(Icon) Jaks Resources (1) - Too Cheap To Be Ignored. Golden Chance To Accumulate

Icon8888

Publish date: Fri, 27 Jul 2018, 09:54 AM

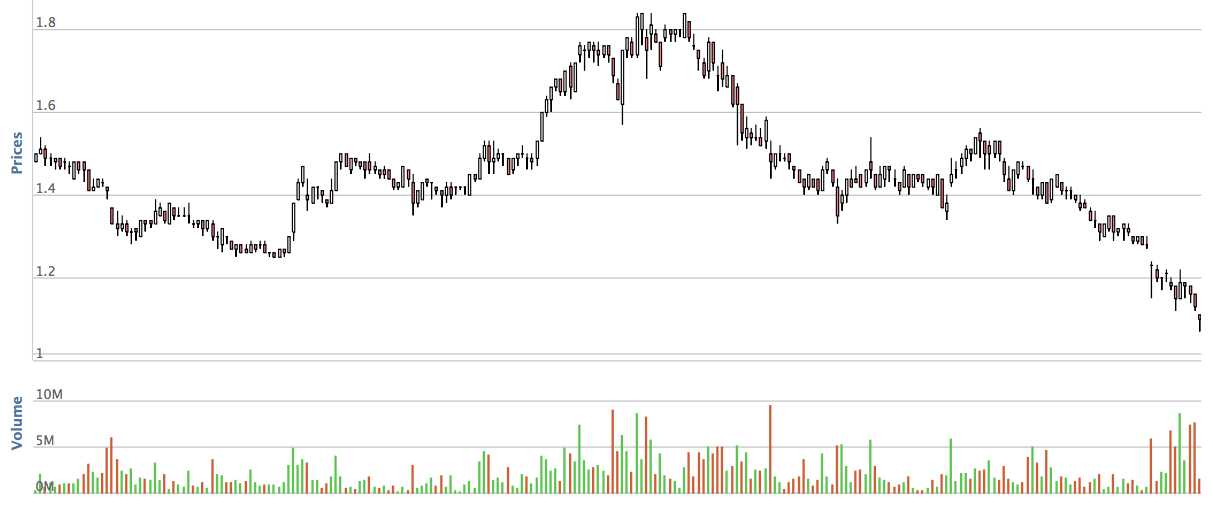

Over the past 6 months, Jaks' share price has declined from RM1.80 to the current RM1.04. What was the reasons behind this drastic drop ?

Well, Jaks has some problem with Star Media. It got a piece of land from Star Media few years ago. In return, it will have to construct an office building for Star Media. Due to various reasons, the building is only 96% completed by due date. Star Media called on the Bank Guarantee of RM50 mil. Jaks is seeking restraining order from Court. The company lost the first round and has submitted an appeal. Today will be the hearing day.

This latest development is unfortunate, but the amount is actually very small. Jaks holds 50% of the affected property subsidiary. As such, its exposure is only RM25 mil. By declining from RM1.80 to RM1.04, market capitalisation has evaporated by RM415 mil. That is too excessive.

Another possible reason is KYY's so called forced selling. On Monday, KYY came up with an article to explain that his bankers had been force selling his shares in the past few days. On 26 July 2018, he followed up with disclosure of the relevant details.

According to the table above, from 20 July until 25 July, banks had forced sold about 7 mil shares. As KYY holds more than 150 mil shares in Jaks (being 30% of 540 mil shares), the market's imagination ran wild and panicked. Just imagine the wave and wave of selling ahead !!! As a result, share price posed a drastic drop this morning to fresh low of 1.04.

I beg to differ. I started buying few days ago at RM1.17. Today, I took opportunity to buy more.

In the first place, I don't believe in the forced selling story. If the bankers really wants to deleverage KYY, they can PLACE OUT JAKS SHARES TO INSTITUTIONAL OR HIGH NET WORTH INVESTORS THROUGH DIRECT BUSINESS TRANSACTIONS.

The stock is now trading at significant discount to its intrinsic value, which is backed by 30% stake in the valuable Vietnam IPP. The project is scheduled to be completed in approximately 18 months time. It shouldn't be difficult to find investors to pick up his stakes at current depressed price.

In other words, it is stupid to sell in the open market in such a disruptive way. I just don't buy the story.

This is a golden opportunity to buy. If you are not comfortable, you can buy half at current price and average down gradually. Barring a major cock up of the Vietnam project, you are likely to make money from your investment over the next 6 to 12 months.

Have fun !

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Uncle KYY liquidates indirectly tell us that something is not right in the company oh! . Better "chau "

2018-07-28 09:19

>>>26-Jul-2018 Insider MADAM TAN KIT PHENG (a substantial shareholder) disposed 1,250,000 shares on 25-Jul-2018.

26-Jul-2018 Insider MR KOON YEW YIN (a substantial shareholder) disposed 770,000 shares on 25-Jul-2018.

26-Jul-2018 Insider MR KOON YEW YIN (a substantial shareholder) disposed 1,685,200 shares on 24-Jul-2018.

26-Jul-2018 Insider MR KOON YEW YIN (a substantial shareholder) disposed 2,050,000 shares on 23-Jul-2018.

26-Jul-2018 Insider MR KOON YEW YIN (a substantial shareholder) disposed 1,378,300 shares on 20-Jul-2018.<<<<

Probably due to forced selling by the brokers to meet margin calls.

2018-07-28 09:25

its been almost 2 years, i haven't seen the proven proof of how business sense works well. Jaks, hengyuan, sendai they have been in roller coaster mode and the only way to earn money from buying these stocks are pump and dump at the right price.

2018-07-28 09:30

Posted by paperplane > Jul 27, 2018 05:32 PM | Report Abuse

haha. if want to retire, at least 2mil nowadays.

no. to retire u need money making machine when you are asleep

2018-07-28 09:53

I also think that by looking at Jaks' stock price came down from RM1.80 to RM1.04, and therefore it is considered cheap may not be convincing.

My calculation on the core EPS (after excluding the one-off items like Subang Jaya land and property disposal gain & etc) for Jaks in FY17 is 75.5sen. Thus, at RM1.10 now, Jaks is selling at 14.5x multiple, which I don't think it is considered cheap.

There are other construction and property companies selling at much lower PE multiple than Jaks in Bursa now..and they are without the issues faced by Jaks currently, i.e. proposed right issue, lawsuit, major shareholder is disposing..

2018-07-28 10:01

I did spend some times in studying Jaks after its stock price plunged as I also do not want to miss any opportunity. However, I come to the conclusion that Jaks is still not cheap at current price.

2018-07-28 10:03

gamuda n ijm drop to pe below 10 at lowest...many construction counters like gadang, mitra,econbhd,hohup etc..drop to pe btw 5-6...so for Jaks...pe of 5-6 is reasonable for px to hit bottom.

2018-07-28 10:14

Company propose right issue normally got cash flow problem. That could be one of d reasons that make Uncle Koon start selling. Expert said follow what d major shareholder does, u won't be wrong.

2018-07-28 10:39

1 for 2 warrants only,not 1 for 1 rights at 80cts with no free warrants.....hehe

2018-07-28 11:00

Under the normal circumstances, a company should be able to finance its additional purchase of assets from either retained earnings or new borrowing or a combination of the two. There are many examples of very fast growing businesses in Malaysia that have prospered without recourse to issuing rights (for examples: Nestle and BAT)

But, companies may have to raise new capital by making rights issues under three types of abnormal circumstances. These three cases are:

(1) The company is improperly managed such that it is either not very profitable (or even losing a lot of money) such that the incoming cash is not adequate to support the need to purchase more assets. Or owing to poor management of its assets, it now requires a lot more assets to support its operations.

(2) The company is moving into another line of business which is large relative to its current size and it requires a great deal of additional capital to start up the new venture.

(3) The company is in a very fast growing business. In fact, it is so fast growing that retained earnings and new borrowing alone are insufficient to sustain the growth.

In order to be a prudent investor, we must analyse the situation of the company which has announced a rights issue carefully to see which category it falls into in the first place.

Depending on which category of rights it is issuing, we can then carry out a further analysis to decide whether the rights issue is a good or a bad one.

Through examining each type of rights issue, an intelligent investor can tell the wolves from the sheep.

Pricing the rights also requires proper evaluation.

Comments: I generally will avoid rights issues, especially, those companies falling into category (1) above.

2018-07-28 11:05

THE PRACTICAL ANSWER IS NOT GOOD OR BAD FOR JAKS....IT IS PRACTICALLY NO CHOICE FOR JAKS....BCOS THEY ARE STUCKED WITH THE HIGH CAPEX AND THE STAR CALL ON THE BANK GUARANTEE WORSEN THE POSITION LOH...!!

PUT IT THIS WAY LOH...IF KYY START SELLING BCOS OF A MARGIN CALL DO U WANT TO FOOL AROUND BUYING JAKS MEH ??

IF U HAD POSITION BETTER SELL B4 TOO LATE, WHEN KYY SELINGS INTENSIFY LOH..!!

DON FORGET U STILL HAVE A RIGHT ISSUE TO DEAL WITH LATER AND THIS NEED MORE & MORE COMMITMENT OF RESOURCES MAH...!!

Posted by 3iii > Jul 28, 2018 10:55 AM | Report Abuse

Some rights issues are good, others can be very bad

Like most things in investment, rights issues are not simple matters.

Rights are not automatically "good things" from the shareholders' point of view. Some of the rights are good, others can be very bad.

Investors have to be careful and they should not rush in every time there is an annoucement of rights. They should classify the rights issue they are considering in accordance with the three categories indicated below:

(1) The case of the improperly managed companies

(2) The case of moving into new business area

(3) The case of the very fast growing company

They should purchase only those of the last category.

https://myinvestingnotes.blogspot.com/2010/01/some-rights-issues-are-g...

2018-07-28 11:05

HI PAPER,

THANKS FOR YOUR INFO, IN FACT I HAVE A POSITION OF RM 300K UNITS WITH AVERAGE HIBISCUS AT AN AVERAGE COST OF RM 0.73...I THINK OF INCREASING MY POSITION AS CRUDE OIL HAS GONE UP....BUT THE UNCERTAINTY SARAWAK PETRONAS DISPUTE ON ROYALTY AND CONTROL OF OIL RESOURCES PUT ME BACK, AS I DO NOT KNOW HOW THIS WILL AFFECT HIBISCUS....!!

Posted by paperplane > Jul 27, 2018 09:22 PM | Report Abuse

Raider bro. Forget those jokers. Theu buy their responsibility. Lets look at hibiscus this yr onwards. I believe their fundamental could be good if oil continue good

2018-07-28 11:11

Icon8888 caught red handed with lie and non existence knowledge of margin financing.Koon admitted force selling on his trading account.Stop sharing margin financing know-how with info from "google"

Quote

In the first place, I don't believe in the forced selling story. If the bankers really wants to deleverage KYY, they can PLACE OUT JAKS SHARES TO INSTITUTIONAL OR HIGH NET WORTH INVESTORS THROUGH DIRECT BUSINESS TRANSACTIONS.

Unquote

2018-07-28 12:31

As KYY has admitted his shares in Jaks were forced sold, we can expect more forced selling to occur should the price of Jaks not be supported.

2018-07-28 13:05

Thx raider bro on your opinion. But for me i think worth the risk taking even for now?

2018-07-28 14:35

Paper,

U need to do more research on their sarawak oil field exposure & impact b4 ....can confidently sailang loh....!!

Posted by paperplane > Jul 28, 2018 02:35 PM | Report Abuse

Thx raider bro on your opinion. But for me i think worth the risk taking even for now?

2018-07-28 14:42

That oildfiled could be deleted, required high tech extraction. Otherwise, shell would sell? Why sell a cow unless that is cow tua already

2018-07-28 17:16

crownford_bl Icon: Are you sure is the right time to get in? From today trading chart, there is a strong support for this stock. But also is the best time for Ang Lam Poh to kill Kyy. This guy is very capable especially in this case. I dont think Ang Lam Poh will miss this opportunity to FORCE SELL Kyy's shares. Furthermore, Kyy intend to reduce the stake in Jaks. He has no intention to acquire further.

27/07/2018 22:16

crownford_bl The price may drop further. I have a question may be you can help me to answer.... Since Kyy, Herbert, Ang Lam Poh are controlling so many stakes. The liquidation in market should be low. Why the price is still so low? Someone must be controlling the price- may be Ang Lam Poh?

27/07/2018 22:23

2018-07-28 21:27

Icon888: I dont think you know well about Ang Lam Poh before writing this article.

2018-07-28 21:29

Finally someone has revealed the fact

The STORY behind - JAKS

Author: Keechia96 | Publish date: Sat, 28 Jul 2018, 06:16 PM

2018-07-28 21:31

Yes raider bro. I need to do more study first. Thinking what kind of risk they would have besides oil prices.

2018-07-28 22:25

Icon u x cakap pun klu bukan margin call forced selling ape reason price jatuh ape dia??

I pun suspect oso cos kyy cost x tinggi sgt pun

2018-07-29 22:32

If KYY cost not high,then high possibility that TOMORROW KYY will sell immediately as much as he can.

2018-07-29 22:47

Interestingly, KYY asked other investors to support this counter recently. Sadly, he faced margin calls soon after when the price fell too low.

2018-07-29 23:50

Why need to fear Jaks loh ??

1. Jaks construction, we all know is lousy....bcos they have rm 50 million bank guarantee being called by Star....due to project delay.

2. Vietnam Power plant...Murphy Law

2.1 It suppose to look attractive but they are not generating power yet, the current profit on construction is book entry profit on shiok sendiri accounting entry loh...!!

2.2 Jaks says it has subcontract everything to its china jv partner...but does its partner pay any profit to jaks on the works ??

Answer No loh...!!

2.3. The china construction co quite cunning loh...just look at msia ECRL and Suria fibre....no need to do anything, already draw 70% on value of the project on progress paymment.

Some more all payment are settle in china....how sure r u jaks interest is really secure and protected leh ??

2.4. The vietnam and china govt has always have an uneasy relationship...what if the dispute escalate leh ??

2.5. People is looking at green energy and here u r...with a coal power plant project....what if the vietnam govt slap it with a carbon tax leh ????

3.0 KYY kena force sell....what if another teething problem.......jaks will fall below rm 0.40 loh....!!

Like warren buffet says, do not bet your farmhouse on this dubious project and inefficient management, it is very toxic loh....!!

2018-07-30 11:28

If u press down...n try to sapu....how to get more rights warrant...when u have less entitle share leh ???

So this theory hard to believe loh....!!

I think KYY need to selldown....bcos he cannot tahan anymore loh...!!

Posted by Icon8888 > Jul 30, 2018 11:24 AM | Report Abuse

my conspiracy theory is that he is pressing down share price so that he can sapu as much rights Warrants as possible. He has done that before in Gadang

=========

SarifahSelinder Icon u x cakap pun klu bukan margin call forced selling ape reason price jatuh ape dia??

I pun suspect oso cos kyy cost x tinggi sgt pun

29/07/2018 22:32

2018-07-30 11:31

warrant is just a speculate tool, I rather choose buy mother share at lower price than get more right warrants

Posted by stockraider > Jul 30, 2018 11:31 AM | Report Abuse

If u press down...n try to sapu....how to get more rights warrant...when u have less entitle share leh ???

2018-07-30 11:35

must be joking Too Cheap To Be Ignored..what a title .nothing seems to be working for this company..Avoid

2018-07-30 12:01

One thing I dont understand...

How would a sane investor put in more than one hundred million RM to acquire more than 30% of a certain Co without having some consensus with the Boss....

In the earlier export co he invested like Hevea, Lii Hen (except Latitude) etc all later came out with corporate games like Bonus/Split/ Free warrant...maybe all due to his broker Ah Bee's hard work...

2018-07-30 12:13

Md ang is working with him mah....!!

Posted by CharlesT > Jul 30, 2018 12:13 PM | Report Abuse

One thing I dont understand...

How would a sane investor put in more than one hundred million RM to acquire more than 30% of a certain Co without having some consensus with the Boss....

In the earlier export co he invested like Hevea, Lii Hen (except Latitude) etc all later came out with corporate games like Bonus/Split/ Free warrant...maybe all due to his broker Ah Bee's hard work...

2018-07-30 12:16

xingquan is an obvious scam...read longtop financial cases in NYSE see, almost similar....

2018-07-30 12:23

Icon asking people to buy while KYY was crazily disposing???

KYY kept asking people to buy & now change his position in less than 2 months!!!

Why now ICON8888 asking people buy? Icon's stock recommendation since 2017 until now are very weird, mostly all DEAD, just be more cautious!

(13 Jun 2018) JAKS: KYY's Proposal to Raise Funds - Koon Yew Yin

https://klse.i3investor.com/blogs/koonyewyinblog/161270.jsp

2018-07-30 15:58

Too cheap to be ignored? Jaks is a falling knife! A long way down before hitting the bottom!

Folks, stay clear!!

2018-08-20 04:02

MAJOR COCK UP NOW

COCK UP MAJOR NOW

NOW MAJOR COCK UP

COCK MAJOR UP NOW

UP COCK MAJOR NOW

///////Barring a major cock up of the Vietnam project, you are likely to make money from your investment over the next 6 to 12 months./////

2018-12-06 18:33

'The stock is now trading at significant discount to its intrinsic value,'...

haha....actually a lot of stocks are way below its intrinsic value, especially in market situation now....

2018-12-06 18:37

lching

surprised surprised........

2018-07-27 22:19