(Icon) Jaks Resources (7) - Jaks WB Is My 2019 Sailang Stock

Icon8888

Publish date: Sat, 08 Dec 2018, 12:08 PM

1. Stock of The Year

In March 2016, I nominated Air Asia at RM1.66 as the Sailang Stock for 2016.

In July 2017, I nominated Hengyuan at RM6.90 as the Sailang Stock for 2017.

In April 2018, I nominated Muda Holdings at RM2.20 as the Sailang Stock for 2018.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

go look at the latest results...its all there in the notes....its RM 50 million....not USD 50 million.

2018-12-10 00:59

Posted by qqq3 > Dec 10, 2018 12:59 AM | Report Abuse X

go look at the latest results...its all there in the notes and in the cash flow statement....its RM 50 million....not USD 50 million

2018-12-10 01:04

sometimes raider is correct.

Joseph Kennedy was a stock market operator and his descendants suffered terrible curses.

========================================

stockraider To sum up on Jaks exercise:

Jaks is a stock selected by KYY to goreng with him as the operator with intention to make big monies but it turnout a big failure due to poor stock fundamental and poor mkt condition.

LESSON LEARN ' U CANNOT CHEAT PEOPLE ALL THE TIME'

09/12/2018 12:39

2018-12-10 01:05

kyy never intended to cheat any one...he was bullish....market collapsed he lost big time...that is the whole story....

well....I buy at 50 sen...but I small time trader, not big time like KYY.

and....I like people who fight latest war....but people like French Generals fight the last war.

2018-12-10 01:17

Dear i3lurker,

Thank you for reminding me of my profanities, I did not mean to offend anyone in i3 community except one. I subscribe to the view/believe/theory:

“The only thing necessary for the triumph of evil is for good men to do nothing.” -Edmund Burke.

“To sin by silence when they should protest makes cowards of men" -Abraham Lincoln.

“I must be cruel only to be kind. Thus bad begins and worse remains behind” -Hamlet

I had already said what I needed to say and it’s behind me now. What I wish is for i3 develop into a community of Redwood forest. I thank you for your contribution for making that redwood community a step closer.

https://klse.i3investor.com/blogs/Sslee_blog/185821.jsp

Thank you

2018-12-10 08:04

ss

lets see how long u can hide your ignorance under all those thank yous......

by me..u need to see a brain doctor.

2018-12-10 11:07

JAKS - My Advice - Koon Yew Yin

Author: Koon Yew Yin | Publish date: Mon, 10 Dec 2018, 12:36 PM

Since I have sold all our shares, many people asked me why I sold all our shares and should they buy it at 50 sen per share.

As I said, forced selling was a blessing in disguise. I was forced to sell at much higher prices in comparison with the current price of 50 sen per share.

I have extracted the following numbers from its latest quarter result:

Short term bank borrowing Rm 99.38 million

Bank over draft Rm 18.214 million

Long term borrowings Rm 323.978 million

Total Rm 440.978 million

Trade & other payables Rm 840.1 million

Total Rm 1,281 million

Total issued shares 546 million

Debt per share 1281 divided by 546 = Rm 2.31 per share.

The company is trying get back to some money by selling convertible warrants at 25 sen each with a conversion price of 64 sen per share, totalling 89 sen. Who will buy the warrant?

As you know the company has a lot of unsold properties and under the current depressed market condition, it will not be able to sell its properties. Moreover, Star’s legal claim for non performance and late completion has not been settled.

As a result, interest charges will be amounting in the next few years. The company cannot hide its losses anymore and it has already reported losses in the latest quarter.

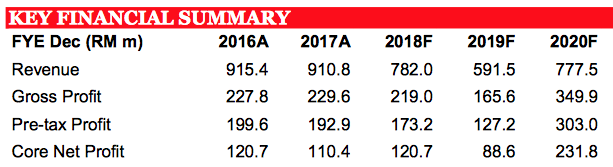

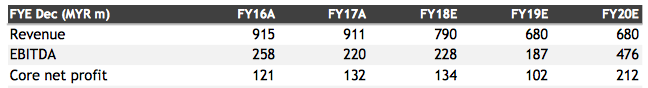

I have already admitted my expensive Rm 64 million mistake because I was focusing too much on its power plant in Vietnam and ignored its property and contracting businesses.

It can only report losses in the next few years.

Why should you buy when the company cannot report any profit?

2018-12-10 14:52

toyoink-wb and gpacket-wb cheap cheap for u all no wanna buy why wanna buy jaks-wa? hehe

2018-12-10 15:12

Certain experiences shape the investor and his/her investing philosophies, and nothing better can happen to an investor than to buy a stock that declines.

Your measure as an investor is how your philosophies hold up during turbulent times.

2018-12-11 07:42

I am with icon on this one.....

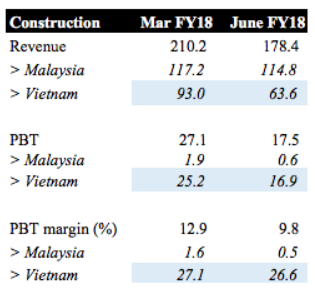

at 50 sen, should put on a bufalo cap...not a traders cap......signs of manipulation of accounts with Vietnam revenue dropping from $ 90 million to $ 60 million to $ 30 million in last 3 quarters.....

2018-12-11 15:12

icon...one more reason to be bullish about Jaks....very well hidden....Jaks suppressed the Vietnam revenue....drastic drop in Vietnam revenue to $ 90 million to $ 60 million to $ 30 million last quarter....at first look, last quarter report look disastrous.

$ 42 million loss from property division

$ 56 million profit from construction .Everyone knows Vietnam profit no cash flow.

but only $ 7 million of the $ 56 million is from Vietnam....meaning local construction profit is $ 49 million....I think from Suke.

and $ 20 million from the $ 42 million is LAD.....LAD will end one day.....total LAD todate is $31 million....it is much less than $ 10 million per quarter and this will end one day.....small matter.

On the surface, the results looks disastrous......easy to sell seeing the results.......takes time for people to through and analysis properly...takes time and takes next result which can be enormously good.

2018-12-11 19:25

Jaks-WA 62.5% under subscribed.

May open at 20 sen, subsequently drop to 10 sen.

Those sailang and sialang follow fake sifus going to holland straight away.

If Jaks mother share is only good for 40 sen, how can WA can be at 25 sen ?

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6005573

2018-12-13 18:54

icon

one more good news for u....

according to accounting rules, companies are supposed to provide for all LAD when it becomes foreseeable....not just up to Sept ....

meaning what? meaning if done properly, total provision of $ 35 million ( $ 20 million last quarter) is all that is needed...it is not apportioned by time. ...meaning also next quarter no need provision.

2018-12-13 21:27

Don't be so fixated about my call to buy at 25 Sen

In general I am just saying that Jaks WA sounds like a good buy from risk reward point of view because it has five years to go, Low absolute exposure , Low exercise price and potential upside from Jaks profit growth

It doesn't have to be 25 Sen buy

If it drops at listing to 10 Sen, then my readers should buy at 10 Sen

Simple as that

2018-12-15 05:24

Trust no one in this forum.

Do your own research and analysis.

Make your own decisions.

2018-12-15 08:24

its written in good faith for icon8888 pocket only.

if you have consideration for peoples' good faith pockets, you should think for those who are unable to think for themselves.

A good person with good faith will consider other peoples' risks rather than be so cavalier that if it drops to 10 sen then other people should buy.

Posted by 3iii > Dec 15, 2018 08:23 AM | Report Abuse

>>> Posted by Icon8888 > Dec 15, 2018 05:25 AM | Report Abuse

and yes, all my articles are written in good faith<<<

2018-12-15 08:29

sailang jaks Wa = sailang mother. good luck. as k why why explain, jaks will continue loss money next two years, that's why he exit

2018-12-15 10:05

good faith doesn't mean altruistic

altruistic is a word I don't simply use

anybody who comes to this forum and say he altruistic is lying

but good faith can be true - it just means I have no ill intention to deceive or mislead

3iii >>> Posted by Icon8888 > Dec 15, 2018 05:25 AM | Report Abuse

and yes, all my articles are written in good faith<<<

Altruistic!!!???

15/12/2018 08:23

2018-12-15 10:47

if you are unable to think for yourself, you shouldn't even be here

=============

i3lurker its written in good faith for icon8888 pocket only.

if you have consideration for peoples' good faith pockets, you should think for those who are unable to think for themselves.

2018-12-15 10:49

you impose very high standard on those that contribute ideas here, as though we should baby sit everybody to make sure they do well

preach that to me when one day you can do that

i3lurker

A good person with good faith will consider other peoples' risks rather than be so cavalier that if it drops to 10 sen then other people should buy.

2018-12-15 10:56

If jaks wa drops from 25c it's very cheap dy.

If it goes to 10c or whatever why not ?

Cheap or not is up to anyone to decide.

Arguing is a waste of time.

Time is money.

I see good risk to reward ratio if wa drops. So I will buy

Cheers

2018-12-15 11:12

written in good faith

Icon8888

15240 posts

Posted by Icon8888 > Dec 15, 2018 05:35 AM | Report Abuse

Thanks qqq3 for the info

===========

LAD whack every thing now....Vietnam drastic drop in revenue when Director in other sources says 40% completed not the 30% in the accounts ...meaning what?

meaning they wanted to whack every thing down this quarter....and this not even an audited period.

meaning it is not an accident, meaning they have motives, meaning they have strategies.

to the real bufalos...not the fake ones we have here....whether bottom at 45 or bottom at 30 sen.....no difference one.....

2018-12-15 12:51

What is the point of writing long article when people rather listen to gossips ..... pitty

2018-12-15 13:53

Posted by Icon8888 > Dec 15, 2018 05:25 AM | Report Abuse

and yes, all my articles are written in good faith

=======================================================

Do you really understand the meaning of 'Thing done in good faith'?

I suggest you go and consult your lawyer.

I remembered KYY also mentioned he promote certain share with noble intention AND in GOOD FAITH.

I did comment what is good faith, and I did not agree he did that in Good Faith.

Likewise, promoting Jaks-WA at 25 sen can never be taken as doing thing in good faith............

2018-12-15 21:19

Posted by qqq3 > Dec 15, 2018 12:51 PM | Report Abuse

written in good faith

LAD whack every thing now....Vietnam drastic drop in revenue when Director in other sources says 40% completed not the 30% in the accounts ...meaning what?

meaning they wanted to whack every thing down this quarter....and this not even an audited period.

meaning it is not an accident, meaning they have motives, meaning they have strategies.

So what kind of management is this to play out other shareholders?

I thought in your priority whether to buy a stock, the number one thing is how good is the management?

2018-12-15 21:43

Meaning Icon8888 is conman? Same like CalvinTanEng?

Posted by i3lurker > Dec 15, 2018 08:29 AM | Report Abuse

its written in good faith for icon8888 pocket only.

if you have consideration for peoples' good faith pockets, you should think for those who are unable to think for themselves.

A good person with good faith will consider other peoples' risks rather than be so cavalier that if it drops to 10 sen then other people should buy.

Posted by 3iii > Dec 15, 2018 08:23 AM | Report Abuse

>>> Posted by Icon8888 > Dec 15, 2018 05:25 AM | Report Abuse

and yes, all my articles are written in good faith<<<

2018-12-15 21:43

kcchong

companies have motives, companies have strategies.....even a kid knows that.

want to sue them? can sue them?

2018-12-15 23:22

no shame....warrant bot at 25 sen, no lose money is no shame...lesser beings expect listing price to be 10 -15 sen.

people who are very bullish is right to buy warrants.

2018-12-21 17:07

When I asked to buy Jaks at 50 Sen back in 2018, people told me I will go bankrupt

2019-10-14 15:53

just hold Jaks and Armada 2019.............better than all my trades / trading.................

2019-10-14 16:02

bro icon888, what is ur view about cimb touch n go e wallet business prospect? last time u bought cimb & hold for grandson is because e wallet business?pls enlighten me.tq

2019-10-14 16:41

i3lurker

BG before issue already secured by banks in conjunction with other facilities.

Once security used up may need topping up another RM50 million as security coz facilities tied up in the ST loans. There will be a security shortfall of RM50 million wif of BG claim.

But as an accountant, you already knew that.

2018-12-10 00:51