performing so far? I did not follow your stock calls but most of them seems to be not performing well. What went wrong? And how should readers trade in this case? Tq for explanation in advance.

31/08/2017 13:29

2017-08-31 13:45

This is a very good article which is very easy to understand, however it will take long time to accumulate the experience for proper

implementation.

2017-08-31 14:07

i tot icon sifu will disclose his portfolio...mana tau only got water la, wood la, fire la... =(

2017-08-31 14:42

Beware of right issues for wce around the corner. Last Monday Agm confirmed that there will be doing right issues @RM0.80. Black swan takes place for drift woods

2017-08-31 17:01

Icon Sifu, what should we do with carepls? Sell or buy more to average down?

2017-08-31 17:02

Thank you Icon for exploring the investment philosophy and strategy of successful portfolio management for the benefits of this forum. As successful strategy is not static, it has to evolve with time, as pointed out by Probab. It is dynamic. Looking for short term fortune or quick bucks in the stock market is always risky and unsustainable,as pointed out many a time by many sifus (90% ends in utter failure, 10% only managed to scraped through). No way we could turn the market into a casino (put one, take two or put one give two)

Syabas, Icon, you opened the mindset of many newbies or even oldies.

Happy Merdeka !!

2017-08-31 17:09

Icon8888 always writes very good article.

He talks with facts and figures.

I like to read his articles.

Good work.

Thank you.

Ooi

2017-08-31 17:35

Agreed!

probability when your capital size becomes big..you have to evolve accordingly to different strategies...

31/08/2017 13:43

2017-08-31 17:45

Hello Icon, how to find Rosmah comment again? he use different ID?

2nd, you totally didnt keep any big cap(real portfolio)?

2017-08-31 22:33

7. The best investors in the world make on average between 10 and 15%.

We already know because of the above that you are probably not going to be among the best. So, if you pick some stocks and passively hold them maybe you’ll earn half that: 7%. Are you happy with that? Then fine. But given the volatility in the market I don’t think thats a good enough return for most people.

Look,some people are good. And some people should invest. But most shouldn’t.

8. The other people who make money only hold for 1/trillionth of a second.

Some trading firms set up their operations right next to the buildings with the computers that process all the trades on the exchanges.

They then pay for high speed cables to go right into these exchanges so their trades get their before yours. These guys make a lot of money in the markets by getting in the middle of every bid-ask faster than anyone else can.

Its a race to the bottom but billions are made. So we see now the way to huge wealth is to either trade in millionths of a second or to hold huge blocks of your net worth in one stock for years. This is not a good strategy for 99.9% of people.

9, Well, what about daytrading?

A lot of people claim to do that successfully. They are lying.

Please see my article “8 Reasons Not to Daytrade”. I got a lot of criticism after that. People wanted to show me their tax returns to show me how good they daytraded. Get lost, punks. Some people make millions playing the violin also.

Doesn’t mean the other six billion people on the planet should perform in Carnegie Hall. In any case, we’re talking about investing in stocks. Not scalping like a little kid with eight terminals in front of him. And guess what, even the best daytraders in the world with twenty year track records go broke sometimes.

2017-08-31 22:37

New generation investment is very different since after the introduction of Internet and online trading

They are investing in better and better computer hardware so they can make the best deal faster than anyone else

Investing is only getting faster and faster

:)

2017-08-31 22:40

Big cap are already on the plateau la..hard to grow only waiting to tip over and rot,unlike youngster ,full of vision and energy

2017-08-31 22:42

Bitcoin is trading at faster speed than anything else that is traded in this world

Forex, commodity, gold, etc you can name it

:)

2017-08-31 22:42

Good article to share...

Oil refining stocks surge on fear of disruption in supply

http://economictimes.indiatimes.com/articleshow/60318653.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

2017-09-01 17:32

BRO Icon8888 ,

I have always look around for an article about The Porfolio Management.

Well, thank you for share with us for such fine one.

Thanks again here.

2017-09-01 20:46

Hope icon8888 bro,

would write another piece of fine article on how to

Earn Ourself a Free Stock' and in contrarian

"How To Make a Strike Back From a Losser Stock"

THANKS ON ADVANCE , BRO .

2017-09-01 20:51

Icon8888's core holding is cresbld as declared by him. Very slow this stock.

2017-09-04 22:28

Airasia was declared core holding of his when it was traded around Rm1.60. Can crashbld repeat the airasia's feat?

2017-09-04 22:30

After this blog out his stocks jump very high so can boast?

abang_misai Icon8888 Sifu missing already kah? Or he has changed his ID?

22/09/2017 12:38

2017-09-22 12:47

Thanks for this Icon8888. Missing you over at the Airasia forum. Then again, believe me, nothing but absolute rubbish over there for a while now.

2017-10-24 16:39

Zai Zai

Surf Rider is trend follower.

ed seykota is the master of this kind of skill

2017-08-31 13:24